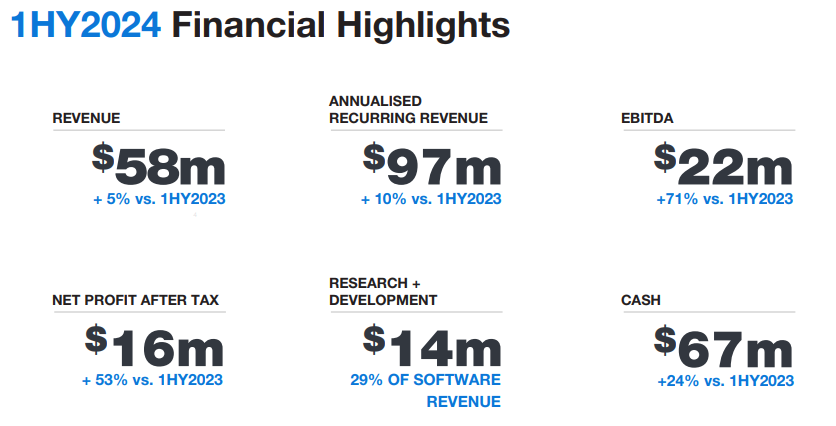

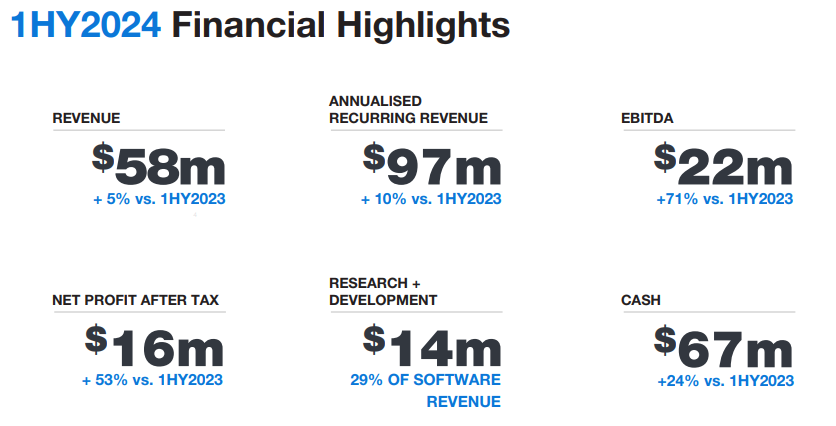

Objective Corp reported last week. From their presentation:

Remember that OCL changed accounting policies in terms of expensing R&D. Changing from expensing 100% to 50%.

In 1H FY24, total R&D spend for $13.557m with $7.2m being expensed through the P&L. On a comparative basis, NPBT would have been around $13.3m compared to $10.7m in 1H FY23 had the R&D expense been expensed in the period. NPAT would be around flat only due to an increased tax expense in the current period.

Personally I thought this result was pretty good although I think it will be better to wait until the full year results for a better comparison given the seasonality of OCL's customers (public sector customers usually pay during the 2H).

In the shareholder letter from CEO Tony Walls, the outlook provided was strong with management targeting ARR growth of 15%. They also provided an update in regards to potential acquisitions with them having done some due diligence on a few potential candidates but ultimately deciding to focus on building the business organically.

Disc: Held IRL and on Strawman.