Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

ASIC sues BDO Audit and its director Dean Just alleging materially false or misleading audit reports

Published 22 December 2025

Background

On 1 March 2024, Dubber released an announcement to the ASX that as part of the audit review process for its 31 December 2023 half-year accounts, the Company had become aware of inconsistencies in respect of funds that had been held on behalf of the Company by a third-party trustee. A preliminary investigation by the Company had uncovered that funds, purported to have been held in a term deposit account, may have been applied for other purposes and were not currently available to the Company. The Company’s maximum exposure was stated to be $26.6 million

AFR article:

Dubber sues auditors BDO for negligence over missing funds

June 17, 2025 – 2.21pm

Dubber Corporation is suing its former auditors BDO in the Federal Court, alleging the firm’s negligence contributed to $30 million of company funds being misappropriated by its former chief executive and an associate.

Aeriandi Ltd (a wholly owned subsidiary of Dubber Corporation Ltd) advises that VirginMedia O2 (VMO2) at around 3:30pm London time 19th May 2025 verbally confirmed that it will not renew our existing Agreement to provide call recording and wholesale SIP services that expires on 30th June 2025.

Someone's got to do it

Hopefully something good for holders that may still be here.

Apple announced call recording with AI capabilities today.

https://mashable.com/article/iphone-call-recording-wwdc2024

DUB has completed its capital raise.

Only 42.7% of the Institutional offer was taken up.

For the retail component, DUB wanted $16.4 million and received $9.9 million, so ~60% take up.

It was fully under-written and the under-writers have picked up the slack!!

No surprise. Why would people give money to a company that literally lost $30 million of its own cash?!

I still hold, both shares and hope, but didn't participate. This stock is a risk-realised scenario for me. The tax loss is of no value this year, so I'll keep holding this bag.

04-March-2024: 4 Reasons I Knew Dubber (ASX: DUB) Was A Dumpster Fire - A Rich Life [by Claude Walker, might be behind a paywall.] Good Analysis!

Big problems at Dubber $DUB and look has been topping up their holdings the whole way along, none other than Thorney.

Not only do Thorney Share holders pay through the roof with egregious fees they also get stellar picks like this. Thorney getting ripped off... beautiful irony.

$DUB released its 4C this morning.

Their Highlights

● Revenue of $9.8m in Q1 FY24 up 10% on Q4 FY23 and 46% on Q1 FY23.

● Run-rate of $5m quarterly cash savings from FY23 restructuring programme achieved in the quarter with operating cash costs including finance lease repayments1 of $17.2m in the quarter, down 8% from $18.6m in Q4 FY23.

● Net operating cash outflows including finance lease repayments1 of $8.2m in Q1 FY24, down 3% from Q4 FY23 and down 20% on pcp.

● Operating cash receipts for the quarter were $9.0m, down 12% on Q4 FY23, and down 5% on pcp reflecting expected seasonality.

● Capital raise undertaken raised $9.1m (net of issue costs) in the quarter.

● Cash on hand at 30 September 2023 was $33.7m.

● Deployment of Dubber Moments (Artificial Intelligence) solutions to customers underway in the quarter.

● Dubber Moments recognised as ‘Best AI Product in Telecom’ at prestigious CogX awards.

● Cisco Foundation programme moves to advanced revenue tier due to increased uptake.

● Continued market penetration with new network agreements signed across the Americas, Europe and APAC in the quarter, with 210+ Communication Service Providers agreements in place at 30 September 2023.

● The Company reiterates its previously advised expectations for FY24 of revenue of $45m and costs of $65m (excluding share based payments, goodwill impairment and FX gains/losses).

My Analysis

This is a business that has been working hard to rein in its costs, and working to maintain revenue, with receipts largely flat over the last 6Q.

