Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

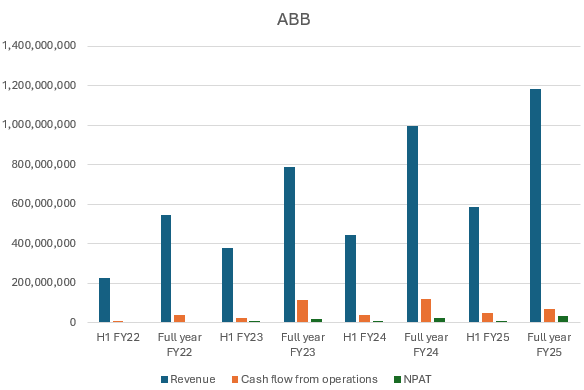

A strong FY result from Aussie today, with shares up 20% as a result. Record revenues and earnings, driven by resi growth, enterprise wins and Symbio’s (ongoing) integration.

A summary below (thanks to my fav PA):

• Revenue: $1.187b (up from $999.7m in FY24).

• EBITDA: $138.2m (vs $120.5m in FY24).

• Gross Margin: 36.7% (up from 36.1%).

• Operating Cash Flow: $68.4m (down from $116.7m)

• Broadband connections: 788,411, up 15% YoY (ex-Origin & satellite).

• Mobile services: 216k, almost doubled share of broadband bundles.

• NBN market share: 8.4%.

• Customer satisfaction: 8.4/10; complaints at 3.5 per 10,000 services.

Last year I remarked that the business was starting to spit out cash for the fun of it. This result was no different, but they doubled down – investing in fibre, repaying debt, paying a maiden (fully franked) dividend and buying back shares. Not bad for a reseller of NBN (tongue in cheek).

All divisions are growing strongly, residential in particular I found to be impressive. In % terms:

• Residential 11% increase YoY

• Business 14% increase YoY

• Wholesale 101% increase YoY, but most of the growth here related to Symbio services moving to the Aussie platform (remains ongoing)

• E&G 23% increase YoY

Who would have thought in FY22, Aussie’s growth story would be reflected like the below – consistent YoY and HoH growth:

What I was most pleased about is the clear evidence of operating leverage (yet again). E&G for instance observed a revenue increase of 9.8m, with costs increasing half of that, while resi revenue increased 91.7m, with costs only increasing 64m. This business continues to scale attractively, reaping the benefits of the fibre rollout.

They once again were named the Most Trusted Telco in Australia (Roy Morgan, 4th year running).

Management rolled out a ‘Look-to-28 Strategy’:

• Targeting >$1.6b revenue by FY28, with residential <60% of total revenue.

• Increase NBN market share, with the aim of surpassing 11% of all NBN services

• Investments in fibre, higher-speed NBN readiness, and AI-enabled customer tools.

• Expansion of MVNO mobile offering under new 5-year Optus deal.

• Becoming the preferred provider for managed telco and voice solutions in Australia (E&G)

• Symbio acquisition integrated; delivered $39.4m EBITDA (pro forma).

Aussie also entered into a six-year agreement to provide wholesale services to More and Tangerine, adding 250k + connections. As part of the agreement, they sold Buddy Telco for an estimated 8m (to be completed in H2). Buddy was performing admirably, having reached 14k customers in its first year and starting FY26 off well with another 2k customers. But these connections will remain on the ABB network under the Wholesale Services Agreement. Going the other way are 5.88m ABB shares being issued to More (subject to escrow). Losing Buddy is disappointing, but ABB will save a buck for the investment being sunk into the brand/service and they will get an estimated 8m as payment. It has presumably also helped them get 250k services + in the door with a six-year deal, the transaction of which is 12% accretive to underlying EPS on a pro forma basis.

Risks, you ask? They exist. Both founders are out the door, despite Phil remaining as a Non-Executive Director. My entire thesis was based on Phil being at the helm – he is a winner and a hustler. I suffered a bit of thesis creep to be honest; I couldn’t bring myself to selling a business that continued to thrive based on the strong foundations set. No guarantee this continues, and risk here has increased, even with his ongoing involvement (for now). Debt remains, but less of it, with the net debt position at a net leverage ratio of 0.93x. More attractive than last year, but still something to consider. Next is valuation: a current P/E of around 50x and a forward P/E of 28x requires growth; any slip up is near certain to see the share price punished. Despite higher EBITDA and NPAT in FY25, cash flow from operating activities decreased – impacted by higher payments to suppliers and employees, the acquisition integration, increase in trade and receivables (makes sense with longer payment cycles from E&G) and a favourable one-off working capital movement which didn’t repeat this FY. The waters get a bit murky for estimating FCF for my DCF as a result, but a thumb suck attempt gets me fair value at around $3.70. They aint cheap, but man the business has turned out to be a cracker.

Aussie is guiding for EBITDA of 157-167m, which would be an improvement of 14-21% on FY25 figures.

Aussie Broadband has sold its 11.99 per cent slice of its remaining holding in Superloop, five months after it was forced to chip away its pre-bid stake by the Federal Court.

I remain of the view that the acquisition was mainly aimed at acquiring infrastructure as opposed to market share, but that's not to say it wasn't partly aimed at capturing additional customers at the cheaper end of the market. Still, Buddy -- as I argued a few weeks ago -- is Aussie's new strategy to remain competitive for those that might consider churning.

I think the current valuation remains compelling, despite the recent share price pop. Phil Britt is a hustler and a winner; I am backing him.

Expect to see improved financials in the next reporting period due to price appreciation of Superloop shares while Aussie held them.

Update: I decided to be a guinea pig. While I care a lot about my internet, I care more about my investment with Aussie and I wanted to get a gauge of the experience/key differences.

Weirdly enough, there was an NBN outage in my area at the time, so I used that as an excuse to call Aussie and ask what the go was. I had moved my service to Buddy hours earlier and the member could see this. The interesting thing was, given Aussie had moved my service to Buddy already, the staff member palmed me off (nicely), suggesting I need to get in contact with them. I played dumb and asked if Aussie could help given they owned Buddy, but he indicated they were essentially two different businesses and I was shit out of luck.

So I checked out Buddy’s website – the only way to get in touch was live chat. This was still an actual person based onshore and in typical Aussie form they were excellent. The porting process wasn’t perfect; they had to do a few things on their end and I had to move the NBN cable to a different port but live chat support rectified the problems encountered.

Are the speeds different? Nope. Still flawless, as is the ping and reliability of the connection.

My takeaway from this is Aussie will not be providing standard phone assistance to Buddy members, so the experience is a lesser one in that respect. While Buddy and Aussie's plans are similar right now in terms of speeds on offer, that will change due to factors like plan speed upgrades (e.g. NBN 100 speeds going to 500Mbps) and the launch of the NBN 2000 speed tier. This will mean Aussie remains the destination for the very high speed end of the market (where the better margins are) while Buddy will focus on competing on more traditional speeds leveraging off Aussie’s fibre infrastructure.

In time, there is a chance Buddy could overtake Aussie by market capture. Most users, at least for the next five years or so, are likely to keep traditional speeds (50 to 100 download) unless NBN make changes. If Buddy is able to maintain Aussie's strong brand, be price competitive with peers and better the margins of those around them, they will increasingly look appealing for a good portion of the market and Vocus, Optus and Telstra will have a difficult time competing with a business that is both cheaper and actually liked by customers. It will be really interesting to see how the relationship between Aussie and Buddy develops; Aussie needs to make sure it offers enough point of difference to remain compelling to the top end of the market.

The new Buddy brand has done my head in of late, but I am slowly coming around to it. I agree with some of the concerns relating to Aussie potentially squeezing their own margins, but management’s comments on the call put me at ease for the most part. When you consider some of the restrictions they are placing on Buddy customers also, I can see why it makes sense from a business/margin perspective (which was my primary concern). Any signs this business wants to get into a cost-war with other budget providers would be a significant red flag/thesis bust, but I don’t think that is happening here.

