Half Year Results - FY2024 - Mineral Resources Group

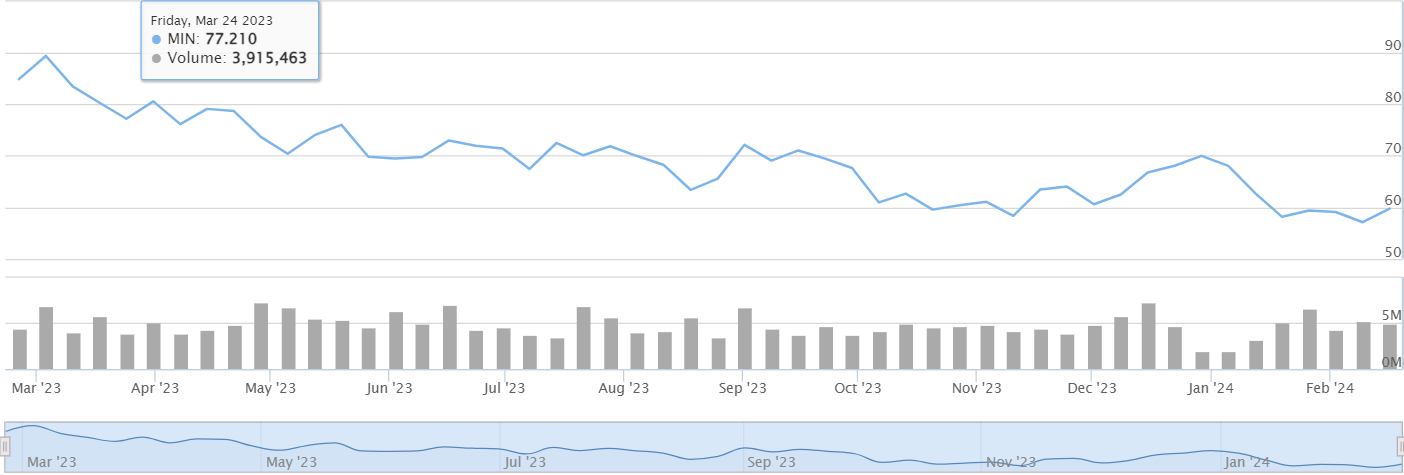

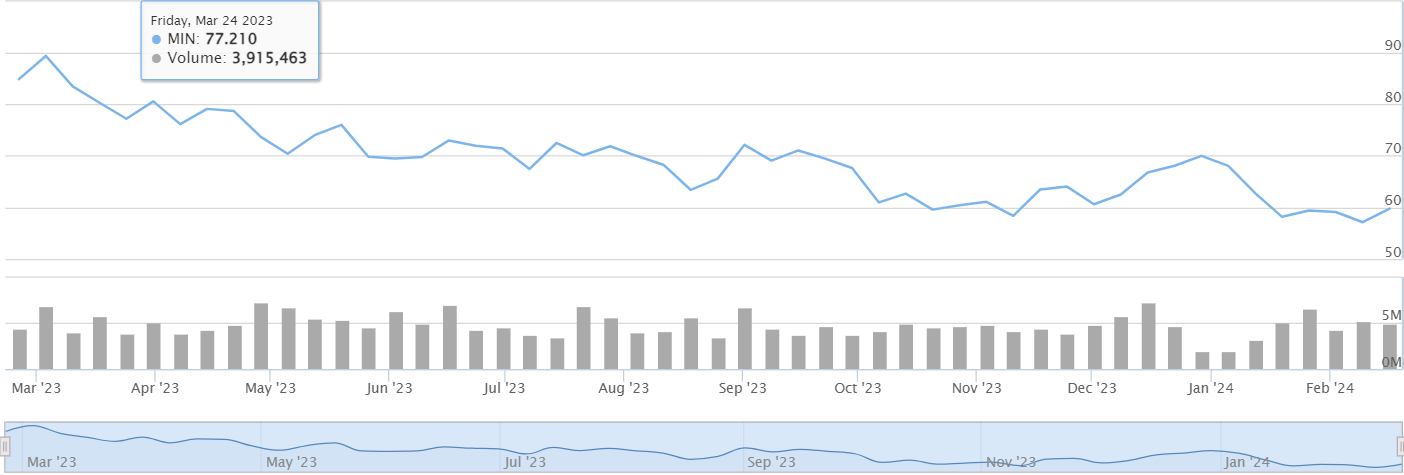

The SP has been hit since the start of the year, aligned similarly with commodity pricing - with highs of around $91, it has been on a steady decline to where we see it today at around $60.

In my humble opinion, this is an underrated company that is treated like a producer, however potentially shouldn't be treated quite the same...

