$DUB released its 4C this morning.

Their Highlights

● Revenue of $9.8m in Q1 FY24 up 10% on Q4 FY23 and 46% on Q1 FY23.

● Run-rate of $5m quarterly cash savings from FY23 restructuring programme achieved in the quarter with operating cash costs including finance lease repayments1 of $17.2m in the quarter, down 8% from $18.6m in Q4 FY23.

● Net operating cash outflows including finance lease repayments1 of $8.2m in Q1 FY24, down 3% from Q4 FY23 and down 20% on pcp.

● Operating cash receipts for the quarter were $9.0m, down 12% on Q4 FY23, and down 5% on pcp reflecting expected seasonality.

● Capital raise undertaken raised $9.1m (net of issue costs) in the quarter.

● Cash on hand at 30 September 2023 was $33.7m.

● Deployment of Dubber Moments (Artificial Intelligence) solutions to customers underway in the quarter.

● Dubber Moments recognised as ‘Best AI Product in Telecom’ at prestigious CogX awards.

● Cisco Foundation programme moves to advanced revenue tier due to increased uptake.

● Continued market penetration with new network agreements signed across the Americas, Europe and APAC in the quarter, with 210+ Communication Service Providers agreements in place at 30 September 2023.

● The Company reiterates its previously advised expectations for FY24 of revenue of $45m and costs of $65m (excluding share based payments, goodwill impairment and FX gains/losses).

My Analysis

This is a business that has been working hard to rein in its costs, and working to maintain revenue, with receipts largely flat over the last 6Q.

