Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

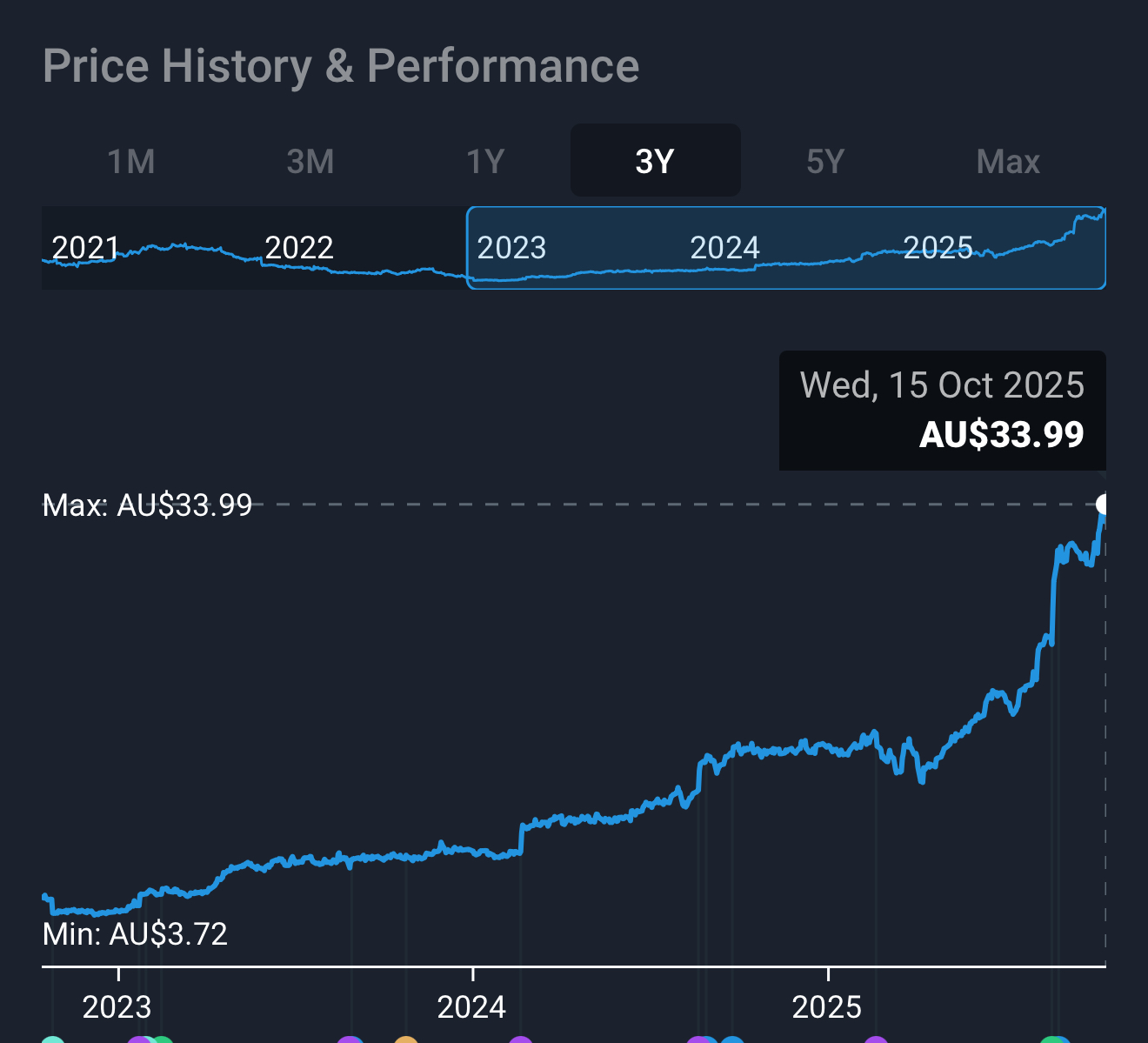

Three years ago I started writing about Codan on Strawman. Back then Codan was well and truly in the dog house! I found this old straw I penned at the time, #History repeats. Here is an extract from the straw:

“I’m a newcomer to Codan, having bought my first shares in January this year. However, for those who have held Codan for more than 8 years, you might be feeling an uncanny sense of déjà vu right now. I found this article from June 2014 (copied below). As you read through this article you could be forgiven for thinking you were in an 8 year time warp. The question on my lips now is…will history continue to repeat itself over the years ahead?

Following an 80% fall from its peak share price in April 2014, it took 5 years for Codan to reach its former peak, and then 2 years on from that the share price was more than 5 times higher than it’s former peak. I’d be happy with that!”

Well, guess what…Codan has done even better this time around! This time the share price is 5.5 times higher than its low of $3.72 just 2.5 years ago! Am I happy with that? You bet I am! But what now? Is Codan expensive? I would say yes and I’ve been taking some profits off the table.

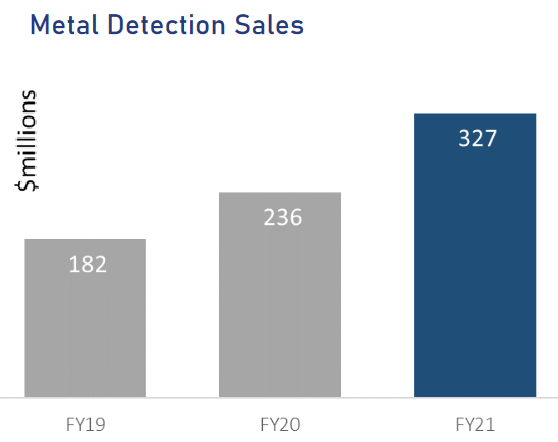

Codan is still a high quality business. ROE is still good and improving (forecast 23%), but not as good as it was before the Russian Wagner Group all but destroyed the artisan gold mining industry in Africa. Metal detector sales dropped dramatically because half the metal detectors were being sold to African villagers.

Source: Commsec

Codan management were quick to focus their attention to growing the communications business, which they have. By FY26 Codan should achieve record EPS of approx 65 cps. That puts the current Codan share price ($20.41) on 31 x FY26 earnings. Earnings are forecast to grow at 15.7% and it has a net debt to equity of 25%, which has been increasing with acquisitions over the last 3 years.

So is it expensive? Here is a PE chart of Codan over the last 5 years. I think 31x FY26 earnings is getting up there!

Source: Simply Wall Street

Using McNiven’s formula and assuming forward ROE of 23%, current equity of $2.74 per share, 50% of earnings reinvested, and dividends paid at 1.6% fully franked, I come up with a forecast annual return of 7%. That’s probably OK for a very high quality low-risk business. I’m not sure Codan fits that category.

What do the analysts think? The consensus 1 year target price from 7 analysts on Simply Wall Street is $18.15. So the share price looks expensive here too.

Despite all this I don’t think there is a hurry to sell Codan in a big hurry either. I’m not an expert on technicals, but I think the chart still looks OK, and we all know the chartists rule! Just look at what happened to CBA…until it didn’t!

Of course the fundamentals will override everything when Codan delivers its FY25 financial results in August. Only time will tell.

Held IRL 10%, SM 25.5%. Reducing.

According to Andrew Mitchell from Ophir Asset Management, the bull run for Codan is not over yet! Going on today’s record highs, he could be right! (AFR 23/10/2025 https://www.afr.com/markets/equity-markets/missed-the-gold-rush-fundies-tip-where-to-look-next-20251023-p5n4o8)

For Ophir Asset Management’s Andrew Mitchell, the standout pick for investors suffering from a bout of gold FOMO is Codan.

The $6.3 billion producer of metal detectors and drones has been on tear in 2025, surging about 112 per cent amid the raging gold price, and the Russia-Ukraine war.

Mitchell said while Codan had a high price-to-earnings multiple of 60 times, there was still room for growth, given the surging demand for gold detectors and booming global defence spend.

“Codan dominates the metal detector market in Africa at a time when people are leaving farming to go into artisanal gold mining, and that hasn’t yet been fully factored into their earnings,” Mitchell said. “As long as there is war in Ukraine and the gold price holds, it will grow at a really strong clip.”

The share price momentum for Codan shares has me gobsmacked! The share price is now 9x its 3 year low back in December 2022. This is when the Minelab sales took a big hit due to the Russian Wagner Group taking over many of the gold mines in Africa, decimating the livelihoods of many of the African artisan gold miners. Back then, Minelab sales in Africa produced most of the earnings for the business. The business has now grown to be much more diversified.

