Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

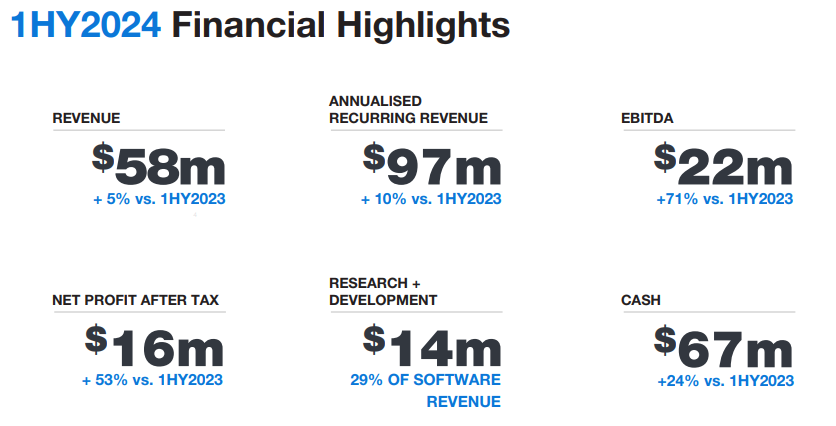

Objective Corp reported last week. From their presentation:

Remember that OCL changed accounting policies in terms of expensing R&D. Changing from expensing 100% to 50%.

In 1H FY24, total R&D spend for $13.557m with $7.2m being expensed through the P&L. On a comparative basis, NPBT would have been around $13.3m compared to $10.7m in 1H FY23 had the R&D expense been expensed in the period. NPAT would be around flat only due to an increased tax expense in the current period.

Personally I thought this result was pretty good although I think it will be better to wait until the full year results for a better comparison given the seasonality of OCL's customers (public sector customers usually pay during the 2H).

In the shareholder letter from CEO Tony Walls, the outlook provided was strong with management targeting ARR growth of 15%. They also provided an update in regards to potential acquisitions with them having done some due diligence on a few potential candidates but ultimately deciding to focus on building the business organically.

Disc: Held IRL and on Strawman.

Buffet stated on buybacks "Blindly buying an overpriced stock is value-destructive, a fact lost on many promotional or ever-optimistic CEOs"

Objectives last years earnings were flat and they are only forecasting 15% growth. Currently on a PE of 48, would this statement apply to Objective I wonder. I wouldn't call them promotional, but can't help thinking that there is a good chance they are trying to support their share price, especially when taking into account Gary Fisher has sold over $40m worth of shares over the last two years.

They may be hoping that the market will re-rate them now that they have decided to capitalise 45-55% of R&D, but even using this model, they are still trading on a PE of 32. R&D is an ongoing expense to their business and I personally have a problem with the way software companies capitalise R&D. Charlie Munger once said EBITDA earnings are bullshit earnings.

I would have thought their money could be better used for M&A, since they have detailed that this is part of their ongoing strategy.

Objective/Altium comparison

I have been doing a comparison of Objective (OCL) to Altium (ALU) as they are both high quality software companies that have shown good growth over the last 10 years. Both business I have been following for some time. Whilst in very different industries they both have excellent recurring revenues and stable management.

Differences/Quality

- OCL is a software provider to government mainly, whilst ALU provides software to design circuit boards to industry.

- ALU has many more clients and is a lot more diversified in my opinion than OCL, who concentrates on govt, which is sticky but the loss of a large customer could be a huge headwind.

- Both have great management but OCL seems to be run by a CEO who has a lot of control, whereas ALU has an experienced diversified board. OCL almost runs as a private company, where ALU is engaged with the market and transparent.

- ALU has had a great year in FY23 growing at almost 20% where OCL's revenue has been pretty flat.

