Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

I made the following post on microcapclub.com. The recent shellacking saw the market cap dip below the US$500m microcap threshold, and gave me a chance to sneak it in.

There's a lot of overlap and repetition of what has already been mentioned here in the past week and throughout the years. Though some members may appreciate the key points put together in one article.

Let me know what you guys think!

https://roeroeboat.com/Audinate%20Group%20Investment%20Case.pdf

(file was too big to upload, so I had to put under my own domain)

To release a downgrade on the worst trading day / highest volatility since Covid shows the same mgmt. naivety as selling down into a Cap Raise.

This is potentially a downside of having a technical founder CEO rather than a professional / slick management. I would still take the owner operator (missionary) over ‘professional’ (mercenary) approach any day.

Other factors like the large cap raise at $13, still unutilised, CFO resignation, Directors selling above $20, relatively low insider ownership, would have put Audinate on a negative watch.

Broker reports saying that they are effectively a hardware maker (not true) and the vast bulk of their sales are non-recurring (not true) and 1 year price targets are closer to $13 would have helped prime the doors for a stampede.

This downgrade to guidance for FY25 was significant but also given the brevity of the release likely raises concerns about some of these prior actions – especially CFO resignation, director selling, raising at $13, etc.

The jaded trader set and the ‘I told you so’ brigade are negative on this stock and currently sounding smart and wisely cautious. They are playing a much shorter timeframe game to me but will likely be the marginal buyers / sellers / shorters so could push the price around quite a lot in the short term. 2.5% shorted last time I checked.

So I would be surprised if the share price rebounded any time soon in any meaningful way but that’s just my best guess.

Buffett talks about wanting to buy a great business with short term problems – his ideal situation is when they are on the operating table. That’s what this feels like to me but only time will tell.

Excellent contributions @ Valueinvestor0909 , mushroompanda @Rocket6 , @mikebrisy and others.

AD8 as an investment proposition has been very much a question of: “How profitable can this business be if it becomes a monopoly?” In the medium to long term nothing else matters.

And in the middle of last year, AD8 and just about every analyst was calling it monopoly-game-over in the Audio segment with AD8 having a 90% market share.

What remained a battleground was the Audio-Visual market, and AD8 were reporting as making good progress. (From the 16/5/24 Investor Day: “Over 50 manufacturers have licensed Dante AV, with 75+ products on the market”).

There are a lot of product categories, names, concepts and words in today’s announcement - and in the end I and I think many others are finding it difficult to get a read on just how they are tracking.

Today AD8 guided an unaudited FY24 revenue of “approximately US$60.0 million.”

And they also stated in FY25 they expect: “……..a >US$10 million revenue headwind”.

How do you achieve monopoly like market domination when you are openly saying sales will fall 16% plus? “Hey, where’re all going on vacation for a year but we’re going to kill it!”

Maybe all will become clear at the conference call on the 19th.

Audinate have announced that they’ve hired a Chief Strategy Officer to oversee M&A among other strategic growth initiatives.

This seems like a good position to fill given their M&A ambitions and the size of their war chest. It should also take some pressure off the incoming CFO whenever they get started. Also good to see a build out of Execs below the CEO as the business starts to mature, hopefully reducing some of the key person risk in the CEO, especially as their impressive, long standing CFO is departing soon.

Nick Pearce looks like a good fit based on his Linked In profile - https://www.linkedin.com/in/nick-peace-5a4ba64/details/experience/.

Having previously been an Audinate Board member and early investor for 4 years until about a decade ago, he’s clearly a believer in the business and a known quantity.

His prior role at Promedicus as Chief Strategy Officer for 2 years will be useful experience and with names like Starfish and Oracle on his CV it’s great to see Audinate can attract someone of this calibre.

Put down my thoughts about Audinate and how I think about the current situation. No idea if I am right or wrong but there it is.

https://www.growthgauge.com.au/p/audinate-asx-ad8-fy24-result-preview

FWIW Morningstar has also updated their coverage on Audinate

Morningstar currently rate AD8 as a 5 Star stock with a Fair Value of $18.50 (so they see it is significantly undervalued)

Audinate Earnings: No Signs of Improvement Yet

Analyst Note

We maintain our AUD 18.50 per share fair value estimate for narrow-moat Audinate following its first-quarter fiscal 2025 update. The company indicated that it does not expect to meet its previously issued guidance for the full year, which it issued in August. Specifically, the company no longer expects to generate “slightly lower USD gross profit compared to fiscal 2024.” The company did not update its guidance but will update the market after the completion of second-quarter fiscal 2025 trading. Although the update is a further disappointment, we, like management, expect fiscal 2025 to be a transition year for the company and expect growth to reaccelerate from fiscal 2026. At current prices, Audinate shares screen as materially undervalued, as the market appears to believe the company’s current slowdown may signal a loss of competitive position or exhaustion of its addressable market.

We view the current slowdown as a combination of a resolved backlog of hardware products and a transition of the business from hardware-based sales to software-based sales. The former echoed the covid-19-induced chip shortage, which led to artificially high demand in fiscal 2024, which the company is now lapping. The second is more structural in nature. To increase market penetration, the company needs to offer original equipment manufacturers lower-cost ways of implementing the Dante protocol, primarily by allowing them to implement Dante through software instead of through separate hardware chips. We view this transition as analogous to what we have seen in many software-as-a-service businesses, where the transition initially led to slower growth but where the new price points unlock sufficient incremental volume to make up the difference.

