A veritable tsunami of 3D geo-spatial data has been unleashed by a range of capture technologies, such as laser scanning, drones and LIDAR. As these continue to descend the cost curve, companies are increasingly adopting them to help monitor, record and manage their assets.

Operators of utilities, mines, infrastructure and more can unlock significant efficiency gains through an ability to remotely monitor their valuable assets, using any internet enabled device and with the assistance of a variety of analysis software tools.

The problem, though, is that these data sets are huge and cumbersome. This is where Pointerra (ASX:3DP) steps in.

Overview

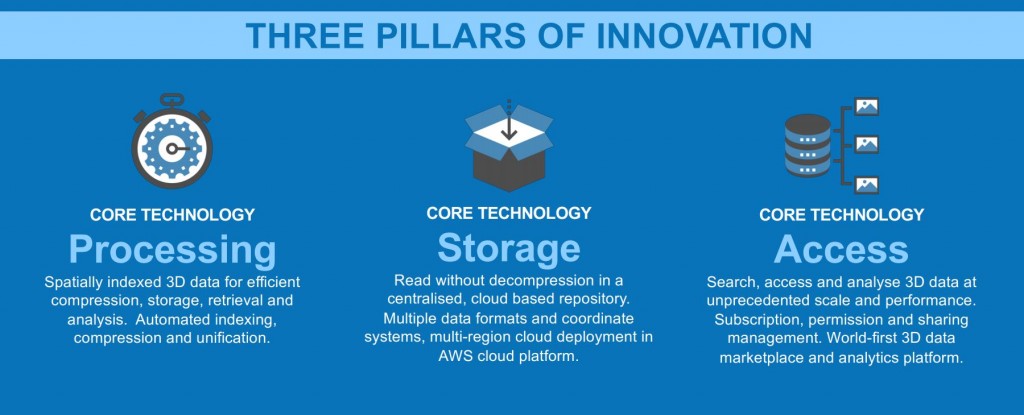

Formed in 2013, and listing on the ASX three years later, the company has a world first cloud platform that enables customers to store, use and share their 3D datasets in ways that were not previously possible.

Based on proprietary technology, and without any clear competitors, Pointerra is chasing a $500 billion global market opportunity. With partners such as PrecisionHawk and Wesfarmers‘ (ASX:WES) Decipher, the company has seen a rapid escalation in sales.

As of May this year, the annualised contract value (ACV) had increased by 42% over the preceeding three months to $1.32m. In the most recent quarter, customer receipts were up $350% from the same time last year. Although the company hasn’t offered any specific guidance, it currently has a number of proposals before enterprise customers and “is confident that it will further grow aggregate ACV in coming months and quarters”.

Investors would be forgiven for thinking that Pointerra shares certain similarities with ASX super-star Nearmap (ASX:NEA) — a company that also deals in data capture and management. But although the value proposition is distinct (Nearmap is more about aerial imagery), Pointerra shares a number of key talents with its more mature cousin.

Dr Rob Newman, the CEO of Nearmap, helped float the company and only recently stepped down as Chairman due to the increasing time commitments of running Nearmap. As at the last notice, he had 13 million shares and 5 million options. His replacement was Graham Griffiths, a founding director of Nearmap (who sadly passed away recently).

There’s also some serious skin in the game, with senior management owning around 38% of the company.

Of course, although Pointerra seems to have a lot going for it, investors should remember that this is still an early stage company and one with several key risks

Risks

Pointerra is still a loss-making business and has burnt through almost $1 million in cash so far this financial year. With around $1.4 million in the bank, it’ll likely need to tap shareholders for additional funds in the next year or two unless it sees a significant step up in customer receipts.

Even then, one of the key challenges for fast growing businesses is to scale effectively. It’s not uncommon for increasing sales to be eaten up by equivalent, or larger, operating costs. This isn’t necessarily a sign of poor management — increased sales and research can help solidify market share and underpin future earnings growth — but it can materially defer the point at which the business becomes self-sustaining.

The company also has around 130 million options on issue, most of which have a 5c exercise price. With around 520 million shares on issue, investors should be mindful of the dilution potential.

The bottom line

Pointerra has a solid first-mover advantage in a fast growing industry, world-leading technology and rapidly growing sales. The current trajectory will see the business pass break-even in the coming years and, given the attractive attributes of a SaaS business model, should enjoy very favourable operating leverage as it scales.

Of course, if sales don’t come in as hoped, or if costs are not well contained, viability could still be a long way off — and shareholders will almost certainly be called upon to help keep the business afloat.

As with many early stage companies, Pointerra is certainly higher-risk, but should management execute well there is some very exciting upside potential.

Click below to see the consensus valuation from the Strawman community.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223