- OCL is forecasting 15% growth over the next few years and ALU's USD500m target indicates growth of around 25% out to 2026

Valuation

Assuming management of both companies can achieve their target growth, then by 2026 ALU will be on a PE of 24 assuming a NPAT margin of 29% and OCL will be on a PE of 22 assuming the same margin. I have used OCL's updated financial model to capitalise R&D and am assuming they are similar in this way. Share price of OCL is $11 and ALU $42 at this time.

Conclusion

Whilst both are very high quality businesses and should provide good returns if they can meet their targets, ALU to me is more attractive and better value at these levels. ALU is likely to grow more than 50% faster than OCL and is on a similar multiple three years out to OCL. ALU is a more diversified business with a more mature board and is more transparent with the market.

Update 04/09/2023

OCL had flagged earlier this year that growth would be subdued. NPAT came in at $21.1m which was only just above FY22 NPAT of $21m.

I believe that growth will return in FY24 and beyond and if they can compound at 15% for the next 5 years then at a terminal PE of 45x, I calculate a valuation of $11.85 to achieve a 10% pa return.

One thing to keep in mind is that OCL is changing accounting policy. Only 50% of R&D will now be expensed compared to 100% in the past.

I think I will likely value OCL on a free cash flow basis in order for consistency. Free cash flow for FY23 was pretty similar to NPAT at around $20m. Going to leave this figure here as a comparison for next period as NPAT is going to jump up based on the new accounting policy. Under the new policy NPAT would have come in around $32m.

Disc: Not held.

Update 25/11/22

OCL released a trading update for FY23 flagging decreased revenue growth and profit margin reduction. This is as a result of a transition from perpetual licencing to subscription based revenue for their products. There will also be salary growth and more spending to win new customers.

Revenue growth is expected to be single digit rather than double digit as seen in the past for the next FY but expected to reaccelerate again in FY24 as subscription revenue is recognised.

I have updated my valuation to $11.38 assuming decreased profit growth to single digit and reaccelerating from FY24 onwards.

I had recently sold out of OCL in my real life portfolio (was planning on selling on SM too but accidentally placed a buy order instead) but will look to buy back in with the expected weakness following this update.

Disc: Not held IRL, held on SM

Update 14/07/2022

OCL released a trading update for their FY22 results

NPAT for FY22 of $21m (which doesn't include a $1.4m settlement with NZCC). So actual NPAT of around $19.6m.

This is still around a 20% increase to NPAT YOY.

Will maintain my current valuation as I think it is still a bit too expensive at the current share price.

Disc: Not held IRL or on Strawman

Update 13/01/2022

OCL released a trading update detailing their unaudited 1HY2022 results.

NPAT: $9.8m which is up 35% compared to 1HY2021

I'll assume FY2022 NPAT of around $20m which would represent around 20% increase compared to FY2021 of $16.1m.

So if they can maintain 20% EPS growth for 5 years and trade on a PE of around 45x. To get a 10% return I have a target buy price of around $12.31.

Disc: Not held IRL or on Strawman

Original Report

Objective Corp is a software company which provides software for many government agencies.

When valuing stocks it is hard to predict what type of growth will occur in the future and so I prefer to think more in the line of: What price would I pay today that would allow a reasonable rate of return over the next 3-5 years.

At the current price, OCL is trading at a PE of around 114x and so if you buy at today's price you'd have to expect 25% EPS growth for the next 5 years and for OCL to be trading at a PE of 60x in FY26 in order to achieve around 10% return per year.

Personally I find this to be a bit rich for me so applying a 15% EPS growth for 5 years and a PE of 45x in FY26 gives me a valuation of $9.95.

However with these high quality, highly scalable companies which can maintain high levels of growth long term it would not be unreasonable for someone with a high risk tolerance to justify the current price but I would prefer to be a bit more conservative given current market conditions.

OCL just had their investor presentation. I put in a written question to them asking what their revenue exposure was to their biggest customer and their top 5 customers and they chose to ignore the question. This is after experiencing on a few occasions the company being unresponsive to my investor inquiries and to others as well. I feel this puts a big question over management integrity and transparency. Just an observation for what it is worth.

