Valuation – Audinate

In my earlier straws and posts this morning, I concluded that “the story” for Audinate was intact and made sense, but that I wanted to take a closer look at the numbers.

I’ve now done that work, and unfortunately, I can’t see how $AD8 gets on a trajectory to make enough money to justify its share price.

Accordingly, I exited this afternoon in RL and SM.

I’m not going to rehash the results or the outlook, as I think various StrawPeople have covered that well enough today. I will focus here on how I have translated today’s presentation and what management said into my assessment of value.

Having done this work, I’ve concluded that I don’t actually have any clue as to what the business is worth, However, the weight of analysis leads to numbers I don’t like. And because I could from $4.80 to $5.05 (in RL) and $4.785 on SM, that looked like a good deal to me, so I took it.

I'll go through the details of my analysis.

Methodology

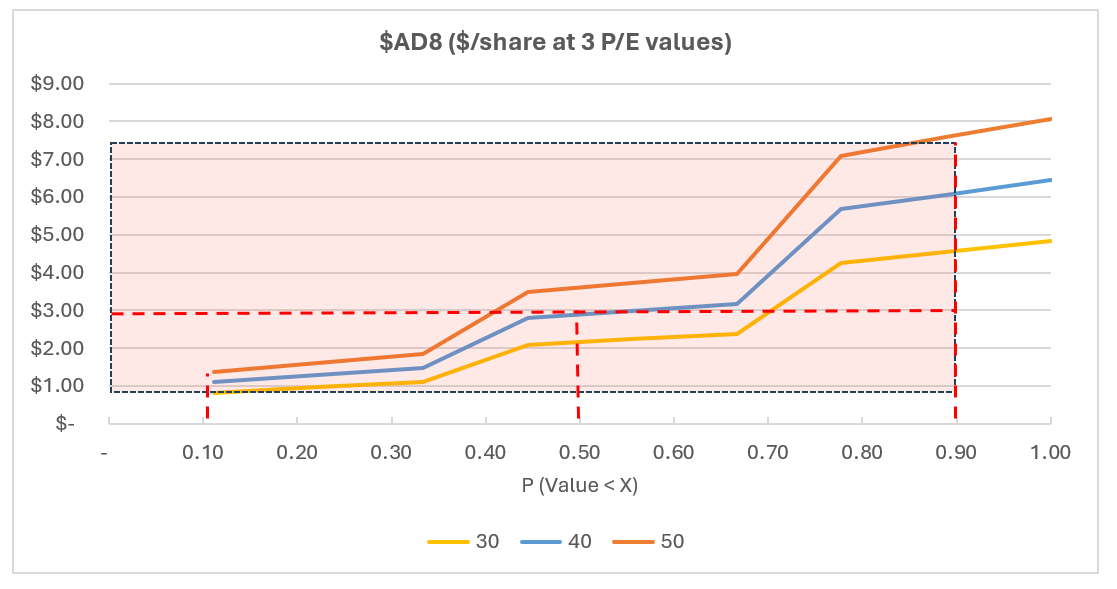

I’ve generated a range of scenarios to generate NPAT and EPS out to FY32. By that time, earnings are growing strongly, so I’ve then applied P/Es of 30, 40 and 50, and discounted back to today.

I considered having a go at a DCF, however, it’s not clear enough what the economics are around investment, so I reverted to extrapolating the financials instead. When you look at the scatter of ranges I get in the graph at the bottom, it pretty much doesn’t matter what method you use. (I defy anyone to trial and nail valuation down more tightly!)

That in itself was reason enough for me to decide that I can’t own this business anymore.

The Big Drivera – What Changed?

Three things have happened, that lead to me not understanding the value of $AD8 anymore:

1. Revenue: FY25 revenues went backwards, materially. We’ve written a lot about this before (i.e., industry ”Bullwhip”) on this forum, so I won't repeat it.

2. Industry Outlook and $AD8 positioning: Coincident with the “bullwhip” is the realisation that FY22-24 had temporary tailwinds of end customers investing in Pro AV networks to support things like hybrid working. The outlook for the industry now isn’t fabulous (AVIXA 3.9% industry growth short term; other sources show 4%-5% medium term; $AD8 revenue growing at 2 to 3 times industry). that's not such an exciting prospect.

3. Three-legged strategy driving business complexity and cost: As @DrPete rightly pointed out earlier today, the three-legged strategy has made $AD8 a complex business. “Video” is not yet profitable, and “Control” is barely launched, with IRIS launching later in FY26. So, +25% Opex for FY26, at a time when Gross Margin is expected to grow at only 13%-15% compounds the harm done to the FY25 financials by the supply chain problems. And don’t forget the investment in acquiring IRIS is going to further elevate D&A.