The share price has now passed analyst consensus by $6 per share (12 month consensus of 7 analysts on Simply Wall Street is $28.40 per share).

Codan has definitely been my best ever stock pick, especially when you consider it has also paid fully franked dividends (although the yield has shrunk to less than 1% at these high valuations). Codan still remains my largest holding on SM and our second largest holding IRL despite my attempts to slowly reduce its weighting.

I think it’s very expensive at $34 per share, but in hindsight I shouldn’t have sold a single share! How long do you keep holding a business like Codan when it’s overvalued and on a red hot run like this? Obviously a long time if you are purely a technical investor. There’s a lot to be said for taking notice of the charts in your buy, hold and sell decisions. I’m still learning on this one.

My strategy at the moment is to keep riding with the momentum (while it lasts) while reducing the holding slowly. Codan is definitely riding on the wave of the record gold prices.

Ahhh dear, this was nice and humbling. For context, I sold 60% of a very concentrated position last month (with the share price just over $20). This followed 2x previous sales of my position at $15.00. With all of this, I am left with a remaining position of around 25% of my initial position holding.

In my wisdom, my decision making was based on shares having run too high. At each point, the market cap had reached 3b, and then 4b. This is a brilliant business – one of my favourite on the ASX in fact – but everything has a price. Well, well done Rocket6, you have missed a heap of upside and a stock that looks like it is now being driven by both fundamentals and ‘momentum’, a powerful force on the share market that knows no bounds!

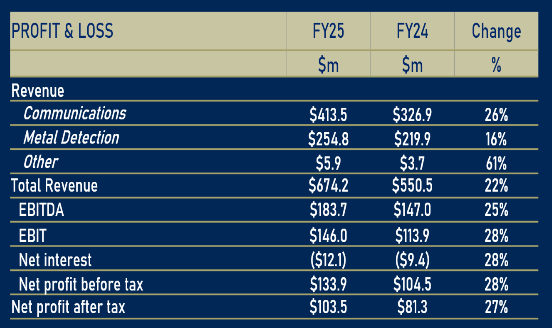

Codan released their FY25 results yesterday. My favourite PA has summarised the results for me. See below:

- Group results: Revenue $674.2m (+22%), EBIT $146.0m (+28%), NPAT $103.5m (+27%).

- Cash generation: Operating + investing cash flow (ex-acquisitions) $146.6m (vs $106.5m FY24).

- Dividends paid: 24.5c fully franked (12.0c final paid Sep-24; 12.5c interim paid Mar-25).

Segments

- Communications (DTC, Zetron, Kägwerks): Revenue $413.5m (+26%); segment profit $107.9m (+34%); orderbook $253m (+28%). Targeting ~30% segment margin by end FY27. Kägwerks contributed $24m revenue in 7 months post-acquisition.

- Metal Detection (Minelab): Revenue $254.8m (+16%); margin 39% (up from 35%). Africa ~$115m revenue; four new products slated for FY26; Gold Monster 2000 soft-launched for Q1 FY26.

Outlook (management commentary)

- Communications targeting 15–20% FY26 growth with ~$155m already in the orderbook as at 30 Jun; Minelab expecting growth with four FY26 launches and supportive conditions.

What our good friend Chat GPT didn’t include above is EPS (which was 57.1c) – a 27% increase on FY24 – which quite frankly is remarkable. All main profit/revenue metrics increased between 20-30% YoY.

As above, re: their segments, it is their comms business that is doing the heavy lifting – which has been a focus of management to diversify their business operations and reduce reliance on a cyclical metal detection market. While they have done this in a remarkable way, they are also now a truly global operation with a diversified customer and revenue base – selling their products in more than 150 countries, with 15 sites across 10 countries. No one continent is responsible for more than 50% of revenue.

In fairness to what is now several terrible decisions to sell, shares are NOT cheap. Assuming a market cap of just under 5b, they are trading on a forward PE of 44x and a P/S of 8x. This indicates some lofty expectations in future growth. A quick and dirty DCF over a five year period, using a net margin of 15% and 20% YoY revenue growth, with a 10% discount rate, returned a share price of $16.

If we increase revenue growth expectations to 30% YoY, only then does the share price range reach around $25.00. Just to clarify, it is very unlikely they achieve this – management are guiding for 15-20% from comms for FY26, and a good year would be 25%. A wonderful business, but an overpriced one.

I was obviously wrong about Codan, when I said it was overvalued at $20.41. Fortunately, I do take more notice of the charts than I have previously and I have only sold a small portion of our holding IRL. However, I do primarily focus on the fundamentals and I will be reviewing our holding following the FY25 results.

For now my focus is elsewhere. My Mum passed away this week. Life changing events like this make you reflect on what is really important in life.

For now I’m happy to accept Bell Potter’s view shared by James Mickleboro from The Motley Fool https://www.fool.com.au/2025/08/22/up-20-in-2-days-are-codan-shares-a-buy-hold-or-sell/

“Codan Ltd (ASX: CDA) shares were on fire again on Friday.

The metal detector company's shares ended the session 8% higher at $28.34.

This means that its shares are now up 20% in the space of just two days following the release of its full year results.

Does this make it too late to invest? Let's see what Bell Potter is saying about this stock.

What is the broker saying?

Bell Potter doesn't appear surprised to see Codan shares rocket following the release of its full year results.

It notes that the company delivered a result well ahead of the market's expectations. It said:

CDA recorded FY25 group revenue of $674.2m (+22% YoY) ahead of both BPe (+7%) and VA consensus (+5%). Comms segment revenue ($413.5m) grew 26% YoY (BPe 21%), including organic revenue growth of 19%, well above the targeted range of 10% to 15%. Metal detection revenue ($258.4m) grew 16% YoY and 21% HoH, which was a major surprise considering management had previously flagged a 2H result similar to the 1H.

Group EBIT of $146.0m (+28% YoY) was again ahead of BPe/consensus and NPAT ($103.5m) grew 27% YoY. This strong performance delivered diluted EPS of 57.1c and a full-year dividend of 28.5c. CDA had a cash balance of $39.7m at 30-Jun25, and the net-debt position reduced to $78.3m.

A key driver of this outperformance was its unmanned systems (drones). This was supported by strong demand for metal detectors in Africa. It adds:

A key factor in CDA's strong performance was DTC's unmanned systems, which delivered ~$100m in revenue during FY25, more than double the FY24 result. Further, Minelab Africa sales rebounded to grow 54% vs 1H25 on the back of improved market conditions, with political instability in the region a key risk to Minelab performance. The growth in these areas more than offset slightly lower growth in the Zetron business than we forecast.”

Should you buy, hold, or sell Codan shares?

According to the note, the broker thinks that Codan shares are fully valued following its strong run.

This morning, Bell Potter retained its hold rating and lifted its price target materially to $27.80 (from $17.25). This is largely in line with where its shares are currently trading.

Commenting on its hold recommendation,

We have upgraded our revenue forecasts in-line with outlook targets of FY26 comms growth of 15% to 20% and longer-term segment growth of 10% to 15%. We now forecast FY26 group revenue of $772.6m (+14.5% YoY), EBIT of $182.9m and NPAT of $131.2m. Our EPS changes are +19%/+14%/+13% in FY26/FY27/FY28.

We have reduced the WACC we apply in the DCF to 9.7% and increased our EV/EBIT multiple to 30.0x to reflect the positive outlook and increasing defence exposure. Our updated PT of $27.80 is a <15% premium to the current share price so we retain our HOLD recommendation.

Held IRL and SM

Apart from some delays affecting the Zeltron business, CEO, Alf Lanniello painted a rosey picture ahead for Codan in his AGM report released this morning.

Outlook

The conditions observed at 30 June 2025 have largely continued into FY26, supporting Codan’s growth outlook across both Communications and Minelab.

Elevated defence spending and ongoing geopolitical tensions continue to support demand across Codan’s Communications markets, with the business remaining on track to deliver 15 to 20% revenue growth for FY26. Growth in the first half is expected to be at the upper end of this range noting that the first half of FY25 included Kägwerks for one month given the timing of that acquisition. Zetron’s business in the US continues to be affected by government shutdowns and funding delays. In September 2025, Codan received purchase orders under the Nett Warrior Program of Record for Kägwerks, totalling approximately $24.5 million, with deliveries scheduled across both the first and second halves of FY26, contributing to overall divisional growth through the year.

Sustained strength in the gold price is maintaining favourable conditions for Minelab, with the level of demand for gold detectors in Africa running above what was seen in the second half of FY25. As a result, Minelab’s overall revenues for the first quarter of FY26 have exceeded the monthly average achieved in FY25 by 16%. While revenues into Africa are typically weighted to the second half, given the strength of current-year first-half revenues, it is too early to determine whether the same seasonality will occur this year.

