Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Found this interesting article covered in AFR this morning. Here are some interesting highlights.

Not sure AVA’s role in this process. It might be something big or just a desperate move from a drowning giant. Interesting to watch either way.

Apperantly I have mixed fundamental analysis with stalking, but anyway, here's some more details about those Telstra trials I've found recently.

In the Feb annoucement, AVA stated that one of those trials was monitoring fibre optic networks in metropolitan Melbourne. I recently heard that the University of Melbourne has some deep research coorporation with Telstra, so I found this website.

https://eng.unimelb.edu.au/partnerships/telstra/research-projects

One of those researches was "Fibre Optic Sensing Technologies and their suitability for Telecoms Fibre Networks".

Here's the description:

Currently, Telstra is enhancing its fibre network with an intelligent fibre sensing capability. This technology detects above-ground vibrations via light pulses transmitted through underground fibre, processed by smart devices in Telstra exchange buildings. Leveraging machine learning and AI, Telstra aims to develop models for detecting vehicle movements and other relevant events. The project focuses on assessing the technology's applicability for diverse applications and refining the machine learning capability for broader implementation across Telstra's fibre network.

Based on the description, there is a very high chance that this was how Telstra had been using AVA's technologies. Therefore, I decided to dig a bit further.

From this photo on the same website, we can see that this research, conducted by Renata Borovica-Gajic (UoM) and Gilbert Oppy (Telstra) and presented in Feb 2024, was about "Connected Freight Vehicle Prioritisation at Signalized Intersections".

With this information, I was able to find this news press from 2023:

https://research.unimelb.edu.au/strengths/updates/news/smart-traffic-sensors-that-reduce-gridlock-and-unlock-the-economy

It looks like Telstra has benn doing the similar research with UoM prior to the AVA trials in Wollongong, utilizing only sensors from traffic lights and technologies developed by Telstra. The data collected was dumped into Australian Integrated Multimodal EcoSystem (AIMES), runs a couple simulations and generate insights.

Although more details about the trials with Telstra are not available, I do believe it's likely that Telstra has been using its fibre optic network and Aura-Ai seris technologies to collect and tag much more data than using just cameras and traffic light. Based on AVA's recent investor presentation, we can see that AVA has done much more than just monitoring freight vehicles. It's possible that Renata and Gilbert have been moving on to validating other capabilities from integrationg machine learning, sensor and fibre optic networks.

But still, I think the real money maker is in the subsea fibre. No hard evidence yet, it's just my gut feeling.

Lots of suspecting here, definetly not investment advice and not even a good story. Let me know what you guys think.

Now that we’ve known this capital raise is just for getting some working capital, I have more questions for Mal next week.

The company’s CFO said AVA had enough capital to fund the growth. Would it be too harsh to ask “Why did you lie to my face?”? I just don’t know how to ask this question in a more subtle way.

Wondering why Mal rescheduled the meeting?

The two back to back presentation slides do have a tiny bit of difference. The one from last Friday gave us an update of top 20 shareholders, which have increased their holding to 56.6% (but still says 56.4% on the slide, apparently there’s no proof reading in AVA, such a shame).

All the smaller investors other than the big guys who got in early, have kept cumulating their positions. I guess there are people out there seriously believing this company.

First things first, please allow me to be upset for a couple paragraphs before actually writing something constructive. My apologies for being annoying.

Stop telling people how much money you think you will earn when you can't even time the contracts accurately. I know it's hard to know when a deal will happen precisely due to the nature of the business. I understand it takes time for things to happen. But still, I don't understand why the management of AVA can make those

I can still remember the last Strawman meeting with AVA, when Joyce the CFO were so confident that it's just a piece of cake to boost the EBITDA margin close to 15%. I've kept my expection extremely low since then because I just hate to be disapointed. I told one of my friends that I would be so happy if the EBITDA margin is between 7-9% for H1FY24 since so many orders got delayed. He just had his biggest laugh in 2024 so far a couple hours ago.

The only thing that is more stupid than those future growth projections is probably giving away special dividend when the company is in debt and doesn't have much cash. It's like renting an apartment while paying a house mortgage. It does not make any sense.