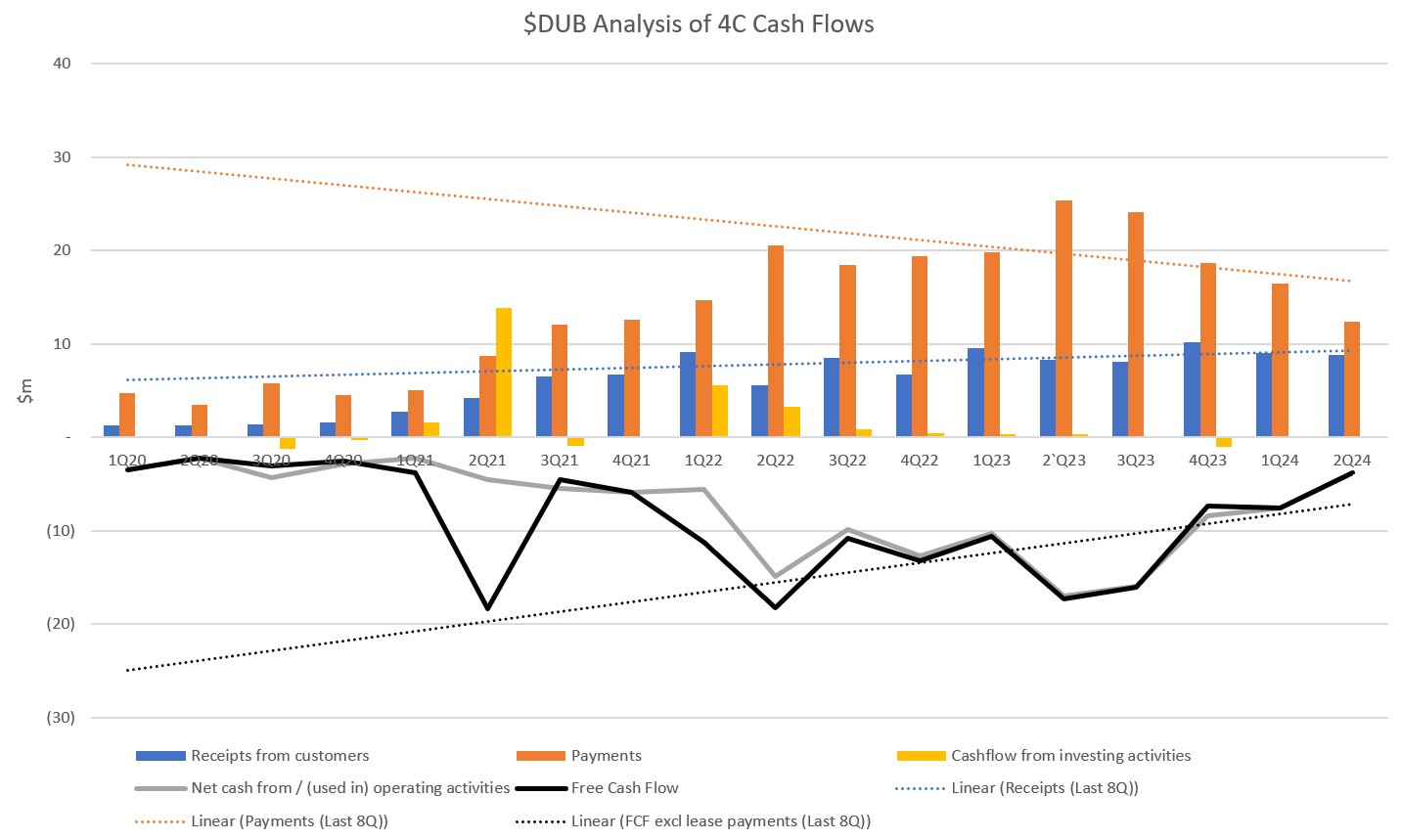

The CF trend analysis below shows just how hard CEO Steve McGovern has been working to turn the ship around.

And with $34m in the bank, and now four successive quarters of significant improvement in cashflows, the business is on track to achieving a more sustainable footing later this year.

It's not for me, but it will be interesting to see how they fare, and to see what level of revenue growth they can achieve once the business is right-sized, given that investments have been throttled right back.

Disc: Not held

Cheeky after hours release of a prelim report.