Business Strategy and Outlook

We expect Audinate’s strategy to primarily focus on accelerating the secular transition toward digital audio networking. Secondarily, we expect Audinate to focus on building out its nascent business for digital video networking.

Audinate’s Dante protocol has become the world’s most widely used protocol for digital audio networking and boasts a more-than 10 times lead over its nearest competitor, Ravenna, in terms of the number of products enabled with the protocol. Given Dante’s dominant market share, we see little remaining upside for Audinate from gaining incremental market share from direct competitors in digital audio networking. However, we do expect Audinate to use its network effect, its existing customer relationships, and its scale on research and development to accelerate the AV industry’s transition toward digital audio networking. Specifically, we expect Audinate to continue creating new hardware and software solutions that unlock new device use cases and to continue developing new software solutions for AV professionals. We estimate Audinate has around 10% market share in audio devices, which leaves Audinate with a large and highly winnable market opportunity, as the industry digitizes. Additionally, we expect Audinate to gain significant pricing power, especially in its software segment, as its network effects continue to strengthen.

We also expect Audinate to continue developing its nascent digital video networking business, although we view this as a more uncertain and likely less profitable opportunity. Video networking has unique challenges compared with audio, primarily due to the larger data intensity inherent in video data delivery. Because of this, digitally networked video uses various compression technologies that are usually not compatible with each other and therefore hinders the establishment of network effects. However, we believe network effects from Dante’s audio solutions will help pull in AV professionals, who are already familiar with the Dante protocol, which in turn pulls in original equipment manufacturers, or OEMs.

Economic Moat

We assign Audinate a narrow economic moat based on network effects in its digital audio networking protocol, Dante. We expect Dante to become the standard for digital audio networking, and for digital to continue to take share from analog networking.

Dante is the world’s most widely used protocol for digital audio networking. Over 400 OEMs, such as Bosch, Bose, and Yamaha, license the Dante protocol to enable digital delivery and management of audio for over 4,000 products, such as microphones, mixers, and speakers. Dante’s closest competitor, Ravenna, has fewer than 400 products enabled with its own protocol, and works with fewer than 100 OEMs.

Network effects arise from strong interoperability within networking protocols, and limited interoperability between them. When audio products are enabled with Dante, these products can be easily discovered by- and connected to the Dante- network and other Dante-enabled products on the network, which is required for their audio delivery to be synchronized. Such automated discovery and connection provides a compelling benefit for AV professionals because it allows them to easily add, move or remove audio equipment to their installations. This benefit may even exceed any perceived brand value toward specific OEMs. Products not enabled with Dante can still be added to the network through AES67, which is an industry standard for audio over IP, but the networking process is more cumbersome. Similarly, competing networks can add Dante-enabled products through a more cumbersome networking process. Given the limited interoperability between the various networking protocols, Dante’s leadership position of more-than 10 times in terms of the number of enabled products results in clear demand pull from AV professionals.

OEMs, in turn, need to cater to the preferences of AV professionals and are therefore increasingly choosing to enable their products with Dante, which leads to Dante’s leadership position expanding over time and a positive flywheel between supply and demand. Dante today enjoys a more than 10 times lead over Ravenna, in terms of enabled products, which is a significant improvement from a 6 times lead in 2017. We also expect Dante’s leadership in terms of deployed products to be even larger than its leadership position in available products, due to Dante’s larger network of interoperable products making its products more appealing to AV professionals.

We view analog networking as Audinate’s primary competition. In analog networking, AV professionals connect products by drawing physical cables between them. This cabling is usually many times pricier than digital networking because the cables need to be drawn the full distance between devices. By contrast, the Ethernet cables used to connect Dante-enabled devices can typically be drawn to the nearest Ethernet port in a building. Many devices also don’t require separate power cabling after they are connected with an Ethernet cable. This provides material savings in terms of hardware and labor costs. Additionally, over longer distances, analog audio cabling can suffer from reduced audio quality, which digital audio delivery does not suffer from. Unsurprisingly, the industry has been rapidly digitizing. We estimate that digitally enabled audio devices doubled their market share as a share of new sales to around 10% in 2023, from 5% in 2016. Analog networking continues to be the dominant networking technology, primarily due to switching costs from existing installations and digital networking being cost prohibitive for lower-value devices and use cases.

We don’t yet see similar network effects in Audinate’s video networking business. Video networking has unique challenges compared with audio, primarily due to the larger data intensity inherent in video delivery. Because of this, digitally networked video uses various compression technologies that balance speed, cost, data, and quality for specific use cases. As a result, products using different technologies are often not compatible, not just in their discovery and connection, but also in their data delivery. The industry is therefore still much earlier in its digital transition.

We do believe Audinate enjoys several distinct advantages in pursuing video networking. Audinate has existing relationships with hundreds of OEMs, many of which also make video products. We believe offering bundling deals through these established customer relationships has traces of an intangible moat. A subset of AV products also has networking needs for both audio and video, which makes them an attractive market entry point for Audinate. Also, over the years, Audinate has been training hundreds of thousands of AV professionals on its technology. These professionals already know how to work with Dante-enabled products and are familiar with the brand, which, we believe, makes for an appealing proposition for OEMs. So far, Audinate is demonstrating strong momentum on all relevant metrics for its video networking business. These include growth in the number of OEMs licensing the protocol, the number of products enabled with the protocol, and in the number of products shipped with the protocol. However, this is from a small base, and we consider the market still up for grabs.

Fair Value and Profit Drivers

Our fair value estimate for Audinate is AUD 18.50 per share, implying an enterprise value/sales multiple of 18 on our fiscal 2025 estimates. We use a weighted average cost of capital, or WACC, of 9%, reflecting high revenue cyclicality, medium operating leverage and low credit risk.

