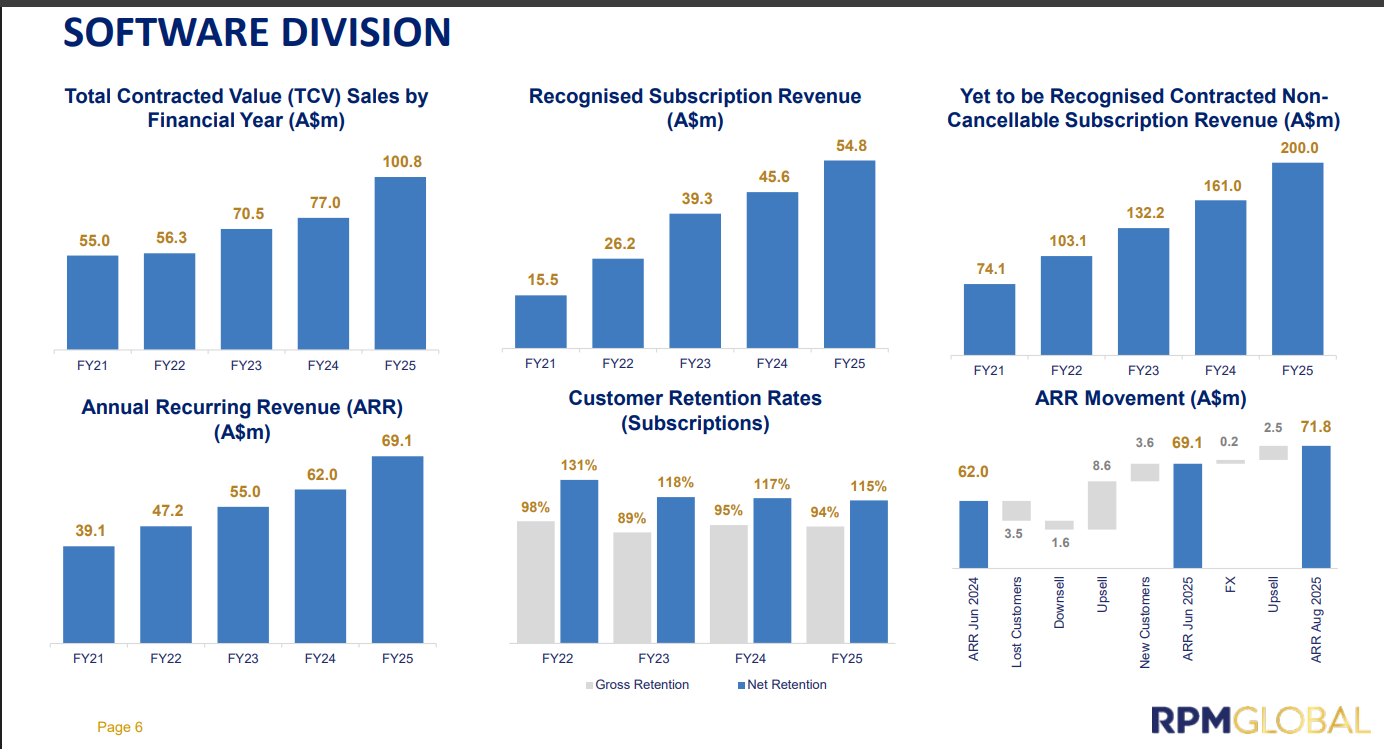

During FY2025, the company concluded $100.8 million in new software license sales (herein referred to as Total Contracted Value "TCV"), up $23.8 million (31%) on FY2024 TCV sales of $77.0 million.

As a result, software subscription license revenue increased year on-year by 20% (FY2024: 16%). Due to the strong growth in software TCV sales, at the end of FY2025, the company had $200.0 million in pre-contracted noncancellable software licence and maintenance revenue, which will be recognised across future years, up $39.0 million from the same time last year.