With continued balance sheet capacity, a renewed $250 million debt facility, and a disciplined approach to capital allocation, Codan remains well positioned to continue investment in the business and pursue future acquisitions that enhance the quality and predictability of its revenues.

Held IRL and SM (slowly trimming)

Update - 22/08/25

Assuming a market cap of just under 5b, Codan are currently trading on a forward PE of around 44x and a P/S of 8x. This indicates some lofty expectations in future growth. A quick and dirty DCF over a five year period, using a net margin of 15% and 20% YoY revenue growth, with a discount rate of 10%, returns a share price of around $16.

UPDATE - 18/08/22

While I still have some digging to do, their full year results look darn impressive. The business has also trumped the projections I made below. While CapEx came in slightly higher than I anticipated (-25.8m), cash flow from operating activities was higher than the business projected, at 51.7m for the full year.

That has resulted in a FCF of almost 26m, which blows my 8m forecast out of the water. As for my other projections, net income was 100.7m (I forecasted 105m), while revenue was 506.1m (I forecasted 510m).

This was after a very ordinary H1 FY22 by Codan, who invested heavily in inventory and recorded a cash outflow of -12m (very rare for them). It also means their second half delivered in excess of 60m in cash flow from operating activities. Impressive.

As for the outlook, the business has warned Minelab's sales 'may not' reach the level achieved in H1 FY22, but they expect a strong H2. As for communications, an existing order book of 150m suggests plenty of demand for their services, noting total revenue from this portion of the business was 241m in FY22. Sales and implementation is much slower here, but these numbers are positive and suggest another strong year ahead.

As for my valuation, my FCF projections are starting to look increasingly conservative, but I will leave these for the time being and wait for the the H1 update to see how they are tracking.

I said it two months ago when the business was trading at around $7.00, and I will say it again as they trade around $8.50-9.00, I still think the risk/reward proposition is attractive at these levels.

_____________________________________________________________

June 2022

I figured now would be a good time to post my valuation of Codan (CDA) following the recent meeting with Alf -- the new CEO.

Disclosure, I hold in my super account. I will slowly start to take a position on Strawman to reflect my interest in the company.

Codan are impressive. I think the new CEO is no different and I was impressed by his conduct during the recent meeting. Currently, the business maintains a gross margin of more than 50%, with a net profit margin of around 20%. Their return on equity is equally impressive, at 30%. Even if this drops to the 20% range in the next 3-5 years like some analysts forecast, this is still more than most businesses (comfortably), let alone the industry they operate in. Lets take a look at their recent cash flow history:

Codan has been a cash generating machine for the better part of 5 years. They have consistently generated increased cash flows since 2019, which has in turn seen their bottom line grow at impressive levels. See below, noting I have provided figures for FY19, 20 and 21.

They also pay an attractive dividend – the yield having steadily increased since 2015. (2% to 4ish% over that time).

Within my DCF, I have forecast FY22 results, made easier by the H1 report and the recent trading update which shared some light on cash flows and profit. On the face of it, H1 was a shocker. The cash flow machine that is Codan invested heavily in increasing inventory levels. This coincided with entering the FY with negative working capital having paid large customers to secure supply. This had a significant impact on cash flows, which went into the negative (to the tune of -12m). This was a big deal for Codan, having traditionally generated significant cash flow from operations. This further terrified an already terrified market. Consequently, they have been absolutely battered (share price wise) over the previous 12-month period.

But here lies the opportunity. At these levels, I think the risk reward proposition is an attractive one. The recent update, to the relief of shareholders, indicated Codan will again make record profits in FY22, with more than 41m being generated from operating activities in H2. They are also sitting on a heap of product, which will further reduce outgoing investment required in FY23. This should again benefit their bottom line nicely, but patience is required to see this play out.

Like Alf stressed, this is a more diversified, balanced business than it was a few years ago. Their acquisitions (which all appear to have added genuine quality to the business) have enabled this, increasing their competitive advantage and widening their moat. This is more than ever a business with pricing power, supported by their own IP – protected by encryption and just generally sophisticated by nature. It would be very difficult for new business to enter the space and compete -- there are innovation, technology and economic factors preventing this being easy.

Within my DCF, I have used a standard discount rate of 8.4%. I have projected FY22 net income of 105m, revenue of 510m and FCF of 8m. For the next four years, I think free cash flow will return to the 100m+ range, provided they keep their CapEx under control. I have gone with steady 8m+ increments per year, commencing in FY23 (at 110m) and ending in FY26 (at 134m). I think this is more than achievable. I reach a CV 2.24b. Divide this by shares outstanding (180m) and I reach a currently valuation of $12.40.

For a more traditional valuation, Codan is currently trading on an undemanding P/E of 12x. Simply Wall Street’s DCF reaches a fair value of around $14, while another tool I use (Finbox) shows a fair value of $9.90. I think whatever metric/process you use to value this business, most would arrive at the conclusion that shares are currently trading on a discount.

In regards to the FY results of Codan noted below:

Group results: Revenue $674.2m (+22%), EBIT $146.0m (+28%), NPAT $103.5m (+27%).

Cash generation: Operating + investing cash flow (ex-acquisitions) $146.6m (vs $106.5m FY24).

Dividends paid: 24.5c fully franked (12.0c final paid Sep-24; 12.5c interim paid Mar-25)

With a FY NPAT of $103.5 Million and earnings per share of $0.571 per share and using a PE of 40 which is a lot more than I would ever use gives us a valuation of $22.84 per share.

I know that CDA are starting to improve sales and their unmanned systems are moving ahead but still feel this is considerably overvalued at its current price of around $30, though I won’t be selling anytime soon in either my Strawman or actual portfolios as it is a definite Hold for me at the moment.

Scroll down for latest update...

August 2019: $4.77 was my 12-month PT, based on increasing gold detector sales, based on an increasing gold price, based on Trump primarily. . . . . .

24-Feb-2020: CDA Blew through my $4.77 PT quite quickly and went all the way to $8.49 (this past Friday). They're just under that now. I think $7 is a reasonable PT for them now. They're over that, but they have warned that the 2nd half will probably be softer because they probably won't be able to land another two large communications contracts like they did in the first half of FY20.

Their gold detector sales (their Minelab business) will keep kicking goals, but the extra detector sales may not be enough to compensate for lower earnings from their communications division, which can be quite lumpy depending on contract timing and the sizes of various contracts. All in all, I'm happy to keep holding Codan shares, but I've been trimming them, and I wouldn't be buying Codan up here.

23-Apr-2020: Lowering my 12-month PT for CDA to $6. Higher gold prices are a tailwind, but COVID-19-related restrictions are a definite headwind in the short to medium term. There's probably scope to increase that PT again later, and I still hold Codan, which were bought at much lower levels, but I think it's prudent to alter my PT and say that they look reasonably fully valued again here considering the current operating environment.

Good company. Good Culture. Good Products. Good Management. Most of that's already in the share price however.

01-Sep-2020: Codan is a company that just keeps on exceeding my own expectations, so I'm very glad that I hold them, and that I've held them for years Their FY20 report was another cracker. They beat all of their own previous records. They increased their final dividend by +47% (from 7.5c to 11 cps - fully franked of course). They make the best (Minelab) gold detectors in the world. Their communications division is also firing on all cylinders. They are Adelaide based (which makes two of us). And they keep creating excellent products which appeal to a global population that want to own and use the best available gear. I only have ONE regret with Codan, which is that I NEVER, EVER added them to my Strawman.com Scorecard...

02-Mar-2021: UPDATE: Increasing my PT (price target) to $17.20 now. Codan had a brilliant report on Feb 18th, after announcing a good acquisition two days earlier which strengthens their communication division significantly. They are acquiring US-based Domo Tactical Communications (DTC), from a Private Equity company. DTC is an established technology provider for high bandwidth wireless communications with specialist capabilities in MIMO Mesh networks (next generation software defined networks where multiple antennas stream data to and from devices across a network that is self-forming and self-healing). DTC is a trusted and long term supplier into more than 20 key United States government agencies as well as the “Five Eyes” intelligence communities. DTC’s MIMO Mesh products provide wireless transmission of video and other data applications to predominantly first world customers, including Military and Special Forces, Intelligence Agencies, Border Control, First Responders and Broadcasters. DTC is headquartered in the US, with locations in the UK and Denmark and has around 40 employees. The acquisition comprises an upfront payment of US$88m (approx. A$114m), with the possibility of an additional payment of up to USD 16 million if certain earn-out targets are achieved in calendar year 2021. The acquisition is on a cash free, debt free basis and is expected to complete by 30 April 2021, subject to a number of US and UK regulatory conditions typical for transactions of this nature. In the first full year of Codan’s ownership, DTC is expected to contribute approximately A$90m of sales, A$14m in EBITDA and A$9m of profit before tax (PBT). It will be earnings-per-share accretive from day 1. As a result of the transaction, Codan will acquire total assets approximately equal to the purchase price with no change to Codan’s shareholder equity. The acquisition will be fully funded from existing cash reserves. All good. Onwards and Upwards!