We assume revenue to grow at an organic CAGR of 15% over the next decade, driven primarily by Audinate expanding the market for digital audio networking. We expect EBIT margins to expand to 38% by fiscal 2034, compared with 9% in 2024. We expect Audinate’s operating margins to expand because of sales and marketing spending, as well as research and development declining as a share of revenue, once its network effects strengthen. We also expect gross margin expansion as strengthening network effects result in increased pricing power and the higher gross margin software segment becomes a larger share of the business.

Risk and Uncertainty

We assign Audinate a Morningstar Uncertainty Rating of High.

The AV industry is still in the early stages of digitizing, which means there is still high uncertainty regarding the ultimate market opportunity for Audinate’s products. Given that we view competitive risk as low in digital networking for audio, due to Audinate’s economic moat based on network effects, our uncertainty revolves around the market’s ultimate size, rather than Audinate’s share within this market. Within video, we see additional uncertainty around Audinate’s ability to take market share.

We see high risk from economic cyclicality. Audinate’s devices or license designs are used in products which are highly discretionary. Although these products are often part of systems which eventually need to be replaced, customers can choose to defer these purchases in challenging economic times.

We see high risk from technological disruption. Audinate’s Dante protocol primarily uses Ethernet cables for data delivery. We cannot rule out other methods of data delivery eventually substituting Ethernet cables, such as wireless internet or other technologies.

Capital Allocation

Audinate has an Exemplary Morningstar Capital Allocation Rating, reflecting our assessment of a sound balance sheet, exceptional investment efficacy, and appropriate shareholder distributions.

Audinate’s balance sheet is sound. As of the end of June 2024, it held significant cash with no debt.

We rate investment efficacy as exceptional. Although Audinate is supported by network effects, when it started, it faced the traditional cold-start problem, whereby no AV professionals wanted to use Dante’s protocol because there were no products supporting it and no OEMs wanted to develop products because no AV professionals wanted to use them.

Audinate demonstrated exceptional execution to solve this problem. Audinate found the right entry points into the market, strategically attracted early customers by making them part owners of the business, developed a product portfolio with the right breadth and depth and delivered the right levels of customer service. All of these competing objectives were achieved with limited resources, which demonstrates to us exceptional capital allocation skills.

Audinate does not currently return capital to shareholders, which we view as appropriate given the opportunities for investment into the business.

DISC: Held in RL & SM

Just noticed the recent ASX announcements for AD8:

25/10 Hyperion to Substantial Share Holder @ 5.24% buying from 8/7 - 23/10

28/10 Pinnacle to Substantial Holder @ 5.26% buying from 1/7 - 23/10

4/11 Fisher Funds to Substantial Holder @ 5.00% buying from 31/6 - 31/10

4/11 AustralianSuoer (already a substantial holder) increased from 7.84% to 8.89% (they constantly buy and sell with trades listed from 9/8 -29/10).

Fascinating seeing all these funds grabbing stakes or increasing their holdings.

Most interesting, the SP on 1/7 was $15.54 and at 29/10 was $9.06 - so all the buys above were made between those prices, more or less - but the current SP is $7.31.

I bought in years ago @ $9.24, so I'm watching and waiting to see how low it will go and for how long it will stay there, before I hit the button to buy more. Not a huge holding but it's a business I've always been interested in, and I'm interested in seeing how they weather the current difficulties in the sense of lessons learned that might be applicable when assessing other similar businesses.

Disl: Held IRL & SM

Great write-ups on here from various posters. One of the things I'm trying to get my head around is what is happening with AD8's customers. Apologies if this has already been posted and I missed it, but there is usually some colour in the earnings transcripts of some of the OEMs that AD8 supplies. The tl;dr seems to be that they over-ordered chips and then customer spending slowed so they are going to spend the next year or so trying to wind down inventory which is basically what AD8 is saying. Here's a recent Yamaha transcript. It seems like this could be a reasonable way to get at least a rubbery feel for where to expect demand is heading.

Now let me talk about the other financial figures. Here is the balance sheet summary. As of the end of March 2024, the inventories rose to a noteworthy level. This is especially due to the inventory of parts staying at the high level. To cope with the semiconductor supply shortage triggered by the pandemic, we raised the level of the stock at hand with the front-loaded order placements, but then the sales volume decline. So we were left with the extra pile of inventories.

As of the end of September 2023, the inventory was as high as JPY 176.8 billion, but we lowered it by a little over JPY 10 billion by the margin. Throughout this fiscal year, we would like to lower the inventory level further down to JPY 142 billion, as described here.

The inventory issue can be seen here. (numbers are in JPY)

Roland Corp has a similar vibe

The nice thing is these guys report quarterly, so we've got a good way of peaking a bit into the future. Once we can see inventories falling back to where they were historically we know they have more or less destocked and will revert to more usual buying patterns (that's the thinking anyway).

OK, the CFO resigned and sold every last share he had this year.

With thanks to Morningstar

Analyst Note | by Roy Van Keulen Updated Aug 06, 2024

We lower our fair value estimate for narrow-moat Audinate by 20% to AUD 18.50 per share after the disappointing prerelease of fiscal 2024 results. While the fiscal 2024 result is in line with our revenue and profit forecasts, guidance for fiscal 2025 signifies a dramatic, unexpected slowdown. The share price nearly halved at the open, before recovering to trade down around a third. We view Audinate shares as materially undervalued as fiscal 2025 is likely a transition year, after which growth will reaccelerate and margins will expand again.