Here are a couple things I picked up from this result.

They talked about lauching this new "Lx LoRa Connect" product in 2024 which got me quite confused. According to GJD, it's supposed to be a cutting edge ultimate solution to perimeter security. I was hoping for a integrated platform, similar to the one new CTO Rod Wilson is supposed to be developing.

However, if you go to GJD website, you well find out that Lx Lora Connect is a bundle of old products connected together. It's like restaurant telling people that they've created the ultimate burrito by wrapping a burger with a pepperoni pizza. Got no idea why people should be excited with this product, probably should ask that question in the meeting next month.

Speaking of Rod Wilson, we've heard nothing about that platform integrating all AVA products together. Not sure what's been going on, maybe we should ask about it as well.

The company is burning cash quite rapidly to bringing more orders, which is concerning. You can see how they've cut the marketing expense and spent more on 'Travel & Entertainment'. Based on the record order intake, this approach kinda worked. They've also spent more on purchasing intangible asset. Maybe they are trying to accelerate R&D process. I suspect Mal will be rushing even faster in the next couple years after losing another few rounds of share price based performance shares. Rushing is never a good sign in my opinion. The only way to avoild a car crash while driving 200km per hour is don't drive that damn fast. It's only been 12 months since Mal was in charge so let's just keep watching for now.

The company is expecting huge revenue boost from adjacencies. However, it doesn't look like the gross margin is going to increase with more sales from Telstra kinda deal. Based on my previous analysis, the telstra deal should have rediculously high gross margin so I'm definetly asking about it in March Strawman meeting with Mal.

I just found that FFT released more details of the multiple contracts announced December last year.

(Here's the link to that anouncement just in case: https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02756537-3A633711)

FFT disclosed information of the following contracts in addition to the annoucement.

Here are the links:

US Jail: https://www.fftsecurity.com/aura-ai-x-selected-to-protect-multiple-us-correctional-facilities/

Highlight: "Of the four correctional facilities, two are new sites currently under construction while the other two involve upgrades of existing FFT PIDS to Aura Ai-X"

South America Pipeline: https://www.fftsecurity.com/fft-aura-ai-x-selected-to-protect-130km-pipeline-at-south-american-copper-mine/

Highlight: "Future Fibre Technology (FFT) has secured a contract to protect a new 130km pipeline at one of the world’s largest copper mines in South America"

LNG Terminal: https://www.fftsecurity.com/fft-secures-upgrade-contract-to-support-lng-terminal-expansion/

Highlight: "Over the next 12 months, the customer will upgrade to Aura Ai-X and FFT’s deep learning subscription service, ATLAS – underscoring the customer’s commitment to enhanced resilience, efficiency and security within their operations"

If I remembered correctly, this is the first time we've heard of actual ATLAS subscription sale. It's small (A$0.3M) but it's also huge. Despite how slow it is, AVA is on track of bringing in more high margin recurring revenue and also more data for machine learning training. There is a potention for AVA to build up a meaningful SaaS revenue model once ATLAS became an essential bundle with Aura Ai-X.

This company really is fun to watch (maybe not fun to hold for years).

Let me know what you guys think.

Despite of all the drama, I think this is a great news.

Entering the telecom market is no big deal. Pretecting the fibre optic asset is the exciting part of this supply agreement. Companies providing fibre optic sensing technologies has been working with telecom companies for years by providing intrusion detection at telecom huts, towers and other security sites.

The nature of this kind of business has no difference from protecting a solar farm, airport or jail, which requires burying fibre optic cables as sensors.

Protecting the cable itself is another story because the asset FFT will be protecting, is the sensor by itself. If I guessed it correctly, protecting fibre optic cables for Telstra will generate small amount of inital revenue ($120k to 220k per quarter I would say), but with very high margin (80%+ will be amazing) since there's no initial installation.

Although we can't find a dollar sign in the supply agreement, I'm not too worried. Telstra will probably order Aura Ai-X when they need one with the price settled in the agreement, just like odering stationery for your office.