ATO. If the proposed return is approved by the ATO as a capital return rather than a distribution of profits, the Board will request approval from shareholders at the company’s October AGM to distribute the $21 million to shareholders post the AGM. If the company does not receive approval from the ATO, the company will explore other capital management initiatives..

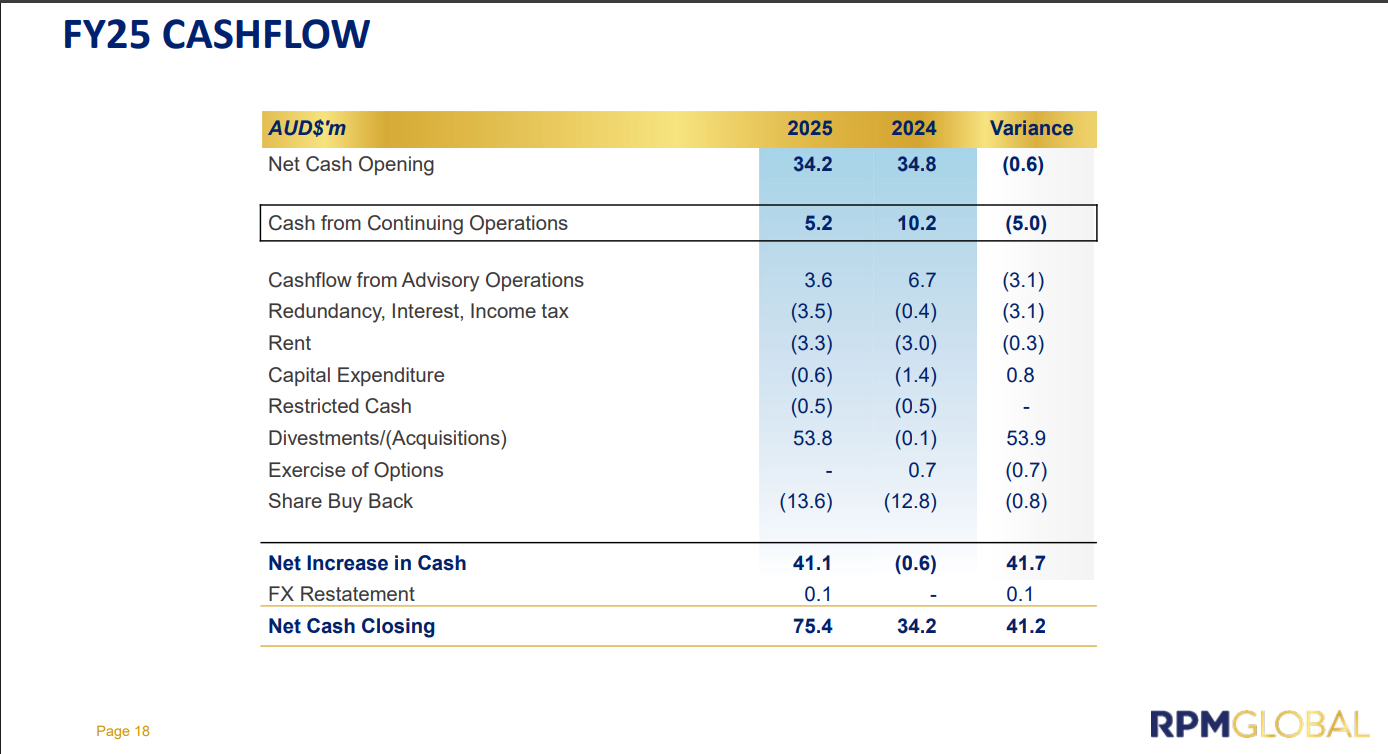

The $100.8 million of software sold during the year generated $12.5 million in new Annual Recurring Revenue (ARR) and as of 1 July 2025, the total value of software ARR was $69.1 million, comprising $62.8 million from subscriptions and $6.3 million from maintenance.

https://hotcopper.com.au/threads/ann-investor-presentation-fy2025-full-year-review.8733205/

The transition from a Perpetual to Subscription licensing model is now complete with Subscription licenses sold in FY25 representing 99.9% (FY25: $100.7 million, FY24: $75.4 million) and Perpetual licenses representing only 0.1% (FY2025: $0.1 million, FY2024: $1.3 million).

