SCROLL DOWN FOR UPDATE....

RePost of initial valuation so it's easier to read. Thanks @Bear77 for your guidance on copy & pasting. it worked perfectly!

Hello Straw People!

My name is Travis, and this is my first ever company valuation. I am newbie "premium" member but have been a "free" member for a couple of years now and have thoroughly enjoyed reading through the various forums, straws, and valuations of others, albeit 4 weeks delayed.

My background in finance is limited to some minor study alongside a huge passion for reading and self-education, which is why I decided to become a premium member, as the collective thoughts, experience and truthful and honest feedback provided here I know I will find most valuable in the process of trying to make a rational investment.

*Please note, I was very hesitant to put my valuation and thoughts out there as I am a novice investor and far less experienced than many here and I assume off the bat that I will have errors in my judgement and analysis that will be highlighted, for which I am ready for and implore you to provide constructive critic and highlight were I may be biased in my thinking!

Before I start, please let me apologise if I babble on, repeat myself or just plainly confuse some with my explanations.

The aim of my valuation (no pun intended) and time of posting was to get It out there prior to the release of the Annual Report on Thursday.

Ok, back to my valuation. I have been a shareholder of AI-Media for just over 12 months and found out about the company here first, alongside @Wini’s previous appearances on the Coffee Microcaps webcast. Which alongside the Meetings on Strawman (which I finally have access too) I find this to be a great way to discover and hear from Small Cap companies.

I hope to write at length about the specifics of my thesis in time, however at this stage the valuation is based on a few important factors that I believe the company has in place and the opportunities in the future.

1. Founder led company, with Tony being extremely passionate and knowledgeable about the company and how Ai-Media’s product suite fits into the workflows of its customers.

2. He has considerate Skin in the Game, which should align our goals of increased shareholder value.

3. They have a product suite in which the Falcon Encoders are imbedded into the workflow of customers, with Lexi sitting on top to provide a captioning service that is faster, more accurate and 90% cheaper than current Human in the Loop captioning.

4. They have a tailwind with advancement of Ai technology, while also having several additional markets to build on. The market matrix of 9 sections was a highlight of the growth potential Americas/Broadcast (currently the biggest Rev generator), Americas/Government, Americas/Enterprise, EMEA/Broadcast, EMEA/Government, EMEA/Enterprise, APAC/Broadcast, APAC/Government, APAC/Enterprise.

5. The market may not be entirely aware of the Tech growth part of the company’s Revenue and how that transition of revenue mix is going accelerate their revenue growth, their margin expansion and EBITDA to get to the FY29 target of $150m in Revenue and $60m in EBITDA.

Which brings me back to my valuation. While it is detailed, I have tried to use as many numbers as possible that are historical, not too outrageous as well as any information I could obtain from the financials both in the reports and from the webinars that Tony and John Bird (outgoing CFO) have held over the past 3-4 years.

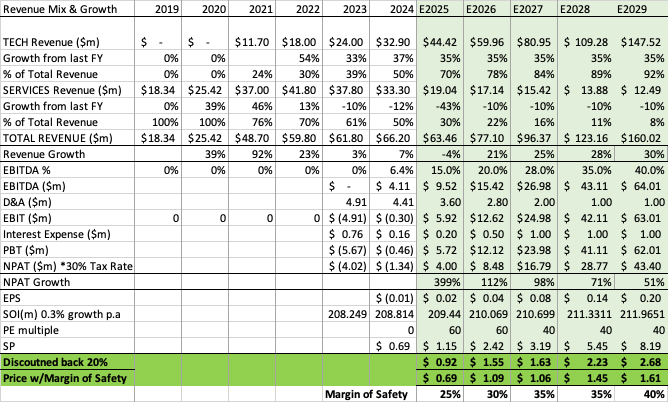

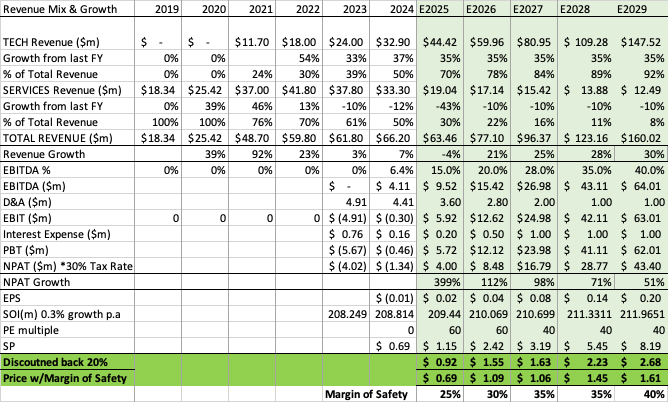

Below is my DCF for the company out to FY29 to see what is required for them to get to the target Tony has spoken about. Please note, DCF’s aren’t my forte and I’m sure I’ve made glaringly obvious mistakes, so please point them out to me as I need as many honest minds to provide me with feedback.

NOTES to my DCF:

- EBITDA Margin is based on a progression to 40% by FY29 to get the $60m target amount.