They are the only company I have ever experienced this with.

Objective release its FY23 result this morning. As guided to market the result will be muted compare to other years.

Revenue:

Customer Receipts

Operating Cash

No. Of Shares on issues

Objective corp is no doubt a very high-quality company with a very aligned CEO who owns a significant portion of the business. Historically, Objective corp has bought back its Shares on market at a very opportune time and they are currently going through a buyback program that intends to buy 10% of outstanding shares on market. Does that mean management thinks business isn't valued appropriately by the market?

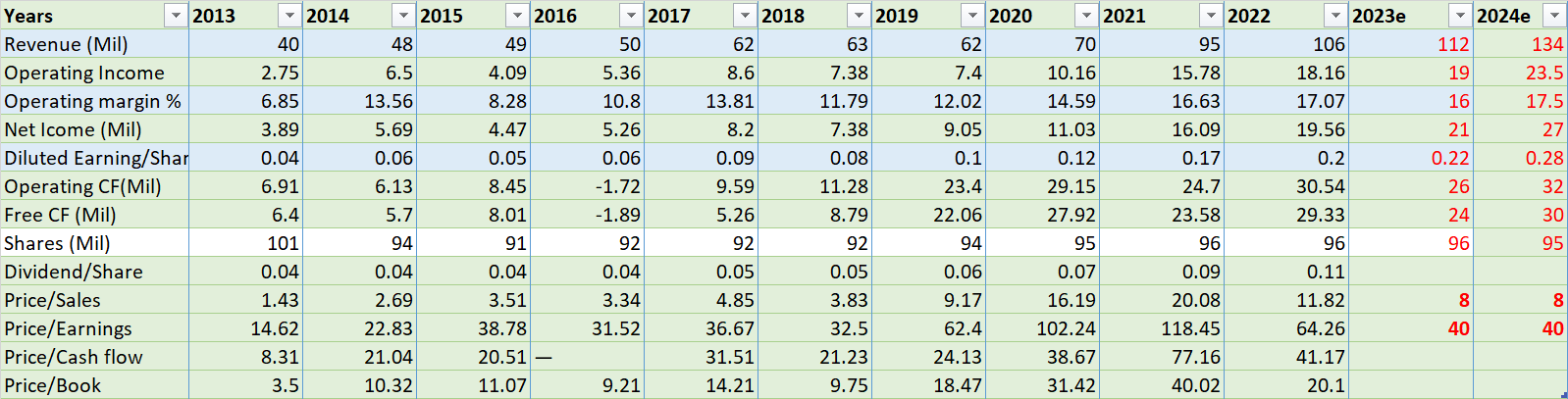

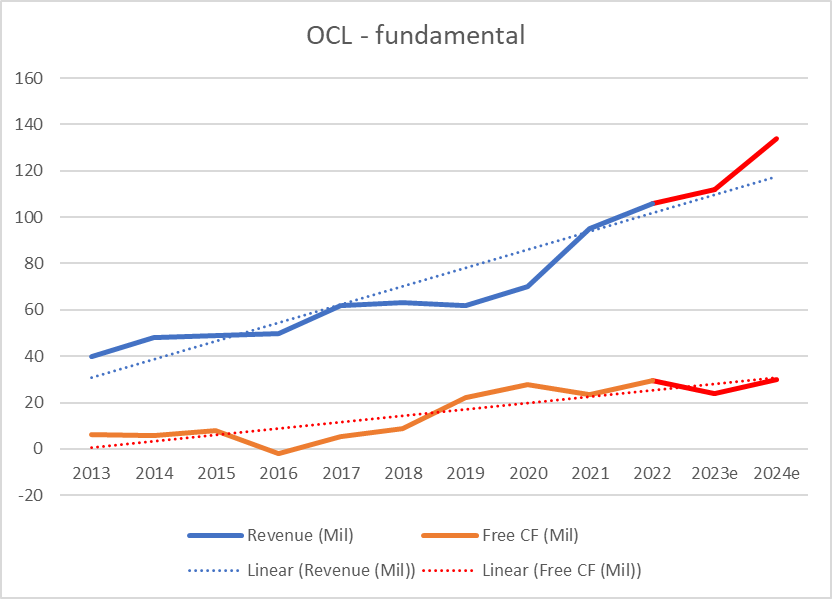

So I have analyzed OCL's FY2013 to FY2022 results and put some of my FY2023 and FY2024expected figures to see

