Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

$ABB just received surprise termination of their white label wholesale contract with Origin.

As a further twist, $SLC have announced a 6-year exclusive deal with Origin.

$ABB have a NBIO to acquire $SLC and own 20% of $SLC.

As pure luck would have it, I recently divested my $ABB holding, in anticipation of turmoil in the $ABB and $SLC contest. However, I didn't see this coming.

No doubt the market will react negatively, as this points to the intense competition that will no douby play out in the enterprise, business and wholesale segment. (Perhaps I was right to follow my instinctive dislike of this segment.)

For now, I will watch with interest from the sidelines, but remain alert to any over-reaction presenting an opportunity.

Disc: I do not hold $ABB or $SLC,.... and I'd never ever hold $ORG

Today, I have exited $ABB, taking advantage of further exuberance this morning.

It was a finely balanced decision, but overall I have decided to maintain the discipline of adhering to my investment thesis.

In September and October 2022, having assessed that the market had completely over-reacted to the slowing resi growth, following the combination of $ABB and $OTW, I built a RL position in $ABB over 4 weeks at an average cost of $2.28/sh.

The thesis was simple: as an attacker with a strong customer focus, execution and reputation, having built its own fibre backbone to access high value markets, focused on the high margin segment, $ABB was stealing market share from incumbents at very attractive margins. Given the location of its network, and inevitable slowing Resi sales (as NBN buildout completed), it turned its focus to the higher margin Business, E&G and Wholesale markets. I epxected it to win here too.

My valuation was predicated on this focused attacker model, with strong growth in the business segments and continuing above-market growth in Resi, driven by its network and reputation. Valuation $4.50 ($3.67-$5.04)

With the announcement of $SYM, I eventually got comfortable that I could hold to the valuation, arguing that the $SYM customer base and product set MIGHT strengthen market positioning in the B, E&B and W/S segements. International was an open question for me, but I wasn't unduly concerned given it relative immateriality. I was also encouraged by what appeared from the outside to be the successful integration of $OTW, with the CEO retained as part of the management team, and good growth in all segments at the FY23 and 1HFY24.

I was concerned about the integration risk, but was prepared to give management the benefit of the doubt. While I didn't update my valuation, in my mind, the risk part of the equation was increased.

Now the low-ball offer for $SLC and the 20% stake, unsurprisingly dismissed out of hand. To me it seems inevitable that $ABB will come back with a significantly improved offer. They've taken the 20% stake, and as a minimum they want to get into a dataroom and do due diligence. And $SLC knows it, so they won't make it easy.

As discussed here yesterday, $SLC is a very different business with a large network of regional and international capacity. Is this complementary to $ABB or dilutive. I don't know. I don't understand the business logic of the combination.

Secondly, it is a bigger and even larger deal than $SYM. Management are going to have to focus on two successive integrations.

Again, while I haven't done a valuation, it is clear that NewCo will carry higher debt at c. $250m, the eventual price for $SLC will dilute $ABB (I've done a quick proforma which indicates NewCo ROE could be around 7.5% in FY24 before synergies, whereas $ABB is around 9%, even though it is possible it will be EPS accretive).

But what about the famous Aussie customer focus? There will potentially be a protracted period of change. $ABB has alrady said that it will run $SYM as standalone initially, So presumably that will apply to $SLC.

And what about Phil Britt? When Phil returned from long service leave a while ago, he said something quite telling, which I've never forgotten. They were words to the effect that he was considering his own future. Of course, after his leave he put everyone at ease but putting the question down, but it made me realise that while I have a lot of confidence in Phil, I don't really know that much about the rest of the bench, nor what the succession plan might look like.

These and other questions mean that I no longer have confidence in my valuation (above). The market gave me the opportunity this morning to cash in at $4.70, and given the risk-reward and the many question-marks in my mind, I decided to take the money.

So, I could be wrong, And I may well be. The NewCo combination might indeed benefit from the improved scale, talent, product suite and weight to attack B, E&G and W/S more vigorously, and accelerate the demise of the lumbering incumbents. But it will be a competitive fight, and what does that mean for margins in future?

So my thesis today is to maintain $ABB on my Watchlist. Who knows, after the combination is delivered (if it is delivered), we may see another SP stumble, like we did in OTW. At that point I will be able to value the NewCo on a solid set of numbers, and see if opportunity knocks once more, I'll be waiting.

-----------------------------------

As I wrote in my Straw when I first reported acquiring a stake in $ABB, I don't really like telco-land. But I am pleased it delivered over a 100% return in less than 18 months.

Farewell $ABB, Good luck. But, hey, I'm still a customer, so don't mess up!