A few considerations

- For the most part, Australians are increasingly shifting to higher speeds (100mbps and over). This is partly consolidation of the tiers but I would also suggest that its evidence a good portion of Australians consider high speeds and reliable internet connection vital for their household, even with current cost-of-living pressures.

- Incumbents are continuing to lose market share. Make no bones about it, this industry is continuing to be disrupted.

- In the recent report (Jan to March 2024) Aussie continued to take more market share than any other NBN provider. Going further, last quarter, Aussie essentially won what Superloop and Vocus did combined (the other dominant players winning market share off the incumbents). This was almost true of the quarter before that, when Aussie won 30.5k services, and Superloop and Vocus together won 32k. Organically, the trend continues that Aussie is winning the most market share and the incumbents are slowly losing their customers. That isn’t to say Vocus and Superloop aren’t also benefiting.

- But what does this mean? What are they winning? Well, not the small end of the market. At 12 and 25mbps, Aussie isn’t growing. There are almost 3m services for these tiers, and Aussie has just 157k – 5% of the market. Even when you add in 50mbps, another 4.3m services and easily the most popular speed tier in Australia, Aussie services just 250k of these, not even 6%. Aussie’s growth here has almost plateaued.

- Consider the very quickest speeds (ultrafast, 1000mpbs and 500mpbs), 140k services in total, and Aussie services 53k of these – a mammoth 38% of the market. But these services are growing (i.e. users are continuing to shift to higher speeds, despite cost-of-living pressures), while Aussie’s take rate is also growing. Aussie is overwhelmingly the provider of choice for these speed tiers, a nice place to be when users continue to migrate to higher speeds.

Importantly, I don’t think there are any orange flags with respect to Aussie’s current market position, this is only continuing to strengthen where the margins are most attractive. I also think, perhaps controversially, that the argument that cost-of-living pressures is impacting Aussie’s core customer base is unfounded. Ongoing organic growth and take rate at the higher end of the market support this. They aren’t losing customers; they are continuing to add them! It is clear that Buddy is going after the customers of Belong, Amaysim, Dodo and other budget offerings. And with that, we are starting to see Aussie flex its own fibre infrastructure – the budget service is only available to customers with fixed-line NBN (which makes sense to Aussie for a margin perspective). Additionally, users won’t be sold/provided a router and won’t get priority call-centre support.

What I do like is that Aussie is clearly separating its premium segment (Aussie) from the budget one (Buddy). The big factor will be, how many customers at the premium end will churn to the budget end? They expect 5%, but those that make this change could quite well have churned elsewhere if savings are the most important factor for them. I don't think this is a big concern but we will see with time.

I think this move does add a bit of weight to the view that the Superloop acquisition attempt was partly based on capturing more of the mid-tier and budget market, but I am still of the view that move was primarily an infrastructure one to capture Superloop’s existing fibre. Ultimately, it is that fibre that allows Aussie to go to war with the budget market and strip out some of the premium overheads.

TLDR – I am cautiously supportive of this move. Time will tell. My thesis is primarily based on Phil Britt – he knows how to win and understands the market very well. There have been very few slip-ups from Aussie over the last few years and I have no reason not to back him in.

Aussie increased prices for most of its NBN plans under a year ago, and they have now indicated a further price increase for some of their plans. To the NBN value plan for example, both of these price increases will theoretically have seen the price rise - per plan, using their NBN value 50/20 mbps as an example - from $79.00 to $89.00.

The recent price increase, set to impact customers in July, is due to 'the rising operating and wholesale costs have meant we have had to add a slight increase to the cost of your plan'. Their next set of figures should provide insight into their churn. Sure, they will have your usual internet users that swap in and out of deals, but if churn remains relatively low in a time when many households are experiencing financial hardship, we may start to see the thesis arise that Aussie can withstand competition from elsewhere while charging more.

Phil Britt (Managing Director) was interviewed recently on Ausbiz. Link here for those interested -- ABB interview starts around 19:30.

Key highlights:

- Britt had some time off, three months off long service leave. Britt admitted prior to going on this leave he was 'probably nearly done at that point' but he has come back with a renewed vigour. Britt can still see plenty of opportunities for Aussie to grow and innovate and he wants to be a part of this. Thinks he will be around for the next few years (minimum). If they keep doing 'cool things' he will be there for a lot longer.

- ***on a side note, this is great to hear. My thesis is busted without Britt at the helm.

- Some discussion around the recent Symbio acquisition -- focus on business and enterprise, and particularly wholesale. Symbio is 'all about voice' according to Britt. @mikebrisy he also touches on Asia which we previously queried (22:20) - they think there is some opportunity there but will take a wait and see approach. Doesn't sound like they will be rushing into things which is good.

- Symbio will run as a separate business. The OTW co-founder, who is still at Aussie (I didn't know this, this is impressive if you ask me) will head over and run the Symbio side of the house.

- Further M&A opportunities. Voice now taken care of with Symbio. Further opportunities across bolt on customer bases, bolt on residential/revenue opportunities, or complementary businesses for the E&G space (particularly in the consulting realm). They won't rush into acquisitions, not an issue due to ongoing organic growth.

- Capex spend -- FY23 around 47-52m, this will be similar to FY24. On a % of revenue basis, this will obviously reduce over time as revenue continues to improve.

- The risk of cyber breaches, ABB do a lot to safeguard against cyber attacks. Britt admits he is a tech nerd and he has a good understanding of where their gaps are and where they need to improve. The beauty of your MD coming from a tech background.

- First priority for the new year -- starting a tech transformation journey for a lot of their systems -- perfect time to do this with new acquisitions coming on board.

Aussie have started to advertise through a number of podcasts of late, including Equity Mates. Many would naturally expect this to involve them spruiking their residential NBN segment, but interestingly enough it was purely around marketing the enterprise and SME sectors. The advertisement included the below:

"They have brought a suite of technology solutions to the table, think networking, voice, connectivity, and cloud solutions. They have already helped over 1000 large Australian businesses and they are ready to do the same to your business"

A few of our members, myself included, believe the enterprise/business segment is the next key opportunity ahead for Aussie. This business increasingly appears to be positioning itself to tackle enterprise and government in a similar way Macquarie did many years before.

Hopefully we see some traction in these segments in H1.

FY23 results

An impressive set of results of Aussie, with key metrics generally in the mid-upper range of their previously updated guidance. A picture says a thousand words:

The key results are:

- Revenue of 788m, up 23.1%, at the middle of Aussie’s updated guidance range.

- EBITDA of 89.6m, up 52%, towards the top end of Aussie’s updated guidance range.

- Gross margin as mentioned above at 35%, an increase of 6%

- Operating cash flow of 116.7m, up 147%

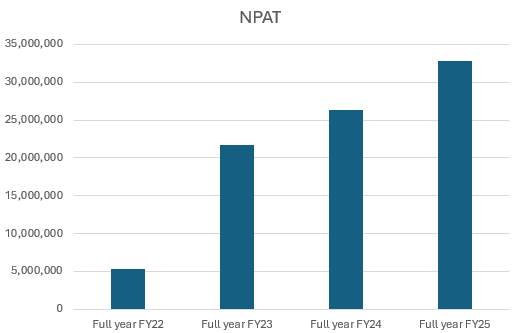

- NPAT of 21.7m, up from FY22’s 5.3m and representing a 308% change.

- Cash holdings 75m, up from 47m (57% increase)

- Diluted EPS increasing from 2.38c to 9.09c

- NBN market share 7.6%

- Broadband connections 691k, up from H1’s 635k (and a 9% increase).

- Churn flat through both halves with an average of 1.0, while the business segment was 0.6.

Let’s look under the hood vs FY22. Revenue increased 23% while network and hardware expenses increased 19%, resulting in an increase in gross profit. Marketing expenses didn’t move, suggesting the thesis is well intact – ABB continues to record impressive growth on the back of their brand, with little additional marketing required. Employee expenses (123m) and admin expenses (32m) both increased in FY23 -- 23% and 47% respectively.

The investment Aussie has made in its own fibre network is starting to do the heavy lifting. In short, revenue increased 148m, while total costs across the board increased 117m, with operating leverage starting to come through. Excluding amortization of acquired intangibles increasing by 9m, the remaining inflows went straight to the bottom line resulting in an impressive NPAT of 21.7m.