It's great to see how fast FFT's customers have been accepting the combination of self-adapting algorithms and real-time fibre optic sensing. There's clearly a strong demand out there with very few competitors. Machine learning is clearly becoming FFT's strongest competitive advantage. Unlike other applications, applying deep learning to fibre optic sensing (FOS) is very challenging. An fibre optic cable as a sensor, brings in huge amount of data, making data labelling very difficult. Even if a software company has the ability to label the data, it probably won't have the access to the sensitive data from security sector. Even if a company has a rich collection of labelled dataset for testing, it rarely has the software design capacity to develop AI models for FOS (I'm talking about Senstar). The only company that has the ability to deploy products like Aura Ai-X at commercial level I can think of is probably Huawei, which is technically not a competitor for obvious reasons.

The corporation with Telstra will potentially make this advantage stronger. With thousands km of cables for testing, Aura Ai-X might become one the most robust FOS AI models in the industry, and that advantage will make FFT a very unique company.

FFT has clearly made a great move and I'm pleased as a shareholder.

In the Q1 update, the company declared that the second half sales would be substantively stronger. To achieve so, the company will have to land something big in H1 so I was hoping to see some exciting news in November but nothing happened.

Finally, in the last month of H1FY24, the company announced this 5 year $500k contract. (And stop telling people it’s $0.5M! It makes the sales look more pathetic instead of bigger.) I think it’s pretty safe to make the conclusion that FY24 will be another $30M revenue year if not less, unless they are selling part of the business again.

I really don’t understand why the board kept being so confident and making false growth projections. I would love to have whatever they’ve been drinking in the last couple years just to stay positive.

It's been weeks since AVA anounced a special dividend. I've got this one sitting in the back of my head ever since.

To be very honest, I still don't have any idea what the hack was that all about.

This is not a rational decision in any universe. The company still has debt from the GJD acquisition, the earning was negative and the first quarter delivered a sister kissing result.

I know the company did claim that the second half will be significantly better but who knows if it's ganna be another Aura IQ.

I watched the AGM recording and was hoping that someone would ask about the dividend. Unfortunatly, it was just two dudes bitching about not getting enough ANN or didn't want to hear updates from Linkedin.

I do appreciate that the company took the dividend policy quite seriously. After all, the EBITDA was positive for FY23.

But still, that was not rational. Nobody needed this dividend. It was nothing even for David Cronin (he's getting about 10 grand I guess).

It's never a good sign seeing the management making a decision that does not purely serving the purpose of growing the busines. It's also quite bizarre seeing a small cap company trying so hard to act like a dividend stock.

I could really need some other point of view here. Let me know what you guys think about this $0.0017 dividend.

In general speaking, not a terrible update.

The reason behind the 36% drop in FFT sales is not clear. It sounds like the company is trying to get some really big deals but failed to close them. If those deals are going to increase the revenue substantively, as claimed by the company, we should hear about it in the next two months.

Personally, I don’t like this kind of communication. It reminds me of how AVA was talking about Aura IQ years ago.

AVA should probably stop talking about any growth projections, start with the 3 year $100M plan. It’s very unlikely that the revenue will exceed $36M. The 2nd half will have to be phenomenal to reach the target.

I’m sure Mal will have to answer many tough questions this week at AGM. Will follow up after that.

Just bought another 50k shares on market.

Solid result and dropped share price on the same day, can't ask for more.

With the current growth rate, reaching $36M revenue in the next 12 months is quite realistic. A 25% growth rate will do the trick.

Not so sure about the 14% margin although David was quite confident about achieving this goal during the Q&A. David also mentioned about distributing dividends in the next 3 years which could be another plus.

During the presentation, Mal mentioned that the company was underperforming in European market and it will be fixed with the new local-based sales team and executive. The 214% growth in Europe is a good starting point (not sure about the rate excluding GJD though).

One thing I picked up is that Jim Viscardi (EVP) is now one of the Key Management Personnel, replacing Matthew Nye-Hingston, COO of BQT. Mal did mention how much he value the employee performance during the Strawman interview. With 81% growth in U.S., it looks like Mal kept his word and rewarded Jim, who has only been with the company for two years, with the proper position within the organisation. I really like this kind of restructuring and hopefully it will be motivating to everyone working at AVA.