Disc: No held in RL and SM

$ABB has come out this morning with an all-scrip non-binding indicative bid for Superloop, clearly deciding to leverage its recovered SP.

The deal implies a value of $0.95 per $SLC share, against Friday close of $0.875.

I note that across 5 analysts that cover $SLC, the range of broker vals. are $1.00 to $1.17, which is quite a tight range and indicates that there may (will?) be a need for $ABB to raise their bid significantly before getting a Board recommendation.

So, its an opening deal to allow $ABB to get the due diligence process underway.

$SLC delivered strong results last week, with Revenue up 32.7% to PCP, underlying EBITDA of $23m up 83% to pcp and OpCF of $24m.

$SLC would significantly enhance $ABB's infrastructure network, although I don't yet understand what the implications of overlapping coverage in metro areas is.

Clearly, coming right of the back of the finalised $SYM deal, $ABB has decided that its strategy is to concentrate the market of the leading attackers, to strengthen it ability to continue to take share from the major incumbents.

This is a significantly larger deal than either $OTW or $SYM.

The deal looks a bit low-ball, so my bet is that $SLC board will decline.

$ABB announced their 1H FY24 result this morning. The results have so far been well-received by the market with the SP at time of writing up 16%.

There’s some detail to understanding the results, however, at a total connections basis, $ABB’s share of NBN connections has increased to 8.3% from 7.0% in the PCP (and 7.6% at FY23). What this means is that new connections accelerated in the H-o-H comparison. This, as well as some minor upgrades to FY24 guidance appear to have driven an initial positive response. (Of course, what the market is really reacting to is that in December I finally became an Aussie customer!)

Their Highlights (comparisons to PCP)

- Revenue grew 17.7% to $445.9 million

- EBITDA before non-recurring items grew 12.7% to $46.3 million

- Operating cash flow grew 57.8% to $40.7 million

- Total broadband connections grew 20.6% to 765,800 with strong growth across all segments\

- Increased NBN broadband market share (excluding satellite) 1.3 ppt to 8.3%

- On track to complete the acquisition of Symbio Holdings (due 28 February 2024, post balance date) providing cloud-based voice and messaging capabilities. Strategically complementary to Aussie’s business

- Successfully raised $140 million through a strongly supported institutional placement and retail share purchase plan, strengthening the balance sheet and providing funding for the Symbio acquisition and other potential M&A

- Aussie Broadband awarded Service Champion for Customer Service Organisation of the Year, and Service Champion for Project of the Year Customer Impact at the Customer Service Institute of Australia ASEA awards

- Aussie Broadband again recognised by The Roy Morgan “Risk Monitor” rankings as Australia’s most trusted telco.

My Analysis

A strong result best examined segment by segment. But before diving in, it was good to see a strong cash flow performance with operating CF of $40.7m up 57.8% and my measure of FCF at $15.2m up from -14.1m, an improvements of $29.3m, driven by both OpCF improvements and falling capex.

The changing capex profile is well-signalled, as $ABB moves from a focus of building their network to now connecting customers, maintaining, replacing and upgrading.

Overall, revenue grew 17.7% to $445.9m, with EBITDA up 12.7%. NPAT was 14.2% stronger $9.8m.

To understand the result, we need to dive into the segments.

Residential

Resi saw an uptick in new connections, with 38k (+3.3%) net adds – the highest result since 2HFY22. %Gm compressed slightly from 30.6% to 30.2% due to (what sounds like) paying for excess data charges under agreement with mobile services provider Optus. This is expected to be a one-off.

Importantly, off the back of SAU changes in December, all customers have been moved to new Resi plans. This resulted in some churn, although less than expected, and $ABB expect to see the benefits of increased margins flow through the full 2H FY24, a major driver of the EBITDA upgrade.

In addition, $ABB believe that several competitors are yet to implement the price increases impacting lower speed plans, and they stand ready to benefit from competitor customer churn in H2, as the price increases are passed on.

Business Segment

Good progress in Business, with 19.7% increased connections over pcp and 8.7% h-o-h, adding another 4.2k accounts in the half. The %GM decline is attributed to the fact that the Zintel NZ business, disposed in 1HFY23, has driven the result. Importantly, churn in this high margin segment is low at 0.8%. SAU and price changes are expected to drive margin improvement in H2.

Enterprise & Government (E&G)

Although E&G connections grew strongly at +21.7% to pcp, total revenue declined -1.2%. This was attributed to a) a sharp decline in non-recurring revenue and b) recontracting of legacy customers to new NBN and Aussie Fibre plans. So the good news is that the 7.3% increase in recurring revenue is on a higher %Gross Margin, and these benefits will flow through into the second half.