Revenue drivers

Increased revenue was driven by an increase in connections and a ‘shift in mix’ including leading fibre connect upgrades in market. Residential did the heavy lifting in the 148m revenue increase (vs FY22), bringing in 96.8m of that, while wholesale’s contribution was a respectable 38m. Business and E&G brought in a combined 12.5m, a little less than what I would have expected.

That said, across the board, residential, business, E&G and wholesale all recorded impressive growth in FY23. There is continued evidence as expected that residential is slowing, putting more emphasis (and pressure, perhaps) on business, E&G and wholesale segments in FY24. It is clear Aussie is increasingly focusing on its E&G market to drive growth and profits, hardly a surprise given the churn and margin benefits seen here.

Some upsides and downsides heading into FY24

Upsides: continued momentum across the board; initiatives leading to cost control outcomes; improved operating leverage; and greater than anticipated deal volumes in E&G.

Downsides: Possible continued delays to NBN SAU past 1 Dec 2023; uncertainty of impacts of new NBN wholesale pricing regime; inflationary pressures on supplier and staffing costs, including wage pressure; cost of living pressures impacting churn and speed mix (not experienced yet); and price competition, particularly in higher-speed tiers.

Guidance:

- EBITDA range of 100-110m, including cost of acquisition and increased investment in E&G marketing

- Capex range of 47-52m, dependent on customer demand for fibre

- Focused on organic growth but open to attractive acquisition opportunities.

The short of it is, this is another impressive result from a business and management team that continues to defy the odds. Who would have guessed a ‘telco’ business driving margins, revenues and cash flows like they have over the past 36 months? It is clear management is looking beyond the next 1-2 years; they are genuinely looking for ways to drive profits into FY25, 26 and beyond. With Britt remaining at the helm and their brand continuing to drive their growth I remain a happy holder. Considering the new results, shares are currently trading on a P/E of 34 at the time of writing, a good indicator of how quickly this P/E can change (previously P/E of 59-odd before the report).

Disc: held

Wholesale NBN services as of 31 March 2023

More good news for Aussie, with net additions increasing by almost 25,000.

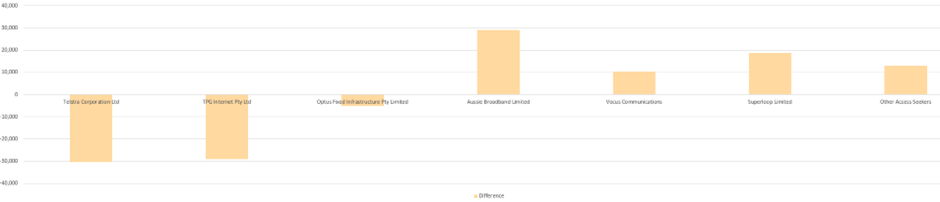

That said, it wasn’t just ABB that continued to increase net additions – Superloop increased theirs by an impressive 56k, while Vocus recorded an increase of 32k. The three telco leaders continue to haemorrhage customers – particularly TPG, losing more than 40,000 services over the reporting period. Collectively, the heavyweights dropped 58,000 services.

Despite Superloop performing well, I still have real questions around their sustainability as a company. This is where Aussie’s moat is starting to shine. Trancer touched on this earlier – poor old Superloop have had to drop costs to keep customers. This looks good in terms of net additions but they chew through capital like there is no tomorrow. Aussie have refused to offer cheap deals to keep customers, preferring that these services churn elsewhere – it is not where the attractive margins are after all.

Despite Superloop performing well, I still have real questions around their sustainability as a company. This is where Aussie’s moat is starting to shine. Trancer touched on this earlier – poor old Superloop have had to drop costs to keep customers. This looks good in terms of net additions but they chew through capital like there is no tomorrow. Aussie have refused to offer cheap deals to keep customers, preferring that these services churn elsewhere – it is not where the attractive margins are after all.

Superloop burnt 21m in H1, while ABB made an 8.5m profit. Let’s hope we see more of the same in H2 (for Aussie that is; I have nothing against Superloop).

Perhaps not surprisingly with inflation, the 25mbps tier increased since the last report (by around 125,000 services, around 16% of the total wholesale market). Most of these services appear to have downgraded from 50mbps (which lost 99,000 services), although some have upgraded from 12mbps.

That said, 250, 500, ultrafast and 1000mbps tiers all recorded increases in services. This is great news for Aussie, they dominate this end of the market as demonstrated below:

- 250mbps: Aussie has 3rd most services

- 500mbps: most services

- ultrafast: most services, with almost double the services of the next closest ISP

- 1000mbps: most services, more than double the services of the next closest ISP

So while slower NBN plans have grown in popularity over the last three months, so to have the high speed tiers – and this is only good news for Aussie noting their dominance at this end of the market.

Aussie Broadband has acquired the NBN customer base of Uniti Group and will start to migrate users from mid next month. The official Uniti release is here. iT News also wrote about it here.

Key details

- Relates to the acquisition of more than 15,000 subscribers

- Concerns Uniti’s entire NBN customer base, including FuzeNet and Harbour ISP. The latter have more than 6000 satellite services as of the last report, so I am not sure what happens to those customers (noting Aussie doesn’t service satellite)

- Migration scheduled to take place between June and July 2023, so should provide some strength to both H2 and FY24 H1’s residential numbers.

- Aussie will honour all existing plans, like the champions they are.

- No mention of how much Aussie paid to acquire Uniti’s customer base.

Disc - held.

The NBN Wholesale Market Indicators Report (December 22 quarter) has been released, and the results are good for Aussie.

Aussie total services

- Sep 22 report – 580,985

- Dec 22 report – 604,951

Key points

- Total NBN services came in at 8.7m, a decrease of 0.1%. With NBN growth stalling, this emphasises that ABB need to capture market share from existing services and justifies their ongoing push towards business and enterprise.

- More of the same – Telstra, Optus and TPG continue to lose market share to smaller players. Who is surprised?! ABB had another strong quarter, but not as strong as Vocus, who picked up 25k services to Aussie’s 24k. Superloop grew their services by a modest 13k. The below chart articulates this better.

- While the 50-speed tier remains the most popular, there was a large increase in the second-most popular 100mbps tier, with almost 190,000 new services. This tier now accounts for over 13 per cent of all services. Customers continue to move towards higher-speed plans -- this is good news for Aussie.

- Aussie experienced moderate growth across all NBN tiers: 25, 50, wireless, 100, 250, 500, home ultrafast and 1000mbps. The higher tiers are what I am primarily looking for, but the growth across the board is a good sign. On that note, growth in services occurred Australia wide, with increases in all states/territories. This reflects well on their competitive advantage/brand.

In short, Aussie continues to impress. I am going to take a stab in the dark and say they will overtake Vocus and become one of the 'big 4’ NBN providers by March 2023 quarter.

H1 FY23

Excellent analysis @mikebrisy. I will try not to repeat what you have already mentioned given your already great summaries from the report and the results call. Most of my thoughts are in line with yours, but I would upgrade the categorisation of ‘decent’ results to ‘impressive’. This was a strong half in my view.

The revenue downgrade bothers me little, offset by an upgrade to EBITDA guidance. Like @mikebrisy, I also believe guidance shouldn’t exist. Let businesses do their thing – investors/analysts should be the ones required to forecast this, the burden shouldn’t be on management teams. That said, I think it is safe to say we are losing this battle!

ABB’s acquisition of OTW, while expensive, is starting to bear fruit. They are starting to produce relevant synergies but it has also given them a head start in targeting business, enterprise and government. The margins are higher here too, and there is also the advantage of locked in contracts and more stable revenues.

The recent CapEx increase (dating back a year) looks scary at first. But businesses that make significant investment with five years in mind -- taking short term pain as an option -- should be applauded, despite this often spooking the market. The rationale is there for all to see and now it is just a question of Phil and his team executing, which I believe they will. Like @mikebrisy alluded to, this very investment resulted in share price weakness. But this allowed me to double down and Mike and many others to jump in. It is good that markets react this way (it creates value for us) but my word it is darn short sighted.

