Thurs 8th Jan 2026:

Disclosure: Lycopodium is my largest position both here and in my real money portfolios.

My analysis today: This is not a company in a bubble of any sort, it's a good old-fashioned engineering and construction (E&C) company that specialises in the engineering (/design) and construction of gold processing plants (gold mills). That's certainly not all they do, but it's what they are best known for, and they are enjoying a positive market re-rating as the liklihood of further work across the gold and copper sectors in particular - and in other commodities also - becomes more and more likely.

Many gold projects that were not economically viable two years ago are certainly positioned to make big profits now if those projects can be brought into production within a reasonable period of time while the gold price is still high. And that's what LYL do globally (and GNG do mostly here in Australia, LYL is my largest position IRL and GNG is my second largest).

LYL and GNG do scoping studies (SS), pre-feasibility studies (PFS), feasibility studies (FS, also known as BFS and DFS - bankable/definitive feasibility studies), front-end engineering and design (FEED), and they are EPC / EPCM / EP&PM contractors as well and that's where they make the big dollars.

- EPC = Engineering, Procurement and Construction.

- EPCM has Management (Project Management) tacked on as well.

- EP&PM (sometimes called EPM) means Engineering, Procurement and Project Management, so not the actual construction.

LYL do not usually do the actual construction, however they mostly manage that construction on behalf of their clients. LYL operate mostly overseas and they usually use in-country construction companies to do the actual boots-on-the-ground construction work and they (LYL) manage that construction with minimal boots on the ground themselves. They have excellent risk management that has worked for them very well for decades and has allowed them to work very profitably in West Africa and other places that are generally considered higher risk.

In the past 18 months two things have happened that I think are noteworthy. The first is that LYL withdrew from the bidding process for two large, higher-risk projects for Barrick Gold - the world's second largest gold mining company who are also diversifying into copper and other commodities now. Those projects that LYL have walked away from are Barrick's Reko Diq in Ballochistan, Western Pakistan (wedged between Iran and Afghanistan - see map below) and Barrick's Lumwana copper mine expansion project in Zambia.

Reko Diq (shown above) in particular is likely to be one of the most dangerous places to build and operate a copper/gold mine in the world today and it's unclear whether Lycopodium withdrew from the bidding process (after delivering studies for both projects to Barrick) because of the risks or because Barrick were not prepared to compensate LYL adequately for those risks; but either way it's a net positive in my view that Lycopodium have the discipline to walk away from a project like Reko Diq which would have been LYL's largest contract ever if they had bid for it and had been awarded it.

I note that Fluor Corporation, a company headquartered in Irving, Texas, has been awarded the EPCM contract for Reko Diq, with final notice to proceed given to them by Barrick in late July 2025 - see here: https://newsroom.fluor.com/news-releases/news-details/2025/Fluor-Receives-Final-Notice-to-Proceed-from-Barrick-on-Reko-Diq-Copper-Project-in-Pakistan/default.aspx

So it's safe to assume that LYL are no longer involved in Reko Diq in any capacity now, which is likely for the best.

Barrick's planned major expansion of their Lumwana copper mine in Zambia is still going ahead apparently - see here: https://www.barrick.com/English/news/news-details/2025/lumwana-expansion-in-full-swing-as-barrick-builds-tier-one-copper-mine/default.aspx [July 10, 2025] - However LYL do not appear to have continued their involvement with that project after delivering the feasibility study (FS) and basic engineering for it in 2024. Again, it's not clear if there are project-specific reasons for this or whether it's just a Barrick thing - or more likely a Mark Bristow thing.

Bristow announced his resignation as Barrick's CEO and President on September 29th, 2025, departing the company immediately, with Mark Hill appointed interim CEO the same day. His exit was sudden and without a stated reason from Barrick, though sources later pointed to issues with Mali operations as a contributing factor, say The Globe and Mail.

Bristow was a hard man to deal with by all acoounts, very stubborn and not prepared to admit when he had made a mistake, and not at all sympathetic to major shareholder concerns about his taking the world's second largest gold producer away from gold into copper and other commodities and moving into much riskier jurisdictions without developing the required positive relationships with those countries governments (at all levels), regulatory authorities or local communities where Barrick either operated or wanted to operate.

Bristow took a hard line approach to dealing with the military Junta running Mali and in the process managed to lose control of their (Barrick's) gold mines in Mali and also had an arrest warrant issued for him (Bristow) in Mali, which apparently still stands if he ever makes the mistake of returning to Mali.

Australian company Resolute Mining (RSG) also had major issues in Mali - Terence Holohan, the CEO and MD of RSG was detained in Mali for 10 days in November 2024. He and two other employees were held in the capital, Bamako, over a tax dispute with the Malian military government and Holohan quit RSG after he was released.