CEO Phil spoke about a strong pipeline of customers, an average of $111k new MRR being signed each month, and larger enterprise customers taking up to 7 months to onboard, due to both customer constraints, $ABB constraints and hardware constraints.

Wholesale Segment

This was the standout, with 24% connection growth to pcp and 52.5% revenue growth, with %GM margin expansion driving a 64.2% Gross Margin growth over PCP. The main driver called out here was strong wholesale voice margins.

Symbio Update

With all hurdles cleared for the Symbio acquisition, this is expect to close next week. As a result, Symbio will contribute 4 months to the FY24 result.

$ABB has committed to $5m cost synergies as a result of the combination. And the discussion indicated that this is the minimum expected, with the potential for further savings and revenue benefits on top.

Aussie and Symbio will initially be run as separate businesses and therefore we will continue to be able to track both separately at the operating level. Over time, however, I expect to see consolidation at the segmental level, with a question mark remaining as to what happens with the international business, on which $ABB has not signalled any strategic intent.

As an approach this makes sense. They can understand what they have. Consolidate and capture synergies at the overhead level, figure out to consolidate systems, before then undertaking a more complete integration.

The high level metrics of the Pro Forma combination is shown in the following slides.

In summary, it is a more diversified business, with greater weight in the Business, E&G and Wholesale segments – the next frontier for $ABB’s attacker strategy.

Management Changes

Phil announced that CFO Brian Maher will take over as CEO of Aussie, with former OTW founder Michael Omeros, taking over as CEO of Symbio. Both report to Phil who will be MD of the Group.

As an aside: It is great to see Michael Omeros, the former CEO of OTW clearly established as a leader in $ABB. Things rarely work out that way.

Guidance Update

Guidance is modestly updated by narrowing the range for EBITDA from $100-110m to $105-110m.

Capex guidance reduced from $47-52m to $40-45m, attributable to the new guys in charge of investment taking a hard look at the programme and make some scope reductions.

Based on 4 months contribution of $SYM, the guidance for FY of the combined group was given as $116-121m.

My Key Takeaways

Across the board, these are good results with no real weakness. $ABB continues to take market share and the areas of margin weakness demonstrated today in some segements appear temporary and likely to be reversed in the second half.

No wonder the market likes the result. I agree.

Valuation

Although I don’t have half year granularity in my valuation, $ABBs result appears broadly on track with my model, and so today I am leaving my valuation unchanged at $4.50 ($3.67-$5.04).

I haven’t given any value uplift for the $SYM acquisition. That needs to be proven.

I’ll update the valuation at the FY.

Disc: Held in RL and SM

Yesterday $SYM shareholders have voted overwhelming for the acquisition offer from $ABB.

The Court Hearing is now set for 16th Feb, with the current plan for new $ABB shares to start trading on 20th Feb.

So, the next report from $ABB will be clean, and then will no doubt include prior period reports on a PRO FORMA basis for a few periods.

It will be interesting to see what the $SYM combination does in the non-residential segments, but I suspect it will be well into 2025 before we can tell for sure.

++++++++++++++++

As an aside, I finally became an Aussie customer in December. My move had complications as a result of NBN and property access/configuration, however, the $ABB customer service was very good.

However, what was next level, was the onboarding process and the excellent automated communications as my account seamlessly switched over. I've never had an experience so good in utilities/TMT.

Best of all was the overnight speed test they performed and the report they emailed me confirming that I was getting in excess of the plan label. Their numbers actally matched my own tests.

Life is indeed better in our household. I rarely got the $TLS label claim, and whenever I tried to follow up there were lots of excuses about position of hub, my equipment, limitations with my device WiFi connections,..blah blah blha.The performance with the $ABB service has proven what I suspected all along ....it was pure BS. And I'm paying about the same as my $TLS plan, but with double the speed, and 3x-5x upload speed.

Happy Customer. Happy Shareholder. (Looks like there's been a bit of price action now that deal looks to be going ahead.)

I've caught up this morning with yesterday's capital raising presentation.

This morning $ABB announced a successful $120m institutional placement at $3.55 per share, a 9.4% discount to the last close before the Trading Halt. As might be expected the market moved down this morning in that direction, with SP at $3.60 at time of writing.

An SPP will open to raised a further $15-20m, taking total for the raise to $135 to $140m, which compares with the acquired value of $SYM which I put at around $260m, of which 75% was in cash, or c. $195m.

So, an important part of the drive for the CR is to maintain balance sheet strength. Prior to the acquistion, $ABB was at Net debt-to-EBDITA of 1.0x. Now twith the acquisition and the CR, leverage moves to 1.5x. Reasonably conservative.