Another interesting thing is that, the performance of Mal, the group CEO, is only measured based on the share price. I suspect that there was some sort of agreement between Mal and the board prior to his appointment. I guess people are getting a bit inpatient and dissapointing with the share price movement in the past three years. But still, we haven't seen Mal doing any kind of suspicious maneuver to pump the share price since joining the company. Instead, he has been very patient with the process, and passionate about the products and services, which is respectful. As a long term shareholder, I can't ask for more from a CEO.

The company is at a very good position at the moment (a little bit less debt would be ideal though). There is a good chance that the company will reach the $70M goal (not sure about the EBITDA margin) if everything is done correctly. The shareholders are in good hands and let's see what Q1FY24 will look like.

First things first, the management team of AVA does hate releasing anything on ASX.

The new deal is to protect a 30km double decker conveyor syetem, probably a direct result from the first Aura IQ deal with the, as quote, global leading conveyor manufacturer.

As usual, we do not know how profitable this deal is. But still, a 30km conveyor system is way larger comparing to the previous one.

Another interesting thing is, although the location of the project is in Far East, the news was posted by AVA's sales director in Europe.

Maybe Robin took over the conditioning sales after Pietro left the company recently. Again, we don't know anything since the company is super quite when it comes to communication.

It's definetly a good sign seeing more Aura-IQ deals coming in. At one point I almost thought this tech was a total flop and I was probably wrong on this one. It may not be a huge sucess as everybody expected, but it does make a solid addition to the FFT product portfolio.

Also, I would be super pissed if this is actually part of the first Aura-IQ deal, which was only $300k.

Anyway, more and more questions should be asked on AGM. Let's see what the company has to say.

A post on LinkedIn from yesterday got my attention and lead me to this quick research about AVA's footprint in Ukraine. I found it quite interesting and could be a nice piece of info for the good folks on Strawman.

A distributor named Fortisec, founded in 2020, prepared a 17-page official brochure in Ukrainian with details of the following products:

- laser detectors

- explosion-proof active infrared barriers

- perimeter lighting solutions

This is quite interesting since we've never heard of anything about AVA in Ukraine. I do know they have people looking after Eastern European market and that's it.

This got me thinking, if GJD is heading to Ukraine during the war, what about FFT? So I digged deeper and found that FFT was actually one of the first partners of Fortisec, according to the official website, and the distributor involved GJD as one of its brands and signed a distribution agreement back in Dec. 29th 2022. That was about 6 months after AVA bought GJD so a good example of synergy right here.

I didn't stop there because I wanted to know more about what FFT has been doing in Ukraine. I couldn't find any contract or detain about specific clients, dut to the nature of the security business.

What I did find, is some figures from the website Import Genius.

https://www.importgenius.com/ukraine/suppliers/future-fibre-technologies-ltd

Since I don't want to pay $USD99 per month for the full acess, I made some some educated estimations using the limited information.

According to this website, Fortisec has been importing FFT products directly from Australian in the past 2 years. I found 33 shipments on the websites, and the value of each shipments varies from $10k to $50k in USD. Based on the descriptions of of products, it looks like FFT has been protecting some sites in Ukraine from theft and fire. They also imported instruments for measuring ionizing radiation, which I found quite odd. I have no idea FFT makes such type of products.

Since the records were not consistent and ended at Oct. 2022, I suspect the actual number of shipment being much bigger than 33. The inclusion of GJD product lines directly proves that AVA and Fortisec have continuous coorporation.

I know the company has been very quite when it comes to releasing nformation to the shareholders as a treat. The management of AVA only make material changing anouncements and they took it seriously. I'm not sure if it's a good thing because as a long term shareholder, I would love to know more details behind the numbers from trading update and answering my questions twice a year is just not enough. The footprint in Ukraine would've made a great news feed, even without mentioning names or locations of the site.