UPDATE - 31-Aug-2021: Codan have spent most of the past 5 months trading at or above my last (most recent) $17.20 price target, which I set back on 02-Mar-21 when Codan was trading at $14.93. They shot through my $17.20 PT in the first week of April, so 1 month later, then seemed to use it as some sort of support line for about 4 months before falling away in the 2nd half of August, since they reported on August 19th actually. I'm still holding Codan shares in RL. They've been one of my best performing investments over the past 3 years and 1 month. My average buy price was $2.88 (in July 2018). Codan have been sold down on their latest result, based on two factors. I believe the first one is the main one, which is that Donald McGurk, their CEO & MD has informed the board of his intention to retire within 9 to 12 months after a suitable replacement has been found. Mr McGurk is the main driver behind the very positive collaborative company culture that enhances their growing competitive advantage in metal detection - they own and manufacture Minelab metal detectors (who make the best gold detectors on the planet). They also have a communications business that provides around one quarter of their annual revenue. Donald is also a fine manager in many other respects, including with sensible capital allocation, and more specifically making good targeted strategic acquisitions and not overpaying. He will be missed, but Codan is more than just their CEO/MD. The second reason is that they have warned that due to recent developments in Afghanistan, they are aware that planned sales into Afghanistan of communication equipment will likely now not go ahead. For context, around 2% of their total FY21 revenue came from sales into Afghanistan, but that was around 9% of their communications division sales. I don't consider this to be particularly material seeing as Comms is not their main money earner - Metal Detection equipment is - and Codan have demonstrated in prior years that they can develop new products and sell into new markets. If Afghanistan is closed to them, they will concentrate their sales efforts elsewhere. It's not a thesis-breaker in my view. Another thing to keep in mind is that Codan thrive when the gold price is high, so it's something to keep in mind. The higher the gold price goes, the better they will do in terms of gold detector sales, which is their main revenue-driver. I hold Codan, and it helps that I'm also a gold bull. Codan has proved to be a great pick-and-shovel play on the gold industry, and on the gold price rising, or staying up at elevated levels as it has. I wouldn't be buying up here, they still look expensive, but I think they'll get even more expensive when gold goes for another run, and I'm therefore setting a new 2 year price target of $19.70 for Codan. So that's a PT of $19.70, by September 2023.

25-Jan-2022: Update: No change to price target. $19.70 by September 2023. However, when I typed that bit directly above about not buying them "up here", the SP was still over $15/share. They're now back under $10/share and I have been buying more Codan sub-$10. However, after today's positive Trading Update they might be back over $10 soon, if not by the close of trade today.

Noddy summed up my thoughts perfectly in his "Trading Update" straw this morning.

Ex-MD Donald McGurk above. New MD Alf Ianniello, below, pictured in his previous role as boss of Packaging firm Detmold Group. Codan and Detmold are both very successful Adelaide based companies.

Disclosure: I still hold Codan, and have been adding to my position sub-$10/share, and I have also recently added them (finally) to my Strawman.com portfolio.

18-Sep-2022: Update: I do hold this one. And I'm very bullish on them from here. They look very oversold, but I admit it could take time for the market to start getting interested in them again. The gold price hitting a new two year low earlier this week hasn't helped their cause either. They have indicated that they expect the bulk of their growth to come from their Communications (Comms) Division during the next year or two, and that makes sense, and they still make the best gold detectors in the world, and I can't see anyone taking that title off them any time soon, so when the gold price does go up again, by enough, their Metal Detection division will resume its growth also. I won't write much on them now, as I've written plenty about them previously, and there's not to much to add to that.

For now, I'm being realistic and taking my target price for Codan down to just under $10. In 5 to 10 years they could easily be trading at $20/share, perhaps sooner, but that could realistically take 5 to 10 years, so my current 2 year price target for CDA is now $9.70, so by mid-September 2024.

26-March-2023: Update: Yeah, this one has been marked as stale, so I'm refreshing it. No change to my $9.70 PT for CDA. There was nothing worrying in their H1 report for FY2023. In fact, it reassured me that the thesis was still on track. Quality company. Quality products. Good Management. Good capital allocators, especially when it comes to M&A - they tend to pay a fair price for strategic assets that add to their business and make it better. Which is what you want.

Their Metal Detection (Minelab) business has taken a back seat to their Comms business this year, which is good - to see the Communications division perform so well, however Minelab is far more than just gold detector sales into Africa. Minelab will grow sales as well in future years. A rising gold price won't do them any harm either!

10th October 2023: Update: Yeah, still good! Comms Division is flying! Metal Detection division (Minelab) will experience growth again soon enough, with or without Africa, Afghanistan, Russia, etc, etc. Happy to maintain a $9.70/share price target for now - they're getting up there:

The Codan share price (SP) has doubled in the past 11 months from just over $4/share to close at $8.18/share today. I believe the recovery will continue.

27-Apr-2024: Update: Yeah, the recovery DID continue; here we are with an SP up around $11/share now. I've raised my TP to $10.75, which is higher than my old one but below the current share price, because I think Codan may possibly have overshot to the high side again now. They tend to trend well, both up and down, and they get oversold, and occasionally overbought as well, which is where they are now I reckon.

Their most recent half year report (H1 of FY24) showed that Comms is still firing and Minelab (Metal Detection) is coming back too, without too much assistance from Africa, so - as I have been saying all along - I thought that the problems in West Africa - and Africa is general - were not a company killer, or even that serious for their Minelab division in the long term.

There will always be headwinds in various parts of the world for a company like this, but when you make the best gold detectors in the world and some of the best communication equipment (encoded radio and wireless video transmission equipment being just two examples) in the world, these sort of setbacks or obstacles will only ever be temporary in terms of the overall growth trajectory.

Above all, even with the change of CEO/MD, Codan still have very good management who are disciplined and make sensible and strategic capital allocation decisions. They also don't sit on their hands or rest on their laurels; they are always innovating and developing new and improved tech and releasing new models across both of their two divisions (Comms and Metal Detection).

I wouldn't be buying more Codan up here at over $10.50/share; in fact I have been taking some profits, but Codan remains one of the largest positions across my real money portfolios, and they are currently my fourth largest position here on SM, behind LYL, DVP and GNG and just ahead of my two favourites goldies, NST and GMD, but I do have a sell order in to trim the CDA position a bit more, so that may move them down a few positions.

My MO is to ride these high quality stocks up from oversold to overbought and then to take some profits and rotate that into some other companies that are oversold in my opinion. But I like to keep a core position as a general rule, not sell out completely, just tinker around the edges.

This is particularly necessary here on SM, because we have a fixed pool of capital that we can't add to except by capital gains and dividends or distributions, so it's always a good idea to rotate money out of stocks that have run hard and slowed down into stocks that have the potential to do the same with the right conditions.

However it's important to not keep moving down the quality curve in search of value, because it's the higher quality companies that tend to run the hardest from being oversold, in my experience, once they do start to run, because people remember the good old days; past investors are often eager to jump back onboard a ride they associate with happy past memories when it starts heading in the right direction again.

And also, sometimes, just when you thought a company was fully priced or better, they find another way to grow. NCK is a recent example.

22-August-2024: Update: Yeah, they keep growing all right!! No longer holding this one in real-money portfolios, and reduced my exposure here yesterday thinking that there was perhaps too much optimism priced in up near $13/share. Well, they've been up over $14.50 today on the back of these results and they're still trading at over $14 now (at about 2pm Sydney time) so the market has not only realised that Codan's metal detection issues are now behind them, the market is also now re-pricing Codan as a growth stock again, which means they don't look cheap.

They didn't look cheap yesterday, and they certainly don't look cheap today, but you can do worse than back a quality management team like this one.

I believe they can now go higher from here now, because the market is no longer concerned about any aspect of this company. I'm still not buying here, but I am holding CDA in my Strawman.com portfolio. It's one to buy on a pullback, if we get one, but we're certainly not getting one today!

