Lov is an amazing business, with great economics, a long runway for growth, high margins, a very good experienced management team, operating as a market leader within their niche, However she trades at 47.5x 2024 earnings in a global economy with subdued demand, while reporting declining SSS, both of which can and are resulting in a slowing of store growth.

It's hard to see any short-term upside given the set-up above of poor market conditions and high expectations.

But thinking more long-term there's no reason why LOV can have 2k+ stores in the US (which is still lower than Aus's current penetration) if they continue to do what they're doing and add in the UK and maybe China dare I say, all of which compares to the total global store count of 854 today. In H1 24 the most recent half, they added 53 stores compared to 86 in both H1 & H2 23 (+172 for the year). Brett has outlined they will grow the store count when they find suitable profitable locations, and in this environment, it's likely getting harder to grow the store count which has raised the possibility for some short-term downside given the optimism

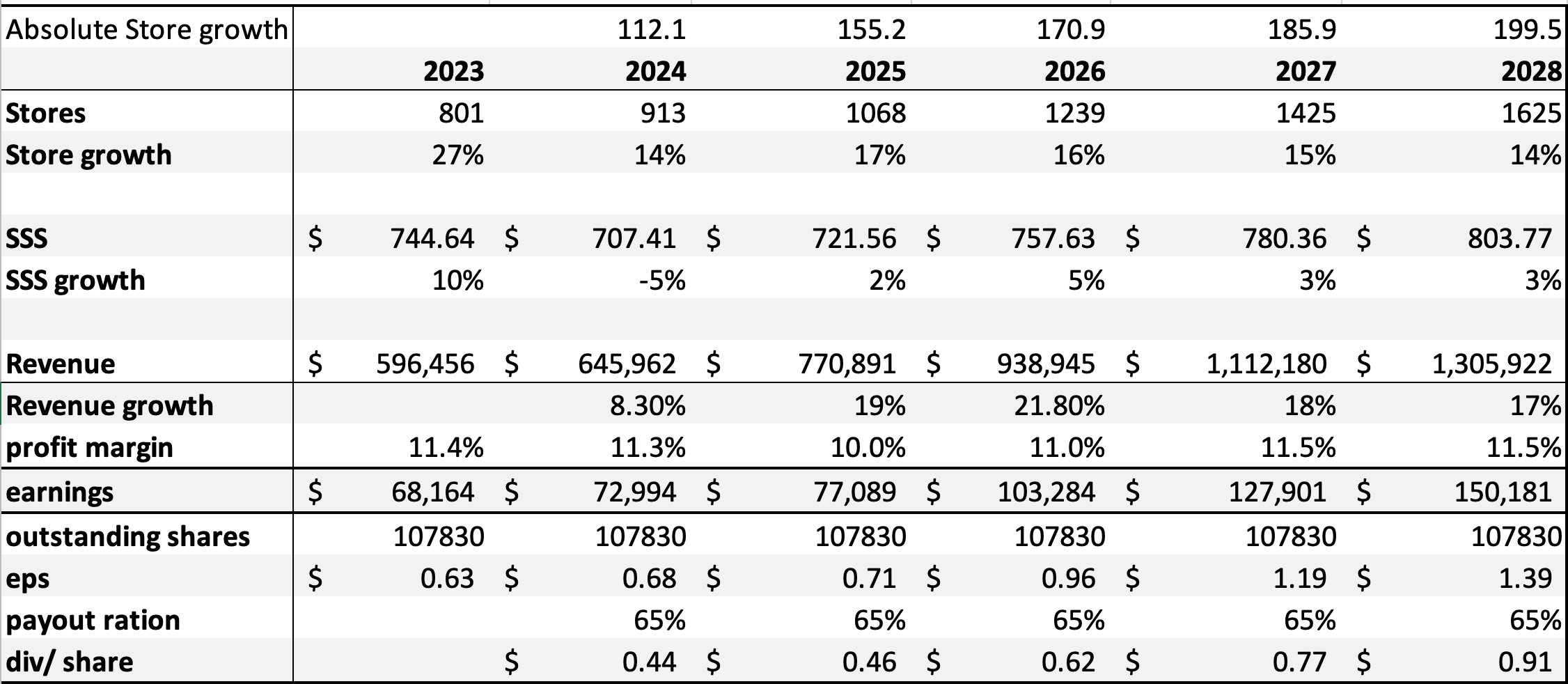

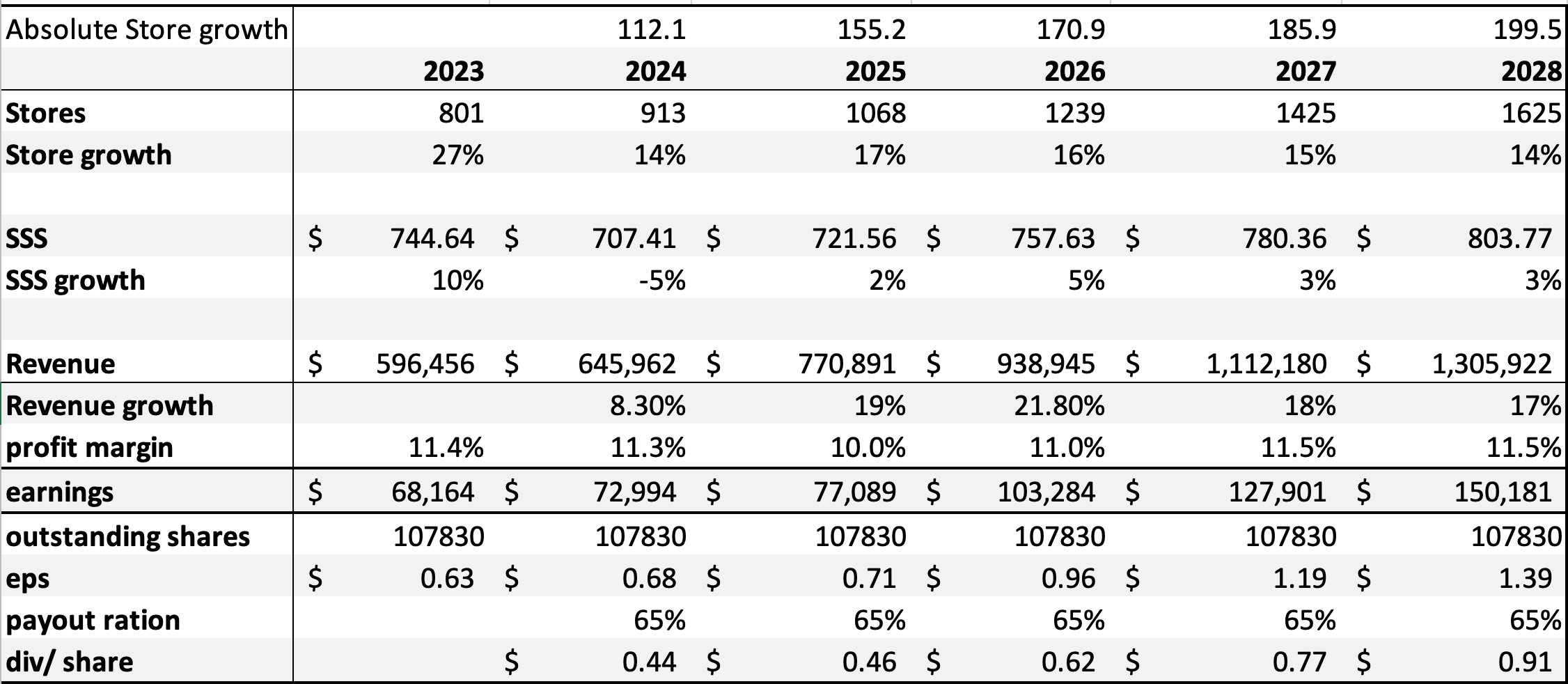

My base case valuation includes

The ASX has never seen a store rollout like this, our best retailers only really operate within Australia, and US peers are likely a better comparison. The Alpha in my opinion will come from years 5+, and I think Lov can compound Rev and earnings for 12-15% for 10+ years. The assumptions above along with a PE of 30 give an IRR forecast of 7.86% across the next 4 years which is very meh.

