Tinybeans (ASX:TNY) has made waves in 2019, with the share price up over 6x this year. Today, though, shares have dropped sharply from their recent all-time high as investors failed to find inspiration in the group’s latest quarterly results.

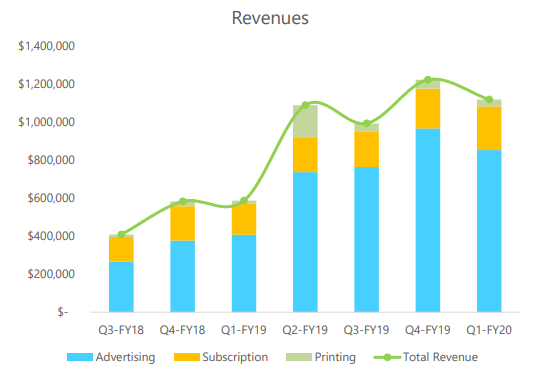

Tinybeans is a social media platform for the private sharing of baby photos and stories to close family and friends. It gained a lot of hype from its inclusion as Apple’s “App of the Day” in early June, which helped it gain significant awareness worldwide. And “eyeballs” are crucial to the social media business model, with the company now earning a majority of revenue from advertising, including an impressive contract with Lego.

Tinybeans also posted promising FY19 results, more than doubling revenue to $3.8 million and decreasing cashburn to $3.9 million. Tinybeans’ business model is attractive in that it has high gross margins of 91%, and relatively strong retention at 75%. They also quoted in their full year results that their lifetime value to cost of acquisition was a huge 14x.

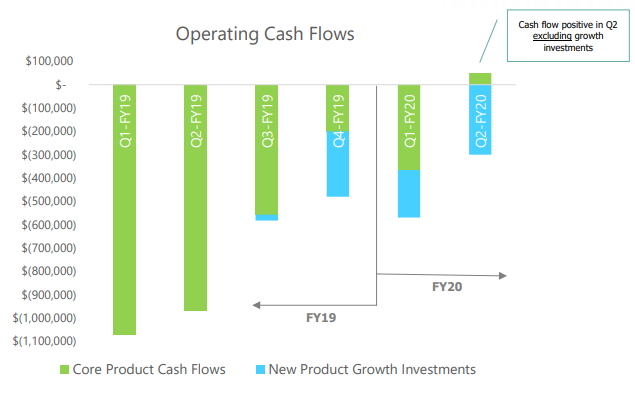

However, today’s release of quarterly results has driven a sharp turnaround in the share price; down over 17% at the time of writing. Quarterly revenues of $1.12 million and a higher than forecast cash burn of $651 thousand failed to impress the market. It is hard to ignore than in the last four quarters revenue has not significantly increased.

Thankfully for investors, after a $5 million capital raising earlier this year, and a favourable scaling of costs, the underlying business is expected to be cash flow positive by next quarter. That makes the company less dependent on the market for funding, at least in the absence of a major acquisition or new growth initiatives.

Management claim that the typically slower first quarter saw several key deals delayed into subsequent quarters, and that their pipeline has increased to US$3.4 million on the back of a more than doubling in the average deal to $70 thousand per customer. However, these claims must always be taken with a grain of salt until deals are actually signed. Larger deals are also expected to see an increase in the typical sales cycle from 90 to 180 days.

Is Tinybeans trading at a reasonable valuation?

With a market capitalisation currently sitting at $76 million, and the business still unprofitable, valuation is resting largely on a strong growth projection into a large addressable market. Tinybeans’ niche is currently fragmented with no clear leader and after the comparatively slow and volatile last few quarters, it is hard to gauge realistic growth rates into the future. Looking at year on year increases though, a compound growth rate of over 100% in advertising revenue is very impressive.

Tinybeans is currently trading on a revenue multiple of 20, which will prove excessive unless significant growth can be sustained. But with a strong market uptake, investor optimism isn’t entirely unfounded.

Ranked #55 on Strawman, shares in TinyBeans remain above the community consensus valuation. Click below to learn more.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223