Codan FY2024 Results Announcement

Because of their higher share price, the increased dividend (12 cps final div compared to 9.5 cps pcp) still puts them on a very low dividend yield - of around 1.6% (22.5 cps p.a. divs when you add the 10.5 cps interim to the 12 cps final div declared today vs an SP of $14.14 right now) but you don't buy Codan for income - you buy them for growth. That's what the market's telling us today.

17-Nov-2024: Update:

Reviewed, and Codan has been sitting above my old $14.77 price target and are trading sideways, or within a narrow range anyway, around or just below $16/share.

It seems the hype has has come out again and they're just trading as a quality company rather than a quality company that is growing at a rapid rate.

They're back on track now, and the market is no longer worried about them losing sales, such as they were in 2021 and 2022 in Sudan and other parts of West Africa, Russia and Afghanistan. It was a converging storm of issues across those countries a couple of years ago that caused them to confirm they would not be making Minelab sales there in the foreseeable future, and in the case of Afghanistan it was CDA's Comms equipment sales (secure remote communications solutions) that would cease there after the Taliban took back control of the country as the USA pulled out.

I said at the time they would find other ways to grow, and other places to grow sales into, and they did. They expanded their Comms division to the point where it became their largest revenue earner, and they kept innovating with Minelab so they have remained best-in-breed for gold detectors and mine detectors.

Anyway, that's old news. Since my last update here - after their FY24 results in August, they announced that they were being added into the ASX200 index from September 26th (2024) - Virgin-Money-UK-PLC-to-be-removed-from-the-SPASX-200-Index-and-Codan-to-be-Added.PDF and then in late September they announced another good strategic acquisition, of Kägwerks, a global leader in tactical operator-worn networking communications technologies that enable connectivity and integrated secure networking in a military environment. Another good add-on for their Comms division. I posted a straw here about that at the time of the acquisition. Here's the Acquisition-Announcement.PDF.

They then held their 2024 AGM on October 23rd - here's their Chairman's Address and CEO's Address from that AGM.

No causes for concern, however they look reasonably fully priced up here to me - I don't think they're worth more than $16/share until we get more positive news. They remain exposed to geopolitical risks in their markets around the world - but hopefully if we do get some global issues in one or more of their markets punters now won't overreact to the same extent as they did in that July '21 through December '22 period where the CDA SP dropped -80% from $19.33 down to $3.80/share.

Sure they were a little overbought at over $19/share in June 2021, but they were also VERY oversold at below $4/share in December 2022. I was buying at around $10 all the way down to below $4.

Up around $16/share is probably a fair price, so while I'm still holding some here, I lightened on the way up, and I sold out of Codan completely in June this year in my real money portfolios, at about $4/share below where they are now, so clearly I exited too early. I thought I'd found something better to invest in but I would have been better off leaving my money in Codan, with the benefit of hindsight, through until they hit $16 in late September anyway.

From here they'll probably move with the market absent any company-specific news, until we get their results FY25 H1 results in February. However if we get a guidance upgrade or downgrade from them between now and then and/or another acquisition announcement, that would certainly change things. But without that it's probably more sideways than up until Feb.

Disclosure: As at 17-Nov-2024, I'm still holding CDA here, but not currently in any real money portfolios.

Sunday 15th June 2025: Update:

I'm not holding this company at this point in time, other than a small legacy position here on SM - not holding in any real money portfolios.

Codan remains a Quality Company with Quality Management.

However, they are also not cheap up here:

So I would be buying Codan on a good pullback, like below $12/share, but I'm not paying over $16/share.

And they're up at over $19 now.

This is one of those "Quality always rises back to the top - like cream - when everything stops getting shaken up by volatility and negative sentiment" companies. And they've risen back up now, so not a "buy" for mine up here.

Of course, they can grow into their current valuation, and then be worth more, which is what some investors are clearly betting on, but I am seeing better opportunities elsewhere right now, just from a pricing perspective. Nothing wrong with this company, just too expensive for mine.

03-Sep-19: Codan Investor Presentation

Note: Codan are about to be added to the S&P/ASX 300 Index as from the 23rd of this month (September 2019).

18-Feb-2021: Half Yearly Report and Accounts plus FY21 half-year investor presentation

RECORD FIRST-HALF RESULT

Highlights

- Highest half-year profit in the company’s history

- Net profit after tax of $41.3 million, a 36% increase

- Group sales of $194 million, a 14% increase against FY20 record first half

- Interim dividend of 10.5 cents, fully franked

- Earnings per share of 22.8 cents, up 36%

Australian-based technology company, Codan Limited (ASX:CDA), today announced statutory net profit after tax of $41.3 million for the half year ended 31 December 2020.

Directors announced an interim dividend of 10.5 cents per share, fully franked. This dividend has a record date of 25 February 2021 and will be paid on 11 March 2021.

The Board expects to continue its policy of paying shareholders in the order of 50% of our full year profits as dividends, and shareholders will continue to be rewarded for the strong performance of the company.

Chief Executive, Donald McGurk, said, “I am pleased to announce that our strategy to strengthen and invest in our core business through innovation and geographical expansion continues to deliver exceptional results.”

“The strong performance was driven primarily by our metal detection business, with significant growth across both gold and recreational markets.”

Cash generation was excellent, resulting in a net cash position of $111 million at 31 December 2020. Our strategy to invest in production capacity to meet demand has seen an increase in inventory during the period. Over the coming months, we expect inventory levels to further increase, which will serve three purposes:

- Ensure we can meet the continued high level of demand for our metal detectors;

- Minimise air freight expense, by maximising sea freight; and

- Mitigate the risk of any production challenges posed by the pandemic

Outlook

Whilst it is too early to determine if our traditional second-half weighting of sales will occur this year, there are a number of factors that are relevant when considering the outlook for FY21:

- As recently announced, we expect to settle the DTC transaction by end of April 2021 and commence integrating this new technology business within Tactical Communications;

- Demand for our metal detection products remains strong, with January achieving $35 million in sales;

- The new GPX6000 gold detector has been very well received, with meaningful sales expected from Q4; and

- The Communications business enters the second half with a strong order book.

The Board is not in a position to provide full year profit guidance at this point; however, we will continue to keep shareholders updated as the year progresses.

--- click on the links above for much more ---

[I hold CDA shares. Codan has been one of my best performing investments ever. A great company!]

19-Aug-2021: Codan (CDA) have announced this morning (along with their cracking results) that their MD & CEO, Donald McGurk, has advised the Board that it is his intention to retire from his role as Managing Director of Codan sometime within the next 9-12 months. Donald will remain as Managing Director until such time as a successor is appointed to ensure a smooth transition. I believe this is the main reason why Codan is being sold down today on this really good result.

As we know, FY21 was the best ever year for Codan, despite the disruption in the Communications business caused by diversion of government budgets and attention because of Covid. (Conversely Covid was estimated to be a $15-$20m tailwind for the metal detection business.)

My takeaways from the AGM:

"Q1 results are ahead of previous year"

"We are confident of delivering a record result for the first half of the year"

'Nuff said.

FNArena Weekly Insights from Rudy on ASX200 rebalance

Is it a concern that the CEO bought $180,000 worth of shares 2 weeks prior to release of a favourable trading update?

Last week (25/05/22) CEO, Alfonzo Laniello, bought 14,000 more Codan shares on market at $7.56 per share, totalling $105,840.

Another vote of confidence from the management!

Anyone know much about the contract with Microsoft/Domo product? I understand they share this 50:50 with another party who had stock shortages. CDA picked up some additional units. Wondering if these are repeatable or reverts back to 50:50 share

Falling Gold price doesn't bode well for the Codan share price.

Add to this the increase in working capital by investing in additional inventory to meet future sales which is uncertain at this moment when consumers could be putting there money in more important things other than metal detectors.

Positive news in the non metal detector part of the the business (ie: communications) could perhaps arrest the slide.

I probably added too much at higher prices, tempted to add more here but everyone knows the golden rule of averaging down - unless there is something that you see which the market has missed.

[held]

At the risk of repeating Bear, these were the notes I took as I listened to the investor call today.

Codan reported their best ever year, and the headline numbers were very impressive:

- Revenue up 25.6% to $437 million

- EBITDA up 34.8% to $139.8 million

- Underlying NPAT up 52% to $97.3 million

- Fully franked full year dividends of 27 cents per share, up 46% year on year.

Metal detection sales up 38%, with growth evenly split across the 3 segments (hobby, prospector, mine detector). A very strong start to FY 22 has been flagged, with high demand and no supply chain constraints.