If we look at parts of this report in isolation, $DUB is a 'sure thing'. Hahaha 84% revenue growth! Hint... don't scroll down in the report.

Disc. Still holding....

Lakehouse Small Companies Fund revealed in their December newsletter than the fund holds Dubber.

Additionally, for a recent ~45% gain, this means the managers bought in at the most recent bottom of ~$0.30! Impressive analysis and timing!

For those unaware, Lakehouse was created and originally managed by Joe Magyer. An investor whom could sniff out value in early tech companies with an enviable success rate. Whilst he is no longer at Lakehouse, his most recent hires will have trained under him.

Maybe it is a short term hold for Lakehouse as Dubber is arguably undervalued. Or maybe the team see longer term value as well. Food for confirmation bias thought.

Valuation decrease based on rising costs (including staff headcount) significantly higher than average of previous forecasts and AI strategy still not proven.

FY22 Results

Annualised recurring revenue calculated as the next 12 months of subscription revenue, net of incentives was $59m, an increase of 51% on the prior corresponding period (pcp).

Total operating revenue was $35.6m, up 75% from $20.2m pcp, reflecting growth derived from new and expanded existing service provider agreements and adoption of additional Dubber subscriptions by service providers’ business and enterprise customers for Dubber’s cloud conversational recording.

Gross margin on call recording improved over the year to 70%, driven by increased utilisation of the platform in all regions against a substantially stable ‘cloud’ cost structure. The Company believes that gross margin will continue to improve as subscriber numbers and utilisation of the platform increases.

Cash receipts for the year were $29.9m, up 48% pcp. Cash receipts can be impacted from quarter to quarter by the timing of remittance of receipts from service providers. Some larger service provider agreements provide for extended payment terms which can result in an increase in trade debtor levels during the year as new growth revenues are added. The Company has adopted new policies and processes for customer payment terms to improve receipts in future periods.

At the end of June 2022, Dubber had 175 contracted service and solution providers agreements, an increase of 9% on the prior year. Since inception, Dubber has had zero churn of service provider customers.

Subscription numbers rose by nearly 40% pcp to more than 580,000 users as service providers and their enterprise customers recognise the benefits of unlocking conversational data across a range of voice services on a network. Subscription numbers do not include users of Dubber’s unified recording and conversational AI under Foundation Partner agreements.

In July 2021, Dubber raised AU$110 million in capital by way of a placement.

Since the placement, M&A opportunities continued to be evaluated, although high valuations resulted in Dubber deciding not to pursue some opportunities. The team will continue to evaluate acquisition opportunities close to its core business with a focus on expanding functionality on the platform and its footprint with global service providers.

The integration of Speik and Notiv was completed during the year with both businesses fully integrated at a team and technology level.

Notiv, rebranded Notes by Dubber, allows users to transcribe any meeting or call and turn that into a set of highlights and actions. Subscribers are able to review meetings that they weren’t able to attend and easily share highlights for action by others. Speik provided mobile call recording for tier 1 carriers in the UK and also has payments related technologies whereby it processes billions of dollars in phone payments securely and compliantly and is deployed into large, sophisticated, global contact centre and service provider customers.

Just to reinforce/ add to @Valueinvestor0909 commentary and analysis, I've also updated my 4C analysis - look at the trend of the dotted OpCF line - continually heading south. There might be a "value proposition" here for customers, but I can't see one for investors.

What is terrible about this is that investors are given no clue of the underlying economic problem in this firm from the Company Results "Highlights". This is another company where it is possible to argue that the Board of Directors could be accused of misleading investors by allowing the published highlights to go out in the form they have. Each statement is accurate on its own, but collectively, they fail to paint the overall picture.

(Note: I always do the analysis below for pre-profit growth stocks - and I always update my analysis before I read the release. It takes a little discipline but it has saved me a world of pain. Each update takes about one minute's work.)

Disc: Not held on SM or IRL (exited on 3-May-2021; now on watchlist)

Dubber today released results for Q4 FY22.

Revenue growth 40% over prior year. I like to look at the 3 year rolling CAGR. This has reduced from 94% to 70%.