This kind of research shows that the company is continuously sending real products to real customers, solving real problems and making real cash while remaining absolutely silent. It helps me sleep well at night knowing that I'm not holding some nonsense like Brainchip.

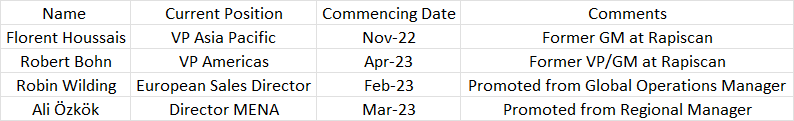

During Mal's presentation on H1 results, he mentioned that he's been working on improving the global sales capacity of AVA. Mal wanted to have a head of sales placed in each time zone, with himself coordinating everything in the heart of the world, Singapore. The clients will then have easy access to someone who can actually make the call and everything will be processed in an efficient way.

Here's some information I gathered from LinkedIn.

(MENA stands for Middle East & North Africa)

Clearly, Mal kept his promise and we now have a director/VP accessible to clients across all time zones. Significant personnel changes have happened in the past 6 months. Florent and Robert are from Rapiscan executive team, which was lead by Mal himself. Robin and Ali have been working at FFT/AVA for years. Robin used to cover Europe and North Africa and Ali was in charge of sales in Turkey (maybe he was the one behind the mysterious Istanbul Airport deal, which we still don't know the exact figure). Appearantly, Mal reassigned their responsibilities, which makes a lot more sens now, and promoted them. I'm sure there are way more changes and additions to the sales team that I couldn't find from public resources.

We also have Sanjay Oberoi covering India, James Viscardi who is now the Executive VP of Global Security, promoted from the position of VP Americas in Jun-22, and Pietro Corsaro, joined AVA in Nov-22, focusing on boosting condition monitoring business (basically Aura-IQ) in Germany.

Those changes are in line with the company's strategy of boosting sales capacity first mentioned back in 2021 if I remembered correctly. At that time, the company was focusing on expanding the team in North America. In two years of time, the company now have propraetors placed around the world. Maybe we all underestimated the ambition of the company after all.

So let's just wait and see how the upgraded sales team perform in the next 12 months. In the most ideal dream-come-true kind of scenario, H1FY24 will be amazing with new orders flying in from every corner of the world taking more than 15% of the intrusion detection market with the most advanced systems. (The market share for FFT was 4% back in 2015 according to the prospectus).

In a much more realistic scenario, I'm expecting the FFT sales in H1FY24 to grow by 10-12%. Not quite enough to reach the $70M goal but very achievable.

The FY2023 revenue guidance of $27.6M to $29.6M really got me thinking. The revenue for H1FY23 was $13.6M, which means the revenue for H2FY23 is expected to fall between $14M to $16M. So they are either expecting a terrible Q4 or only part of the $8.7M is contributing to the Q3 revenue.

Also, it looks like the company is trying to settle a contract worth $2M.

The order intake of FFT grew by 68% into $6.4M impressively. It would be nice if AVA could communicate with the shareholders a bit more during the process.

Again, no further Aura IQ contract mentioned. I'm not sure if it's because the company couldn't land any new deal or Aura IQ deals aren't ann worthy anymore in the eyes of management.

In general, this performance is not bad, especially for Q3, which is usually a sad quarter for the company. A bit dissapointing seeing the FY23 guidance though, not sure what's going on here. $27.6M is still far from the $70M benchmark set by the company. Based on the public information, reaching that benchmark within 3 years seems to be very challenging.

I know the liquidity of this stock is very low, but still, let's see if the market likes this update or not.

Btw, I think the chances of the management selling BQT and giving away another stupidly large, unfranked special dividend is getting higher and higher. The division kept sinking after signing the global distribution agreement with Doormakaba and the management doesn't seem to be very excited about this division.

I was thrilled to see the first Aura AI-X deal happened so soon. When I first heard of this new product, I was worried about going through this Aura IQ drama all over again.

A$2.2m is reasonable for such a contract. There is a good chance that the profit margin is a bit larger comparing to the energy facility contracts. I was hoping to see some recurring revenue from Aura Ai-X deals. Unfortunately we have to wait longer for that.