Lycopodium is likely to have a list of countries that they will NOT work in, such as Mali at this point in time, and that list would be fluid as situations change, and Lycopodium would also have companies that they would prefer not to have as clients, often because of the company's management and the way they go about things, and that could be the case with Barrick, I don't know, but LYL don't often walk away from large projects after doing all the studies and a fair bit of FEED work, yet they have walked away from two large projects both owned by Barrick in the past 18 months.

My take on that is that it is a real positive because it highlights to me that Lycopodium's risk management processes are robust and they won't chase work that is too risky, or where they are not being adequately compensated for risk where they believe they can manage that risk.

In relation to Lumwana, Google tells me that Zambia presents mixed risks for mining: it's historically stable but faces significant challenges like severe environmental pollution (lead, heavy metals), high safety risks (accidents, poor conditions), and governance issues (taxation, local benefit sharing), alongside recent major environmental disasters (like the 2025 Chinese-owned mine tailings dam collapse) that strain investor confidence and community relations. So not sure whether Lumwana was considered too high risk or a project for which Barrick did not want to adequately compensate Lycopodium for the risk in Lycopodium's view.

China and Russia (Russia mostly through the organisation formerly known as Wagner Group) are both becoming more and more involved in Africa, both central and western Africa, and that also brings various new risks to the countries in Africa where China and Russia are most active.

This is interesting: Zambia Mining Disaster May Have Been 30-Times Worse Than Estimated [Aug 15, 2025, Bloomberg Television, on YouTube]

Plain text link: https://www.youtube.com/watch?v=4IMLHxiyTXM

OK, so that's the first thing I've noticed over the last 18 months, clear examples of risk management in action at Lycopodium.

The second thing is their acquisition of 60% of SAXUM - which has been covered here in straws and forum posts. I like that a lot. I like the measured way they are expanding into Central and South America using SAXUM and that they have the option to acquire the remaining 40% of SAXUM at a future date - the deal is designed to keep all of the SAXUM founders and employees in place and incentivised to continue to grow the company and do well.

I also like that instead of issuing new shares when they believed they were undervalued (at around $10/share then - now over $14/share) or borrowing money, they simply used their own cash and replenished that cash by reducing one dividend. LYL remain debt free and they've had a stable share count for over a decade now.

So evidence of risk management in action, and evidence of a growth strategy into new geographies and new areas of construction, e.g. SAXUM is big in cement and lime in Latin America, and that side of their business is growing at a good clip, so there's geographic expansion opportunities as well as cross-selling opportunities.

Lycopodium is a very well managed company under Peter De Leo's leadership - and there's heaps of insider ownership with around 35% to 40% of the company owned by their Board, Management and the company's founders, with some of those founders still working within the company in Management and Board roles.