A few quick thoughts of my own.

- Investment thesis well and truly intact: ABB is shaping up to be a dominant player in the residential market – with a strong foothold in the higher speed tier market – and plenty of growth and scale to come as they target business, enterprise, and government.

- Show me the money: operating cashflow up 35% to 30.8m. It is still early days and ABB has lots of growing to do. We are starting to see evidence of what this business can become – a cash generating machine backed by strong management, an impressive brand and a competitive advantage which only continues to strengthen.

- For a more detailed cost breakdown analysis, there was a 65% increase in revenue from 229m to 378m – a difference of approx. 150m. While this occurred, we had employee costs rise 32m, network/hardware costs increase 79m, marketing decrease 1m, admin expenses increase 7.5m and D&A increase 17m – with costs totalling around 134m. This is evidence of scaling. Analysis of cash flows suggests much the same. With all that said, we are likely to see continued improvement to margins as the business targets higher margin segments and leverages its fibre rollout.

- The telco industry is tough, competitive, and crowded. The very idea that ABB can increase their margins while the NBN market is maturing is impressive. This is largely thanks to their fibre project and their push into wholesale, business, enterprise, and government.

- Residential continues to be the backbone behind ABB’s impressive growth. Pleasingly, we saw gross margins continue to increase across the board. We will see much slower growth here in the years ahead, but the important thing is ABB continuing to take a good portion of market share. This is where their competitive advantage (their brand) will do the talking for them and hopefully require minimal marketing/advertisement (which actually decreased in H1).

- Perhaps linking in with both the above points, customer churn was reported at 1.2%. Without being repetitive, this is bloody impressive in the telco industry where competition is rife and cheap discounted deals are commonplace. It also reflects a more mature customer base.

- On the topic of brand, ABB was again awarded the Roy Morgan Most Trusted Brand in Telecommunications. The little things.

- Business, enterprise and government is where ABB will see its future growth/value – higher margins, optionality for upselling and value-add services, and locked in contracts. This really underpins management’s thinking with the OTW acquisition, which provides them IP and SME in this segment.

- Wholesale continues to perform strongly, with almost 16k net new connections, although gross margin % was impacted by an increase in COGS (revenue increase of 129%, while COGS grew 141%).

- OTW: divestment of Fonebox and Zintel NZ operations, which management considered non-core for their strategy. These have since been sold to MaxoTel for 6.5m. The proceeds will be used to repay debt. This deal has also resulted in a newly forged partnership between MaxoTel and ABB for Aussie’s wholesale services (voice and inbound calls). Think looks like tidy business by management.

Disc: held

The NBN market indicators report has been released, relating to the September quarter.

Key takeaways:

- The total number of residential services increased by 0.2 percent -- almost 17,000 services.

- The trend continues: Australia's largest telcos continue to lose market share. The 'big 4' (Telstra, TPG, Optus and Vocus) lost 123,000 residential services between them in the quarter. Telstra experienced the largest fall in market share. Note: it will be worth keeping a close eye on the December report; I expect Optus will lose significant market share following the September cyber attack which needs no introduction.

- Smaller providers meanwhile gained more than 140,000 services in the quarter, increasing their combined market share to 14.2 per cent, up from 12.6 per cent in the previous quarter.

- You guessed it: ABB and Superloop were the main beneficiaries. Their market share increased by 0.3 percentage points -- reflecting the largest increase of the providers. The thing is though 'other' NBN providers actually lost significant market share (almost 100k services). The difference is ABB and Superloop both bucked the trend. The chart below speaks volumes re: this change.

- More specifically to ABB, residential services increased from 557k to 581k, an increase of 4.3%. Actual connection increases for ABB were more than Superloop's, but only marginally -- 24k vs 23k increases.

- ABB increased market share in all areas -- metro, outer metro and regional. Further, customers across all states and territories increased -- that is remarkable. This is important as it demonstrates they aren't largely dominant in one market, but are starting to appeal to the masses countrywide. @mikebrisy discussed it on this very forum last week -- the more ABB customers continue to speak glowingly about their internet provider (ABB) the more we will see the business grow across the country without having to advertise and over-spend on marketing. This is ultimately a competitive advantage.

- 50Mbps speed tier remained the preferred tier option, accounting for just over 50% of all services. Services using NBN's smallest tier (12mpbs) decreased by more than 40,000. About half of these appear to have filtered through to the 25mbps tier, while the rest have elected for higher speeds. In what is good news for ABB, Homefast connections increased from 1.2m to more than 1.3m. ABB do well in this market, so customers increasingly moving to these tiers will only benefit ABB.

The TLDR of the above is 1) the big 4 telcos continue to suffer, while ABB and Superloop continue to shine, and 2) NBN customers are shifting to higher speeds plans.

I think the following statement from the ACCC Commissioner is most telling:

“The rate at which smaller broadband providers are gaining market share from the big four accelerated markedly in the September quarter. The smaller providers increased their combined market share by 1.6 percentage points, which is about double the rate of the previous three quarters”

This supports my investment thesis. My view? Australians are sick and tired of being taken for a ride by the major telco providers -- we want better customer service, more reliable connection and stable speeds. This report suggests we are continuing to see this play out. We are witnessing disruption to the NBN industry and in a big way.

Edit: removed date on graph.

Aussie's CEO Phillip Britt purchased 500k worth of shares on market on 30 August 2022, at a share price of $2.70.

Good to see I am not the only one who thinks shares are currently trading at a discount!

Disc: held

FY22 at a glance

- Revenue increased 56% throughout the year to 547m

- EBITDA before non-recurring items increased to 39.4m, up 107%

- Cash flow positive – 37.8m of cash intake – up 49% on FY21 figures

- Gross margin increased to 29.5% (previously 28.1%)

- Evidence of scaling vs FY21 – revenue increased by nearly 200m, while network/hardware expenses increased by 130m. We did however see a sizable jump to staff expense (another 30m), while marketing also increased (5m).

- NPAT (before amortisation of acquired intangibles) came in at 10m, an increase of 223%

- Net profit 5.3m, after making a -4.5m loss in FY21

- Net debt 138m

- Cash on hand 47.7m

- FY23 update: 15k total net adds across all markets. Uncertainty around market conditions remain, in addition to a number of potential upside opportunities and downside risks.

- FY23 guidance: quite aggressive, expecting revenue of 800-840m and an EBITDA margin of 10-10.5% (vs 7% in FY22).

I am mainly pleased; most things are ticking along as anticipated. But there has been a serious increase to investing cash outflows (308m vs 17.1m), largely due to the OTW acquisition and fibre rollout. Who would have thought investment in oneself would be expensive? :-)

In total, there was a 9.3m net decrease in cash and equivalents, but with almost 50m cash on hand I don’t have any real concerns here.

Similar to my assessment of Codan no longer being just a metal detector business, ABB is no longer just a retail NBN provider. This is a more balanced, diversified business than it was 12 months ago – thanks to the OTW acquisition and a shift in strategy.

Looking ahead, the proposed NBN pricing is currently being discussed by relevant parties. This is definitely something to watch. ABB suggest the last update (August 2022) is a positive step forward, with CVC to be phased out over a 3-year period. Where things get really interesting is where the biggest improvement appears to be to the cost structure – high speed tiers – which is where ABB likes to fish.

It also emphasises the continued shift in strategy we are seeing. The business is increasingly pivoting from being your standard NBN reseller, to targeting higher margin services at the top end of town (which is also where costs will largely decrease in the proposed cost structure). With residential growth slowing, there is a shift towards upsell opportunities (NBN and mobile packages etc). Management stressed they will not chase retail growth at any cost, particularly at the low/no margin residential part of the market. I put this to the test a few days ago and asked if ABB would price match the lower-quality Superloop deal. They could not have been less interested.