Continual innovation of products has allowed Codan to maintain market leadership position in this business segment, which accounts for 75% of sales.

Communications business revenue is 22% of total, and sales have declined 8% largely due to government budgets being redirected to covid-related health initiatives. This business has been given a shot in the arm with 2 acquisitions of DTC and Zetron, for a combined cost of $174 million. This gives them a broad portfolio of market-leading communications products across voice, data and video targeted at the military, first responders, aid organisations and similar. These aquisitions are expected to add $22m to EBITDA in FY22, and were funded with cash generated by the business. Further acquisitions can be expected.

Codan have shown smart capital management with the divestment of the Minetec business to Caterpillar, who are much better placed to sell into the mine market, for $18m. In addition Codan will continue to supply the product to Caterpillar for 5 years, purely in the role of a contract manufacturer.

The only bad news in the report, and presumably the reason for the negative market reaction, is that CEO/MD Donald McGurk is resigning after 21 years with the company, 11 of those as CEO. Just to put this in context, Codan has a very strong ang long-tenured senior management team:

- Paul Sangster leads Tactical Communications business, and has been with Codan for 8 years;

- Peter Charlesworth who leads the metal detection business has been with Codan for 17 years;

- Michael Barton CFO has been with Codan for 17 years.

In the investor call, the main risks discussed for the coming year were:

- Transport disruption caused by Covid restricting ability to supply from Plexus contract manufacturing in Malysia

- IC supply difficulties in second half of the year

Codan is the longest-held company in my portfolio, with annual returns of 31% over 8 years, so it is no surprise it has grown to 9% of my portfolio. This is overweight given I try to equal-weight across 20 companies, but I hold with such high conviction that I cannot bear to part with any of my shares.

Every results season throws up some “oddity” that I find cant be easily explained. To me this season one such stock was Codan (CDA). I have been reasonably familiar with this story over several years, and met the outgoing CEO a few times, but am only a recent holder.

The treatment meted out to CDA has been severe given the result and I thought it worthwhile having a closer look.

My first comment is that this market is occupied by trend followers to a greater extent than anything I have seen in 30 years of investing, the upshot of that is that stocks will trend way above and way below what are reasonable valuations, imo. Could be the case here to some extent. Both ways.

The companies record over a reasonably long period has been quite good. It is a leader in detecting equipment and spends on R&D to maintain that position. The company has used the cashflow from that division to acquire more in the communication area. All sound stuff so far.

Although having a tech slant there is a weakness in the variability of the base biz. This is due to the reliance on some areas such as Sudan and Afghanistan for a reasonable amount of demand, quantified to some degree in the last result. Some with longer memories will recall the issues around 2013/4 that saw sales fall dramatically and it took some time to recover, although sales again are impacted the declines are much more manageable nowadays. Probably scares some.

However this variability means the stock is not a CSL etc. and shouldn’t and now doesn’t trade like CSL.

So there is variability in earnings that the market should have known of and priced accordingly, didn’t happen, the stock trended too high, that has been over corrected now imo. Is the company over earning? Maybe to some extent but not dramatically imo.

The other area of interest are the acquisitions in the communication segment. In the past CDA record in this segment has been patchy. However mgt went out of their way to say all was well, although early days. There are big hopes here. Any disappointment would be severely dealt with by the market.

The surprising issue with this result is that there were/are risks but they appear to be handled well so far but the market has shot first. IMO that is why I hold and would look to add if more stability is forthcoming. That’s enough of a rant for a typing beginner!

I’m a newcomer to Codan, having bought my first shares in January this year. However, for those who have held Codan for more than 8 years, you might be feeling an uncanny sense of déjà vu right now. I found this article from June 2014 (copied below). As you read through this article you could be forgiven for thinking you were in an 8 year time warp. The question on my lips now is…will history continue to repeat itself over the years ahead?

Following an 80% fall from its peak share price in April 2014, it took 5 years for Codan to reach its former peak, and then 2 years on from that the share price was more than 5 times higher than it’s former peak. I’d be happy with that! :)

Value Stock - Spotlight on Codan (1 June 2014)

“Talk about being in the wrong place at the wrong time. Codan has been smashed as a falling gold price and civil unrest in parts of Africa cut demand for its metal detectors, and as the fading resources investment boom weighed on its mining technology division.

Codan shares more than tripled between mid-2011 and early 2013 as the market latched on to its fast earnings growth and stellar prospects in emerging markets. But after peaking at $3.95 in March last year, the company has slumped to 68 cents in a brutal fall from grace.

Value investors could give up on Codan. Its earnings can be volatile, sales are heavily skewed towards Africa and other frontier economies, and much depends on the hard-to-predict gold price and rate of gold discoveries. Also, it is hard to define Codan’s sustainable competitive advantage.

Clearly, Codan is not for the risk-averse or those with a short investment horizon. No business that earns half its sales from the African mining industry, and operates in political hotspots such as the Sudan, can provide the consistent, recurring revenue that characterises exceptional companies.

Even so, the market habitually gets too bullish on small-cap companies at the top, and too bearish at the bottom. That could be the case with Codan today, making it a stock for portfolio watchlists of speculators, as its share price forms a base.

To recap, Codan has three core divisions. MineLab is the most important, accounting for 54 per cent of sales in the first half of FY14. It sells metal detectors to small-scale artisanal miners who search for gold as their primary source of income, and to gold hobbyists and prospectors. Governments and non-government organisations also use its detectors to find land mines and other unexploded shells.

The radio communications business contributed 39 per cent of sales for the half. Government and military customers use Codan’s high-frequency radios for long-range communications, and companies and consumers buy land mobile radios for short to medium-range communications.

The Minetec division, which contributed 4 per cent of revenue, provides a range of safety products, asset tracking and communication infrastructure to underground mines. Codan divested its underperforming satellite business in 2012 to focus on these three divisions.

Its strategy, for the most part, had paid off. Codan’s return on equity (ROE) soared from 20 per cent in FY09 to 41 per cent in FY13, thanks to stunning growth in net profit. Net debt had steadily decreased and there was plenty of cash on the balance sheet.

In some ways, Codan was among the more impressive Australian small-cap companies. It had become genuinely global and built a strong on-the-ground presence in difficult frontier markets. Its sales in the developing world have exceeded $100 million in each of the past five years.

Codan still looks well placed to benefit from long-term growth in emerging markets, and as the resource sector eventually recovers. Up to 13 million people worldwide are thought to participate in small-scale gold mining, and many still use traditional methods rather than high-tech metal detectors.

Frontier countries, by their nature, are unpredictable in the short term. Codan’s net profit after tax slumped to $4.8 million for the December 2013 half, from $26.5 million a year earlier. Falling demand for its metal detectors in the latter stages of FY13 spilled over into the first half of FY14.

Civil unrest in the Sudan, extreme weather conditions, counterfeiting of metal detectors, and general political instability in West Africa led to a 64 per cent fall in revenue in the metal-detection division to $32.9 million. Gold-detector sales fell an astonishing 80 per cent on a year earlier.

Lower profit margins compounded the sales woes. A strong second-hand market in metal detectors has emerged in Codan’s key African markets, reducing its ability to sell higher-margin new detectors. And it was caught holding far too much inventory, after not having had enough during its boom years.

Codan’s other divisions also slowed. Revenue in the radio communications business was to $23.6 million in the December half, from $32.3 million a year earlier. Sales of land mobile radio products, predominantly in the United States, were hurt by cuts in US Government spending.

Sales in the MineTec division slumped from $9.4 million to $2.4 million, year on year, as Codan transitioned from supplying traditional mining services to commercialising its own technology. On any measure, Codan’s earnings woes – flagged to the market in December – disappointed.

However investors cut it, the result was a bloodbath.

Codan has responded with $10 million in annual cost cuts, and other volume-related expense reductions. The big question is how much lasting damage has been done, and how quickly it can get its ROE – 7.8 per cent in the first half of FY14 – back to previous levels.

The company’s balance sheet has been weakened: total debt rose from $33.8 million in FY13 to $71 million in the latest half. Excluding cash and short-term investments, the net debt-to-equity ratio is 54 per cent – manageable, although heading towards higher risk.

Codan had $6.4 million in cash at December 31, 2013, from $8.6 million at the end of FY13. Although the $64 million in net borrowings are within its bank facility of $85 million, Codan arguably does not have much scope to withstand continued earnings shocks without additional debt or equity capital raisings. Gearing at 35 per cent in the first half of FY14 is moderate risk.