The deceleration has two main drivers, a resolved backlog of hardware products and a transition of the business from hardware-based sales to software-based sales. Although both drivers were known, the magnitude was much greater than expected. We previously forecast 24% revenue growth for fiscal 2025, marginally above market consensus at the time, but now lower this to negative 9% in line with guidance.

The transition from hardware-based sales to software-based sales is accelerating. Although management expects revenue to decline in fiscal 2025, gross profit is expected to be only marginally lower given higher average gross margins. Gross margins for the second half of fiscal 2024 are expected to be 5% higher than in the first half, based on the preliminary results. The guidance for fiscal 2025 implies another 3% increase in gross profit margins, compared with the second half of fiscal 2024. This exceeds our prior gross margin expectation for the year by 7% and reflects a shift to higher-margin, though lower-priced, software sales.

As is generally understood, the short term is not looking great. Management reiterate "The long-term outlook for Audinate remains positive".

"The outlook for FY25 was somewhat of a disappointment for us, because we had become

accustomed to much higher growth rates year after year. But it’s here that there is also a good

news/bad news message in our findings. The bad news, as we have previously communicated,

is that we expect 2025 to be a transitional year, as our OEM customers continue to work through

their backlog, and we wait for end-user demand to pick up the slack and reaccelerate future

orders. As of right now we are expecting this to only take a year, but obviously that’s a projection

that could change in the future."

I would think that this is already baked into the share price, but lets see.

Note from Macquarie courtesy of FN Arena

Macquarie rates AD8 as Neutral (3) -

Macquarie observes the current Audinate Group share price is reflecting a free cashflow compound average growth rate of around 42%, which the broker states is a "high bar to meet".

The analyst points to the cyclical nature of the company's hardware sales with an estimated 89% of revenues as non-recurring, and the discounting of AVIO adaptors, the second most important revenue generator.

Including the potential cannibalisation of revenues from new products like Dante Director and challenges around cash positions, M&A and recent management changes, the broker revises earnings forecasts for by -23% and -25%, for FY25 and FY26, respectively.

Accordingly, the target price is lowered -20% to $14.40 from $17.90 and the Neutral rating unchanged.

Target price is $14.40 Current Price is $15.20 Difference: minus $0.8 (current price is over target).

If AD8 meets the Macquarie target it will return approximately minus 5% (excluding dividends, fees and charges - negative figures indicate an expected loss).

Current consensus price target is $20.02, suggesting upside of 40.2% (ex-dividends)

The company's fiscal year ends in June.

Forecast for FY24:

Macquarie forecasts a full year FY24 dividend of 0.00 cents and EPS of 10.60 cents.

At the last closing share price the stock's estimated Price to Earnings Ratio (PER) is 143.40.

How do these forecasts compare to market consensus projections?

Current consensus EPS estimate is 9.2, implying annual growth of -33.1%.

Current consensus DPS estimate is N/A, implying a prospective dividend yield of N/A.

Current consensus EPS estimate suggests the PER is 155.2.

Forecast for FY25:

Macquarie forecasts a full year FY25 dividend of 0.00 cents and EPS of 11.40 cents.

At the last closing share price the stock's estimated Price to Earnings Ratio (PER) is 133.33.

How do these forecasts compare to market consensus projections?

Current consensus EPS estimate is 15.7, implying annual growth of 70.7%.

Current consensus DPS estimate is N/A, implying a prospective dividend yield of N/A.

Current consensus EPS estimate suggests the PER is 91.0.

Sharing my AD8 notes to myself following the recent downgrade, so apologies if some of this is repetitive has been covered elsewhere...

Growth

I think about Audinate’s growth as having 3 sources. All are from selling their Dante protocol in different forms. Note, this is different to the 3 segments they call out in their presentations – more on them below.

The primary revenue source is from sales to existing Original Equipment Manufacturers (OEM’s) who buy Dante enabled Chips, Cards & Modules (CCM’s) from Audinate.

The growth drivers I see are:

1) Existing Dante enabled pro AV units being shipped in greater quantities over time. Note, this piece can also go in reverse, as is now forecast for FY25, but unlikely to drop for long as new products gain in popularity or are replaced by Dante enabled products that do and the market continues to grow.

2) Design Wins in one year becoming sales in the next and subsequent years. This is likely the biggest driver of revenue growth and market penetration early on (especially for Video but more on that later).

3) Software sales (SaaS) to end users, usually sound engineers, their employers or owners of networked installations (eg, Sydney Trains). The greater the ‘installed base’ from 1 & 2 above the higher the value proposition from Dante software to manage them. In time they’ll likely also / instead sell the protocol to OEM’s as software (licence per unit) rather than embedded in chips / hardware.

When an OEM designs a Dante chip into their hardware in Year 0 (aka a Design Win), sales of Dante CCM’s are triggered whenever new hardware is built. For Example, if a Pro audio equipment maker in South Korea makes 1,000 units of a Dante enabled product in Year 1 and ships 950 of these to distributors in US, Europe & Asia, 1,000 Dante enabled chips will be sent from Malaysia to South Korea, along with nuts and bolts from China, circuitry from wherever… to be assembled in South Korea. If these sell well, they might make 1,500 units in Year 2, so 1,500 Dante chips are sold for this product in this next year.

It seems existing sales in FY24 were brought forward to such a large extent by covid supply shocks that OEM’s have over stocked and won’t need to buy as many chips in FY25. Further this decline is unlikely to be made up for in new design wins (from FY24) or expected software sales in FY25.