It also emphasises the continued shift in strategy we are seeing. The business is increasingly pivoting from being your standard NBN reseller, to targeting higher margin services at the top end of town (which is also where costs will largely decrease in the proposed cost structure). With residential growth slowing, there is a shift towards upsell opportunities (NBN and mobile packages etc). Management stressed they will not chase retail growth at any cost, particularly at the low/no margin residential part of the market. I put this to the test a few days ago and asked if ABB would price match the lower-quality Superloop deal. They could not have been less interested.

On the other end of the scale, business/enterprise/govt customers continue to be where growth opportunities exist. It is also stickier and with it comes higher margins. As an example, they recently secured a three-year deal with Mitsubishi Motors with all of their locations nationally.

Key risks to the business include uncertainly over CVC costs, staff recruitment to support further growth, wage pressures, increased market competition (NBN/5G).

So what does the result mean?

Sometimes it's important to step back to gain some perspective. Since last year, ABB's share price has halved. What's changed?

Well, here is a snapshot (FY21 to FY22)

- Revenue: 350m to 546m

- NPAT: -4.4m to 5.2m

- EPS: -2.63 to 2.39

- Cash from operating activities: 25.2m to 37.7m

- Gross margin: 28.1% to 29.5%

- Free cash flow: 5m to -32.5

We have also seen the business make the acquisition of OTW, which expands ABB's offerings and margins, and better places it to target enterprise/government. The fibre rollout, which is 90% complete, again increases ABB margins -- but more importantly will benefit them significantly into the future.

That is a pretty remarkable 12 months. This is not a lower quality business now – in fact it is the opposite – with the business going from strength to strength over that time.

Then again, the investment into the business has resulted in significant increases to both Capex and liabilities (the former largely being based on investments and the acquisition, with the latter primarily being borrowings, contract and trade payables). In particular, PPE more than tripled. But the business' balance sheet is healthy and I don’t have any real concerns here. What it does mean though is FCF will be impacted for the next 12-24 months while the business makes these investments. But I am far more concerned about the five-year snapshot than the short term one – hence why I can appreciate the significant investment they are making in themselves, even if it does murky the financial waters temporarily.

The business is currently trading on a p/e of 80 and a p/s of 1.5x. With the business still growing and only just achieving profitability in FY22 I don't think using a p/e multiple is reasonable here. So despite what appears like a lofty p/e multiple, I think the current share price is an attractive one.

Nicely put @jayjayjayjay. Despite new connections slowing up, my thesis remains intact. The business continues to command respect from the industry, and they are generally liked by the majority of customers – their point of difference in an otherwise unpopular market.

Net additions weren’t quite as impressive in Q4 (see below). Excluding the OTW acquisition, total broadband services came in slightly below previous guidance provided, due to reduced marking through the federal election (presumably it was more expensive to advertise during this period?). This is something to watch – they can’t be expected to continue the growth they have achieved in the retail segment, but slow organic growth will supplement the opportunities that lie the business space. Post Q4, ABB’s NBN market share is expected to be around 6.5%, up slightly from the 6.2% reported in March.

Addressing call wait times (absolutely essential) and receiving another industry award are further positives from the quarter.

The report includes an update on the OTW acquisition and integration. Management note OTW has strengthened ABB’s business offering and added 16,000 business, enterprise, government, and wholesale customers – where I think ABB should be looking to expand and where I think the majority of opportunity lies. The integration is progressing as planned and they are already generating revenue synergies from the acquisition, including two large regional health alliance and shire council deals recently signed. The integration is expected to be fully completed in Q1 FY23, which will result in margin improvements and improve fault restoration times. Synergies relating to the migration of Aussie voice traffic onto the OTW network has yielded 2.9m in annualised savings, more than initially expected. When you include a further 2.3m in other synergies achieved, this brings total cost synergies to 5.2m annualised. So they are strengthening their business offering and synergies are enabling savings – that is pretty impressive if you ask me.

More savings (13.5m) will be generated from Aussie’s fibre rollout, which is 90% complete. This is expected to be fully complete in Q1 FY23. The business note they are starting to identify further opportunities to expand their network, with a number of buildings identified. This will enhance their ability to generate new sales. Moreover, new connected buildings have excellent scale benefits – when one customer is added, the next customer (added) in the same building typically has 80% lower capex costs, compared to the first.

There is also an update on CVC and NBN pricing – essentially ministerial intervention is calling for a reset in NBN’s pricing approach. This should be good for ABB and the industry in general, but this probably warrants a separate straw.

Growth is priced in – and expected by the market – so its important ABB continue to grow slowly while it shifts into new verticals. That is the main risk I see at the moment. That said, management, led by founder Phil Britt, continue to run this business exceptionally. I am comforted by their continued focus on the long term, and the steps they are putting in place that should see the business benefit in 3-5 years time.

Disc: held

The ACCC recently released their NBN data for the March 2022 quarter. Between Dec 21 and March 22, ABB continued to take the majority of NBN connections. As a whole, the data suggests consumers are walking away from the dominant players; instead they are electing to take out connections with smaller providers. The graph below shows ABB's dominance with respect to the recent quarter.

Sheeeesh, the market goes whack! I read the report prior to looking at the share price; my thoughts were largely indifferent. The biggest concern for me was those pesky CVC costs -- the last report noted an expected increase in Q3 but I wasn't expecting costs to double. As predicted, wholesale and business segments will largely be key for future growth and this results reflects that. It's good to see they are taking around 20% market share of new enterprise customers. The business segment will only go from strength to strength with the OTW acquisition so this is the one to watch.

I have no concerns with them coming in at the low end of guidance. It's obviously not the ideal outcome, but a -30% hit to the share price? Really Mr Market? I do not envy a business that sets guidance in this environment. You are damned if you do and damned if you don't.

I do agree that their valuation is more realistic following today's beating. The ABB share price has been creeping towards the $6 mark the last few weeks -- I don't think anyone will argue that they were expensive at those levels. @Strawman, I agree -- I think a forward PE of around 35 isn't too demanding, but also doesn't make the business a cracking bargain. That said, I am sure it comes as no surprise to anyone when I say I'm a big fan of ABB. I don't think management have put a foot wrong since listing -- including this result! I will be looking to top up my holding at around $3.50 (if we see the share price drop to that).

I mainly attribute the share price hammering to a combination of the small guidance lowering and increased CVC costs. It was a nervous day on the market so this no doubt played its role too -- generally it wasn't a good day to release a quarterly. The acknowledgment that they are struggling to find staff isn't ideal, but not unexpected when you consider their HQ is based in a remote area of Victoria. The real concern here is the comment around longer wait times. I don't think ABB margins will be squeezed due to the nature of the beast -- customers are happy paying extra for high quality service and connection -- those that want cheaper internet shop elsewhere. But the business must ensure it maintains its fantastic customer service otherwise it's competitive advantage will be impacted. I do think it's good that the business acknowledged the relationship between longer wait times resulting in increased churn -- that suggests to me their finger is on the pulse. Keeping call wait times to a minimum needs to be priority number one.

To conclude, has the result revealed any serious structural impacts? My answer would be absolutely not -- it's business as usual for ABB.

Phil Britt – ABB’s Managing Director – recently spoke at the AusNOG (link here). The presentation mainly references the fibre rollout, in addition to a general overview of business activity over the last five years. It provides insight into how much the company has matured over that time.

Phillip Britt (co-founder and MD) sold another 2m shares on market a few days ago -- at a share price of $4.95 -- so almost $10m. I wouldn't consider this price overvalued by any means. In fact I think ABB are fair value around $4.50 - $5.00.

He still owns around 17m shares post-sale, so around 8% ownership (according to Simply Wall St data). He remains one of the company's two largest shareholders.

I would argue that, of all the companies I own, ABB's management team is at the top of the pile for being aligned with shareholders. It is very clear that he gives a toss and genuinely cares about staff, shareholders and customers. He has also demonstrated a willingness to make logical, forward-thinking decisions that will benefit the company long term -- the very company he co-founded. So no major issues here for me at all, just something to keep an eye on going forward. Britt remains absolutely key to my investment thesis, so I would rather he be selling shares than calling it quits. Heck, buy yourself a yacht Phil, you deserve it!

Disc: held - largest position in portfolio

Q2/H2 FY22 highlights:

- 2Q FY22 revenue grew 11% QoQ.

