@mikebrisy and @Rocket6 , I'm interested in how you are valuing the Business / Enterprise & Govt revenue potential for ABB.

Do you see this coming from reselling core connectivity eg. NBN Enterprise Ethernet product or Value Added Services on top of the line (eg. IP PBX, Managed Routers etc.)?

My long term hypothesis is that ABB is one of the primary recipients of a tax payer subsidised destruction of the Telecommunications Monopoloy/Duopoloy in Australia. AKA NBN. I also believe that TPG will be a major beneficiary as well and will occupy the "value space" vs "premium service space" taken by ABB. With Telstra being a loser as their monopoly is broken down (structural separation etc. but subiidised with an $11B cheque from NBNCo). I also suspect Optus will be a loser in this transition by being stuck in the middle (not having a clear differentiated proposition like ABB or TPG) as well as being hampered by things such as their Data Breach and foreign ownership.

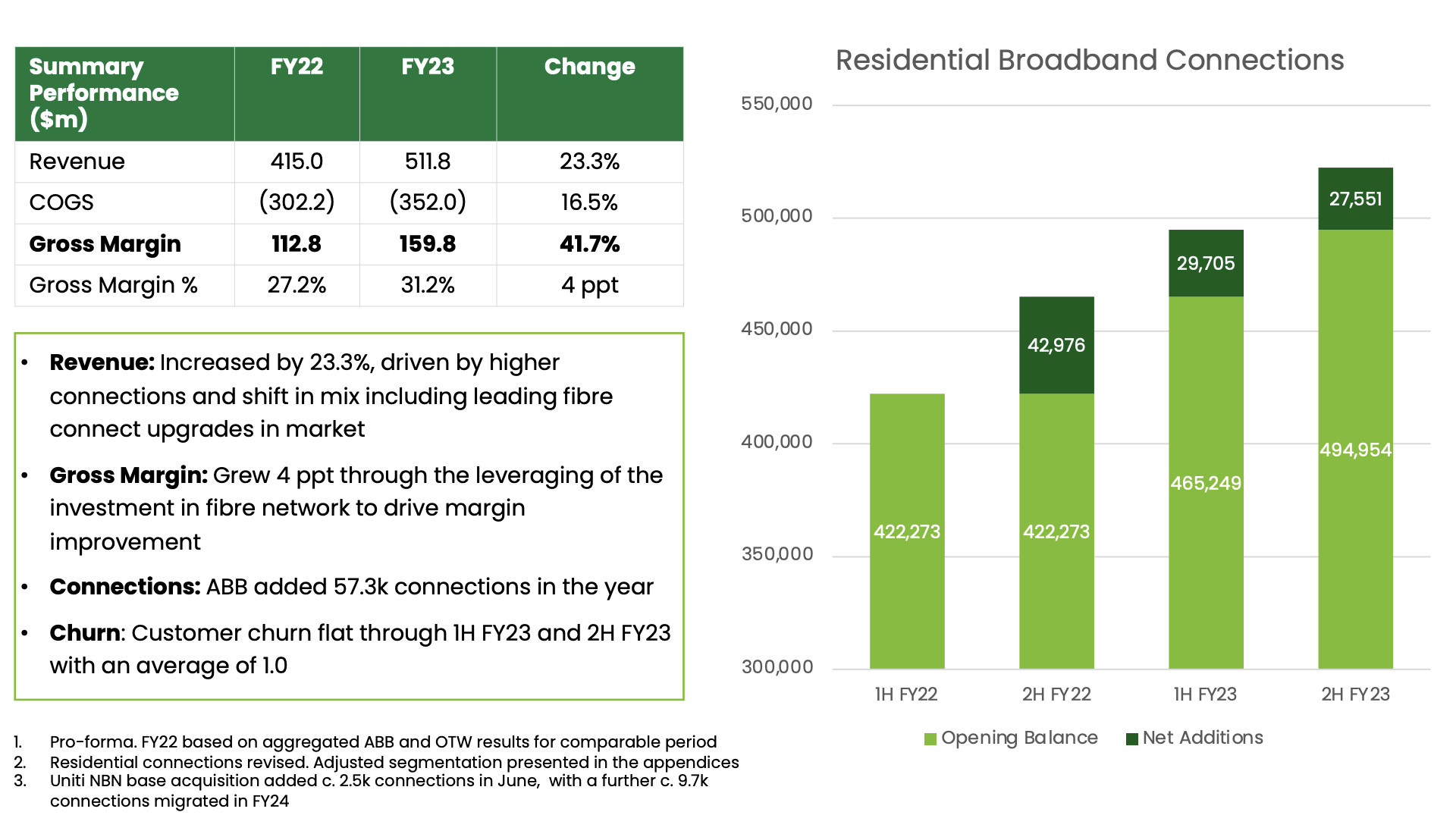

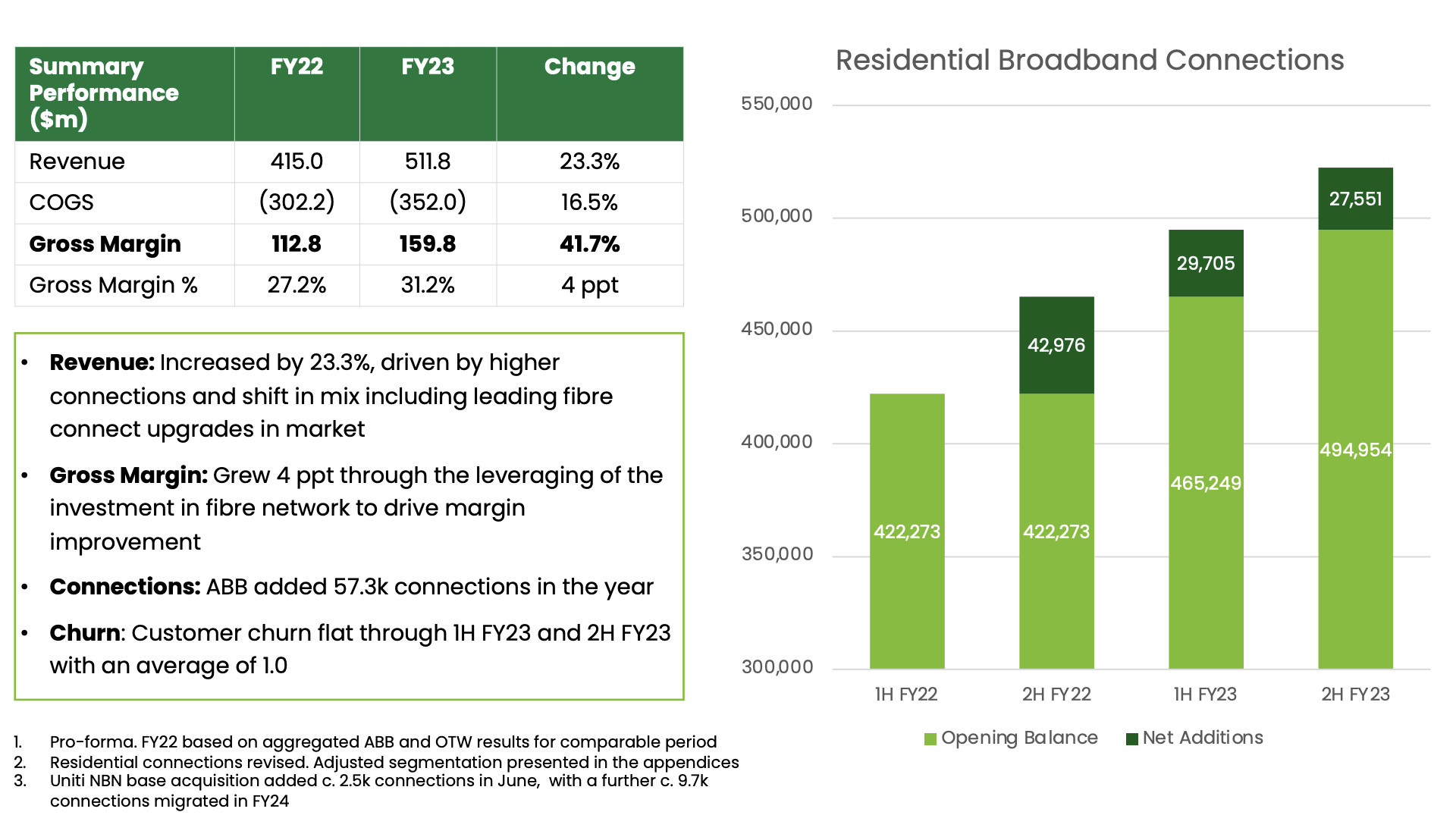

Your models seem to be based mainly upon residential NBN. I worry that much of the easy growth from consumer NBN is probably done (rollout complete, pressures of bigger Telcos selling 4G/5G Fixed Wireless Broadband to undercut NBN's lower speed tiers, limited growth in SIOs (basically new dwellings approvals at about13,000 builds a month at the moment so 1-2% organic NBN growth and an increase in some of the NBN Access charges for Telcos pressuring margins). While I think ABB can probably still take market share in this space as they have built a good reputation as a company providing great service in a generally mediocre industry, there is still quite a bit of inertia to force change now that NBN rollout isn't forcing people to conduct a once in a lifetime review of their relationship with Telstra.