Given 44% of stores fall within Aus and the US, I'll show some data looking at US peers which gives a good gauge on the market and Lov likely SSS and store count growth. All ASX retailers are recording poor numbers which isn't too much different to the US

US Peers: overall from the most recent government data US retail spending was up 2.67%, with in store sales up 1.5%

Target- recently reported -3.2% sales growth in Q1, with EBT up 1.3%, noting decent declines in discretionary partially offset by beauty (Likely strong online growth)

Amazon-Q1 US sales up 12%, with US operating income up from $0.9B to $5B, with International Sales up 10% and operating income falling from $1.2B to $0.9B

Lululemon- 2023 sales up 18.5% with Profit up 81%, however, they have guided for 2024 growth of just 9% for revenue and EPS growth of 3-5%

Nike- Q3 sales up 2% constant currency, noting no growth in the US, with decline's in Europe/ the Middle East offset by growth in Asia with NPAT down 5%

ADIDAS- Q1 sales up 8%, noting growth in all markets But North America which declined 4%, with Profit up 3%

Inditex ( Zara, Massimo Dutti, and Pull&Bear)- FY sales up 10.4% and NPAT up 30%, with US sales up 7%

H&M- Q1 sales down 2%, with US sales down 7%

Summary, the non-online and more discretionary retailers are struggling, all recording no real growth or strong declines in growth (ex Amazon)

Summary for Lov: I will likely Trim, it's hard to see any real upside in the short-term while there is a decent amount of downside given the valuation and market conditions, would love anyone's commentary or thoughts