- 2Q overall broadband connections increased 11%. This was mainly led by business broadband connections which increased 13% QoQ, while residential connections increased by 6% QoQ.

- 2Q mobile services increased 9% QoQ, 29,560 to 32,207 services.

- Wholesale and white label services increased by 188% including 8,725 white label migrations.

- QoQ NBN CVC charges decreased by 45% largely due to relaxion of restrictions.

- FY EBITDA guidance of 27-30m, excluding contribution from OTW acquisition.

No surprises here after the recent trading update, although the company has flagged increased costs in H1 due to promotional discounts and marketing expenses. As I forecast months ago, business broadband is starting to lead ABB’s key growth metrics. Demand for their services seems strong, with the company taking 15% of all business NBN enterprise ethernet orders in H1. They have also incorporated their mobile services business into Carbon (their business NBN platform) which should see an increase in business-related phone plans. Smart move by management – business mobile plans should result in improved margins and less churn, with customers less likely to look for deals elsewhere to save $$$ and instead opt for convenience.

The 6% increase in residential isn’t crash hot, particularly noting what they have spent on promotional discounts in H1 FY22 (vs H1 FY21) – but the decrease was also largely expected with the Christmas period, which is typically the quiet period for NBN providers. There was also a bit of churn as customers started to migrate off one of ABB’s main promotions.

Pleasingly, white label connections were a little stronger than I suspected, with 9000 new organic connections and the migration of 8625 services – resulting in the wholesale and white label segment growing 188% QoQ. As I mentioned in previous posts, this is important for the company as customers onboarded under white label shouldn’t be as ‘demanding’ as your typical ABB customer (gamer, streamer, etc). These customers should result in increased margins vs the average ABB customer.

The company flagged first half EBITDA being impacted by increased promotional costs and CVC expense associated with lockdowns. That said, CVC charges decreased by almost half as in Q2 as lockdowns started to become a thing of the past (did I just jinx us?). Management anticipate H2 FY22 should see improvements in operating leverage with employee, marking and admin expenses expected to be lower as a % of revenue. FY EBITDA guidance was provided at 27-30m – so management are obviously expecting a much stronger H2 due to a pick up in residential connections and a decrease in costs. Should ABB achieve the lower end of guidance, that will result in an FY22 EBITDA increase of around 42%.

Their FY guidance seems a little lofty on the face of it, but management haven’t made any guidance errors thus far so I have no reason not to back them.

Disc: held

Trading update

Positives

- Previous guidance was 53,000-60,000 net additions. This was made up of 33,000 to 40,000 organic broadband net additions through all channels, in addition to the migration of 20,000 white label services. Organic net additions for Q2 – the most important metric – expected to be at the top end of guidance (38,000 to 40,000). This demonstrates that ABB continues to take significant market share off its competitors.

- Total broadband services in Q2 is expected to have increased by around 10%. Gradual, but additions are moving in the right direction.

- The migration of white label services should be around 15,000 in Q3 based on new estimates. This bodes well for future total broadband forecasts.

Slight negatives

- White label migration – only 8715 services (of expected 20,000) migrated. The remainder will instead be migrated in Q3. The delay was due to ‘teething issues’.

ABB continues to tick along nicely. Looking forward to delving into the Q2 report in a few weeks’ time.

DISC: Held

Receipt of non-binding indicative offer from ABB

Over The Wire (OTW) has confirmed it has received an unsolicited, non-binding indicative offer from ABB to acquire all of OTW’s shares by way of a scheme of arrangement representing 5.75 value per OTW share.

Discussions between the parties in relation to the offer are preliminary and incomplete and no agreement has been reached as of yet.

Payment will be made via a combination of cash and scrip consideration to be determined.

OTW entered into a Process Deed on 16 October 2021 under which ABB is being provided with the opportunity to undertake due diligence and negotiate transaction documentation over a period ending on 30 November 2021.

Interesting developments. @jayjayjayjay our discussion earlier this week appears to have been impeccably timed! I am not well versed with Over the Wire, but from the initial research I have done I am not at all surprised by the acquisition attempt – it appears OTW have a strong data centre and ‘infrastructure as a service’ nexus, in addition to their work with telecommunications? @Noddy74, feel free to correct me or add further given you are a OTW shareholder (and presumably a happy one, at that?)

I think the comments in the Australian recently (link here) were ordinary at best. The following is a quote from the article: ‘Another market analyst says a purchase of Over the Wire by Aussie Broadband is not be an obvious move, because Over the Wire has a customer focus whereas Aussie Broadband is more of a reseller of the National Broadband Network.’

The analyst then went as far to suggest another business (Spirit Technology Solutions) would make more sense as an acquisition target. Que?! Suggesting ABB don’t have a ‘customer focus’ is perplexing – particularly given this is their biggest point of difference in the market. Their customers love them because they ARE customer focused, unlike the majority of their competitors. I think this is also a key reason why ABB is trying to acquire OTW – the business are said to be customer focused and their incredibly high retention rate (>95%) supports this. This is a good fit for ABB who have the highest customer ratings in the industry.

I suspect the analyst quoted doesn’t have a great understanding of ABB’s business model. I think its writing ABB off to an extent to suggest they are just an NBN reseller. Sure, it’s a fundamental part of what ABB currently do. But their developed and expanding infrastructure – and the hints along the way that they want to expand existing services – suggests to me that the strategy is much more complex than ABB simply being another ‘NBN reseller’.

Further, ABB won’t be able to expand rapidly forever while continuously overloading its network with new customers; it will reach a point where something must give – ABB will either be forced to reduce some of the top-notch service/speeds it provides to its customers at the expense of growth (which I definitely don’t want to see - Internode, anyone?). The alternative is it expands into different service areas – like data centres, infrastructure as a service, and/or cyber. This makes far more sense to me – ABB can leverage off its reputation and offer additional service offerings to customers. Noting that I have a limited understanding of OTW at the moment, this acquisition makes sense to me from a fundamentals point of view.

DISC: HELD

1Q FY22 trading update

Highlights

- Revenue increased 11.3% QoQ

- Residential NBN connections increased 9% QoQ

- Business NBN connections increased 13% QoQ

- White label and wholesale connections increased 341% QoQ, with ABB citing higher that anticipated demand

- Mobile services increased 15% from the previous quarter, from 25,606 to 29,447 services.

- NBN CVC charges up 137% due to lockdowns – a significant increase, but this should return to normal levels as NSW and Vic shift out of lockdown.

Another great quarter for ABB – continued growth in all business segments. The net additions (attachment below) demonstrates that ABB continues to attract and take impressive market share from competitors.

My rough (conservative) estimates for FY22 have ABB increasing revenue to approximately 430m in FY22. Should revenue continue on this trajectory it will easily surpass this figure.

Impressively (and perhaps most importantly) business net additions increased 13% QoQ. This is the most important growth aspect for the business going forward due to the current reliance on marketing and customer promotions.

RE: white label customers, ABB also suggested the following – ‘demand for services has been higher than originally forecast and to date only new services have been connected to the Aussie Broadband network’. This is great to see, given white label additions were just over 7000 in Q1 (new additions, and not from the previous signed deal).

The company expects further net additions of over 50,000 in Q2, including the migration of 20,000 white label services. It is typical to see a slow down over the Christmas period, but Q2 is shaping up to be another good quarter for the company.

Something to be wary of – both marketing spend and CVC charges were up in Q1. The former is OK with me, ABB is driving subscriber growth in all areas of its business and this is important as it continues to successfully take large chunks of market share from competitors. The company has indicated similar marketing will occur in Q2. That said, I have previously commented that this isn’t sustainable long term, with the business segment (and to a lesser extent white label) in my opinion are the areas to watch going forward to reduce the burden on promotional activities. Lockdowns coming to an end in NSW (and shortly Vic) will see CVC usage and associated charges return to normal levels.

Armed with a significant war chest at its disposal, it wouldn’t surprise me if ABB make an acquisition in Q2 or Q3 – which will hopefully compliment organic growth nicely.