I'm feeling somewhat underwhelmed and I'm sure the market will respond accordingly.

Comments from the investor call:

- Fully funded for 5 year business plan - code for don't expect free cash flow until at least FY27.

- Expenses are higher than expected due to spending on customisation for specific carriers - for the promise of future cash returns.

DUB will be highly volatile over the next 5 years and any long term holders will need a strong stomach.

Dubber Announced Q4 FY2022 Report.

So basically, it burns roughly $12m every Q. Based on $84m current cash, it can survive 7 Qs.

Based on its current number it doesn't look like it will be cash flow positive before FY24.

I would question the business model - is it sustainable?

Excellent coverage on Dubber ARR ! Topical as ever

@value investor

having been a longterm holder, it's difficult not to agree with you.

The negatives are pretty apparent:

- huge increases in costs. Staff costs are nearly 10million just for the last quarter. Product manufacturing and operating costs were over 8 mill. almost bugger-all of these were due to marketing/advertising and product development which I would be happy to see, assuming it would drive future growth

- a drop in revenue this quarter vs last. There were some excuses, see announcement, and I understand getting timely payments of telecom companies can be extremely difficult but it is a red flag.

- dilution is ongoing and significant (as per last post from value investor)

The positives still exist:

- fat bank account with 78mill in cash and 30mill drawdown available

- cash burn is reducing (if one assumes receipts return to previous trajectory). They make a point of stating that growth in ARR is picking up faster than core opex.

- headline ARR is increasing nicely.

- number of providers and subscribers continues to trend up, which one assumes is a lead indicator.

On balance, though, I am now increasingly doubtful. There is no mention of ARPU, just a statement that partnerships "are leading to opportunities to offer higher ARPU products". There is no mention of any of the other metrics one would expect from a SaaS company (churn, NRR, CAC/LTV etc), which I am sure would be mentioned if they were positive. The benefits of scale and exponential unit economics that a Successful SaaS should demonstrate, do not appear to be eventuating. Perhaps it is a bit too early and/or this business has a higher fixed base than I had appreciated? Perhaps the size of the opportunity will, in time, dwarf the fixed costs?

The story still sounds great, right? The leader in voice recording for multiple massive telecom providers, partnered with Cisco, expanding into Zoom and similar teleconferencing apps...and so on.

I still hold, but sold down 50% earlier in the year shortly after the big rush following a Motley Fool buy rec - which was an opportunistic but lucky move, as this last 4c shows.

Love to hear others' thoughts.

C

Share count increase

Strong growth YoY but it is slowing significantly QoQ, so expect a bumpy start to trade today:

· Revenue $8.1m +149% YoY but only +9.5% QoQ

· Subscribers over 450k, +96% YoY but only +7% QoQ

· ARR $43.5m +140% YoY but only +12% QoQ

· Cash $126.7m following $110m cap raise

· Notiv acquired during the quarter

· ASX300 inclusion

I was hoping for growth rates QoQ to be stable or grow with the Cisco partnership, so I am disappointed (and I expect the market will be) despite what are very good growth rates in general. I am holding my valuation steady, but it looks unlikely that DUB will hit my expected FY22 revenue at this rate.

Disc: I hold (RL+SM)

DUB has acquired Notiv for A$6.6m ($5.15m cash + 386,277 shares, all upfront) – attached:

· Notiv is a developer of innovative cloud-native AI-based products that turn meetings into transcribed notes, summaries, signals, actions, and more

· Key management and employees are to stay with the business

· With Notiv, Dubber will now have the ability to automatically take notes and create action items on every call.

This acquisition strengthens the AI offering Dubber has and adds to the development team. It doesn’t sound like it will provide a stand-alone product for additional sales, rather it adds features and further development to Dubbers AI value added offering.

It’s only a small deal, so has little impact on valuation, but helps underpin it’s competitive position and innovative capacity – no change in valuation.