Assuming all shares are issued at $3.55 then $140m will be around 40 million shares, compared with current SOI of 239m, so a dilution of 17%.

Of course its not really a dilution as it adds GM of $99m to ABB's GM of $279m, or 35% to give a combined GM of $378m.

So the question to mull over is whether to take this opportunity to increase my position via the SPP.

The presentation is informative, because if provides some insights into how $ABB sees $SYM complementing its business. The chart below shows just how important $SYM is in adding weight to the B+W+E&G segments. And the other slides articulate just how $ABB sees the $SYM product set in complementing its existing capabilities, as well as adding key customers and important partnerships.

In earlier exhanges with $StrawPeople, I think there is a consensus that $ABB continues to win in Resi, and the next battle will be in the other segments. These higher margin segments will be defended strongly by the incumbents and so $ABB adding heft to its capabilities and product set makes good sense.

With my central view on valuation of $ABB being around $4.50, if I believe the $SYM acquisition will be executed successfully and deliver an enhance ability to compete in B+E&G+W, then it makes sense to take the opportunity of the SPP.

So, I will mull this over, but at this stage I am favourably disposed. The acquisition makes sense to me. $ABB have demonstrated their ability to integrated acquisitions successfully as shown by $OTW and they have also shown that they are already competing well in these segments.

I'm still no so sure about the regional / international play, and I hope this doesn't blur the laser focus on the Aussie customer experience. I look forward to deep-diving into this at the next Investor Day.

Disc: Held in RL and SM with strong conviction

$SYM Acquisition Recommended by Board

$ABB announce the $SYM Board has accepted their offer and signed the deal, which is now subject to the usual approvals.

$ABB now in a trading halt, pending announcement of a capital raise, presumably to maintain balance sheet strength post deal.

$SYM will strengthen the $ABB product offering in voice and video servic products. Just not sure where the international bit fits, although I am sure Phil will make this clear in due course.

So far, flawless execution.

Disc: Held in RL and SM

$ABB has concluded due diligence and now gone unconditional on the $SYM offer. Value of the deal has changed to reflect the fall over recent weeks in $ABB SP, which is down to macro conditions.

$SYM have until midnight tomorrow to accept the offer.

$ABB describe constructive and ongoing engagement with $SYM, so the tone of the update is positive.

The $ABB offer is superior to $SLCs both in its face value and the fact that there is now a deal on the table capable of being closed. So the $SYM Board would have to be faced with a significantly better offer to justify turning down in favour of another ("bird in the hand..." argument). So, if $SLC are going to respond, today or tomorrow would be a real good time. (I've not assessed the deal from $SLC's perspective, so I don't have any comment to make on that front.)

Disc: I hold $ABB in RL and SM

$ABB provided some key updates in the AGM address being presented later today:

- NBN Market share has now passed 8%

- Update on connections at Q1 FY24

- Update on SAU (Special Access Undertaking) - overall favourable to $ABB

- Rationale for $SYM takeover bid

- FY24 Guidance Reaffirmed

I'll comment further on the last 4 items, the first item being self explanatory

2. NBN Connection Updates

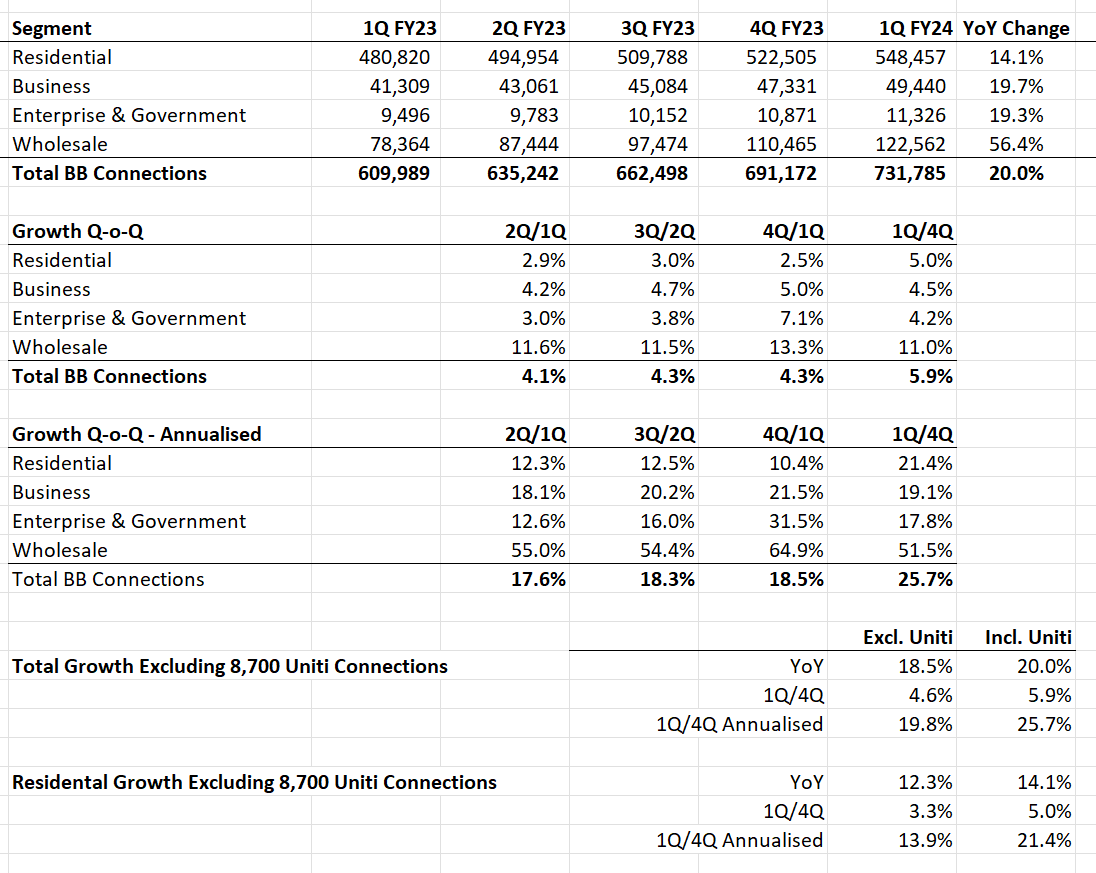

In the table below I compare the YoY connection growth rates with the quarterly growth rates, and quarterly growth rates (Gq) annualised (Ga). (Note: Ga = ((1+Gq)^4 -1) and not 4xGq!)

Figure 1: Connection Growth (Connections)

Although this kind of analysis is too fine-grained to pay much attention too (e.g., because it doesn't show seasonal variations), it shows that residential growth in 1Q FY24 has accelerated significantly over the prior 3Qs. The other 3 segments are still also growing strongly in 1Q, alebit at a slightly moderated pace compared with the FY23 overall growth rate.

However, the 1Q numbers include 8,700 customers acquired from Uniti. (Hey, I thought it was 15,000, but they are reporting the number as 8,700 having migrated across in 1Q FY24, so let's take that at face value.)

So, the two tables at the bottom of Figure 1 look at the growth rates taking 8,700 out of the Total Connections and Residential Connections, to get a better handle on the organic growth (Excl. Uniti), which for ease of reading I place alongside the reported numbers (Incl. Uniti).

So, even if the Uniti Connections are excluded, the growth rate in Total Connections picked up pace to 19.8% Q-o-Q Annualised, compared with 17.6%, 18..3%, and 18.5% rates in the prior 3 quarters. And the same metric in Residential picked up to 13.9% compared with 12.3%, 12.5% and 10.4% QoQ annualised in the prior three quarters.

So, no matter how you slice and dice the numbers, Aussie is continuing to maintain strong momentum in growing market share.