Objective Revenue and Free CF graph tells how the company has performed and what my expectation for the next 2 years.

Let's see how market sentiment has shifted for this company.

Now, Even for my projection revenue and Net profit for FY23 and FY24, I give Price/Sales = 8 and PE = 40 valuation comes in between $9.13 and $11.32 ( Not sure if the market will give this valuation in the future - but OCL is a very high-quality company run by high-quality management with recurring revenue serviced to very defensive customers and expensing 100% of R&D (~20% of Revenue) deserve premium )

So I am a bit baffled that Objective is buying back its share in the range of ~$12.00 - $12.80. It will be interesting to see how the next couple of years unfold and will give us insight as to how to value such a company.

PS: I has similar thought when $PME were buying back their shares at ~$25 in 2019. look at it today - even in a bear market, it returned 100%.

Objective CEO's recent letter has an interesting comment about the market.

Objective announced that they are expecting slowdown in revenue growth and margin compression for fy23 and i am not sure if this is going to be the story of FY23 for the most companies.. but it does look increasingly that way or this is probably because of Objective's strategic direction of offloading implementation to partners instead of inhouse for scale.?

Objective is very high quality company with very aligned founder in Tony. Although it is trading on very high multiple for single digit growth but again they are expensing 100% of their R&D.

Short term pain ahead for long term gain? May be one to watch out and dust off valuation for potential opportunity ?

Sold out completely. I’m concerned that government procurement has slowed down across all IT since COVID due to distractions. IT is focused on working from home desktop rather that digital transformation projects. I’ll watch from the sidelines for the next few reporting cycles

ASX Announcement for significant contract win for their RegTech business (formerly Itree Pty Limited). Looks like the Itree acquisition is working out. I understand NZ Police have significant contracts with PEGA Systems and ServiceNow so the fact that they chose a new vendor for this project is interesting especially with such a high profile project in Firearms in NZ in the wake of 2019 shootings. Note that the ARR for this contract has already been reported at 1HY2022.

Objective selected for firearms legislative reform

Objective RegWorks, a specialist end-to-end regulatory platform, has been selected by New Zealand Police to develop the firearms registry Sydney, Australia – Following a competitive multi-phase tender process, Objective Corporation (ASX:OCL) has been awarded a 5 year, circa $13M NZD contract for the implementation of the Arms Information System.

Objective RegWorks will be used by Police to manage the end-to-end regulation of registration and licensing for firearms as part of a programme that includes the establishment of a new Arms Information System (AIS) to support the effective regulation of New Zealand’s licensed firearms community (approximately 250,000 licence holders). The Arms Information System will be a secure digital platform that will manage the information related to arms (firearms, parts, ammunition and other restricted weapons), firearms licensing, and any activities associated with the possession and use of firearms. It will ultimately give Police a clear picture of all firearms transactions in New Zealand, and over time, all the legally owned firearms in New Zealand.

Ben Hobby, Global Vice President, RegTech at Objective said “Our team is deeply aware of the significant outcome this project will generate, which directly aligns with our company mission to drive stronger communities and nations with outstanding digital government software. The harrowing events of 2019 suddenly brought in to focus the need for reform and for an Arms Information System that will assist to underpin continuing freedoms that the people of Aotearoa have enjoyed for generations. We are extremely proud to be partnered with New Zealand Police to make this vision a reality.”