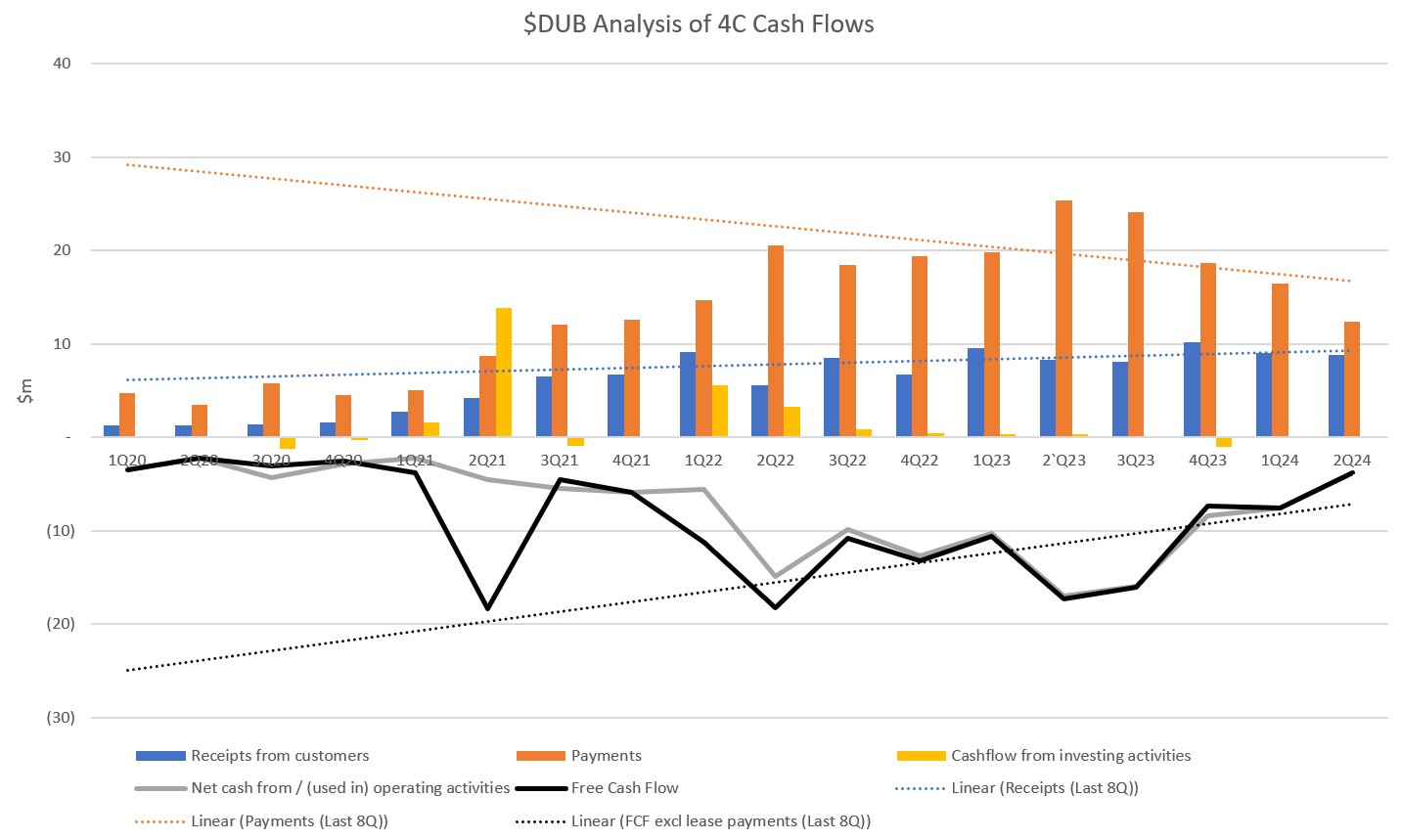

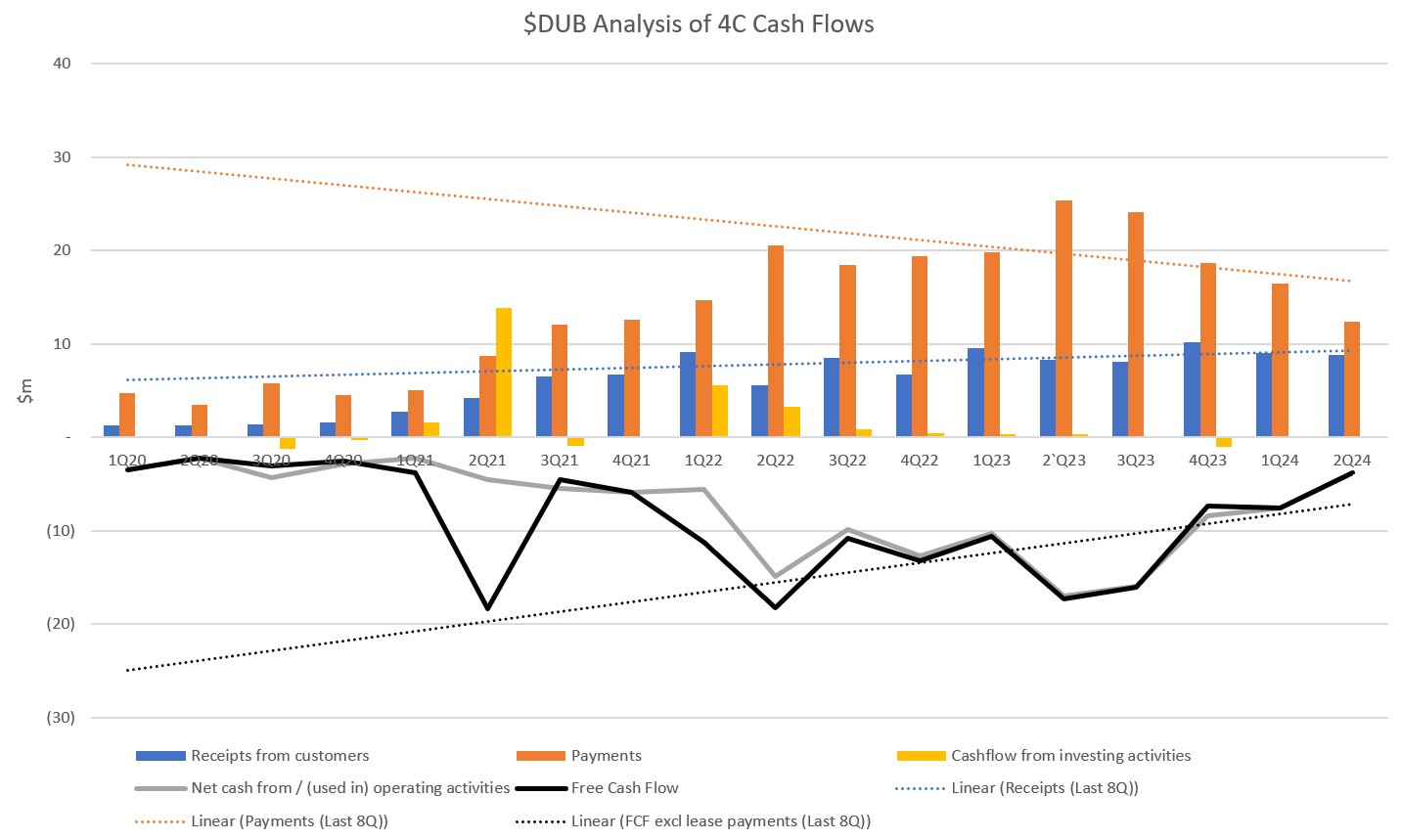

The CF trend analysis below shows just how hard CEO Steve McGovern has been working to turn the ship around.

And with $34m in the bank, and now four successive quarters of significant improvement in cashflows, the business is on track to achieving a more sustainable footing later this year.

It's not for me, but it will be interesting to see how they fare, and to see what level of revenue growth they can achieve once the business is right-sized, given that investments have been throttled right back.

Disc: Not held