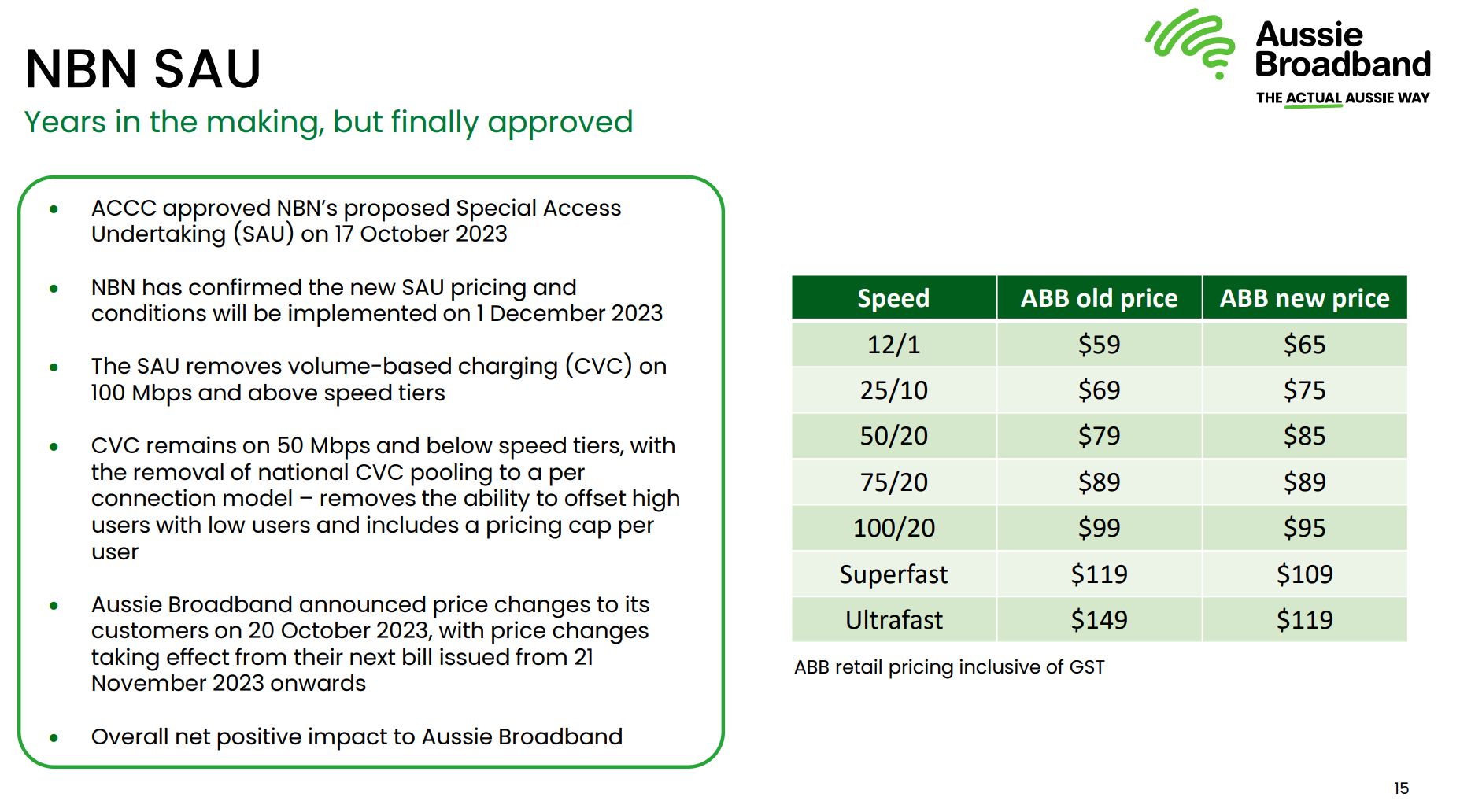

3. Update on SAU (Special Access Undertaking)

The market has been waiting some time to hear how the determination for the SAU has played out. At the FY23 Results $ABB said they expected it to be net favourable for ABB. Today they published how the determination impacts their different plans. See Slide 15 below.

While the CVC volume-based charging remains on the lower speed plans, Aussie makes its money in the higher speed plans.

The net effect is that the premum plans will be cheaper and therefore more attractive to customers, which should drive incremental adoption and margin growth for $ABB.

In a word - good news. (Looking forward to signing up for Power House Plan!)

Slide 15 from Presentation

4. Rationale for the $SYM Acquisition

While the due diligence period has been extended by a week, Phil set out the following rationale for the takeover in his MD's address as follows:

"We believe that Symbio’s range of services and platform would complement Aussie’s NetSIP operations. Symbio offers three product sets: Communications Platform as a Service, Telecommunications as a Service, and Unified Communications as a Service. The business hosts 7.3 million phone numbers, carries 9 billion voice minutes, and manages over 180,000 mobile, nbn and voice services for other MSPs. In FY23, Symbio reported revenue of $211m and underlying EBITDA before one-off items of $27.7m. We are continuing our due diligence, and we will provide a market update at the appropriate time."

While the rationale is just as we have discussed here in other straws, it is silent on the international aspect of the business. For now, we just have to see what happens i.e., whether the deal progresses.

5. FY24 Guidance Reaffirmed

Good on 'ya Phil. Enough said. (Of course given the run up in SP some might be disappointed not to see an upgrade, however, it is early in the FY.)

My Key Takeaways

$ABB tracking nicely in line with the thesis.

It will be good to see how the $SYM deal plays out.

Disc: Held in RL and SM

A few StrawPeople (including me) recognised in the second half of last year that former market darling $ABB was oversold. Today we got the first look at a clean half year of results following the $OTW acquisition.

As reported by @jayjayjayjay , the overall results are decent.