DISC: HELD

ABB is now a top 20 holding for Wilson Asset Management’s (WAM) Microcap Fund - see their September Update here. It wasn’t previously in their August update, so they have recently bought or strengthened their position. This is good to see.

WAM made the following comments – see attachment below.

Highlights

- Highly strategic fibre swap to enable greater geographic reach

- Underpins launch of business fibre services in key regional Victorian towns

- Increased redundancy and protection for the Victorian network

- Complements Aussie Broadband’s own fibre network build & recently announced Telstra Wholesale deal.

ABB has announced a 10-year deal (including two 10-year options) with VicTrack to swap access to their respective fibre networks. VicTrack is a Vic government business enterprise that operates the state’s fibre assets.

Under the agreement, VicTrack will provide its fibre network throughout Vic and will construct access for VicTrack to several NBN POIs.

Why is this important? It will increase ABB’s geographic reach, particularly relevant to regional Victoria. This will enable ABB to roll out business fibre services to regional areas – which continue to grow and expand at a steady rate, particularly due to Covid 19 tailwinds (more numbers heading into regional areas and working remotely etc.). It also frees up capital to improve its reach in other states/territories.

The move will also provide ABB with redundancy and protection options without needing to construct further backbone links. This all links back in nicely with the business’s unique point of difference – quality over quantity – and ensuring it can guarantee customers high-quality and reliable connection.

Impact on finances:

- 'the lease of Aussie Broadband’s fibre paths to Victrack takes the form of an operating lease and as such will be recognised as lease income over the term of the lease ($3.1m per annum).'

- 'the lease of Victrack’s fibre capacity by Aussie Broadband at an annual lease cost of $3.2m will require the recognition of a AASB16 right-of-use asset and corresponding liability.'

The impact on after-tax earnings will be immaterial but EBITDA will be improved by the impact of the operating lease income. This looks like great business to me – enhancing reach across regional Vic with minimal cost outlay.

Mr Market likes the news – ABB is up 8% at the time of writing.

DISC: HELD

FY21 Highlights:

- Revenue of $350.3 million, up 84% on prior corresponding period (pcp) and 3.6% ahead of prospectus forecast

- EBITDA (before IPO expenses) of $19.1 million, up 433% on pcp and 55% ahead of prospectus forecast

- 400,848 total broadband services, up 53% on pcp

- 37,498 broadband business & wholesale services, up 90% on pcp

- 25,606 mobile services, up 102% on pcp.

- Customer churn remained under 1.6% (per month) for FY21

- Cash reserves are steady at 57m, with a loss of 4.2m reported for the year.

As expected, ABB’s FY21 was bloody impressive. The company attributed its impressive year to customer growth in both business and retail segments, an increase in ARPU, solid CVC management and NBN extending CVC credits and promotions rebates. This doesn’t take into account the single largest factor in ABB continuing to disrupt and grow – their management team.

Phil Britt was 1 of 3 reasons I invested in ABB (see my previous thesis Straw). He understands the business and the industry, but importantly he appears to be a genuine person who cares about his business, staff and shareholders. This is a recipe for success in my opinion. He and his management have performed exceptionally well in a difficult period – performing well ahead of expectation. I am confident that they will continue to deliver strong results for the company going forward.

Now, back to the business. As I have indicated in recent straws, I am looking for solid market share capture relevant to retail and phone services – the latter provides ongoing insight in ABB’s customer loyalty, with onselling capabilities a powerful tool for a popular company with high retention. But where I am really interested in their growth is the business NBN segment, this will provide the bulk of their growth in 1-2-3 years’ time. As expected, the numbers are impressive:

Residential: 241,627 to 363,350 – 50% YoY increase.

Business and wholesale: 19,734 to 37,498 – 90% YoY increase.

The company achieved more than 20% of net NBN order in Q4 FY21. This is well and truly ahead of expectations and is good to see.

I also found the following metrics interesting:

- 138 seconds average call wait time

- 5.76 complains per 10,000 services.

I think its great the company has reported this. It provides another metric to help determine that customer service remains a priority for the company. In addition, customer reviews on Product Review, Facebook and Google continue to be impressive. The company and CEO also won various awards in the reporting period, which is also great to see.

Fibre rollout

The project remains on track to complete in FY22, which will result in connections to 106 POIs and data centres. Builds have now been completed to 13 on-net customers, with another 35 currently under construction.

Why is this important? The combination of the fibre rollout and new Telstra Wholesale agreement will bring $15m in savings from FY23 onwards, with additional capabilities to bolster customer speeds and deliver impressive service.

FY22

The company provided a small insight into its FY22 figures, indicating it was expecting a record sales month in August. So far, so good.

In addition, migration of 32,000 white label broadband services onto the ABB network will commence in 2Q FY22 (due to customer request).

Unlike many other businesses, lockdowns typically don’t impact ABB too much. In fact, there is an argument to be made (as I have indicated in other straws) that lockdowns and an increasing focus on a digital environment provide tailwinds for the company – with more seeking high-quality connection speeds and service.

Possible headwinds/risks to be aware of include ongoing CVC expenses associated with the lockdown. More is not always better. The company needs to ensure it delivers reliable speeds for customers. It’s essential for their business and provides them with a point of different in the market. In short, it will cost the company more to keep speeds high during higher traffic times. NBN has indicated it will provide CVC relief for August and September, which will partly assist in mitigating increases to CVC expenses.

Due to this and the dynamic current environment, the company has elected not to provide FY22 guidance. I trust Britt in making this call and I am not overly concerned, particularly with August shaping up to be a record month for the company.

I am hoping to tune in to the investor presentation at 1300 hrs today. I will provide further updates if necessary. I also plan to have a more detailed read of the reports later in the week week.

DISC: HELD - ABB are the largest positions in my RL and Strawman portfolios.

I indicated in my recent straw that I would expand on my #bullcase for the business NBN segment, and why I think it’s shaping up to be important for ABB long term. Today’s announcement (see @Vandelay’s straw from a few hours ago) reminded me to provide some additional thoughts.

Why I think business NBN is crucial for ABB:

- Residential NBN is highly competitive with tight margins. NBN providers are constantly having to market their services and provide discounted rates to customers. This is expensive and unsustainable for any business that wants decent margins. While it can be said ABB doesn’t deal with the cheap end of the market, it still needs to remain competitive at the top end of town (some competitors here are Telstra and Superloop). ABB continues to disrupt this market nicely, but continued growth in this area year-on-year is unrealistic. I am of the opinion that this is why ABB is aggressively targeting the business segment.

- Unlike retail customers, business NBN customers are sticky: there are a lot of moving parts in connecting a business to NBN (although this is simplified by ABB’s Carbon – more on this below). I won’t delve too much into this, but the process of changing provider can be a pain in the backside, particularly for larger businesses. This will provide ABB with a more consistent bottom-line moving forward.

- ABB recently unveiled ‘Carbon’ – a self-service platform that was developed in-house. It aims to solve several issues in the business segment (initial connections, service tests, configurations etc.). Carbon will differentiate ABB from the rest of the market. It allows customers to apply configurations to their services quickly, in addition to other benefits like running tests and diagnostics, and real-time monitoring of bandwidth and data use. In short, it aims to streamline and simplify the nitty gritty backend stuff, and provide the business with additional capabilities they wouldn’t normally have. This makes ABB an excellent contender for businesses wanting a more ‘hands-on’ experience with their internet (this includes your typical ‘nerd’ – which leads me to my next point).

- ABB appeals to ‘technical users’ with their self-service tools. These same ‘nerds’ are often responsible for determining which ISP a business will use. I will elaborate…. in the retail sector, ABB have succeeded in targeting the top end of town – those that are happy to pay more for high speeds, reliable connections and great customer service. This end of the market naturally attracts your typical ‘geek’ or ‘nerd’ (like me). But here is the thing – these same individuals, statistically speaking, are more likely to work in IT or networking. Now I am not saying that all ‘nerds’ work in IT, far from – but there is a good chance the IT/networking staff at a business are technical users. Should any of these individuals be influential in selecting an ISP for a business, they are more likely to be drawn towards a provider like ABB that offers self-service tools and a better overall experience.