The business complexity point is not to be down-played. Each product, whether hardware or software, will have a finite life cycle, a need to support customers on legacy platforms (Aidan made references to this today), so the product portfolio can be expected to proliferate over time. Yes, this will be easier to manage as software becomes a greater share of revenue, however, $AD8 is not a digital native, and they have not demonstrated that they have the capability of effectively and efficiently managing software lifecycles.

In my preparations for the FY25 results, I was expecting to tell a story about a business that has suffered a 1-year hit, resulting from a transitory supply chain disruption. Instead, I’m looking at a business where the combined effect of the existing supply chain disruption, together with the investment needs to stand up the next two legs of the business have pushed profitability out into the future by 3, 4 or 5 years – depending on what you believe.

So, to the numbers and the scenarios I considered in valuation.

Revenue

With revenue growth of 2-3 times the industry, I’ve considered annual revenue growth scenarios or 10%, 12% and 15%.

Gross Margin

Over the period FY26 to FY32, I’ve assumed % Gross Margins advance steadily from 81% to 88%, as more and more of the revenue’s come from software, and hardware becomes less important.

Opex

We’ve been guided to +25% Opex growth in FY26, to support the launch of the “Control” leg of the business.

I’ve assumed that Opex growth moderates in FY27 (+6-10% in the high growth scenario; +5-7% in medium growth scenario; and +4-6% in low growth scenario).

Thereafter from FY28 to FY32 I’ve assumed 4% and 5% Opex Growth depending on the scenario.

Non-Operating Income

Income from the current cash pile was important this year, and I’ve ramped this down over the next 4 years, as the cash pile is depleted and as interest rates ease a little further.

Capex

Because I’m running a financial model, the impact of capex isn’t explicit, as the D&A is embedded in the Opex growth assumption.

However, D&A as a % of revenue has averaged 16% over the last 7 years, with [PP&E+Intangibles] amounting to 23% of revenue.

So, one question is, once the three legs of the platform are built doesn’t investment slow down, and will this help drive operating leverage? I clearly assume it does, given the modest rate of Opex growth from FY28 onwards, but again, this is where the portfolio complexity can bite. All of the products in the market have a limited life cycle, and so $AD8 will need to innovate continuously, bringing new features to market across the portfolio.

Ideally, I’d have looked further at this. However, management have never really given a lot of insight into the R&D and Capex programme. So I felt that looking at this in further detail is meaningless.

Shares on Issue

I’ve made an allowance for 2% annual growth in SOI.

Other Parameters

Tax rate – no taxes paid while unprofitable, and I’ve assumed in the later years a tax rate of 15% is payable, as there will be a significant deferred tax asset.

Discount rate – 10% applied.

Scenarios

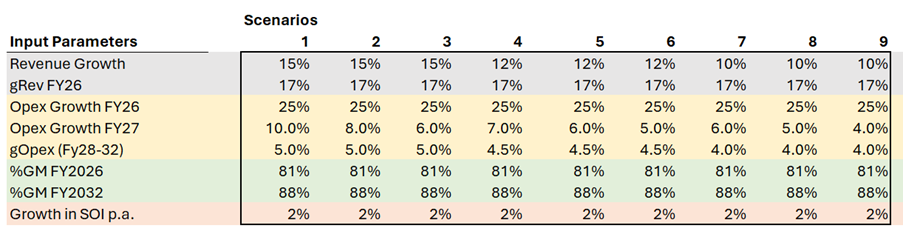

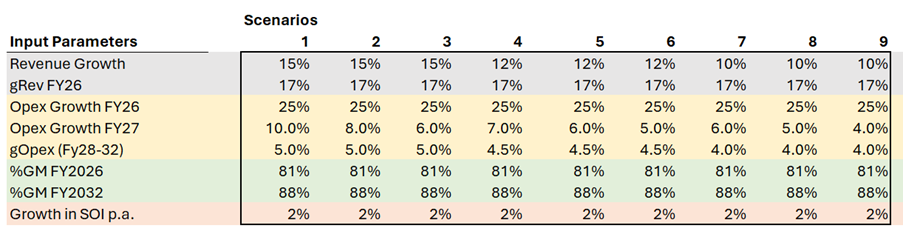

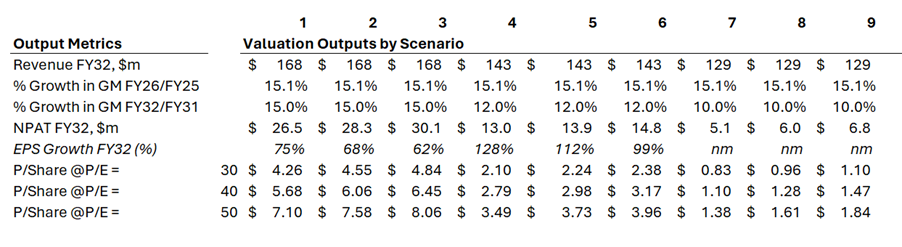

Table 1 (below) lists the 9 input scenarios that went into the valuation.