So from here on in, I'm hoping that further growth is going to come from the Business and Enterprise and Government segments:

- These are coming off a very low base

- However, they seem to offer higher Gross Margin (45-50%) vs 30% for the Residential and Wholesale segments.

- They don't seem to be growing this revenue at a meaningful rate yet (7-9%) vs 23% for Residential (albeit this rate is declining every half) but I'm wondering if this is because the service offering is still so new or whether ABB does not have a sales force sufficiently skilled to address these more complex customers.

There is some sense that with the products from NBNCo for Business and Government (such as Enterprise Ethernet) launching to market much later and potentially some longer term contracts also protecting incumbents its still very early to make a prediction.

- I note that ABB seems to be taking a larger share of Enterprise Ethernet SIOs than their share of Residential Customers:https://www.crn.com.au/news/aussie-broadband-nabs-15-percent-of-nbn-enterprise-orders-575388. (I'm not sure if this is still the case as this information doesn't seem to be published)

- I note that Enterprise revenue for NBNCo is increasing quite rapidly. According to TPG in their ACCC submission https://www.accc.gov.au/system/files/TPG%20-%20Submission%20to%20ACCC%20consultation%20paper%20-%20Public%20version.pdf "For instance, NBN Co reported on 9 August 2022 ‘business segment’ revenue of $1B, which is up 20% year on year. On 15 February 2023, it reported revenue from ‘business customers’ increased to $549 million in HY23, up 11 per cent from $493 in HY22. It has predicted take-up of enterprise ethernet services will grow “rapidly”. TPG and other incumbents with large fibre footprint hate that NBN has gone beyond its initial mandate or residential access.

- NBN themselves think that there is potential for lots of Enterprise Ethernet (and this is really only just beginning) with potential for 318K services in non-metro alone. "The Company’s enhanced Enterprise Ethernet service is enabling eligible business customers to order broadband based on wholesale speed tiers of close to 10 Gbps1,2, which is up to 10 times faster than previously available on the nbn® network. We now have over 20,000 active Enterprise Ethernet services, with 6,000 additional services activated during the half. nbn® Enterprise Ethernet is available through RSPs to NBN Co's existing Enterprise Ethernet footprint, including around 900,000 premises located in nbn® Business Fibre Zones across Australia. Of the 321 Business Fibre Zones, 142 are located in regional Australia, enabling approximately 318,000 businesses to access Enterprise Ethernet in non-metropolitan areas". https://www.nbnco.com.au/content/dam/nbn/documents/about-nbn/reports/financial-reports/NBN-Co-Half-Year-Report-FY23.pdf.coredownload.pdf

I'm not sure whether modelling ABB's growth in Enterprise Ethernet as the core of the Enterprise and Government Revenue is the way to go or whether we should be assuming a greater mix of value added services on top of the core connectivity

