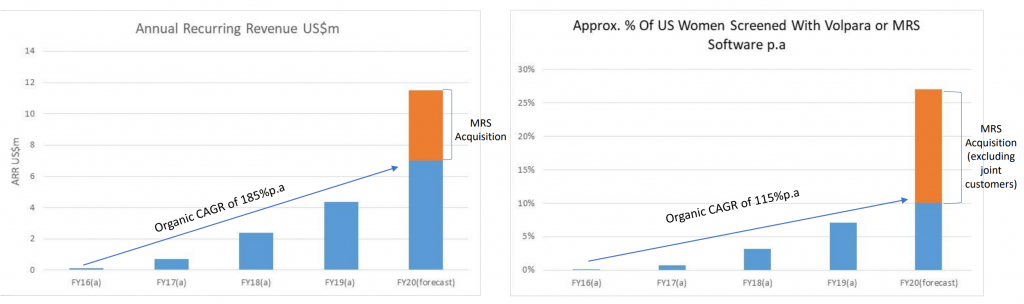

Kiwi breast imaging software specialist Volpara (ASX:VHT) has confirmed it is on track to meet its target for NZ$17.1 million in annual recurring revenue (ARR) for the 2020 financial year. That compares with an ARR of NZ$6.6 million in the previous year, with the recent acquisition of MRS Systems expected to contribute around NZ$6.7 million to the total.

At the end of its first quarter (ended June 30, 2019), Volpara said the recurring revenue run rate was at NZ$14.6 million and that it now had a 25% market share in the all important US market. By the end of the 2020 financial year, it hopes to have secured a 27% market share in this massive market.

It’s been an incredible assent for Volpara, which only transitioned to a subscription model three years ago, and was then only generating a couple million in annual sales. Little wonder shareholders have done so well — shares have increased roughly 4-fold over that period.

With the business still firmly focused on capturing share, profitability hasn’t been a priority and the company continues to burn through cash; around NZ$10.6 million in the last financial year. Still, there’s a decent cash buffer with the recent capital raise boosting the company’s cash reserves to around NZ$35 million.

Volpara is chasing a truly massive global market and appears to offer significant competitive advantages, such as unique IP, clinical validation, regulatory approvals and notable reference clients. The business enjoys high gross margins (~83%), strong recurring revenues and a relatively fixed and scalable cost base.

It’s worth mentioning, too, that the business is very well placed to take advantage of the AI revolution, which is well suited to image recognition. Although still in the early stages, this technology holds great promise in improving the efficacy of cancer detection and is already implemented in Volpara’s solutions. As more reference image are acquired, and as these are augmented with clinical data, the effectiveness is only likely to improve and further strengthen Volpara’s market position.

The main issue for investors is price.

At present, Volpara is trading on roughly 18 times FY2020 forecast sales — which hardly seems cheap. Nevertheless, such metrics can be misleading when considering companies that are experiencing rapid growth into large, winner takes all markets. If Volpara does indeed become the dominant breast imaging software in the US — which is certainly feasible — then today’s price could well seem like a screaming bargain in another decade or so.

Ranked #14 on Strawman, and having just entered the market-beating Strawman Index, Volpara is a clear community favourite. Best of all, it remains below the current consensus valuation. Click below to learn more…

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223