Objective and New Zealand Police have established a delivery partnership and are actively working on developing delivery phases now. This contract was recognised in Objective Corporation’s ARR result reported at 1HY2022, corresponding with the contract start date during that period. Under the terms of the contract, Objective agreed not to disclose the specific customer details at that time.

-ends-

High quality business which I would love to own if only I could purchase it at a reasonable valuation. CEO owns around 67% of the business so extremely illiquid which I think is the reason for the extreme valuation.

Revenue growing at 13% and profit up 28% in the last year.

I am estimating that they are on track to achieve $25m NPAT next year and I am happy to apply a 30x multiple due to their sticky customer base. That would imply a market cap of $750m and a share price of $7.90. Yes that is less than half its current price.

Whilst Objective is an excellent company there are some potential risks including rising wages inflation in the IT sector and integration risk of recent acquisitions.

Forgot to do a Straw for the results which came out a few weeks ago and saw no one else had done one either.

Another solid HY result for OCL. Results from their presentation below:

NPAT came in slightly above what they guided for in January but this was excluding $1.4m which they had to pay as part of a NZCC Settlement so reported NPAT was around 8.6m which is only a 20% increase compared to PCP.

I am willing to maintain my valuation from January of $12.30 as I believe this is a high quality company that is still growing its top and bottom line at good rates however the current price is still a bit rich for me so am waiting patiently for a good entry point.

Disc: Not held

@techbunny - Was a Seveneves reference there?

Twas I ignored for being a bunny?

The multiple now, 'tis very funny.

The buyers might have been some funds

But the founder hasn't yet sold one.

So I'll hold it for the yolo ark

Right or wrong; it'll be a lark.

Objective Is Mostly Owned By Its Founder,

For $1.7b this one has low float.

The high valuation makes some investors flounder

But index huggers are all in the same boat!

They'll have to buy shares whatever the price

For long term holders, that should be nice.

One of the best unknown tech stocks on the ASX, Objective Corp is again on track to deliver another year of solid growth.

(I held years ago, and never got back in due to a stupid anchoring bias!!)

The company has reported preliminary results for FY21:

- Revenue up 36% to $95.1m

- ARR up 31% to $74.2m

- NPAT up 45% to $16m

- Cash balance of $48m

- R&D spend of 24% of revenue (all expensed)

CEO Tony Wallis said he expected a "material lift in revenue and profitability" in FY22.

You can read the ASX announcement here

At >100x earnings, my only problem with OCL is the price. That being said, with a high cash balance, fast growth, high quality cash flows and fully expensed development costs, that mulitple could fairly be normalised lower.

Congrats to all long term investors. Shares are up >10x in the last 5 years, and the company has returned 17% of the cost base in dividends (excluding franking credits!)

Objective Corporation (ASX:OCL) provides the following trading update for the first half of financial year 2021 (1HY2021), based on unaudited management accounts as at December 31, 2020.

The expected headline results for 1HY2021 are a revenue increase of 40% to $46.5m (1HY2020: $33.3m) with an EBITDA increase of 74% to $11.8m (1HY2020: $6.8m).

Annual Recurring Revenue (ARR) at 31 December 2020 was $70.1m, representing an increase of 30% over 31 December 2019 ($54.1m). Perpetual right to use (upfront licence) fees continued to decline as a percentage of revenue, representing only 3.6% of total revenues in 1HY2021 (7.4% in 1HY2020).

Cash balance at 31 December 2020 was $27.7m. During 1HY2021, Objective paid $18.4m as consideration for the acquisition of Itree Pty Limited and fully franked dividends of $6.6m.

Objective Corp Starts A Run

Which Will Surely Be Fun

An Index It Could Enter Some Day Soon

Which Might Send The Share Price To The Moon!

Objective Corp has acquired Australian 'RegTech' business iTree for $18.5m, or about 1.3x FY21 sales. It's customers include the Dept. of Home Affairs, Queensland Rail and Worksafe Tasmania.

iTrees products will be integrated into Objective's Content Solutions suite, and Objective will market these solutions to a wider market opportunity.