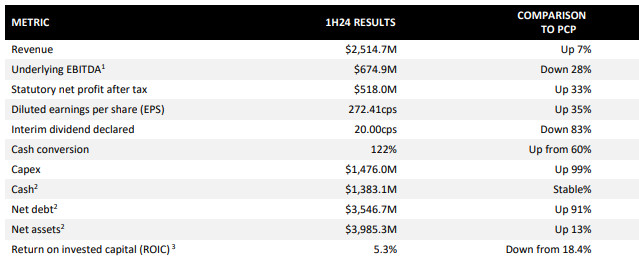

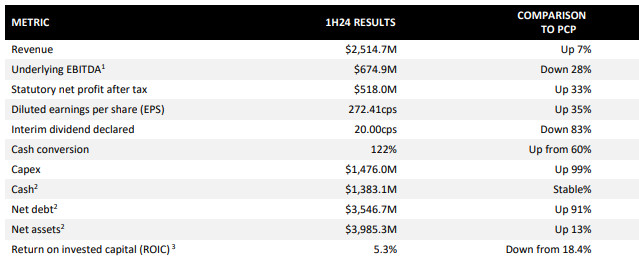

A few key financial points from todays announcement:

- Revenue increased by 7% to $2,514.7 million.

- Statutory net profit after tax rose by 33% to $518 million.

- Underlying EBITDA was $674.9 million, a 28% decrease.

- Iron ore segment revenue up by 37% to $1,329.4 million.

- Significant expansion and acquisition activities in the lithium segment.

- Declared a fully franked interim dividend of $0.20 per share.

They've also provided a review on their operations for the first half:

Mining Services:

- Production volumes were within guidance and delivered an underlying EBITDA of $253 million.

- Awarded five (5) new contracts and renewed three (3) contracts with Tier 1 clients.

Iron Ore:

- Construction of Onslow Iron remaining on budget and on track for shipments in June 2024.

- Sales volumes reaching 8.7 million wet metric tones, aligned with guidance.

- Underlying EBITDA of $266.2 million, up from $37.1 million in 1H23.

Lithium:

- Commissioning of Mt Marion plant expansion, resulting in 99,000 dry metric tons of SC6 equivalent spodumene concentrate shipped, up 39%.

- Pre-strip activities at Wodgina were well advanced, with an increase in shipped concentrate of 36%.

- Acquisition of Bald Hill, effective 1 November 2023, and the completion of the MARBL joint venture restructure in October 2023, which increased Mineral Resources' ownership in Wodgina to 50%.

Energy:

- High-quality clean gas intersected through drilling activities at the Lockyer-3 appraisal well.

- A development application for a gas processing facility was submitted, with a Final Investment Decision expected in 2H24, subject to WA Government agreement for partial export.

A few risk areas from my point of view:

Lithium and iron ore price along with market and economic conditions:

- An obvious one, however the lithium and iron ore segments of the business could take a hit dependent on the price of both.

- The lithium segment already saw some performance issues, despite the offset of lower costs due to higher plant recoveries and increased volumes.

- To some extent, the global economic environment with overall fluctuations in commodity prices and demand for these resources.

High capex and failure to execute:

- They've made some significant capital investments through the development of Onslow Iron, the expansion of Mt Marion and the acquisition of Bald Hill - Yes, there is no doubt that these are strategic investments, they were also a substantial outlay of funds.

- If these investments don't hit the mark for the expected returns, or their delayed, the market may not look at them too favorably.

The following is directly from the Director's Report:

Underlying operating cash flow before financing and tax7 of $820.8M was up $261.5M on pcp, representing a conversion rate from Underlying EBITDA of 122 per cent.

- Progressed development of Onslow Iron, with all major approvals received and equipment orders placed. Construction is expected to be within budget and remains on track to deliver first ore-on-ship in June 2024. Drill and blast and load and haul operations commenced in the period. The Onslow 300- room construction village has been completed and is fully occupied. The transshipping wharf was completed and the shiploader was installed in December 2023. Successfully completed first transhipper sea trials, with the first two transhippers scheduled to arrive in 2H24.

- Mt Marion expansion commissioned and ramping up.

- Pre-stripping of Stage 2 and 3 at Wodgina.

- Continued focus on gas exploration in the Perth Basin. Commenced assembly of a new automated drill rig, expected to be operational from mid-2024.

- Investment to support new Mining Services contract wins.

- Acquisition of Bald Hill with project control assumed on 1 November 2023.

As I write this today, the market has seen these results as positive, and the SP has increased by around 4% to $61.50.

I'll be doing my own valuation on the financials this evening (pending my 11 month old daughter's sleep routine... which is ever-changing) and I'll post that at some stage. Might even give the McNiven's Formula a whirl, thanks to @Rick's presentation the other night.

Cheers,

Tom.

Disclosure: I hold both in my real-life portfolio and on Strawman.