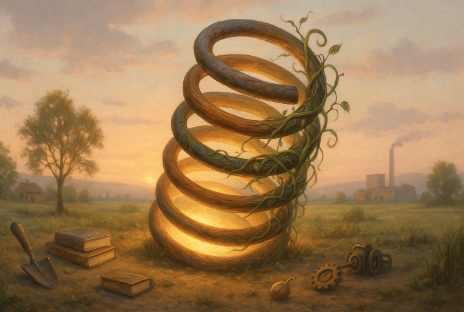

Making money in the market is hard. Not just because spotting an undervalued stock is tough, or because you have to stomach the occasional dump. The real challenge, most of the time, is staying sane through the long, mind-numbing stretches where nothing happens and doubt starts whispering in your ear. Understand the following, however, and you’ll be less likely to […]