Objective has a great track record of making sensible bolt-on acquisitions, and this appears no different.

iTree is profitable and like Objective fully expenses R&D costs. The acquisition will be cashflow positive, EPS accretive and will be funded from existing cash reserves.

ASX announcement here

20-Dec-2019: CCZ Equities Research: Objective Corp (OCL): No Objections to ARR growth and expanded margins

- Recommendation: Buy

- Valuation: $7.16

- Market cap: $611m

- Share price: $6.58 (31-Jan-20: $6.50)

Excerpts:

- Initiating coverage: Objective Corporation (OCL) is a multinational software business focused on providing content management and governance solutions with over 30 years of operational experience. OCL now provides software across Australia, New Zealand, the UK and the US to over 1,000 customers and 500,000 users in regulated industries. This supported revenue of $62M in FY19 (70% ARR) and close to 300 full time staff working across Australia, New Zealand, Singapore and the UK. OCL has been driven by the steady hand of founder and majority owner (~67%) Tony Walls since 1987 and has been listed on the ASX since 2000.

- Supporting CCZ’s buy recommendation is the upside risk to our forecasts which do not include growth via acquisitions. With a clean balance sheet OCL looks primed to add further products to the portfolio.

- The recent Alpha and MBS acquisitions in New Zealand (NZ) highlight OCL’s ability to create value. The acquisitions allow OCL to become the development approval (DA) process market leader in NZ with 74% of councils as customers. The development of a digitised end to end solution for the DA process through the combination of their Trapeze software along with the software acquired as part of the Alpha and MBS acquisitions should be a source of significant revenue growth into the future.

- The opportunity for OCL to cross sell products to current customers is significant. The majority of OCL’s customers only utilise one product of the 10 on offer in OCL’s portfolio. Most customers would benefit from utilising more products within the OCL portfolio and the software purchasing decision makers generally already have a relationship with OCL. CCZ expect that most of the revenue growth in future years will come from existing customers.

- OCL’s transition from the sale of perpetual licence products to SaaS (Software as a Service) annual licence fees has been a handbrake on revenues and earnings growth for the past few years. We expect negative effect of this transition to diminish with perpetual software sales only representing ~11% of revenue in FY19 and 70% of revenue being SaaS ARR (annual recurring revenue)

- The strong management team’s focus on providing solutions for customers, educating customers, high spend on R&D (over 20% of revenue all expensed) and specialised product offering act as a moat and have enabled OCL to develop world class products and a loyal customer base.

---------------------------

Disclosure: I don't hold OCL shares currently, but they're on my watchlist.

Objective Corp is a capital light, founder led business with a long history of delivering outstanding shareholder returns.

Clients tend to be highly sticky governement departments. Around half of revenue recurring in nature. Indeed the business appears to be rather defensive (sales and earnings grew over the GFC) and is extrenely capital light. That enables the business to fund growth (it has a long history of significant -- and fully expensed -- R&D) as well as return a good deal of profit back to shareholders (Payout ratio tends to be between 50% and 75%)

The founder and CEO owns the vast majority of shares, is strongly aligned to shareholder interests and has many decades of experience as a successful capital allocator.

The company has no net debt and strong operating cash flows.

Shares are quite illiquid, but certainly one to consider for a long term hold.

A master at capital management

Objective Corp. has reduced its share count by a massive 32% since 2008, starting with the company aggressively repurchasing 11% of shares outstanding during the GFC.

Those that didn’t sell into the buy-back have seen their stake in the company — and their share of the profits — increase by about 47% over the past 9 years. So while profits have grown 310% in the period, per share profits have climbed 500%.

It did this all while being essentially debt free, and making numerous bolt-on acquisitions -- something that it's capital light nature greatly enables.

Incredibly shareholder friendly and prudent capital management