It is not all bad news. Codan has several new metal detectors due for release in FY14 and FY15, and says its radio communications division entered the second half of FY14 with its strongest order book in several years.

The MineTec business won an important tender to install its mine simulation software, which will provide proof of concept and a platform for further sales. Codan says MineTec is now successfully commercialising its technology in a highly competitive global industry.

Even so, Codan provided muted guidance in the outlook statement in its latest profit report: “Although sales have been softer during the past nine months, our baseline metal-detection business remains strong, and we remain confident of future growth as we continue to develop new market-leading products and extend our global reach, all supplemented by the upside of future gold rushes.”

Prospective investors might have hoped for more specific guidance on how Codan intends to arrest its earnings decline. In fairness, current volatility in the company’s core markets must make it hard to give more precise guidance.

Prospective investors need a high margin of safety to buy Codan, such is the risk of forecasting error (with only three forecasts in the consensus) and the potential for continued earnings volatility. None of its recent problems, notably civil unrest in parts of Africa, look like reversing anytime soon.

Lower expenditure by mining companies and government cutbacks, which affect the radio division, will linger for some time. The surprise could be continued gains in the gold price, which encourages more prospecting and leads to more gold discoveries, which in turn spurs metal-detector demand. But pinning ones hopes to the gold price is risky.

A better strategy is to watch and wait. It is hard to find a re-rating catalyst for Codan between now and the full-year result in August, and the first downgrade is rarely the last for micro-cap companies. A weaker gold price is a threat for its gold-detector sales.

More evidence is needed that Codan is arresting its sales decline, boosting ROE, and restoring market credibility. It said the ‘challenges presented by some of its markets makes it too difficult provide guidance at this time”.

Chartist will keep a close watch on the price action as Codan consolidates between 60-70 cents a share,

– Tony Featherstone is a former managing editor of BRW and Shares magazines. This column does not imply stock recommendations. Readers should do further research of their own or talk to their adviser before acting on themes in this article. All prices and analysis at May 28, 2014.”

…and how did the share price fair over the following 8 years?

Officially bagholding after this update

Looks like the update on Sudan not very good and the diversification progress is slower.

Sudan is turning to be the next Zimbabwe mugabe era.

Should have listened to myself and just sold like what i did with aquarius platinum

Held]

Shock 1H23 guidance

AGM Chairman and CEO Addresses, 2022

Codan’s 1H23 shock profit guidance of between $25 - $30 million announced at the AGM not only surprised me, it shocked most of Codan’s investors. It is now feasible that Codan’s FY23 profit result could end up similar to my worst case scenario of $57 million (37 cps).

This could put profits down about 40% on Codan’s record $100 million profit result last year. Codan puts lower profit guidance this half down to the uncertainty relating to the timing of shipments on a large communications project as well as the ‘lack of visibility’ in a number of African markets.

Codan said it recently learned from their people on the ground that there are a number of factors impacting Minelab sales into Africa. The Codan CEO, Alf Lanniello, said “Beyond COVID, geopolitical and macroeconomic challenges remain across Africa, and it is only now clear that there is an overhang of product in the market following the very significant volumes of detectors purchased in FY21 and FY22.”

Codan CEO Alf Lanniello said “Sudan has been materially impacted by the military coup. The previous democratically-elected government actively encouraged artisanal gold mining as a means of driving employment and building wealth within regional communities. Now, under military rule, some gold mining regions are being controlled by military forces and remain off limits to artisanal miners.”

In fact it is worse than this as I uncover further down!

Alf said “This was a key reason for the reduction of our sales in FY22 and this market has further declined in FY23 along with broader weakness seen throughout Africa”.

Alf said “Our planning and budgeting for this year anticipated a gradual improvement in sales into Africa in the first 6 months of this financial year. Following a recent in-depth market by market analysis after our people travelled to all regions, we have now formed the view that sales will remain depressed for FY23.”

Are Codan’s days of consistent growth over, or will this business shine once again?

Codan Blindsided

It concerns me that Codan appears to have been blindsided by what has been happening in Sudan, Codan’s single largest African market. Codan had not picked up on the significance of what was happening in Sudan until just recently when their team was able to “get back into the field after COVID”. At least that is what Codan was telling unhappy investors at the AGM who questioned why profit guidance had not been announced earlier. Until the AGM, Codan had left several analysts forecasting profits similar to last year. So what has gone so wrong so quickly…or perhaps why has it taken so long for Codan to find out what is REALLY happening in Africa?

What’s happened to the African Minelab Profits?

The African gold detecting market has been the largest market for Minelab historically, with sales peaking at $185 million in FY21, before declining to $125 million, or 26% of Codan’s total revenue in FY22. However, due to Minelab’s higher profit margins, this represented about 35% of Codan’s total profits, or $35 million for FY22 (on my calculations).

Now doing some rough maths based on my assumption Codan’s FY23 profit will be c. $57 million, this would mean Codan will be down about $43 million compared to FY22. If we were to write off all the profits Codan made from metal detector sales in Africa last year completely, (c. $35 million), this would put Codan’s FY23 profit at $65 million. Something is not adding up here!

Codan says ROW sales are growing and margins in the Comms business is improving, so how can Codan’s profit fall by more than the profit Codan makes out of Minelab in Africa?

Is it possible that Codan has over-invested in Minelab inventory over the past 12 months in anticipation of increasing sales in Africa and it is now left with warehouses full of metal detectors? This would certainly explain why Codan’s profits and cash flows might be lower this year.

Significance of Artisanal Mining in Africa to Codan

“An artisanal miner or small-scale miner (ASM) is a subsistence miner who is not officially employed by a mining company but works independently, mining minerals using their own resources, usually by hand” (Wikipedia).

“There are four broad types of ASM: permanent artisanal mining, seasonal (annually migrating during idle agriculture periods), rush-type (massive migration, pulled often by commodity price jumps), and shock-push (poverty-drive, following conflict or natural disasters).”

Sudan is Codan’s single largest market in Africa and “artisanal gold mining is widespread across much of Sudan, employing more than two million people and producing about 80 percent of the gold extracted nationwide.” https://phys.org/news/2022-07-sudan-gold-wreaks-havoc-health.am

In 2021 Codan experienced a “COVID Gold Rush” as Africans out of work due to COVID rushed to the gold fields. The growth in Minelab sales during 2021 turned out to be unsustainable.

Russian Interference and Gold Plundering is Affecting Artisanal Mining

“One of the world’s least-developed countries, Sudan is a hotbed of illicit financial activity — Transparency International ranks it among the world’s 20 most corrupt countries. It is estimated that only a fifth of the country’s gold output passed through official channels, with the rest smuggled out of the country. In 2019 more than $4 billion of gold was unaccounted for.

In the new interim government, Hemeti is the second most powerful general after Abdel Fattah al Burhan, the country’s top military leader, who launched a coup to oust the civilian leader Abdalla Hamdok. After the recent coup (October 2021), it has been even easier “to smuggle gold to Dubai.”

https://www.mining.com/web/how-a-sanctioned-russian-company-gained-access-to-sudans-gold/

There are also allegations that Russians are smuggling gold bars from Sudan.

“Backed by the Kremlin, the shadowy network known as the Wagner Group is getting rich in Sudan while helping the military to crush a democracy movement.

Wagner’s operations in Sudan began in 2017 after a meeting in the Russian coastal resort of Sochi.

After nearly three decades of autocratic rule, President Omar Hassan al-Bashir of Sudan was losing his grip on power. At a meeting with Mr. Putin in Sochi, he sought a new alliance, proposing Sudan as Russia’s “key to Africa” in return for help, according to the Kremlin’s transcript of their remarks.

Over the next 18 months, Meroe Gold imported 131 shipments into Sudan, Russian customs records show — mining and construction equipment, but also military trucks, amphibious vehicles and two transport helicopters. One of the helicopters was photographed a year later in Central African Republic, where Wagner fighters were protecting the country’s president, and where Mr. Prigozhin had acquired lucrative diamond mining concessions.

Gold production in Sudan soared after 2011, when South Sudan seceded and took with it most of its oil wealth, but only a handful of Sudanese have gotten rich. General Hamdan’s family dominates the gold trade, experts and Sudanese officials say, and about 70 percent of Sudan’s production is smuggled out, according to Central Bank of Sudan estimates obtained by The Times.

Most of it passes through the United Arab Emirates, the main hub for undeclared African gold. Western officials say that Russian-produced gold has likely been smuggled out this way, allowing producers to avoid government taxes and possibly even the share of the proceeds that is owed to the Sudanese government.