However, some shareholders were clearly spooked with the 4% downgrade in revenue guidance for the FY from $800m-$840m to $780m-$800m, which was headlined by the positive news of an upgrade in EBITDA guidance from $85m - $90m, from earlier guidance of a margin of 10% to 10.5%.

For clarity, the old EBITDA guidance, at the midpoint of the previous revenue ($820m) and EBITDA margin (10.25%) guidance ranges was $84.0m. So the EBITDA upgrade is +4%. (Honestly, I often wish firms didn't give guidance at all.)

Shares are down 1% on the day; however, they hit -10% earlier in the session, before the results call.

I'll consider the results through the lens of my investment thesis. First, I am not a fan of the telco sector. However, I am attracted by “attackers” or late entrants to a market with incumbents ripe for disruption ($TLS, $TPG). In the case of $ABB, the thesis is that an agile, customer-focused player, free of legacy infrastructure and systems, can focus on higher margin customer segments by investing in targeted infrastructure and technology to establish a profitable, growing share, defended through excellent customer service.

The Numbers

$ABB were good enough to report the PCP comparison using the proforma combination of $ABB and $OTW, to remove the inorganic consideration in the comparison. (Thanks, guys! This makes up for the muddled guidance.) All my comparisons are therefore on that basis.

Drilling down below the headlines reported by @jayjayjayjay , the EBITDA growth of +86% to $41.1m had two main drivers: 1) network savings (+$9.1m) and growth (+$10.3m). The network savings arise from where NBN backhaul charges are avoided by using $OTW/$ABB's own network backbone, which they are continuing to build out.

Capex: $31.2m was spent in the half with the mix shifting from replacement, upgrading and backbone investments to an increased emphasis on $17.5m growth capex (which means laying network to new customers areas plus actual new customer connections). FY capex was guided to $55.0m, so 2H FY23 number of $23.8m, with clear signalling that peak capex is behind us.

Importantly, the $ABB networks has been expanded to 1,400+ buildings available for connection, which is +320% on PCP.

To meaningfully understand the results it is necessary to consider each of the four business segments in turn: Residential, Business, Enterprise and Government and Wholesale.

Residential: New additions of 30,077 were down on the last half’s 43,000. This is still a healthy +7% on the PCP total, recognising that the overall NBN market is now mature. (Total connections in the market grew from just 8.4 million connections in Jan 2022 to only 8.5 million in December 2022, Source: NBN Co.) Customer churn remained low at c. 1.2%. With revenue rising at 26% and COGS at 18%, Gross Margin increased 49% to $72.0m, with GM% rising from 25% in the PCP to 30%. In summary, while volume growth is moderating, $ABB is still gaining market share concentrated on the high speed premium plans. Operating leverage is driving margin expansion. Residential appears to be in rude health.

Business: New connections here also slowed, adding 4,161 compared with 4,980 in the prior half. This was 11% growth on PCP total connections, and additions were 24% higher than the PCP. Revenue grew on 7% in this segment with COGS up 25%, so Gross Margin was flat at $23.0m and GM% declined from 49% to 46%. I didn’t understand the rationale here which was put down to “Gross margin stable with change in product mix.” The analysts on the call didn’t dig into it, and I wasn’t fast enough on the case to ask a question myself. So, Business is one to watch going forward.

Enterprise and Government (E&G): Total revenue was flat due to “timing of non-recurring revenue”. However, recurring revenue grew at 5%. COGS actually reduced 7%, so Gross Margin increased 7% to $19.2m, and GM% increased from 49% to 52%.

Wholesale: grew strongly, with revenue up 129% to $49.4m, but with COGS up 141%, Gross Margin increased only 111% to $18.0m. (GM% margin declining from 40% to 37%).

Cashflow: Net cash from operations increased 34% from $19.2m to $25.8m. Therefore, given the $32.5m investing cash, net cash flow was -$14.1m. Looking ahead, with declining capex, I expect 2H FY23 to be cash flow positive, and for $ABB to turn into a solid cash generator in FY24, as is the consensus view.

Insights from the Q&A Discussion

CEO and co-founder Phil Britt summarised $ABB’s position by stating that “Residential and Wholesale are running strong. Business, Enterprise and Government is now positioned for strong growth.”

Asked to explain the reason for the revenue downgrade, Phil said that they hadn’t quite hit the expected mobile customer additions and that the Origin white label deal was “a bit slow” getting started.

On his bullishness for Business and E&G in H2, Phil said that there was now an integrated $OTW+$ABB team in place and the pipeline is bigger than before. He also pointed out that there is a time lag between signing customers and revenue flowing. He pointed to the first enterprise pilot in Brisbane CBD where they are halfway through standing up 20 new enterprise customers, enable through a focused buildout of the $ABB network. “I’m really bullish about the E&G opportunity.”