@Magneto mentioned-

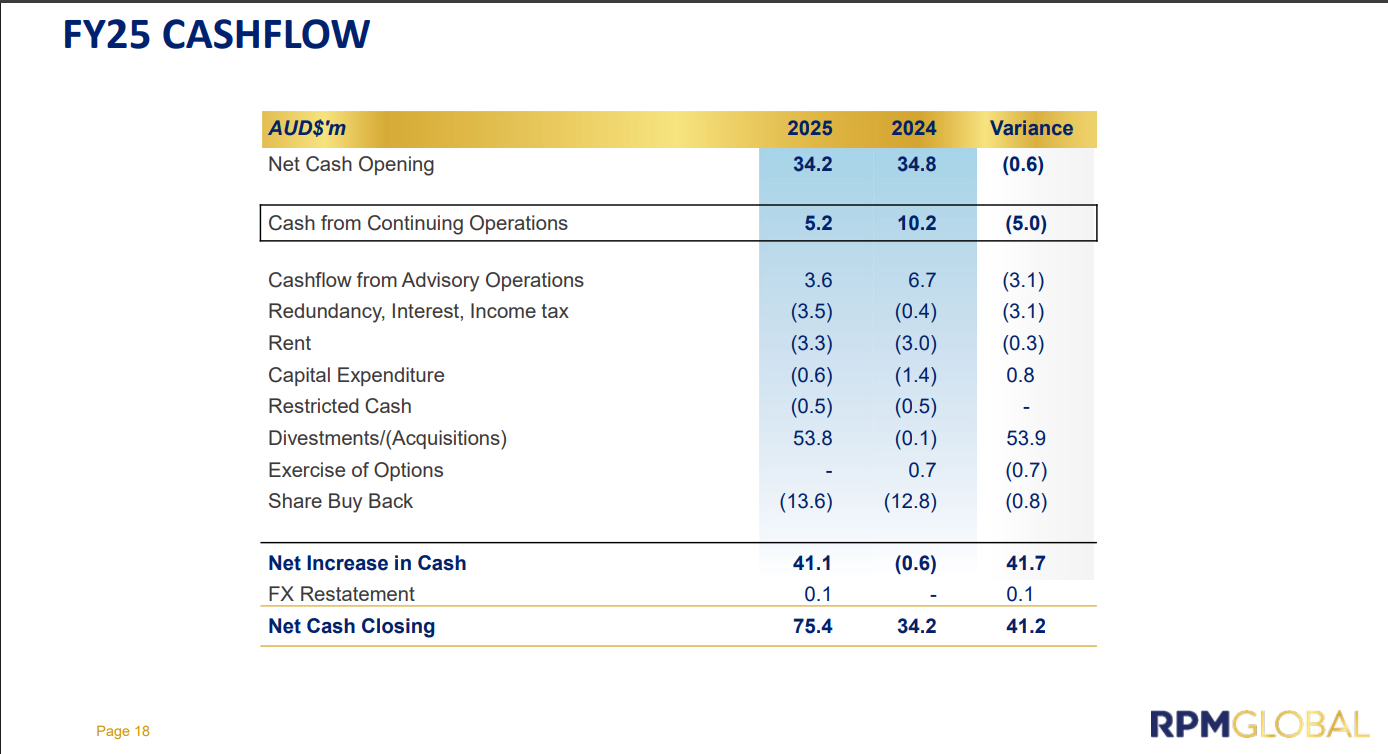

On Market Buy Back : In May 2025, the Board resolved to extend the company's on-market share buyback for a further twelve months.

• During FY25, the Company spent $13.4 million buying back its shares at an average price of $2.65 per share.

• As at the close of business on 30 June 2025, the company had acquired a total of 17.97 million shares via the on-market buyback (since its inception in June 2022) at an average cost of $1.943 per share for a total cost of $34.9 million.