The over earning in FY24 was a one off, FY25 should see lower Revenue AND Gross Profit, despite rising gross margin, so normalised revenue growth rates are probably something like the 22% average you get when you average the 6 years to FY25, including an estimate of -5% for next year.

3 Segments

Audinate split their market into Audio, Video & Software.

Audio is where they dominate with 12x the units in market of their nearest competitor. So even though they have less than 10% of the addressable market, they have 90% of the penetrated market and an even higher proportion of new units coming to market.

So there is 90% of the market still to be taken from the incumbent which is physical cabling of networked pro-Audio products.

Audinate’s dominance of this market suggests that Dante becoming the default Audio over Internet Protocol format is just a matter of time and management have said as much.

The key questions are how much of this 90% can they take, by when and what margins can they earn?

Video is the newest part of the strategy, the biggest focus for the business, the biggest opportunity, and the biggest risk.

This is off to a good start exceeding management expectations for units shipped and growing fast off a small base.

It probably needs some M&A to step up and compete against some of the larger competitors in this space. The $70m Cap Raise @ $13 in Oct-23 was to be used for this purpose but is still sitting on the balance sheet. More on that later.

Software is already a significant and growing piece of the Revenue mix (20% I think) and should grow well from here – just how far it can go will depend on the success of the Video strategy – at which point they can unify both formats under Dante as the Operating System for the Pro-AV Industry which is their stated longer term strategic aim.

I think of this as Audio being the foundation, funding source and playbook for Video penetration – this will be the battleground for dominance.

Video is the big opportunity as it potentially unites the industry under one format for Networking over IP and opens up the opportunity for high margin sticky software to manage a large installed base.

USD Revenue CAGR increase %

The FY22 performance metric for the performance rights is aligned to the Company’s US Dollar revenue compound annual growth rate (‘CAGR’) over the three years from 1 July 2021 to 30 June 2024.

The Company’s Total Shareholder Return performance compared to the relevant index

The FY21 performance metric for the performance rights is aligned to the Company’s Total Shareholder Return (‘TSR’) as compared to the ASX 300 Index over the three years from 1 July 2020 to 30 June 2023. The ASX 300 Index was selected as it represented the market performance of alternative companies that Audinate shareholders may invest in. In the event that the Company achieves a negative TSR that is better than the relevant index TSR the percentage of performance rights to vest is capped at 50%.

Audinate FY24 preliminary unaudited results and FY25 outlook

Key FY24 unaudited results

• Unaudited revenue of approximately US$60.0 million (A$91.5million), up 28.4% in US$

• Expected EBITDA A$19.5 – A$20.5 million (compared to A$11 million in FY23)

• Unaudited gross profit (GP) of approximately US$44.5 million, up 33.2%

• Unaudited gross margin of 74.3% (compared to 72.1% in FY23)

FWIW UBS's First Read of AD8's results out before this mornings conference call

UBS SnapShot: FY24 Results

ONE LINER: Majority pre-released, with a challenging year ahead. Incremental is good ongoing momentum in video

KEY NUMBERS (post AASB16): Rev. US$60m (+28% y/y) / A$92m (+31% y/y). U/lying EBITDA $20m (+85% y/y) vs UBSe & Cons $20m (in-line). U/lying PBT $12m (vs $0.9m pcp /UBSe $11m/ Cons. $10.6m). DPS 0cps (in line)

RESULT HIGHLIGHTS: 1) G/dance met: GP US$44.5m, +33% y/y vs guided ~26-31% growth (A$68m +35% y/y), but big deceleration in 2H24 (1H +49% / 2H +19%). 2H24 GM 76.8% vs 71.8% 1H24 driven by product mix & cost-down on Brooklyn. 2) CCM revenue +26% y/y driven by Brooklyn & Ultimo, Software +33% (IP Core, DEP, retail software) with 2H indicating deceleration. 3) Video: +18 video products in 2H24 (vs +18 in 1H), +4 OEMs in 2H (vs +16 in 1H). with g/dance met in 1H (>30k - no details on units shipped in FY24/2H24). 4) Continued strong audio ecosystem, 460 OEMs +161 developing shipping products vs 430 + 153 1H24 & 400 + 138 in 2H23, 4,176 products (+168 in 2H / +155 in 1H) 12x the closest comp vs 4k in 1H24. Trained professionals +48k / +22% to 271k in FY24, with acceleration in 2H24. 5) Op. cost control in line $48m vs UBSe $48m, with 2H24 EBITDA $10m vs UBSe $10m. 6) 3rd consecutive period of +FCF ($7m) & OpCF conversion 112%. 7) $48m cash, no debt

VALUATION: $10.90 PT, Blended 2yr fwd EV/Sales to sales CAGR / DCF valuation

GUIDANCE: Unwinding of FY24 revenue tailwinds to result in FY25 Rev decline y/y, marginally lower FY25 US$GP (flat to -9% y/y), with exp. cost growth of 7-9%. UBSe analysis suggests this implies an EBITDA range of $6.8m-$14.2m / -66% to -29% y/y. AD8 is actively exploring potential M&A opportunities

UBS COMMENT: Ongoing positive video momentum in 2H24 the real incremental in this release. Strong FY24E performance, however partially from a pull forward of FY25E sales, which combined with other headwinds creates a challenging year ahead. Based on FY25E g'dance, our analysis suggests LT GP CAGR reduces from prev. 24% to 20- 22% - which would give upside vs UBSe (incorporating +18%) and consensus. LT story looks attractive, ST lack of growth will understandably hold some investors back

DISC: Held in RL & SM

News SummaryDJ Audinate's Headwinds Look Temporary to New Bull -- Market Talk

AD8 $8.75

09 Aug 2024 09:44:042 Views2343 GMT - The savage share-price drop that greeted Audinate's fiscal 2025 guidance helps attract a new bull to the audio-visual tech provider.

