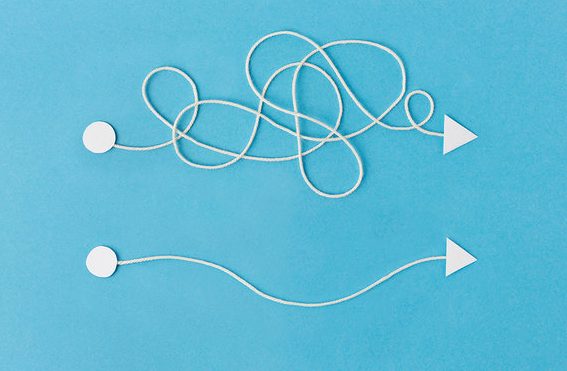

. Businesses that enjoy network effects tend to have a much greater capacity to deliver outsized returns. They aren’t especially common, but if you can find them you stand to do extremely well — even if it often feels like you are too late. At its core, a network effect describes a situation where the value of a product or service increases exponentially […]