Return (inc div) 1yr: 39.66% 3yr: 28.23% pa 5yr: 21.50% pa

And

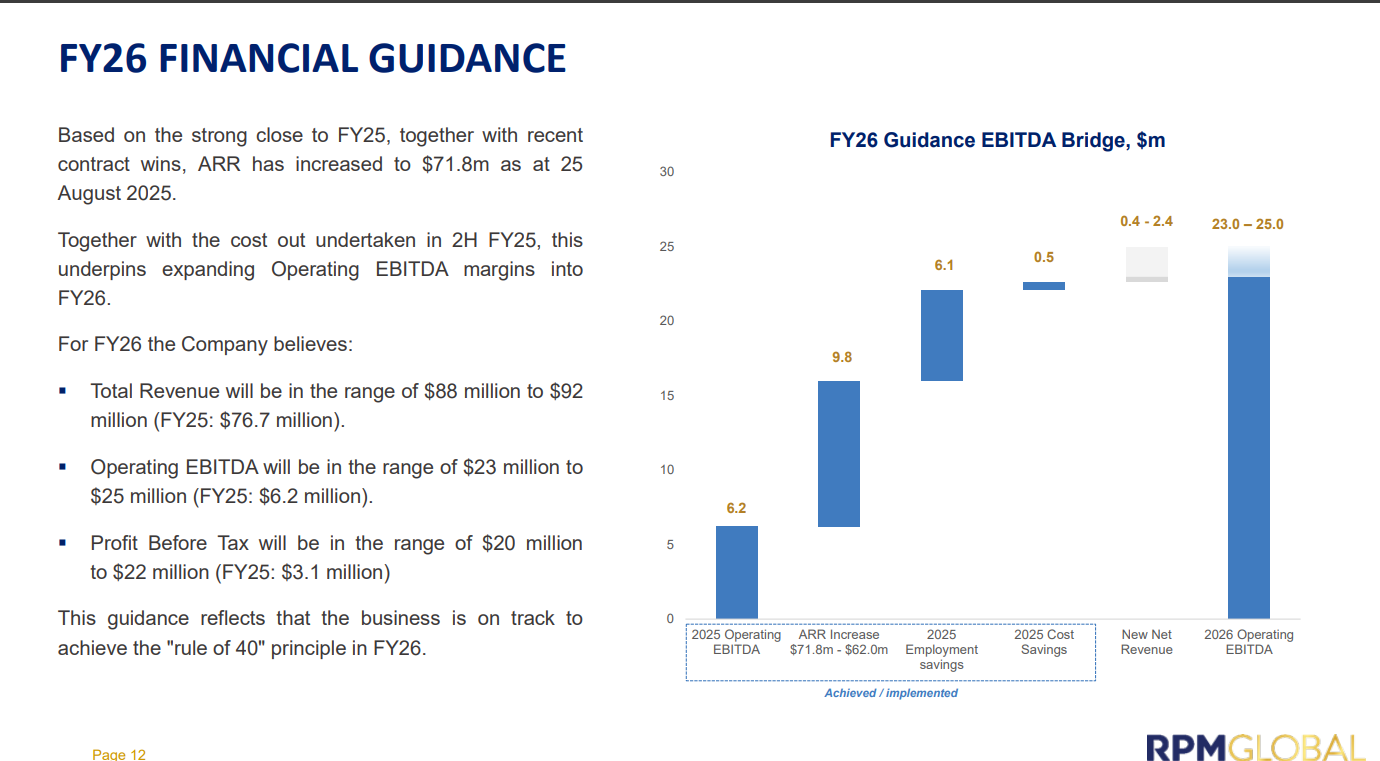

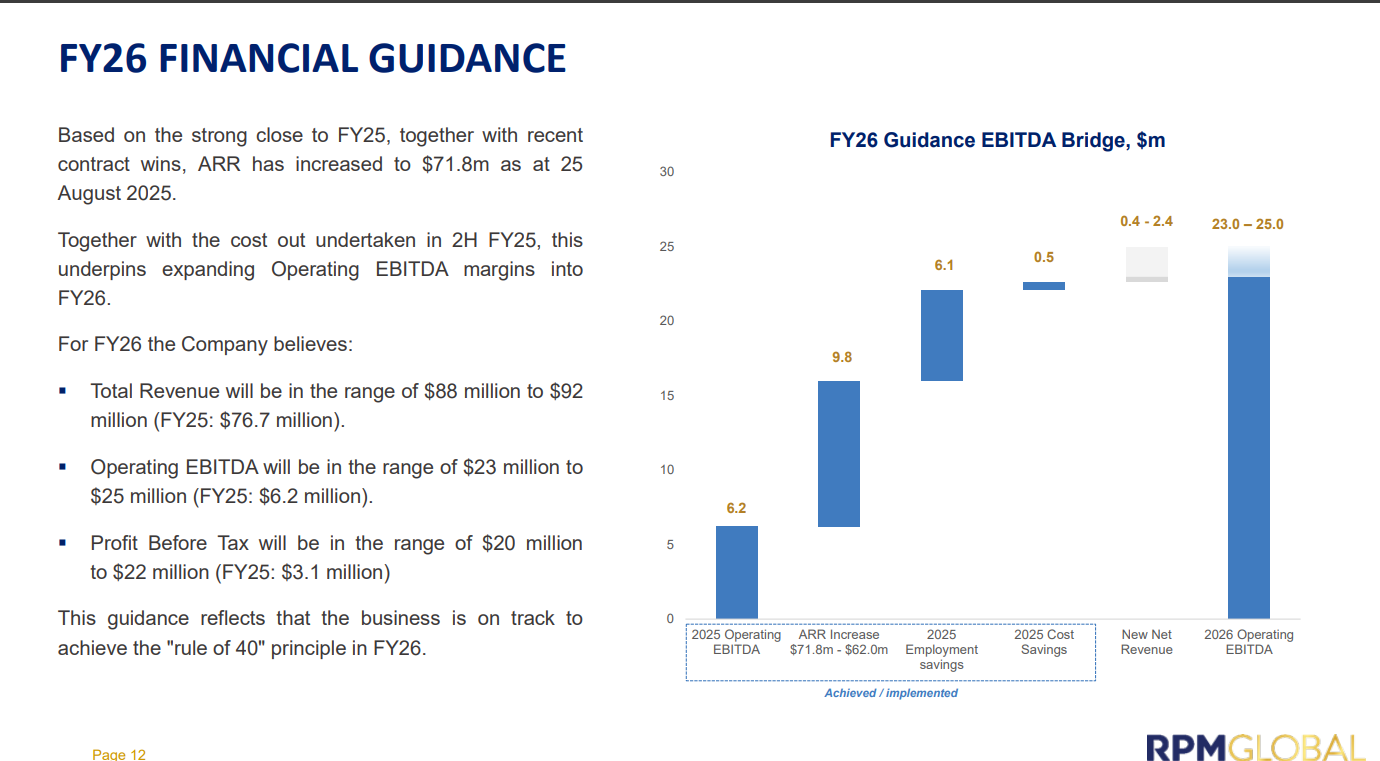

The Rule of 40 is a benchmark for SaaS (Software as a Service) companies, stating that their combined revenue growth rate and profit margin should equal or exceed 40% to indicate financial health and sustainable long-term potential. This metric helps investors and company leaders balance growth with profitability, as rapid expansion often comes at the cost of short-term profits, and vice versa.

How it works:

- Calculate Revenue Growth Rate: Determine your company's annual or monthly revenue growth rate.

- Calculate Profit Margin: Use a profitability metric, such as the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin.

- Add the two: If the sum of your revenue growth rate and profit margin is 40% or higher, the company is considered to be performing well under the Rule of 40.

Example:

- A company with a 25% revenue growth rate and a 15% profit margin would score 40, meeting the benchmark.

- A company growing at 30% with a 10% profit margin would also meet the 40% target.