Jefferies analyst Wei Sim raises his recommendation on the stock to buy from hold, telling clients in a note that he doesn't think that the current headwinds facing the company are structural.

His conversations with industry experts confirm that Audinate's Dante is still the leading professional audio protocol, and that development in video is on track.

He also adds that Audinate tends to be conservative with its guidance. Jefferies cuts its target price 39% to A$11.00. Shares are at A$8.75 ahead of the open. ([email protected])

(END) Dow Jones Newswires

Some quick notes from some of the brokers who cover Audinate (I think @mikebrisy was looking out for this?)

Morgan Stanley: Overweight PT $10.50

1st look at AD8 AGM - large downgrade to FY25e + guidance pulled:

• Delivered 1Q25 US$7.2m gross profit + 2Q25 expected to be broadly similar

• AD8 currently run-rating at c.US$28.8m FY25e GP, a material miss vs VA cons of c.US$42m / AD8 guide of FY25 US$ GP "marginally lower" than US $44.5m FY24 GP

• Weak 1Q25 driven by customer inventory normalisation and soft demand - although 1Q/1H weakness was expected, magnitude still surprises negatively

While AD8 is making progress on adoption (design wins +22% / interest strong on Certification programs), uncertainty is high with 1Q25 seemingly a large shortfall vs internal expectations when FY25 guide given in August

Questions we have:

• What's changed between August guide and 1Q25 result noting a seemingly large gap?

• How has customer feedback / tone changed?

• Are there increased competitive pressures?

• Cyclical weakness across verticals?

• What are the "strong demand indicators" called out?

UBS: Neutral 12m PT $12.20

Headwinds ongoing despite incremental positives

A soft 1Q25 update, with further downgrades to GP g/dance - reflecting ongoing challenges including softer demand, shorter lead times, increased inventory and slower clearance of inventories from manufacturers. While AD8 expects this period to be transitory (FY26 return to growth), uncertainty (esp. regarding Audio growth) is likely to sideline some investors in the near-term (in our view). That said, there are some incremental positives, namely 1) 2H25 new AVIO products and a premium version of Dante Virtual Scorecard expected to contribute to 2H25 earnings; 2) 1Q design wins +22% y/y; and 3) Dante certification and training programs remain strong. Our view around the strength of the business, the competitive moat and the structural thematics underpinning the story remain unchanged, however we recognise that the near-term uncertainties need to be worked through

UBS analysis

1Q was always expected to be the weakest quarter, given the need to work through the over-ordering by a large customer (UBSe Qtrly 1Q $8.8m / 2Q $11.2m / 3Q $11.5m / 4Q $11.8m). However the run-rate of 1Q25 GP (US$7.2m / A$10.6m) is expected to continue into 2Q, which we interpret as another print of US$7.2m. This implies 1H25 GP ~US$14.4m -28%/-30% vs UBSe/Cons. Assuming current FX (AUDUSD $0.67) and cost growth at 7%, this equates to 1H25 EBITDA of A$-3.2m vs UBSe of A$4.2m. If we assume a continuation of the expected 2Q25 miss vs UBSe (ie US$-3.9m vs UBSe in 2Q25), our initial analysis suggests FY25E EBITDA of A$-5.8m (vs UBSe A$12.5m). Assuming an ongoing +US$2m quarterly improvement vs original UBSe in 3Q/4Q implies FY25E EBITDA of A$3.1m

1Q25 trading update

Key Points: 1) 1Q GP US$7.2m (A$10.6m), with headwinds to continue into Q2FY25 (run rate in line with Q1). 2) 7-9% cost growth (in line with prev. g/dance) expected for FY25, below annual cost growth of 28.5% over last 3 years. 3) Growth drivers include increasing adoption of Dante tech, and launch of new AVIO adaptor products and premium version of Dante Virtual Soundboard. 4) Design wins in Q1 FY25 up 22% vs PCP. 5) Dante Certification & Training programs remain strong, with attendance >4,000 per month a contributing driver of global Dante AV installations