Several protests against Meroe Gold operations have erupted in mining areas. A Sudanese YouTube personality known only as “the fox” has attracted large audiences with videos that purport to lift the lid on Wagner’s activities. And pro-democracy demonstrators theorize that Moscow was behind last October’s military takeover of the Sudanese government.”

https://www.nytimes.com/2022/06/05/world/africa/wagner-russia-sudan-gold-putin.html

Wagner Group accused of attacks on artisanal mines

Wagner Group CAN massacre YouTube

“Russian mercenaries working for the Wagner Group, a private military company that has been linked to the Kremlin by western officials, have mounted a series of bloody attacks on artisanal mines in the lawless border zones between Sudan and Central African Republic (CAR) in an effort to plunder the region’s valuable gold trade, witnesses and experts have said.

Wagner has been active in a dozen countries across Africa, and has been repeatedly accused of human rights abuses on the continent. Western officials allege the Kremlin is using Wagner to advance Russian economic and political interests across Africa and elsewhere...”

“Unstable regimes in Africa have sought assistance from Wagner to prop up their governments, including in Libya, Mali and Sudan, according to the US.”

Artisanal Gold Miner Describes Attacks

“Artisanal gold miner Alnazir Mohamed said he was digging for gold when an attack helicopter swooped to the ground flanked by tanks. Soldiers who appeared to be foreign streamed into the mining site and opened fire.”

“They killed randomly and looted, taking everything including property, money and gold,” Mohamed, 30, said in an interview last month in Nyala, Sudan.

The mercenaries, working with the domestic army, killed at least 100 artisanal miners between March and June, according to a tally kept by local rebel leaders.

“Their forces scout gold-mining areas using drones,” said Enrica Picco, a senior analyst with the International Crisis Group who was previously a member of the UN panel of experts on the CAR and has been doing field research since Russian fighters arrived in the country. “Then they use helicopters to deploy soldiers who indiscriminately kill miners and rebels in control of the site, loot property and steal gold.” https://www.mining.com/web/russian-mercenaries-seek-gold-sow-chaos-in-car/

“There are regular reports of attackers arriving by helicopter, killing artisanal goldminers and rebels, taking everything they can and then leaving,” she told British newspaper The Guardian. “Sometimes they come back again a month or so later and do the same thing. It is nothing to do with securing a mining site.”

The Wagner Group’s presence in gold-mining areas has increased since governments around the world unleashed massive sanctions against Russia for its war in Ukraine.

https://adf-magazine.com/2022/07/wagner-group-terrorizing-sudanese-gold-miners/

What’s the Future For Codan in Africa?

Alf Lanniello said “While our sales into Africa are currently lower, I want to assure shareholders that management are working hard to rebuild and maximise our sales of gold detectors into this market.”

In reality, given the geopolitical circumstance, the instability of governments and the level of corruption, particularly in Sudan, Codan’s people will have little influence over artisanal gold mining activity.

Alf admitted Codan has “a lack of visibility into a number of the African markets”. I think Codan needs to invest more resources into on-ground intelligence in Africa to better understand what is driving and influencing artisanal gold mining activities across Africa. The level of artisanal gold mining activity directly impacts Minelab sales and profitability.

Rest of World (ROW)

Codan said “Rest of World (RoW) sales for the Minelab and Communications businesses, into markets such as North America, Europe, Lantin America and Asia Pacific represented over 70% of FY22 revenues.”

Metal detection (ROW)

“Encouragingly, Minelab’s rest of world sales – excluding Africa – has been a fantastic growth story, with sales growing at 14% CAGR from FY18 to FY22, despite the cessation of Russian sales. The breadth of products being sold (including gold, coin and treasure and land mine detectors) as well as growth in key geographic markets in North America, Central and Latin America, Australia, Europe and Asia means these sales are generally more predictable and stable compared to our African market.”

“Minelab has a strong track record of successfully entering new geographic markets and we are confident that our ongoing engineering capability and innovation will support the continued release of leading-edge products. Having not released a high-end coin and treasure detector for over 10 years, it is with much excitement that during FY23 Minelab will launch several new coin and treasure detectors.”

“Despite these headwinds our Rest of World metal detection business continues to perform well, maintaining gains made in FY22 and we expect the first half of FY23 to be in line with the prior year after normalising for the ceased Russian market.”

Communications

Codan said “there will be a particular focus on increasing the profitability of our Communications business.”

“The acquisitions of DTC and Zetron have diversified Codan’s sales with the Communications division increasing from 23% to 48% of group sales in FY22.”

“However, as the Communications business continues to grow their sales, we would expect segment profit margins achieved in FY22 of 21% to increase, as the business will benefit from operating leverage. Our longer-term objective is for the Communications segment profit margin to reach 30%. This may take some time; however, we are confident in both the near and long-term growth prospects of our Communications division.”

“We believe our Communications businesses represent a significant future growth engine for Codan and expect our results for the first half of FY23 to have sales in the range of $123 to 135 million, which represents a 5 to 15% increase on the prior corresponding period. With respect to the large communications project announced at this time last year, there is currently some uncertainty relating to the timing of shipments. Orders remain in place and we are confident that all product will ship over time.”

“With the growth in sales, we are expecting to lift the segment profit margin for our Communications business from 21% in FY22 to 25% over FY23, as the business will benefit from operating leverage.”

First half FY23 outlook:

• A number of macroeconomic and geopolitical factors have significantly impacted Minelab African sales;

• Minelab’s Rest of the World sales are proving resilient and in line with a normalised FY22; lastly

• Communications will deliver strong growth in both sales and segment profit.

Divisional profit forecasts to December 2022 were considered in detail by the Board late yesterday. We are expecting a first half net profit after tax in the range of $25 to $30 million, given the uncertainty relating to the timing of shipments on our large communications project as well as the lack of visibility in a number of African markets, we believe this is an appropriate range.

The results for the second half of FY22 are expected to be stronger than the first half.

Cash generation in the first half of FY23 has been impacted as our sales into Africa have reduced. Sales into Africa are generally made on a cash before delivery basis. We also have a major $5 million capital expenditure program underway to relocate our Zetron businesses which will minimise future rental costs. We expect to close the first half of FY23 with net debt in the order of $70 million. Over the second half of FY23 we expect to return to the positive cash generation that Codan is known for and therefore drive down our net debt position.

Sum up and valuation

Apart from the African Minelab operations, the rest of Codan’s business is performing well and growing. However, Africa made up about 35% of Codan’s profits during FY22 (on my calculations. I need to confirm this with Codan).

The geopolitical issues in Africa are dire, with alleged Russian interference disrupting governments and artisanal gold mining in a number of already destabilised parts of Africa.

Russia is allegedly plundering gold to fund its war efforts with Ukraine, and with increased global sanctions, this is making the situation even worse for artisanal gold miners across Africa’s gold rich nations. It could take years for the situation to improve.

If we were to write off Codan’s African segment for the medium term, is there enough value left in the rest of Codan’s business to support the share price today and over the next few years. Africa still has plenty of gold and the majority of it will be mined by artisanal gold miners, but it might take years for this to return to the glory days.

Last year (FY22) Codan’s earnings were $100 million. If we were to write off all the African profits, say $35 million, that leaves us with a profit of $65 million. This could be lower this year (say $57 million) due to Codan over spending on inventory for a market that has all but evaporated. This is the pain you get when you “lack visibility” into one of your most important markets.

As a shareholder, and for the sake of knowing what to do with Codan, I’m going to attempt to value the business based on a number of assumptions.

I will assume the African business will cost Codan cash flow and profits this year and consolidated earnings will be c $57 million. FY24 Codan’s earnings will be closer to $65 million assuming there is zero profit from Africa (that’s pretty harsh I know).

I will assume the rest of the business will comtinue to grow from FY23 with a return on shareholder equity of 18% (down from 30% FY22) with 50% of the earnings reinvested into growth. That puts earnings from FY24 growing at 9% per year.

Using McNivan’s formula and a required return of 10% per year, I get a valuation of $5.90 ( without the African gold detector business)

Codan is currently trading around $4.00 and it seems to me the market has already written off the African gold detector business, plus some more.

It looks like the market has overreacted. However, due to the ‘lack of visibility’ shareholders have into the contribution of profits from Codan’s various business segments, it is difficult to make a well informed valuation. For me it’s a hold.

Will Codan shine again? Who knows?

Just saw that CDA director K Gramp bought $50k worth of stock at $3.88. she has experience as cfo of austereo and was on UWL board so looks like a numbers type person. doubles her holding. interesting