Livetiles targets mid to large organisations moving from traditional code-heavy digital workplaces to drag and drop, customisable and machine learning oriented intranet software.

Shares remain depressed since the company’s June quarterly update, having lost close to 30% in the past few months. So is this a buying opportunity, or are there more falls to come?

Livetiles’ annual recurring revenue (ARR) has increased by a factor of ten in the last two years to just over $40 million, which is significantly above the industry median for both the age of company and ARR level. Moreover, with a target to grow recurring revenue to over $100 million by June 2021, it seems there’s still a long way to run.

Livetiles is still unprofitable, and in the last financial year the company acquired Wizdom – it’s biggest competitor, and the European market leader – which put a further dent in Livetiles’ full year loss. However, Wizdom is cash flow positive and will continue to help improve cash flows.

Because the majority of Livetiles’ contracts are quarterly, and are paid after a grace period, it takes about two quarters until an increase in announced ARR delivers a corresponding increase in revenue.

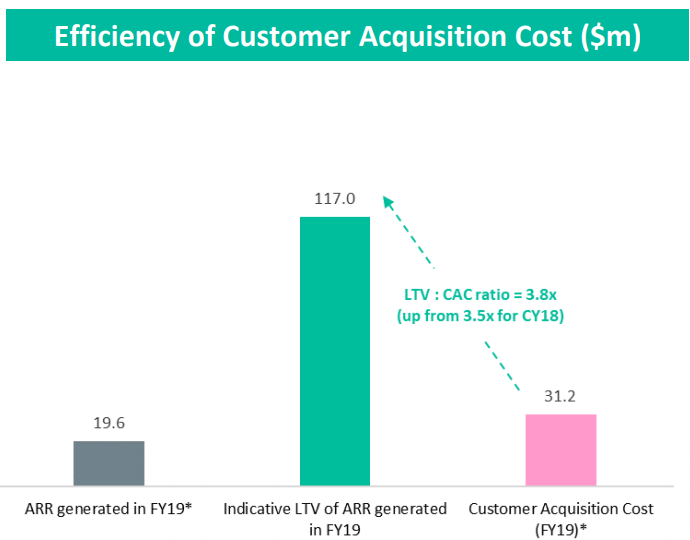

In contrast, acquisition costs are realised upfront, meaning that cash flow is not pretty in these early high-growth stages. This is despite the underlying unit economics being strong. Livetiles boast a net retention rate of over 100% due to expanding customer contract values, and as a result has a lifetime value to cost of acquisition ratio that is very attractive in the long run.

For example, in their investor presentation, using a discount rate for future cash flows of 10%, a gross margin of 95% and a very conservative churn of 92.5%, they estimate that every $1 in sales and marketing now is worth $3.80 in lifetime value of the acquired customer.

With only $14.8 million in the bank, and reporting an operating cash burn of over $6 million in the last quarter, it seems investors are wary of the potential for a capital raise. It is worth noting, however, that cost of acquisition on a seasonal basis has been decreasing while average contract value increases, and that unit economics remain in check — meaning that any capital raised will likely generate an attractive return.

Ranked #9 on Strawman, and with a consensus valuation well above the last traded price, it seems the community considers LiveTiles an interesting proposition. Click below to learn more.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223