Valuation: $12.20 PT, Blended 2yr fwd EV/Sales to sales CAGR / DCF valuation

DISC: Held in RL & SM

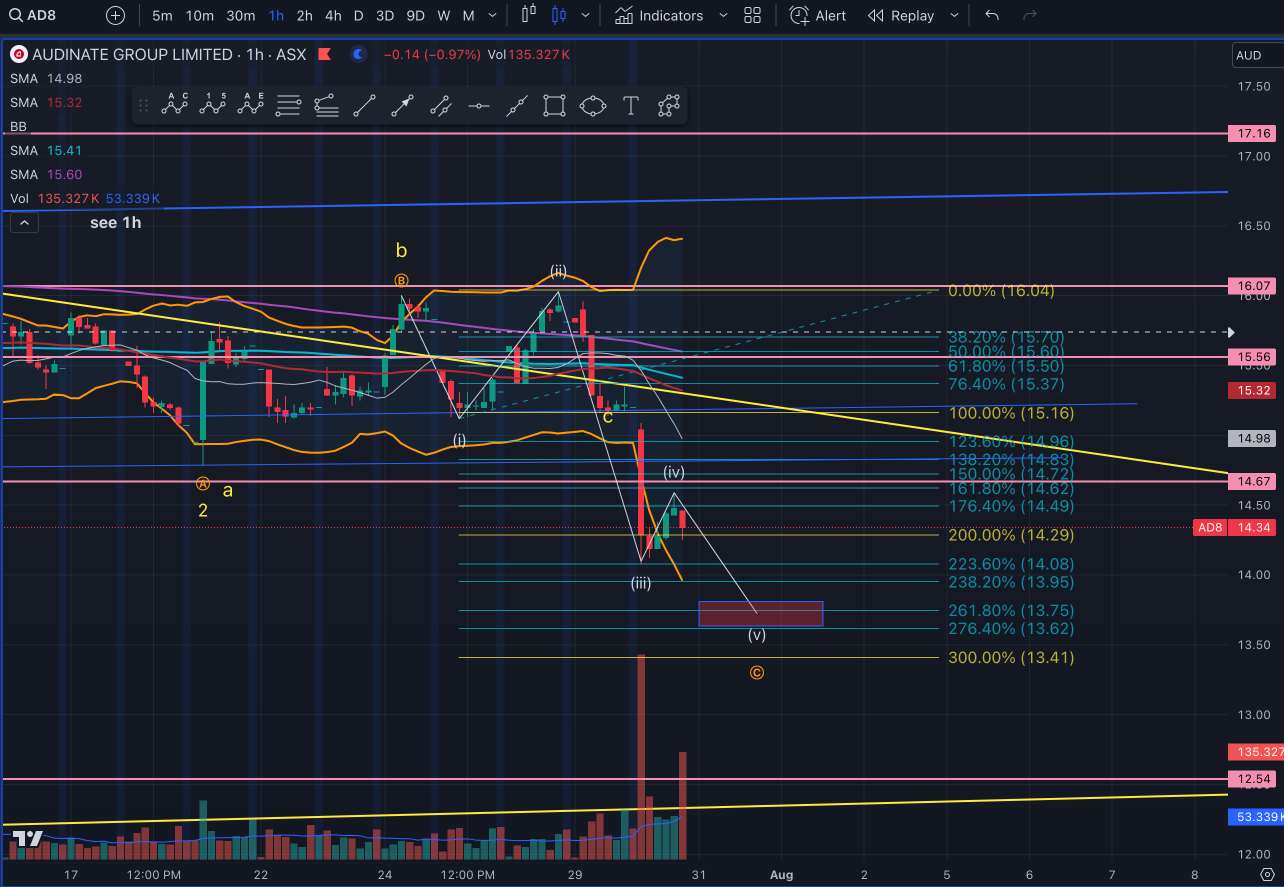

Chart Update Tues 30th July

So after todays info and the explosive move down for w(iii) (dropping harder than the norm for a w(iii) ) we should be seeing the next stop at 13.75 ish for w(v).

however now we are getting close to the main rising Yellow trend line & Supp level (pink horizontal line) below (as well as 2 x Blue Trend lines).

Zooming out on the 1d

What I thought might have been a w1 around June 24th has now been invalidated as we have taken that whole wave out. Also what I thought was the Super Cycle W2 now gets kicked further down the chart to the next major bottom to come.

There is loads of Supp down between the 12.54 - 13.03. When stocks drop close ish to good support they nearly always test it out. I will have to wait and see how it plays out over the next couple of weeks to see if its going to head down to those prices.

Also note the white Retracement levels on the left side of the secobd chart. It blasted below the 38.2% retrace of Supoer Cycle W1 over the last couple of days which opens the door to head to the 50% retracement level (circle on second chart) which aslo happens to be at those price levels with all that support.

Watch & Wait

AD8 down about 10% over last 2 days on very low volume. Topped up today at 14.28. Looks like a broker note from Macquarie may be responsible today with a price target of 14.40

Here's Nick Maxwell's take on Audinates results yesterday.

Most of his commentary along the same lines here on SM.

https://arichlife.com.au/audinate-asx-ad8-share-price-recovers-on-fy-2024-results-release/

On Livewire today: Should you buy the dip on Audinate?

With Elston Asset Management's Justin Woerner

This has the potential to go either way at this point. It is setup to make both direction feasible. Its either going up to wave i or down for wave C. Long term it looks up obviously however 10min 30min 1hr chart look like they want to reset dropping it down for a C wave them it will have the strength to run up for wave i more convincingly.

AD8 Ceo Aidan Williams Interviewed today on Ausbiz.

https://ausbiz.com.au/media/audinates-record-profit?videoId=37361

this would have to be one of the most enthusiastic valuations of recent dates..

Moaty ASX share crashes to five star price

Audinate's forecast for 2025 sent its shares sharply lower. Here's what went wrong and what we think matters in the long-term.

Mentioned: Audinate Group Ltd (AD8)

Audio networking company Audinate (ASX: AD8) updated markets this week and the reaction wasn’t pretty.

The company, which we recently highlighted as a high quality small-cap stock, saw its shares plunge 50% before recovering to finish around 30% behind.

Morningstar’s Audinate analyst Roy Van Keulen has decreased his Fair Value estimate for the shares but maintained that they offer value for long-term investors.

Before we dig into the results and the longer term outlook for Audinate, a quick reminder that you shouldn't consider individual shares or funds without having a solid investing strategy in place first. Here is Mark LaMonica's step by step guide to crafting one.

How does Audinate make money?