Output

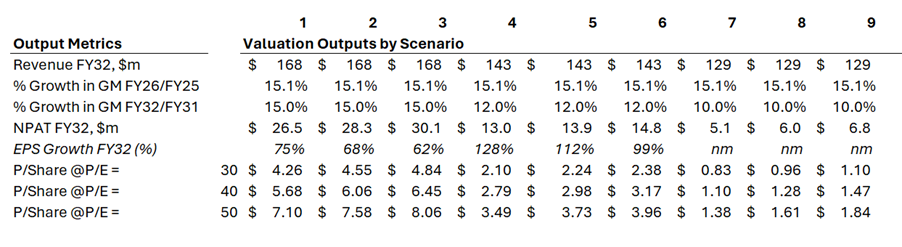

Outputs for selected metrics are show in the table below.

Graphical Output

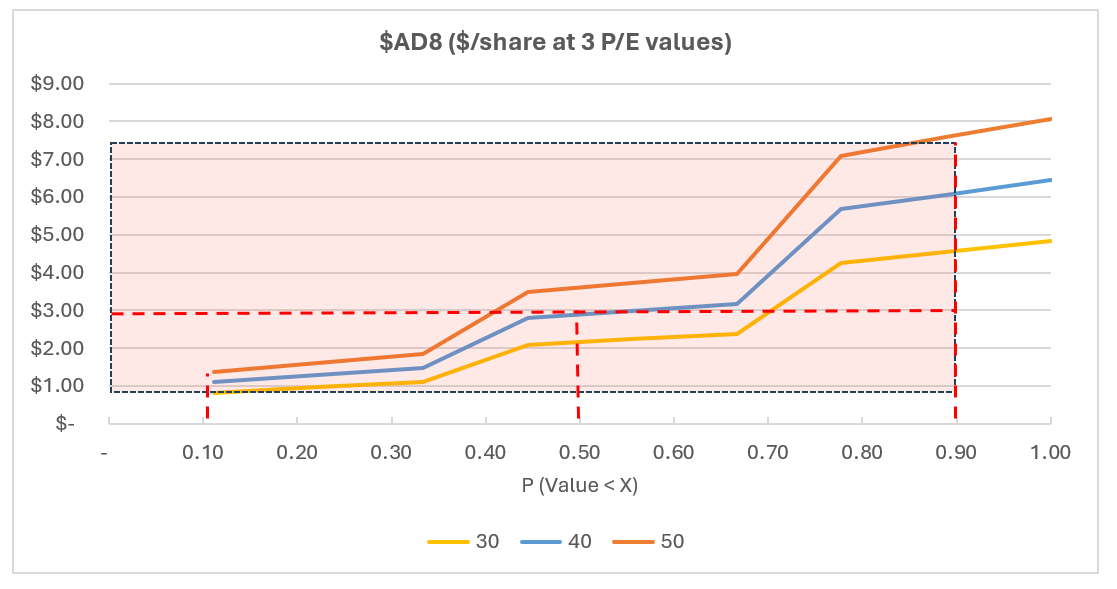

My p50% valuation ranges from about $2.00 to $3.80, depending on the FY32 P/E, with the range of scenarios generating valuations anything from about $1.00 to $7.50.

My Conclusions

It really should come as no surprise that it is virtually impossible to value $AD8 with any conviction. Afterall, in 2022 an unprofitable, hardware audio networking business pivoted to software, as well as entering the Video networking business via acquisition. Now, barely 3 years later, a barely profitable business suffers a material supply chain shock, while at the same time evolving the strategy to add on the “control” segment via an essentially pre-revenue acquisition.

I certainly don’t know what the economics of this business look like, and the valuations presented here are simply what I think might be a range of reasonable extrapolations of the recent financials, the guidance given, and the industry attractiveness.

For my valuation, I am going to settle at $3.00, and I’m going to put a range around that of $1.50 to $7.50.

From today’s share price of c. $5, I don’t like the potential downside of this investment, and the upside doesn’t look exciting enough for me. Afterall, even in the best scenario, we face another 4-5 years where this is a loss-making business.

Who knows what new challenge will arrive in the intervening period.

I’m out.

Disc: Not held in RL and SM

Disclaimer:

This is not investment advice. Scenarios are illustrations only. This analysis is only intended as a record of my personal decisions.