But still, this contract does give me more confidence and I will be less of a cynical shareholder when I hear phrases like "most advanced", "market leader", "high profit margin" from the management of AVA.

Here are a couple things I found interesting from this report.

The company is no longer debt free due to the GJD acquisition.

Although it hurts a bit to know the fact that AVA is no longer a debt free company, this is still a reasonable move.

When I first read about the GJD acquisition, I was amazed by how cheap the price was. For the first time, we can have a look at the balance sheet of GJD pre-acquisition and it explains a lot. If you had $1.6m in receivables but $19k in your bank acount, you kinda need someone to bail you out. The balance sheet shows a business with good product but just needs a bit more sophisticated management.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02625965-3A611735?access_token=83ff96335c2d45a094df02a206a39ff4

Just finished reading Q1 FY2023 Trading Update.

I think the biggest and only highlight in this anouncement is seeing the board has been trying their best to bring in the right people. AVA has great products that need to be known by more customers. Due to the nature of security business, the best way to promote the product is probably through leaders with deep and strong connections across industries.

I know 28% growth seems to be impressive, but the elephant in the room is obviously not landing Aura IQ or IMOD type of licensing contract, which are the core of AVA's future growth. Without those two types of income, shareholders are not getting anything in terms of dividend (maybe just above one cent but that's nothing), even under the same policy.

Let's see how things turn out under the new CEO in the 2nd half.

The company didn't make much earning in FY22. Now I am really curious about what they've been cooking in the last couple months.

Not complaining though.

Hey guys, I recently discoverd Strawman. I think it would be worth it to bring my other post on Hotcopper regarding to Aura IQ here to have a discussion. Please let me know what you guys think.

As we know, the development of Aura IQ is partialy funded by ACARP. Therefore, Mining 3 is obligated to submit reports regularly to ACARP and you can actually purchase those reports.

Based on those Mining 3 reports I found, the development of Aura IQ has four phases so far. The first three ones are:

Phase 1: Feasibility demonstration

Phase 2: Demonstrate proof of concept on site

Phase 3: Improve the classifier of the system.

After the first three phases, Mining 3 received many feedbacks from the industry. The industry really wanted Aura IQ to be a near-real-time system and made it very clear that this feature would add significant commercial value to the system. So the main focus of Phase 4 was to optimize the system and enable it to run continuously.

Phase 4 was planned to take a year, starting from Dec. 2019. From the management's perspective, they would have a system that satisfied all the industry's commercial need by the end of 2020. That's probably why they were extremely confident of having their first Aura IQ deal in 2021.

Then the COVID hit. The lock down delayed the testing and made certain parts hard to be accessed, which slowed down phase 4 by 4 months. After that, the lead scientist stepped down and paused the project for 3 months until they found a replacement. Eventually, Mining 3 concluded phase 4 in Jul. 2021.

According to the same report, phase 4 was quite a sucess and the feedback from the industry, as I quote, "positive and informative" and they've been conducting further development to handle customers' unique features. The fire detection system integration is probably on of those unique features.

Another thing I found interesting was Strata Worldwide anounced their partnership with AVA about the same time when they were running field test for phase 4. I think it is a strong indicator of the sucess of phase 4.

My conclusion is, after the completion of phase 4 in mid 2021, Aura IQ became a completed product that was finaly ready to be deployed to the market. in the past 12 months, the company was probably being busy modifying the product according to all the specific requests from each client. It's very hard to estimate when the clients will be absolutly satisfied but my guess is a good deal from the mining industry should be around the corner.

I do have some concern about the IP ownership. It looks like all the core AI algorithm related patents are owned by Mining 3 because they mentioned at the end of the report that they planned to use the same algorithm on other applications. FFT is more like a sensor suppliers to get raw data. I don't know the details of the agreement between FFT and Mining 3 but it does look like FFT could be replced with other sensors. Even if Aura IQ did become a huge sucess, we should still keep our eyes open.

Post a valuation or endorse another member's valuation.