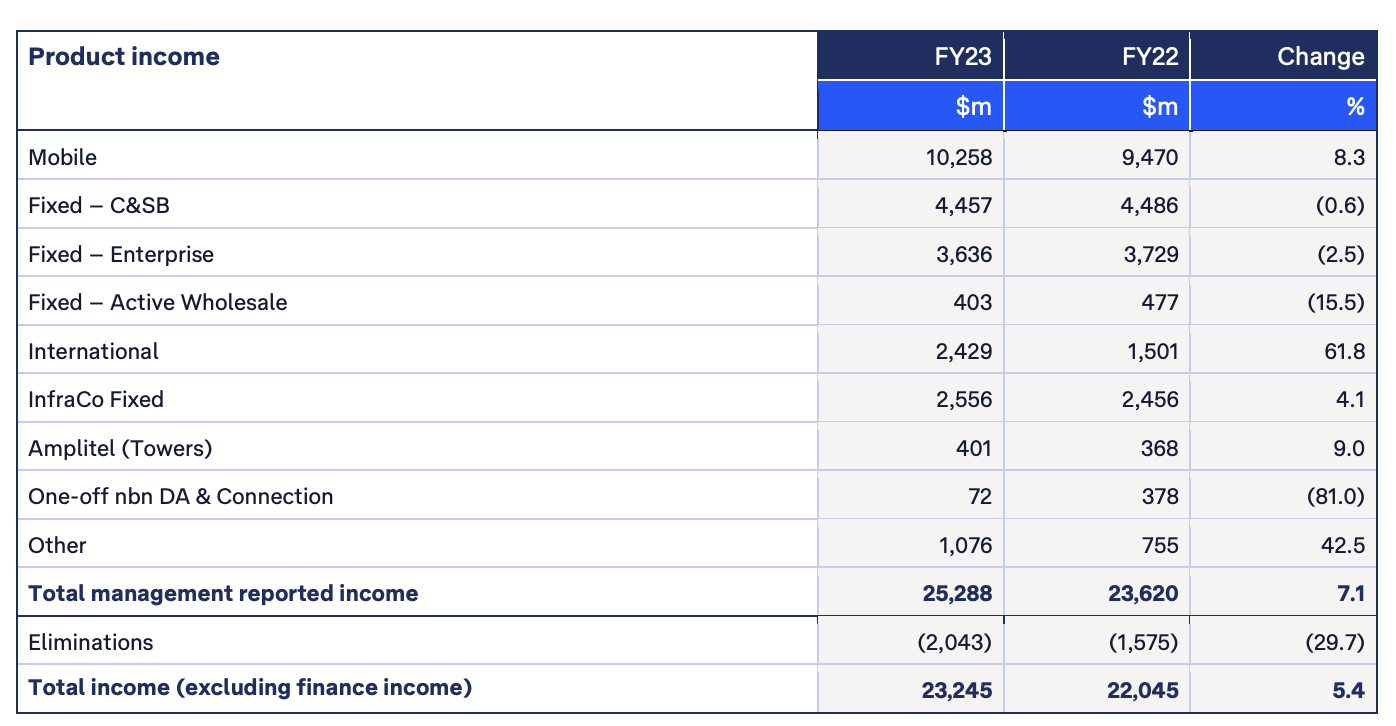

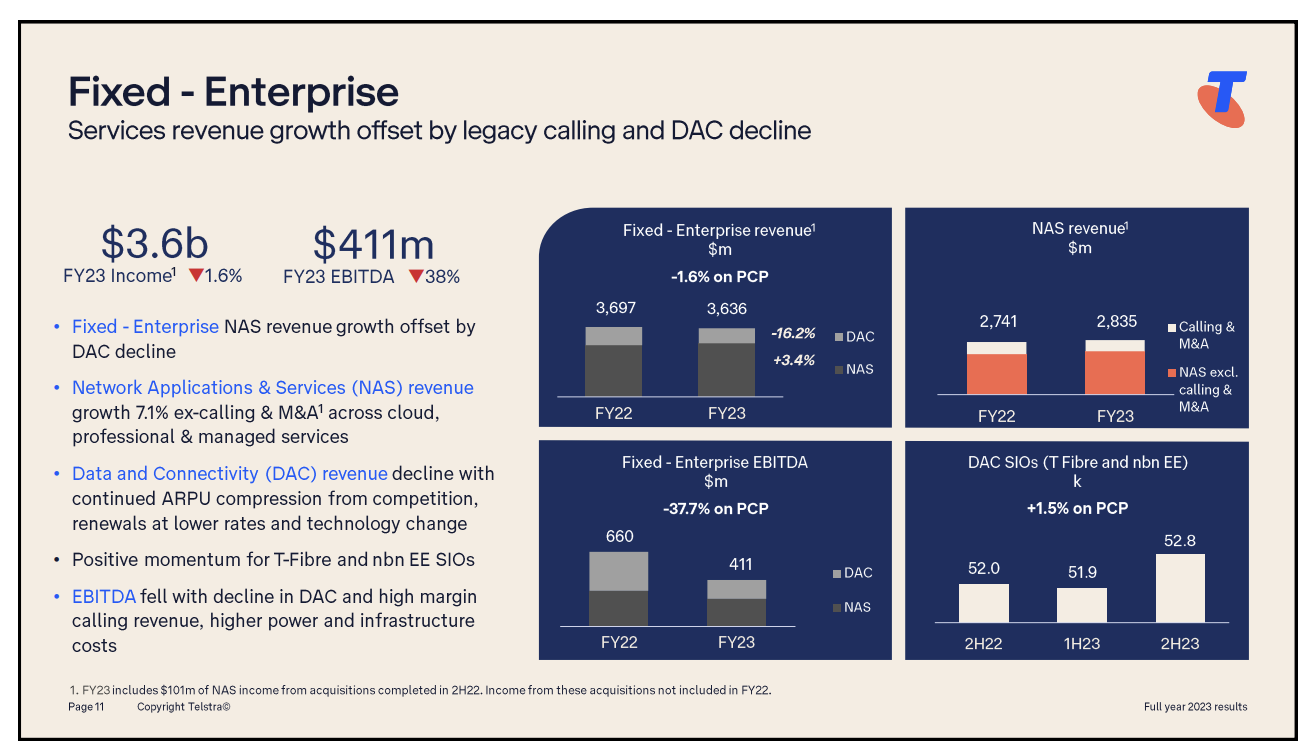

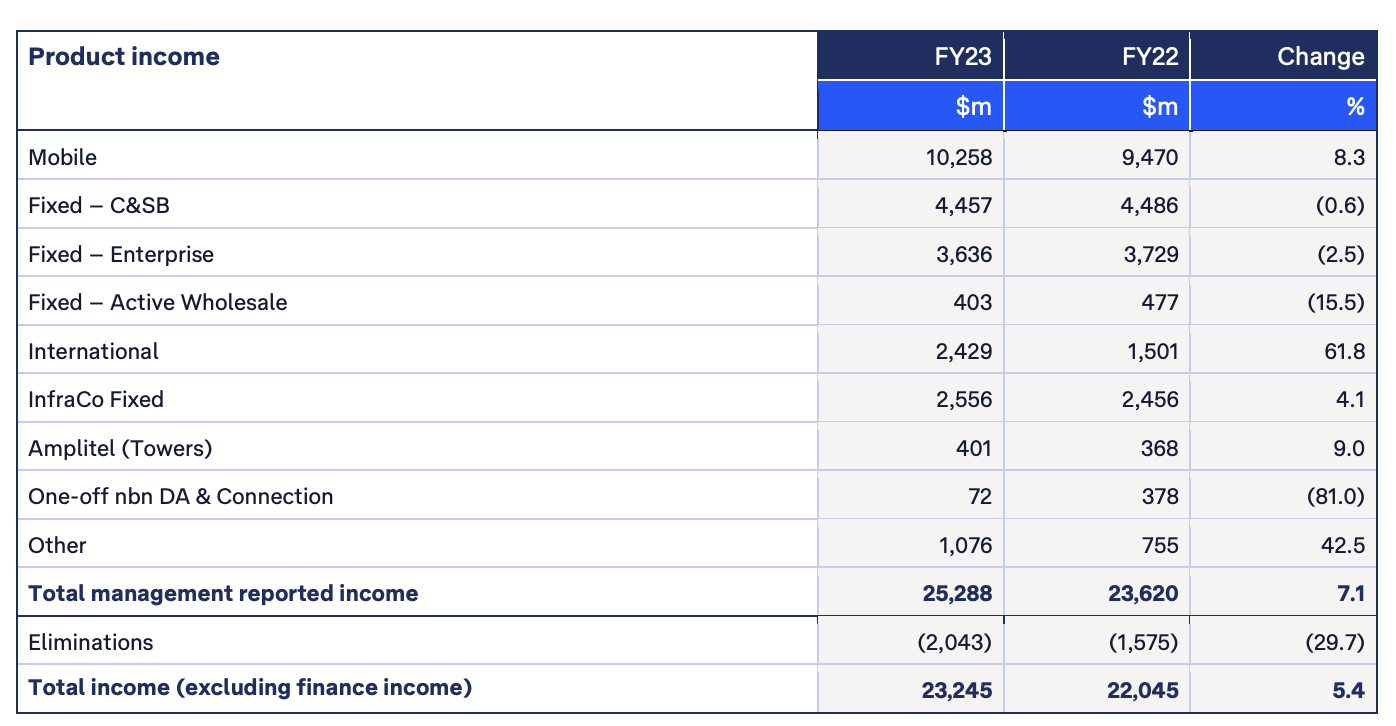

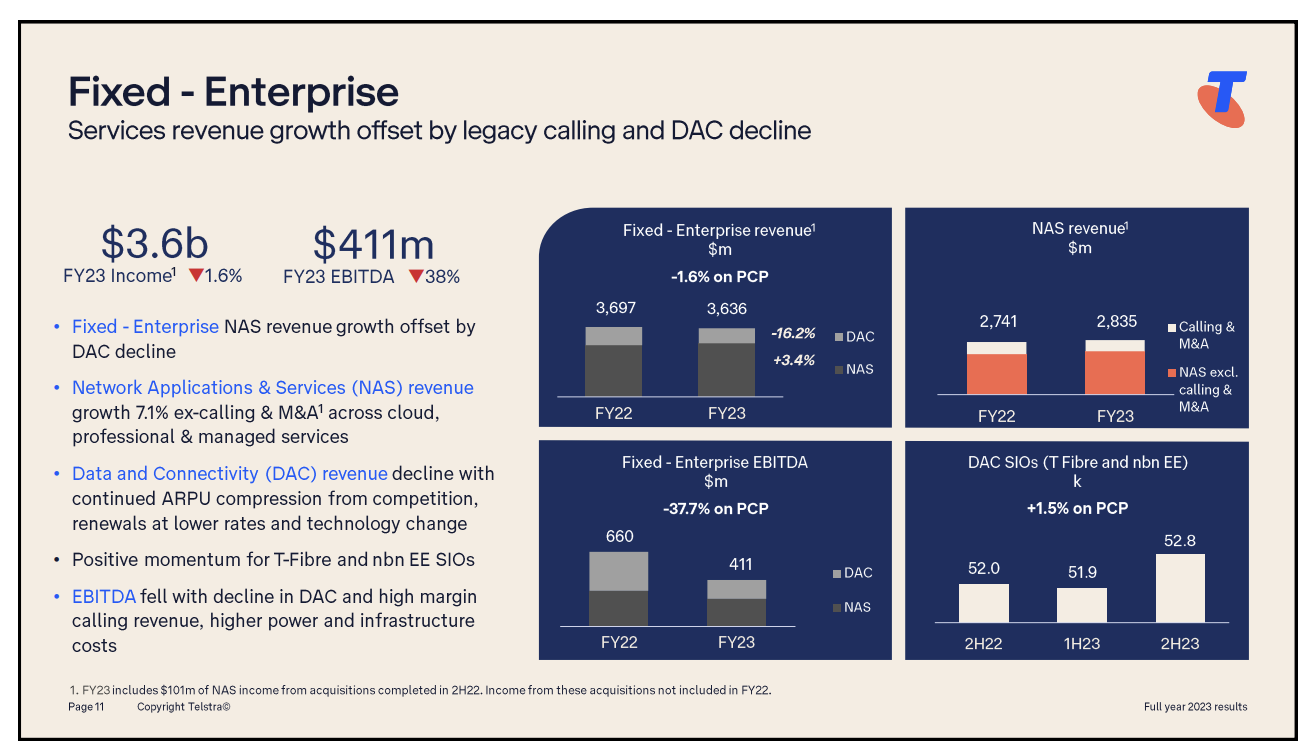

- Telstra seems to be starting to see a decline in their Enterprise and Government fixed line revenue but they seem to be trying to offset that by going further up the stack with NAS (Networks and Services). According to Telstra data the liones share of their revenue is coming from the NAS. https://www.telstra.com.au/content/dam/tcom/about-us/investors/pdf-h/TLS23_17%20Results%20for%20FY23.pdf

I'd appreciate your thoughts. My gut wants to buy some more ABB but my head and DCF which is based upon residential broadband to date is telling me that the stock is currently priced about right unless they can crack Enterprise and government. I'm a bit scared by the rate of decay of net adds per half compared with the install base in the green chart above (2HFY22 10.2%, 1HFY23 6.4%, 2HFY23 5.5%, ...)

DISC: Hold TPG IRL and ABB IRL and Strawman