On costs, Phil said that headcount will now be steady, with the current team able to drive the next period of growth. Of course, customer support has to scale with revenues, so he was referring to business development and customer onboarding.

On competitive positioning and pricing, Phil said there has been a lot of competitor activity in the lower-tier market, but that they are seeing consistent new additions in their target premium segment. This has continued with a strong January and February also going well. So Phil reported that they are not seeing customer demand falling off. On pricing, competitors have raised prices, but $ABB will hold off until the new NBN determination is in place, hopefully for the start of FY24. He believes this will be favourable for the higher speed plans. Any changes, currently being indicated by ACCC review are likely to be favourable to FY24.

On margins, with the midpoint of new guidance at 10.8%, Phil noted that there would be further benefits from Aussie increasingly using their network as well as well as CVC charges "remaining with tolerances". He indicated that there is some further opportunity for margin expansion. Of course, overall margins will expand if Business and E&G grow faster than Residential.

My Overall Take Aways

Following today’s call, I am happy with the progress and my investment thesis stands, notwithstanding the 27% increase in the value of my holding (RL). Having taken an initial position (RL 2.5% now 3.2%), I was looking today for evidence of progress that would justify increasing this position.

Trading on an EBITDA multiple of 10, $ABB is valued at a 30-35% premium to the sector ($TLS, $TPG).

As it transitions to generating free cash in H2, provided it continues to take market share at strong margins, then this valuation is justified. With declining capex, free cash flow should grow. Operating margins should expand ahead of further improvements in gross margin. Gross Margin expansion should be assisted by a maturing residential sector and the delivery of the CEO’s bullish view on the higher margin business and E&G sectors.

I don't fully understand what is going on the Business and E&G, but with clean numbers for the last half, I will be in a better position to judge at the FY. Given that we are already one-third of the way through H2, there must be a solid basis for Phill's bullishness today!

In summary, the proof point at the FY will be the progress made in Business and E&G, continued progress in Wholesale, even if growth in Residential continues to mature.

For now, I am a happy HOLD.

Disc: Held

I have been following $ABB for a while - up and down - and have followed my usual rule of avoiding buying in when everyone is so hyped about a stock. However, I am starting to accumulate now, as the recent results and market reaction convinced me that the selling pressure is more about i) macro sentiment impacting the sector generally and ii) hangover of the hype-cycle unwinding. To be clear, my initial RL position is small as we may still be in falling territory.

I'd thought here I'd share some of my sector comparables analysis. Please note that the assembled "peer group" are not really peers. They are broadly in the same sector but very different businesses. However, the comparison is instructive, and I will draw out some points of interest.

Overall, I am not bullish on telecoms, but my thesis is that $ABB is an attacker, building market share in the retail base, targetting higher value customers and now migrating to commercial customers. Elephant incumbents $TLS and $TPG lack agility and are ripe for the picking from a competitive dynamics perspective. Their scale ensures resonably orderly market conduct overall.

So here goes:

1. Financials

What strikes me is how favourably $ABB compares to mature incumbents, when you might reasonably not expect that for several years to come. You'd maybe expect it to look more like $SLC or $MAQ. (BTW, I know $MAC has a fundamentally different investment lifecycle due to its datacentres business and absence of retail exposure)

2. Brokers

Brokers generally agree. Although lots of health warnings in this analysis, particularly given the systematic bias in coverage of smaller firms to be strongly biased to optimistic views. Even so, looking at this sector, the views on upside looks interesting. Fundamentally, given the strong financials, I argue the upside is strongly asymmetric to the downside.

3. Customers and People

Just for a bit of fun, I've thrown in reviews from customers and employees.

On a serious note, ABB has established a strong brand with customers. If it can maintain customer service as it scales and continue to leverage that brand, its position as an attacker will be strengthened.

4. What the pundits are saying

I found the recent exchange between Gaurav and Mathan on Ausbiz The Call interesting. Gaurav holds (was surprised not to see it in his Top3 picks from the SM meeting) and Mathan is watching and waiting. Both are observing the outflow post-hype cycle I mentioned above. Management are generally well-regarded, although more work to do here.

Watch from 7:36 to 12:10 mins. for the discussion.

https://www.ausbiz.com.au/media/the-call-monday-29-august?videoId=23808

Conclusion

$ABB has all the hallmarks of a quality growth business at a discount to fair value. I have initiated positions in RL and SM as I start further research on this sector. I expect to accumulated on further weakness over the coming months.

Disc: Held in RL and SM

Post a valuation or endorse another member's valuation.