DISC: Held

ABB 4Q FY21 trading update

Highlights:

- 4Q FY21 Revenue grew 8% quarter on quarter (QoQ)

- FY21 EBITDA excluding IPO costs is expected to be at the upper end of guidance ($17 million- $20 million)

- 4Q overall broadband connections increased 7.4% and business broadband connections increased 12% on the previous quarter

- 4Q mobile services increased 20% from the previous quarter, from 18,684 to 22,454 connections

- Signed first white label customer

- Launched services on new Optus mobile virtual network operator (MVNO) agreement..

My take

Not many companies drop a bad quarterly report at 0830 hrs on a Monday morning, so I had high hopes right from the get-go. I wasn’t disappointed.

- Market share of NBN services increased 4.9% (up from 4.4% of the previous quarter).

- Revenue: Revenue for the quarter was $100.1 million, an increase 8% QoQ. ABB anticipates EBITDA to be at the upper end of guidance provided on May 2021 ($17 to $20 million – which was already an upgrade on guidance in itself).

- Residential connections: overall broadband services were over 400,000, an increase of 7.4% QoQ.

- Business connections: Similarly, business NBN broadband connections were reported over 35,000, an increase of 12% QoQ. There are now 338 managed services providers activated on ABB’s business platform (Carbon).

- Mobile services: connections were reported to be above 22,000, an increase of 20% QoQ. I think ABB expanding into mobile services is a smart move and adds yet another avenue for further growth. In saying that, loyalty to phone providers is much less relevant, with mobile competition high and differences between ‘smaller’ service providers minimal. The company will likely have success shifting existing broadband customers to their mobile services, but I doubt the company will attract new customers just to its mobile services alone. My main criticism with phone services is launching under agreement with Optus – I think ABB is better aligned with Telstra’s services/reception (typically better than Optus). However this was probably a financial decision by ABB management?

- Optic fibre network: the rollout remains on budget, with 25 sites now completed (rollout is occurring to 78 NBN POIs and over 20 data centres). There have been delays to the rollout due to the CV19-related lockdowns, which is expected.

- NBN announced a CVC rebate to partly offset increases overage charges incurred during lockdowns. CVC overage is expected to be over budget in July, but not materially.

Perhaps unsurprisingly, the quarterly results are excellent – with growth to all major metrics QoQ. In addition, none of the reported metrics include figures from ABB’s first white label customer (Origin Energy) which commenced connecting services on 19 July 2021. This should provide tailwinds to FY22 figures.

ABB noted that targeted promotions were required to maintain sales volume at expected levels. This is unsustainable long term. When ABB becomes cash flow positive, some of this profit can be fed back into marketing but this is still some time away. I think this is one of the reasons why ABB has aggressively targeted business NBN and white label offerings (and to a lesser extent, mobile services). These sectors will provide the company with opportunities to increase growth and revenue. Business NBN in particular is shaping up to be very important for ABB long term – I will discuss this in another straw in the near future.

ABB will release its full year results on Monday 30 August. I anticipate these results will be more of the same (positive), following an excellent 12 months for the company.

I will be the first to admit that reselling NBN subscription plans is not particularly ‘sexy’, nor an attractive business model given its typically a highly competitive low margins game. That aside, I am a fan of Aussie Broadband (ABB). I posted a straw in June which details my thesis and provides insight into why I am a current shareholder. The below is a quick summary of ABB's recent activity. More importantly its an opportunity for me to assess my thesis, with the company expected to release FY results in a few weeks time.

Positives

- In HY21, ABB posted revenue of $157 million, an increase of 89% YoY and almost 5% better than forecasted in the IPO prospectus. ABB provided a recent market update in late-May reporting that, based on preliminary accounts, EBITDA would be in the range of $16-19 million (or $17-20 million excluding IPO-related costs). This compares to the prospectus forecast of $12 million. The growth component of the thesis is doing well.

- Most of the funds raised during the recent IPO will be used to progress the construction and deployment of ABB's own fibre network across Australia. From all accounts this is progressing well. Upon completion this will replace 63% of ABB’s leased capacity – this should minimize reliance on other carriers and improve margins (lower leasing requirements).

- ABB has launched a new white label solution for major retail brands that allows them to sell ABB’s internet services under their own brand. ABB has already signed its first white label customer – Origin Energy. I think the move into white label solution is sensible and should provide ABB with significant revenue opportunities in the future. It will also onboard customers with typically lower internet demands in comparison to ABB's normal clientele (good for operating costs).

- A recent Choice survey ranked ABB customers as the most satisfied in Australia, with the ISP topping the charts for connection speed, value for money, reliable connection and overall satisfaction. This is fundamental to the thesis (reliable, high-quality speeds and excellent service) and is good to see.

- Other tailwinds: ABB are partly a strategic holding for me, offsetting some risk associated with the pandemic (particularly with my tendency to invest in the smaller end of the market). Current or future outbreaks/lockdowns shouldn’t have any major impact on ABB, other than resulting in slightly higher operating costs (less off-peak periods with more people at home). In fact, the pandemic (and what we subsequently take away from it as a society) will probably benefit ABB’s business model. This will probably result in more customers looking for providers at the top end of the internet market - where ABB position themselves. This is due to the demands of working from home, growing emphasis on flexible working arrangements and those seeking a more enjoyable gaming and streaming experience (due to being at home more often).

Negatives

- The company recently lowered residential connection guidance to a range of 360,000 to 364,000 (was previously 380,000 to 410,000). Previous guidance included white label customer transfers anticipated to occur in FY21. This will now occur in FY22.

- Two substantial shareholders (Bennelong Funds and Regal Funds) recently sold out of their positions. This is not particularly concerning as they were likely taking some profits following their involvement in a successful IPO. Unfortunately, this appears to have placed downward pressure on the share price in recent months. In addition, the Executive Director (Phillip Britt) also sold a small portion of his holdings. It’s never a great look seeing this, but he still maintains 9% ownership and was likely taking some profits post-IPO. No huge concerns here but keeping a close eye on any additional insider selling that occurs.

Some minor blips along the way, but I am happy with how the company has expanded and grown post-IPO. I will provide an updated straw in a few weeks time following the release of full year results.

DISC – HELD.

Aussie Broadband Limited (ABB) is an Australian owned and operated telecommunications company, focused on NBN subscription plans and bundles to residential homes, small businesses, not-for-profits, corporate/enterprise and managed service providers. The company also offers a range of other telecommunications services including VOIP, mobile plans, entertainment bundles (through its partnership with Fetch TV) and connections through the Opticomm network. It's primary business is providing NBN services to residential and business segments.

Thesis/three main fundamentals:

- Sticky customers: the customers that choose to have their broadband provided by ABB do so knowing that they could absolutely get a cheaper deal elsewhere. Customer reasons for joining ABB are what sets the organisation apart from others in the industry - top notch customer service, Australia-based staff and reliable, good-quality internet connection. This thesis is broken if ABB moves it's call centres off-shore or if it reduces the quality of internet or service it provides. The latter would result in it losing its edge in the telecommunications sector and it becoming 'just another player'.

- An excellent management team and founder-led: the company is in good hands with Phil Britt at the helm. He understands the industry and also what separates ABB from its competitors. He also, like myself and many others, believes in keeping the company's call centres and support services onshore. Further, management have under-promised and over delivered, with a logical strategy in place for continued growth. This is probably the most important point of the thesis. If Phil Britt leaves or steps down for whatever reason the thesis is broken.

- The business performs well against competitors and contiues to grow: it took 16.5% of overall NBN net adds in the third quarter of 2021. The company's reputation should see it thrive in this area. I am personally looking for net adds of 10% or higher to justify itself as a big player in NBN services.

While NBN is a super tight margins game, I am strongly of the belief ABB have established themselves as a big player in an industry traditionally associated with underwhelming service and dissatisfied customers. This is where I think ABB thrive, and what allows it to continue growing and adding value to the industry.

Disclosure: held since IPO - in it for the long term provided the fundamentals remain strong.

Post a valuation or endorse another member's valuation.