First thing I noticed about this one is the very welcome change in presentation style. Previous management was very promotional and would generally lead with whichever metric happened to look good. How refreshing to start with the drop in revenue, deal with that, and then move on to better news.

Overall this is actually not that bad.

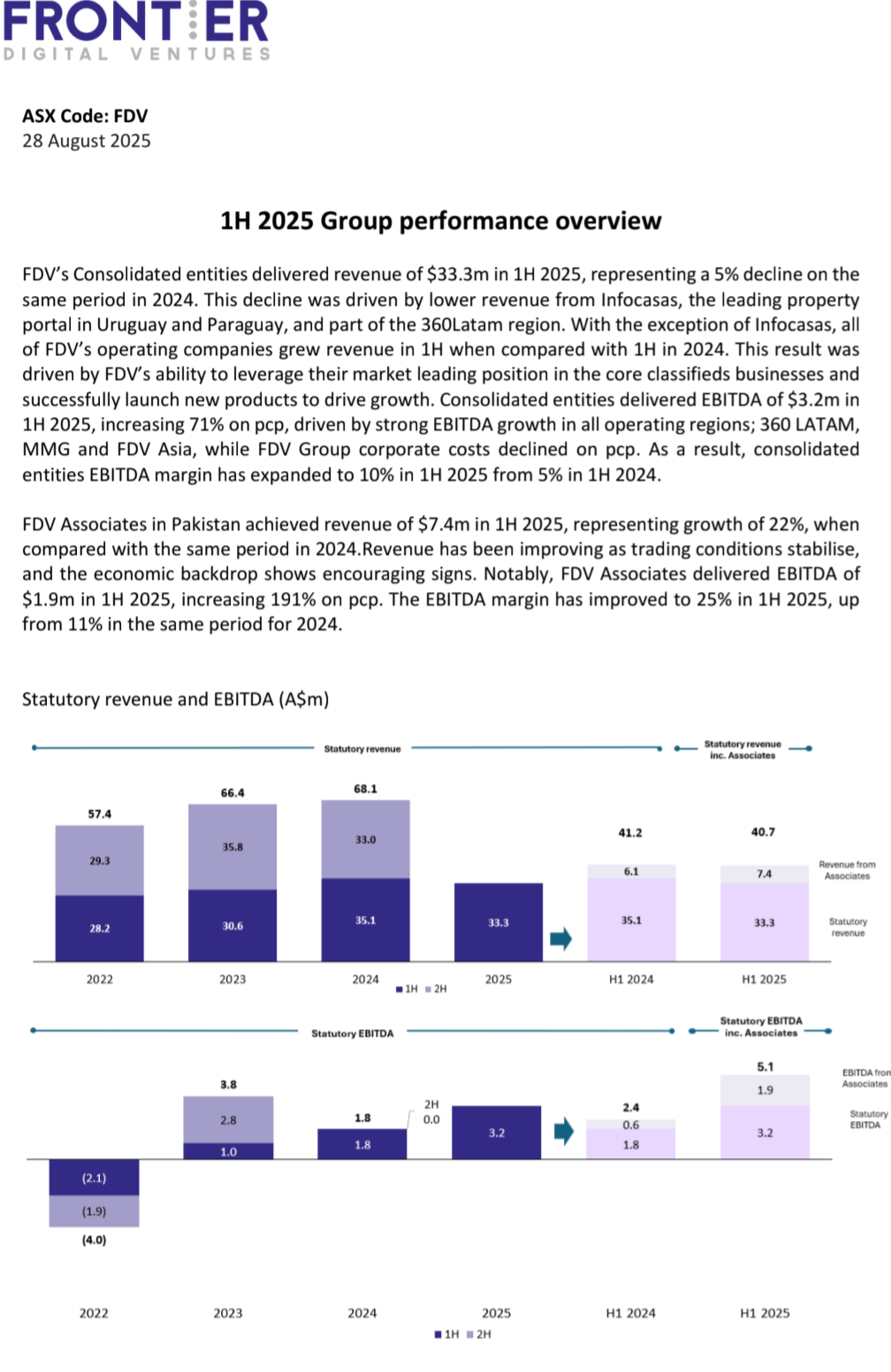

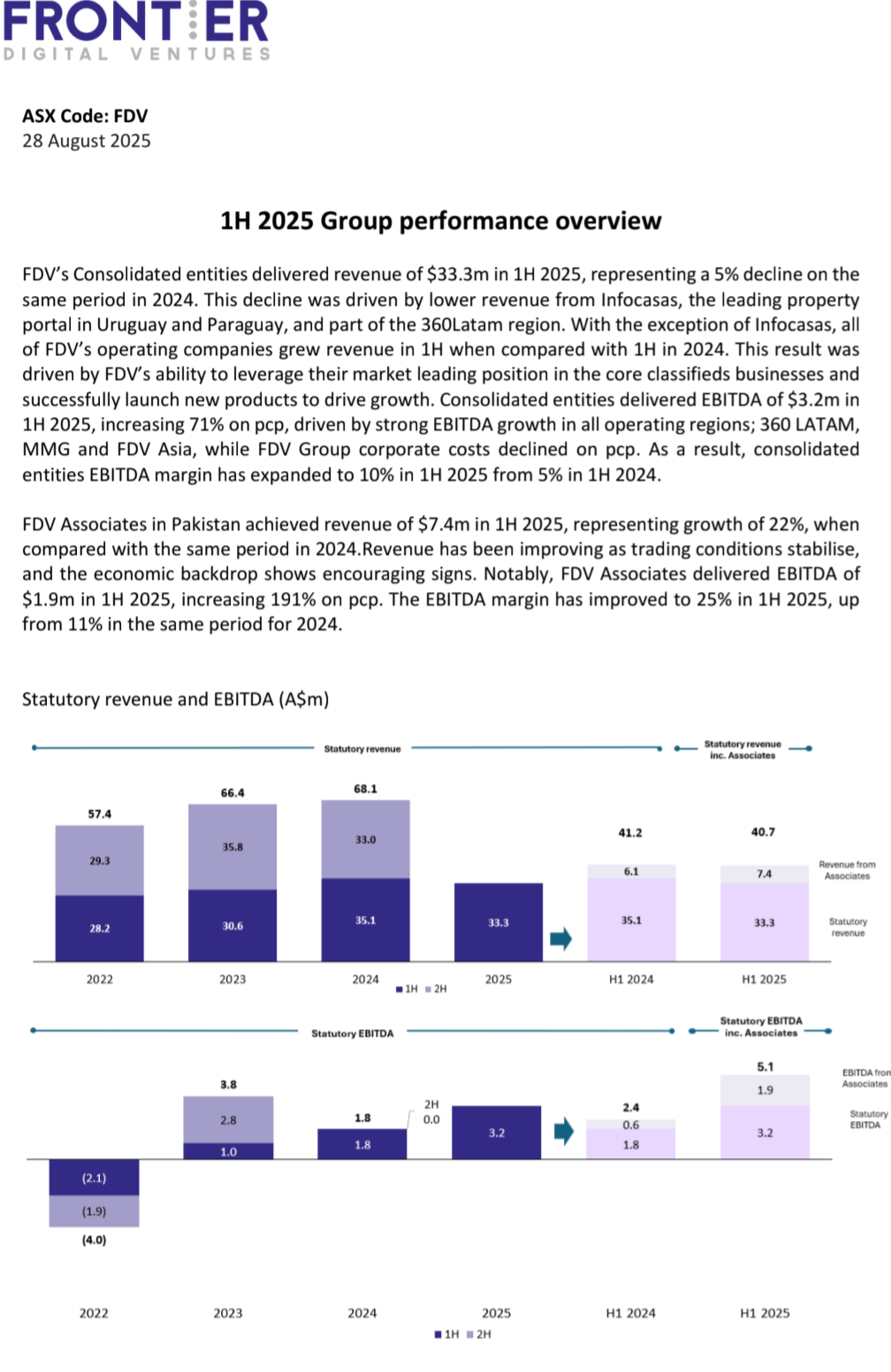

The decreased revenue was entirely due to Infocasas, where revenue fell by more than 50% compared with the PCP ($11.7 million HY24 dropped to $5.1 million HY25) due to "moving away from lower margin revenue products and re-focussing on its higher margin core classifieds business". It would be great to get some further clarification about this (there is nothing further in the HY report). Perhaps in the investor presentation that they promise to release "before Monday September 9th".

The better news is that revenue increased in every other region (other than Infocasas). In fact overall revenue only decreased by 0.5 million vs HY24 if you include "associates" (basically the 2 Pakistan businesses in which FDV holds minority stakes, which are equity accounted). So the remainer of the business made up over $6 million of the $6.6 million decrease in revenue from Infocasas. Also profitability was much better, with increases in EBITDA and cashflow.

Zameen is recovering strongly, with revenue up 22% to $7.4 million (FDVs share) and positive EBITDA of $1.9 million.

Costs were well contained. They have $10.88 million cash equivalents and no debt. There is little chance of any capital raise being necessary.

My Thoughts

This has certainly been a frustrating investment. However I don't believe that now is the time to sell.

At a market cap of $126 million and an EV of $115 million, this is really not priced for any kind of success whatsoever. I want to give the new management more of a chance. It is easy to see multiple catalysts for share price appreciation. The 30% share in Zameen alone could end up being worth more than FDVs current market cap in a few years. Multiple other businesses in the "stable" also have potential. A full or partial takeover has to be a possibility at some point. There is some good info in the @Bushmanpat straw from 3 months ago re most of this.

This article re Zameen is a couple of years old, but still very relevant and worth reading:

https://www.fujikapital.com/p/zameen-an-emerging-market-marketplace