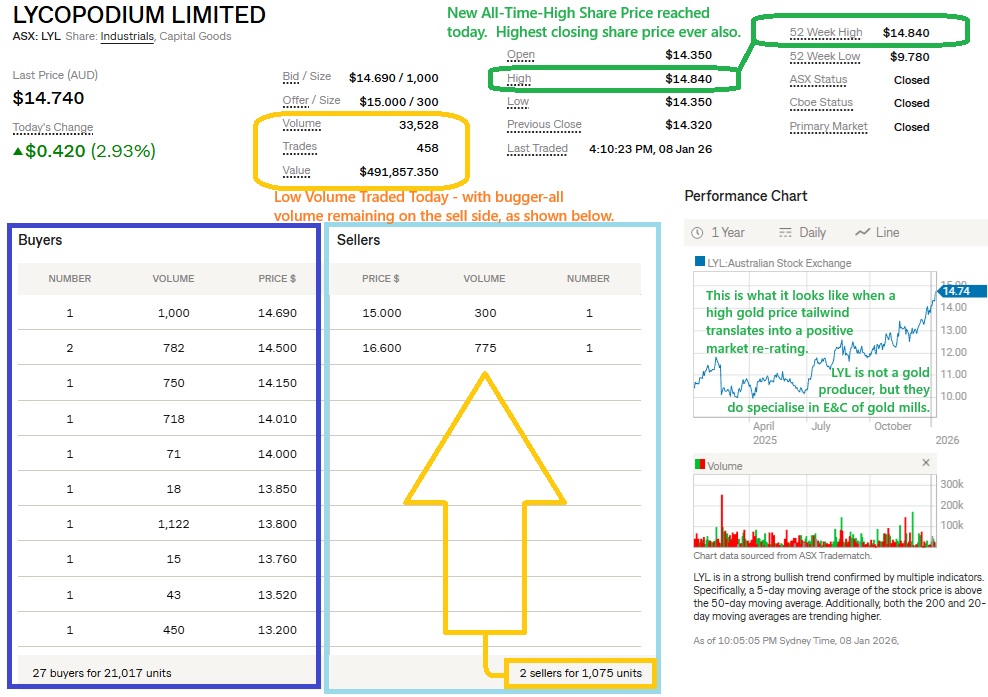

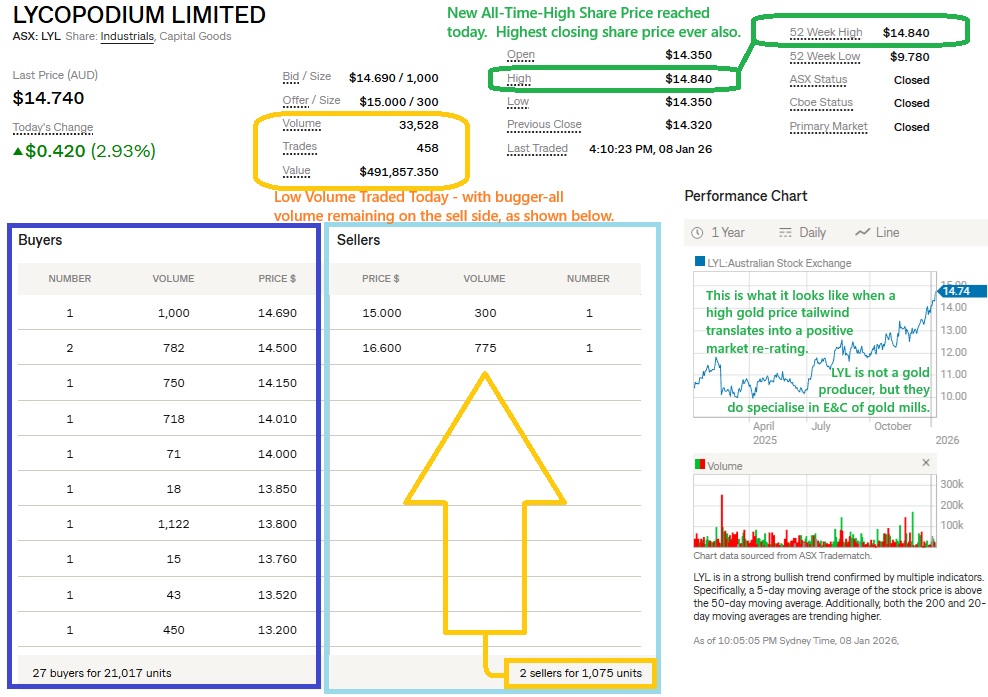

This high insider ownership reduces the free float, and shareholders like me who tend to aggregate a larger position rather than sell shares also tends to reduce the liquidity even further, as I've highlighted at the top of this post with just 2 remaining sell orders left in the market after the close today, being 300 shares for sale at $15 and 775 shares @ $16.60 - and that's it. More sell volume will surely emerge during trading tomorrow, but even during the trading day the volume is usually thin with this one.

What that lack of liquidity means is that you probably want to get in when the share price is depressed, like the 7 months between November 2024 and June 2025 (inclusive) where the LYL share price traded mostly between $10 and $11 and kept dropping back to $10 regularly, because when they get a positive re-rating - as they have recently - there just aren't the sellers there to enable you to build a half decent position.

On the flip side that's good if you already hold a decent position (I do), because while the demand to buy them continues, the share price is more likely to rise further than to fall because of that lack of volume on the sell side.

It's certainly a nice graph now! As Colonel John "Hannibal" Smith, the leader of The A-Team, used to say, "I love it when a plan comes together."

Further Reading: FY2025 AGM Presentation: https://www.lycopodium.com/wp-content/uploads/2025/11/FY2025-AGM-Presentation-1.pdf [13-Nov-2025]

Further Viewing: Peter De Leo presenting at ASX SMIDcaps 2025: https://www.lycopodium.com/wp-content/uploads/2025/10/ASX-SMIDcaps-2025-Presentation.mp4 [09-Oct-2025]

So, are they a buy today? They were at below $12/share and I was not shy about that at the time. Up here near $15/share there's obviously now less upside, but I still reckon a buy up here wouldn't be a bad thing when you look back in 5 and 10 years time from now, but no, I'm personally NOT buying up here - They are already my largest position - I hold 10,000 LYL in one portfolio - currently worth $147 K, and some more in a second portfolio that holds my kids' investments - and that kids' portfolio only has one company in it, LYL. So no, I'm not buying more up here myself, but I'd consider buying more if they pulled back to near $10/share again.