- SOI growing by 0.3% based on the growth from FY23-FY24. Tony and John have said they have no intention to capital raise, which should limit SOI growth.

- D&A future estimates based on CFO (John Birds) comments in FY24 results webinar. See at 1h5min mark here. Although he expects D&A to drop to around $0.5m in 3-4yrs. I’ve kept it higher in case of future acquisitions that they decide to capitalise on the balance sheet.

- Interest Expense based on a conservative future amount. I don’t foresee AIM requiring any debt to fund future growth, as Tony and John have said numerous times that it will be funded with cashflow. However, I thought I would include some interest expense just in case.

- PE is the most difficult variable to add in the mix. I went with a 40x multiple in FY27-FY29 based purely on a conservative multiple for a company averaging 146%pa NPAT growth between FY25-29.

- I’ve used a 20%pa. discount rate as well as a tiered Margin of Safety to account for the risk projecting so far into the future.

So, there it is! My first ever Strawman Valuation for $1.61 for Ai-Media (AIM).

Please let me know where I might be wrong in my calculations, or where I may have stated lofty or incorrect numbers that could have affected my valuation.

Disc. I hold shares in RL & on SM.

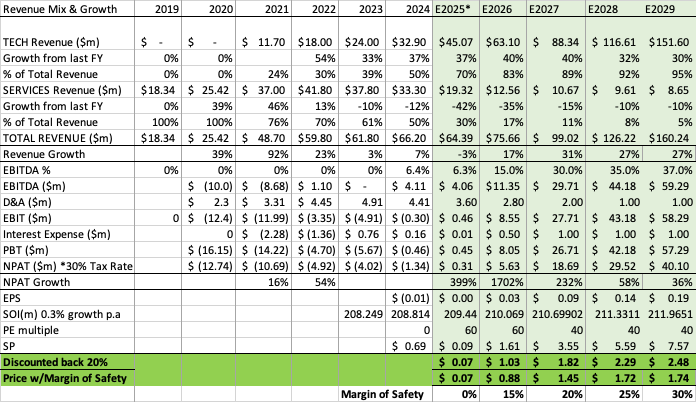

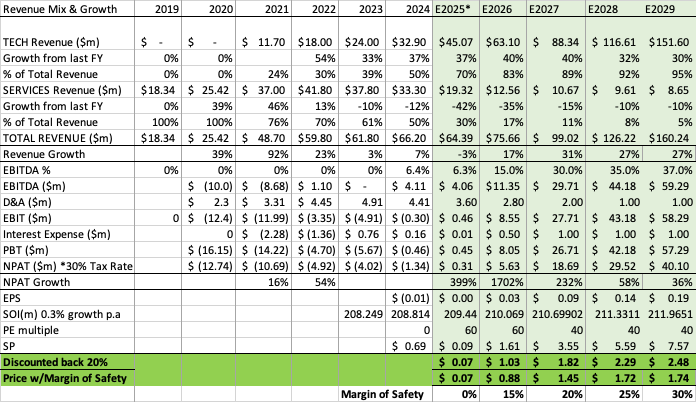

UPDATED VALUATION Ahead of FY25 results (AUG 24th 2025) of $1.74

I forgot to update my valuation and projections post HY25 results in Feb, but I wanted to get ahead of the full year results. Below is an updated valuation table, mainly to the estimated FY25 result.

I know there are a lot of numbers in my projection and only small deviations can change things dramatically. However my thesis is this, at least for the upcoming FY as the first step to the 2029 target:

- Tony has stated many times in interviews over the past 6 months that they expect the transition of TECH to SERVICES REV composition will continue and expect TECH to be at 80% of total REV by Dec 2025. So, I have estimated a 70/30 split between TECH and the declining (on purpose) SERVICES sections for this FY, then at 80/20 split from HY26. *Please note if this is achieved and considering a similar growth in Tech Rev of 37% for FY, then the H2 REV for Services would drop from $14.3m in 1HY25 to ~$6.7m in the 2HY25. A huge drop that may not happen and therefore may surprise on the top line.

- Tony has also mentioned multiple times, including on his most recent @Strawman interview that they project $4m in EBITDA, which I have included in my FY25 projection.

- D&A are estimated based on the run rate from HY25 and also comments from previous CFO (John Bird) on the FY24 earnings call. Only thing that would blow this out is if AIM send big on PPE or some intangibles during the 2nd half, but as Tony has said numerous times, they like a "clean balance sheet" and therefore don't like to capitalise asset purchases onto the balance sheet, they prefer to expense it on the P&L.

- While my projection goes out to FY29 to see how things could possibly move towards the stated target of of $160m in REV & $60m in EBITDA (mainly through organic growth using the 9 box matrix outlined as their focus), I have used a very conservative discount rate of 20% as well as using incrementally larger margins of safety on the future years to reflect the additional execution risk.

I'm eager to see how the numbers look and hear what Tony and Jason have to say on Thursday!

Disc. HL in RL & on SM. (one of my largest Small/Micro Cap positions)