The ABB result was better than I expected. All segments of the business did well.

The key takeout for me was the success of their price rises on the residential broadband market. They had lower churn from this than they expected and added more new connections with a net increase of 38K, higher than either of the last two halfs. Now have 8.3% market share of the NBN market. Did have some short term margin compression, due to the higher marketing costs, which they said were part of the strategy around implementing their price change. I can attest to this as I have received several flyers promoting their high speed plans and bundles over the last few months. They expect margins to return to prior levels over the next half.

Enterprise and government section going well. Recurring revenue increased by 7% to 38.4m but one-off revenue declined slightly to leave the period flat at the headline level but with a slight increase in margin. Happy with the progress and commentary around this segment.

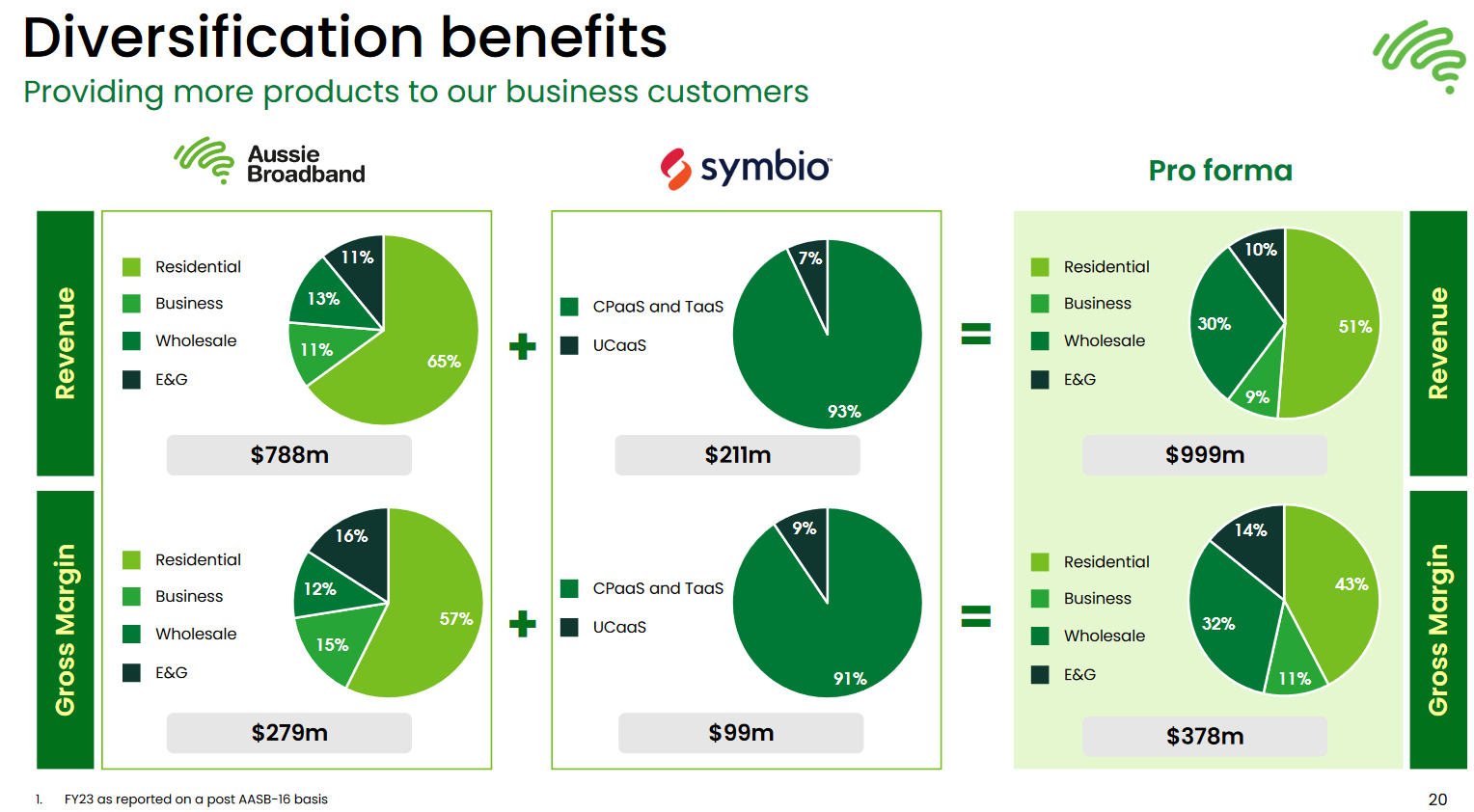

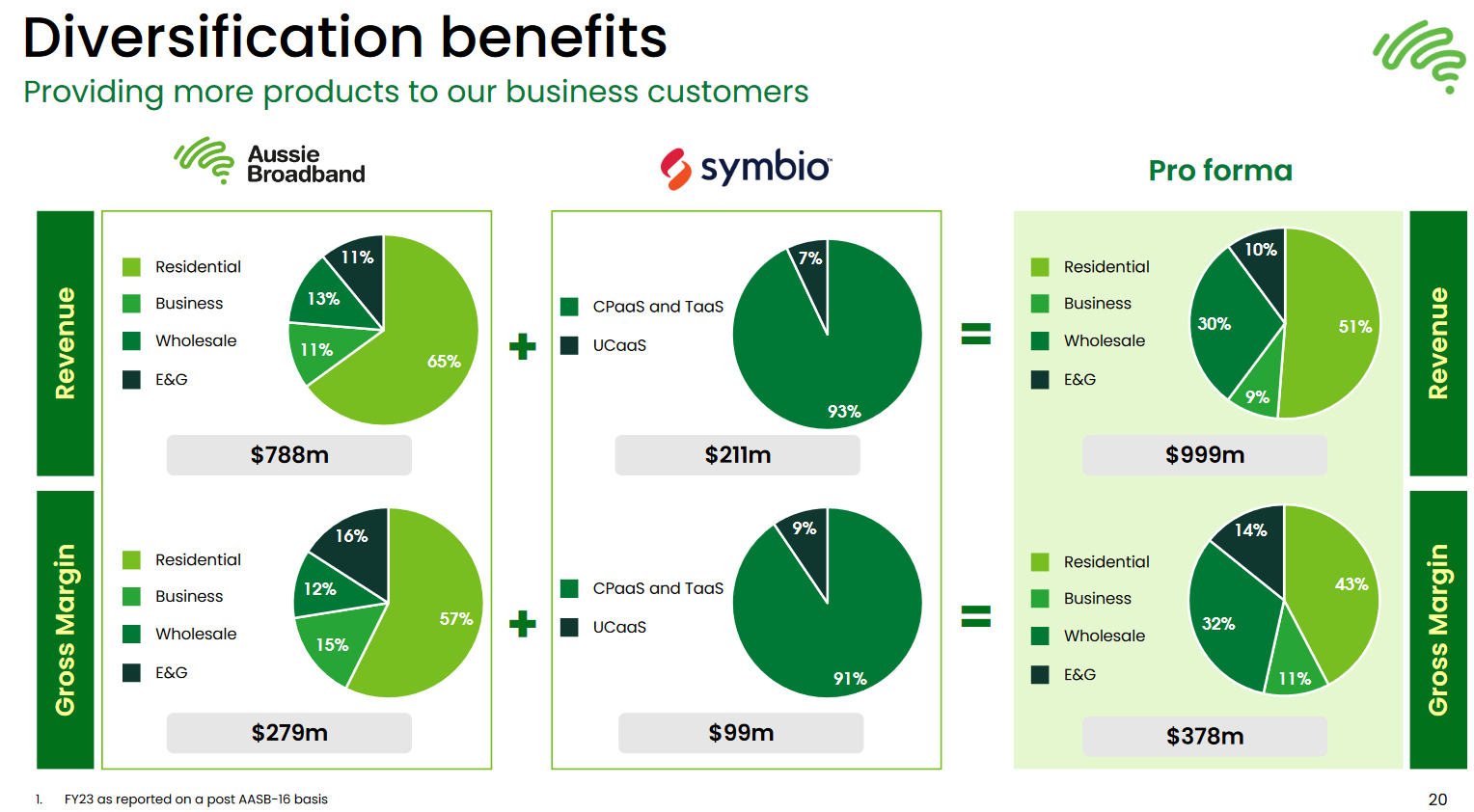

Provided this slide on the Symbio aquisiition, which I think is informative of how they see it adding to their buisness and wholesale operations. Symbio will be maintained as a seperate entity, with the CEO (Michael Omeros) from their Over the Wire acquisition running this side of the business. Phil Brett will become managing director of the overall group.

Gave a tightening of guidance to the upside with EBITDA to be between 105-110m (prev 100-110) from ABB and EBITDA of $116-121m with the 4 months addition of Symbio.

Broadband connection momentum continuing with 19000 new connections added so far in Q3. Very solid result and more than happy to keep holding.