I hold DUB

You ask the most important question @Firedup in your straw:

“A question about the Cisco arrangement. If Cisco decide to leave Dubber is it so easy as to just depart or have Dubber an entanglement with all the Cisco customers that will be difficult to unwind. In other words is Dubber's involvement down the line from Cisco creating a real stickiness?”

The short answer I believe is YES, attached is an announcement that has links to a presentation and 6min video that are worth viewing on it.

The Long Answer:

· DUB is providing a “Freemium” type model that is distributed via Cisco with a basic free plan available to all “Cisco” customers. This doesn’t provide the stickiness we want to see.

· However, when free users becoming paying users they sign up to a DUB subscription, at which time they become “DUB” customers for that service and it’s partner Cisco receives a commission on this (terms and amount unknown). This provides the stickiness we want.

· If a customer wants to retain recordings for greater than 30 days and/or wants to switch on the analytics and intelligence functionality then they need to upgrade to a DUB plan.

· DUB is provider agnostic (ie telco or app indifferent), so provides one place for a customer to house and analyse all their recorded data. If they change telco’s or app’s they don’t have to worry about loosing access to previously recorded information. This provides DUB with an advantage over Telco’s and video app providers setting up and offering their own call recording offering (also they would need to replicate the analytics capacity of DUB).

· DUB is the one that stores the data and the data is where the value is for the customer, so as long as DUB controls that data it owns the customer.

That is my take on it, DUB don’t exactly spell out who “owns” the customer, as it is a partner approach, but I think DUB owns the customers voice data service, while the Cisco owns the customers phone or webex service

Given DUB is now worth $1b and is trading about 40% above my previous valuation of $2.54 it’s time to understand what the current price implies. My comments about the company in the original valuation from 8/2/21 still hold, but added a Like/Loath list. The DCF assumptions that are needed for the current value (a reverse DCF) are detailed below and valuation summary attached:

IV = $3.48 (current market value justification)

Like: Skin in the game and Founder lead (3% CEO, 19.6% insiders per YahooFinance), rapid growth of subscribers, ARR and contracted service providers; global opportunity; go to market partner approach lowers risk, offers land and expand options but retains high net profit margin opportunity at scale; capital light business model; low friction scalable and sticky product offering; cloud leader with value added AI offerings, perfect for Covid and post Covid world providing functionality to existing demand and expanding demand with accessibility for online recording and analytics.

Loath: FCF negative and need to raise capital; sub-scale leaves it vulnerable to competition; yet to crack the US market (Cisco agreement addressing this); loss of margin through partner go to market; risk of poor M&A outcomes; continuous need to invest in R&D to remain competitive; Risks around cybersecurity and IP protection have significant downside potential; Glassdoor 56% but only 10 reviews; 20p remuneration report (long but not complex).

Reverse DCF Valuation Assumptions:

· TAM: Jonathon Higgins at Shaw and Partners has a total addressable market of about 100m potential users with current pricing around $100 per user per year, this would put the TAM at A$10b. DUB is the leader in the market which is growing so it is clear there is little in the way of TAM limits to growth over the next decade.

· Revenue/ARR: The company has targeted A$100m in ARR by 2023, I accept this as achievable and expect 1m Subscribers are needed with ARR per subscriber increasing to over $100 ($92.86 FY21). I expect strong growth to continue with A$400 ARR and 2.8m subscribers my 2030 target if they continue to lead and the market grows.

· Margin: Ignoring other revenue like grants, H1 FY21 gross margin was 48.1% up from 31.6% for FY20. I expect this to grow to mid-60% by 2030 with scale and upsell opportunities. Note this is much lower than most SaaS businesses because they operate through partners who are resellers and clip the ticked on the way through which impacts gross margin, but it reduces marketing and sales spend requirements to grow because the partners dive most of this, so still leaves a strong net profit % at scale.

· Op Cost: will grow with product investment but much slower than the rate sales, so Opex% will drop rapidly and I estimate 50% of sales by 2023 is possible and sub 20% by 2030.

· EBITDA: The operating leverage of the business with improving gross margins and low sales and marketing cost requirements to fund growth should result in high EBITDA% opportunities, as high as 50% by 2032 I think is possible.

