Elmo Software (ASX:ELO), a cloud-based human resources and payroll software as a service (SaaS) company, today announced a quarterly update which was seemingly in line with investor expectations.

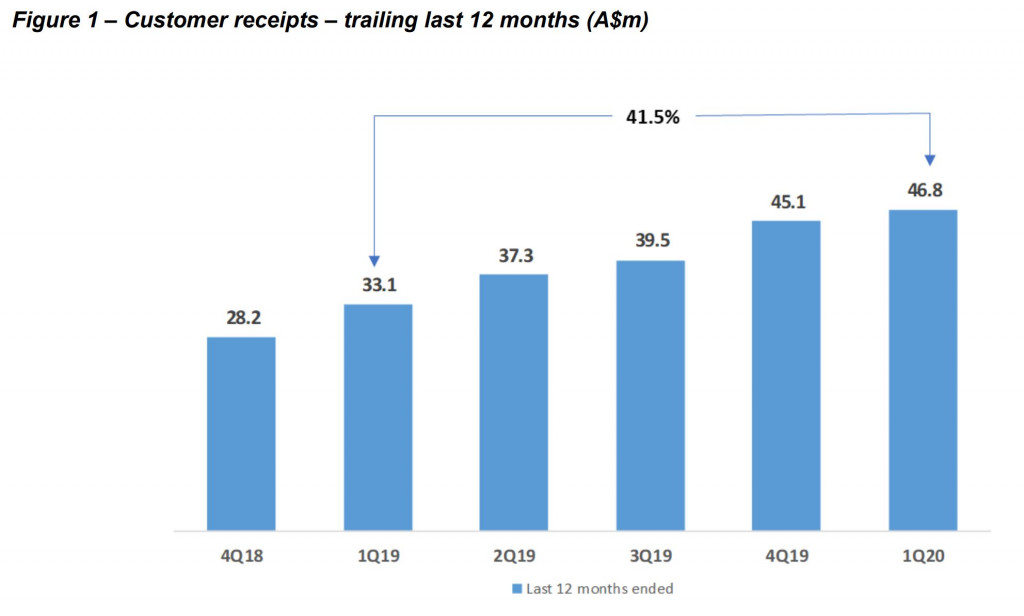

One thing worth noting is that, as previously announced in the recent full year result, the company’s annual recurring revenue (ARR) has grown significantly to $46 million. Encouragingly, this ARR has been coupled with a 12 month customer receipt sum of $46.8 million in the first quarter of FY2020, implying a prudent reporting structure for recurring revenue (which isn’t, sadly, always as timely for other SaaS companies). Past yearly results have shown a similar relationship.

In the current quarter, cash receipts of $12 million were below the $15.5 million recorded in the preceding three months, but were nevertheless a record result for the usually slow first quarter.

This quarter, Elmo also commenced a partnership with the University of Technology Sydney to develop new predictive analytics and AI products for HR and payroll professionals. This development should see an increase in product value and potential for up-selling and cross-selling opportunities.

Management have reaffirmed guidance for ARR of $61-63 million by FY20 as they continue targeting low- to mid-market sized organisations. Revenue and EBITDA guidance for FY2020, was also reaffirmed at $53-55 million and $1-3 million, respectively.

Elmo is currently unprofitable, with cashburn for the quarter at $3.7 million. Additionally, investors were heavily diluted earlier this year when the company raised $55 million through institutional investors and a further $15 million through a share purchase plan. Thus, at the current market capitalisation of $420 million, Elmo is trading at about 9.1x its current ARR, and 6.8x forward ARR.

In comparison to the industry average of about 8x ARR for SAAS companies, this may seem a rather ‘full’ valuation. Nevertheless, given the impressive rate of top-line growth, low churn, high gross margins and a total addressable market (TAM) of $2.4 billion, it is certainly plausible.

Ranked at #54 on Strawman and trading 20.1% below community consensus, Elmo Software may be an interesting company to add to your watchlist.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223