Dubber Corp Ltd . ASX.DUB

March 2022

Dubber Corp are a call recording and artificial intelligence business which are cloud based. Dubber has partnered with 160 of the worlds largest telco’s and IT brands. Examples are Microsoft, IBM, Cisco, Optus. Dubbers customers are these companies who then on sale Dubbers product to their customers

Revenue comes via a subscription model where users calls are recorded and stored for future analysis. Using AI voice calls are digitised to txt and then available for analyse. The model is SaaS based. The annual revenue per subscriber is around $85pa.

There are many reasons why a company may need to record employee and customer calls. Training and quality, legal liability, fraud detection, improvements to customer support etc. Think the large banks and some of the recent anti money laundering issues.

Financial Summary

Current Share Price $1.38

Market Cap: $420m

Subscribers (Dec21) 510k +

ARR (Dec21) $51.8m

Cash on hand $108k

The value of the business is dependent on the growth of subscribers future.

Recent quarterly growth in subscribers numbers has been around 15% to 17% . If this momentum can be sustained then annual revenue multiples of at least 60% can be achieved

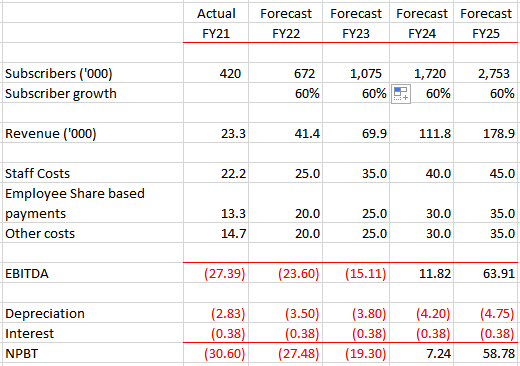

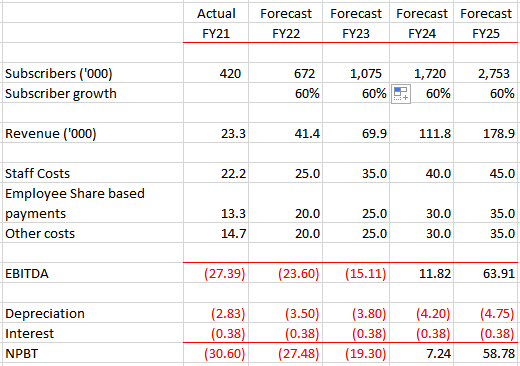

FY22 Forecast

The key to business forecast is the growth in the subscriber numbers and growth of staff headcount and related costs.

Here is my forecast

What I like

1) Dubber are SaaS based business and are solving a problem which many companies need.

2) Once implemented a customers become “sticky” and there is little churn

3) The Directors own 8% of the market cap or $33.7m. The CEO Steve McGovern has around $24m of company shares.

4) The total addressable market is the worldwide market. The partner companies are located globally.

5) Dubber have focussed on growing the business relationship with key business and large partners. They now need to the build subscriber numbers through this business network

My concerns

1) Dubber sells its subscription service via partners. It doesn’t control the relationship with the end user.

2) There has been a large increase in the headcount as the company pushes to grab market share. This increased headcount cost needs to convert to subscription and sales growth.

3) Recent subscriber growth over the last 3 quarters has been lower than the previous quarters.

4) Competition and new technologies are a risk.

Conclusion

Dubber experienced significant share price growth based off a market excitement in early 2021. Since then share price has declined from around $4.20 to $1.38

It is difficult to value Dubber due to the challenges of forecasting subscriber growth.

The software SaaS model can add large numbers of new subscribers with minimal increases in cost per subscriber.

Disclosure

I currently hold Dubber in my Strawman and real life portfolio.