· Capital spend: With R&D product development costs being expensed, there is very little capital spend required. I have conservatively used 500k for FY22 increasing by 10% pa.

· Share Count: Taken as post current raise then rising at 2% growth going forward to allow for dilutive issues, but I assume raises for further acquisitions will be EPS accretive. To take into account growth opportunity from acquisition I have allowed at 10% premium.

· Discount: I am using a long-term market return rate of 10% as my discount rate and EV/EBITDA multiple of 10 in the terminal year which equates to a P/E of 14 and perpetual growth rate of 3%. Note I am ignoring amortisation of acquisition goodwill which supress earnings but should be ignored.

Is the current price justified?

Well it’s possible, given it assumes DUB only gets around 3% of the TAM by 2030. It is also possible that growth will be faster and revenue much higher given there are very few speed limits on growth with partners selling to customer and upsell opportunities with product expansion.

It’s a good business model and a leader in a rapidly growing market, so I am happy holding my position pending full year results at current prices. I will be looking at how operating costs have moved when the annual report is out at the end of the month, which were not disclosed in the recent update. I am expect a loss in line with last year and on track for break even by FY23.

DUB has completed both tranche's of it's $110m placement. I had thought the second tranche was for retail shareholders but am disappointed to find out that it isn't...

Not good form to leave retail shareholders out in the cold, I will be registering my thoughts on this with them. I understand the need to quickly land a large portion of a capital raise with insto's but a later dated SPP should be on the table.

Dubber is capitalising, literally on a good Q4 update to build an M&A war chest and cash reserves for organic growth. 4C is attached and I have added a table I have summarising key metrics over the last 2 years and key extract to the top. Summary below of update and placement:

Q4 Update:

· Revenue: $7.4m (+12%) for the quarter, $21.5m (+82%) for the year

· Users: 420k, up +10.5% QoQ, +118% YoY

· ARR: $39.0m, up +14.7% QoQ, +142% YoY

· Cash: $32m on hand, but capital raise for additional $110m

· Dubber is now a standard feature of every subscription for Cisco’s Global cloud telephony platforms Webex Calling and UCM Cloud.

· Dubber has successfully integrated the acquisitions of Speik and Calln

Placement Summary:

· $110m fully underwritten placement for 37.3m shares at $2.95 (7.8% discount to close)

· Initial placement of 33.1m shares to insto’s will settle by 30 July, not subject to shareholder approval.

· Conditional placement of 4.2m shares to everyone else will settle by 3 September subject to shareholder approval.

I hold DUB, the capital raising was a bit of a surprise but provided they spend well it’s the right time for them to accelerate growth beyond what they can do organically. The current price is now well over my $2.54 valuation done back in February, there was upside opportunity in my valuation so I am happy to continue to hold and update once full year results are out

06-May-2020: Dubber Goes Live on Cisco Global Price List

DUB up +11% so far today.

Dubber Goes Live on Cisco Global Price List

- Dubber Call Recording, Data Capture & AI services now available via Cisco Global Price List

- Services can be ordered as a native feature for Cisco Webex Calling

- Opens up the market to Cisco’s global sales channels

- Immediate demand as part of enterprise Business Continuity Planning requirements

Dubber Corporation Limited (ASX: DUB), which provides the call recording and data capture platform for Cisco Webex Calling, is pleased to announce it is available via the Cisco Global Price List and order entry system (CCW) with immediate effect.

The Dubber services have, for an initial period, been available in the network via an interim process which required the Cisco channel to liaise directly with Dubber to satisfy immediate requirements. Now, Call Recording and Data Capture services for Cisco Webex Calling can be ordered by any of Cisco’s resellers globally directly from Cisco.

Against the background of a generational shift to working from home, businesses and enterprises are now looking to Cisco Webex Calling for the solution to their immediate workforce requirements and long-term Business Continuity Planning (BCP) as they seek to replace legacy hardware-based telephony services with flexible, cloud based capability. Call recording is a key requirement in this process and is now immediately available for any Cisco Webex Calling user.

--- click on link above for further information ---