Audinate’s Dante protocol has become the world’s most widely used protocol for digital audio networking. Over 400 equipment manufacturers including Bosch, Bose, and Yamaha license the Dante protocol to enable digital delivery and management of audio for audio-visual (AV) products, such as microphones, mixers, and speakers.

Dante is enabled in over 10 times as many products as its nearest competitor, Ravenna. AV products using the same protocol work well together, while products on different protocols experience more friction. While two protocols could theoretically be installed on the same device, the extra cost of doing so for manufacturers makes it less likely.

Taken together, Van Keulen thinks that Audinate’s business can benefit from network effects as the market for digitally networked audio devices grows. This underpins his view that Audinate has a Narrow economic moat, something we define as a structural advantage that can deliver outsized returns on capital for at least 10 years.

Why did Audinate shares fall?

Audinate’s revenue and profit for fiscal 2024 were largely as expected. But investors were caught off guard by a forecast revenue decline in 2025. This was considerably lower than the 20% or higher growth that was expected by most analysts covering the company.

The coming revenue slowdown stems mostly from two factors – one of which was always likely and one of which could be seen as a long-term positive.

The first headwind was that 2024’s sales were boosted by a bigger than usual backlog of orders being cleared. This meant that 2025’s sales were always going up against a tough comparable. This was expected, but the magnitude of this appears to have been underestimated.

The second factor is Audinate’s continued shift in revenue mix from hardware products – mostly chips, cards and modules that are placed inside AV devices – to lower ticket but higher margin software revenue. This shift weights on sales but helps Audinate keep a higher percentage of sales as profit.

The long-term view

Van Keulen expects that Audinate’s strategy will continue to focus on accelerating the secular transition toward digital audio networking. This market is still at an early stage – Van Keulen estimates that digitally enabled audio devices were around 10% of new device sales in 2023, up from 5% in 2016.

Analog networking continues to be the dominant technology, with switching costs from existing installations and digital networking being cost prohibitive for lower-value devices and use cases. However, a continued transition to digital networking looks likely.

Digital networking requires far less cabling than analogue setups do, a big cost saving. It also doesn’t experience losses in audio quality over longer distances in the same way that analogue setups can.

Audinate is also trying to gain a foothold in the video networking market, however, the market is at a far earlier stage due to its greater technical difficulty – and Audinate does not currently enjoy anything like the dominance it has in digital audio. Van Keulen does note, though, that its existing relationships with equipment manufacturers and audio professionals could put them at an advantage.

How much could Audinate be worth?

Van Keulen revised his Fair Value estimate for Audinate down to $18.50 per share.

This valuation reflects an assumption that Audinate can grow its revenue at an average of 17% for the next decade. The main driver here would be further growth in digital audio networking, a market that Van Keulen thinks Audinate is set to dominate.

If network effects make Dante a “must have” in digital AV devices, this could give Audinate pricing power and lead to higher profit margins. The continuing shift in revenue mix from hardware to software products is likely to boost these further.

At current share price levels, Audinate shares command a five-star Morningstar rating. This means our analyst thinks they trade at an attractive discount to Fair Value. While 2025 looks likely to be a year of transition for Audinate, Van Keulen thinks it could precede a resumption in growth.

Van Keulen attaches an Uncertainty rating of High to his valuation. It remains impossible to know how big the audio networking market will prove to be. He also sees technological disruption and cyclical demand for audio devices as other potential risks.

Chart Update 2nd Aug 24

If you look back at my last update, we were working on the yellow ABC count down which completed this morning. During that yellow ABC however, another one formed inside (Orange ABC). You will notice the ellipse target box just below which has many strong support levels. I can't tell you which one will be the bottom. I will wait to see the first impulsive waves 1/2 up before I consider entering

Thurs 27 Jun Chart update

Wed 24th July 24

Should be looking for a small w(ii) down while 1h stoch resets

FWIW Morningstar has recently initiated coverage of Audinate at a four star (undervalued) rating with their fair value estimate of $23

Analyst Note | by Roy Van Keulen

We initiate coverage on Audinate with a fair value estimate of AUD 23 per share. We assign Audinate a narrow economic moat based on network effects. We forecast revenue to grow at a 10-year CAGR of 22% and EBIT margins to expand to 36% by fiscal 2033 from 1% in fiscal 2023. We use a weighted cost of capital of 9%. We assign Audinate a Morningstar Uncertainty Rating of High and rate its Capital Allocation as Exemplary. At current prices, Audinate shares screen as materially undervalued and not reflective of our view of Audinate as a well-managed high-quality company with a large and highly winnable market opportunity

Audinate’s Dante protocol has become the world’s most widely used protocol for audio networking. Today, there are over 4,000 products available which are enabled with its protocol, which is more than 10x its nearest competitor. Audio networking protocols allow professionals in the AV industry to connect, control, and manage their audio systems with minimal friction. Network effects arise from strong interoperability within networking protocols, and limited interoperability between them. In other words, products using the same protocol work well together, while products on different protocols experience more friction. AV professionals therefore prefer using products which are on the same protocol and prefer using protocols with a large catalogue of available products and widespread adoption. Given Dante’s extensive lead over its competition, we see AV professionals gravitating towards the Dante protocol. OEMs, in turn, prefer building products which are in demand by AV professionals, thereby creating a network effect. Because of these network effects, we consider the audio networking market as highly winnable

Business Strategy and Outlook

We expect Audinate’s strategy to primarily focus on accelerating the secular transition toward digital audio networking. Secondarily, we expect Audinate to focus on building out its nascent business for digital video networking

Audinate’s Dante protocol has become the world’s most widely used protocol for digital audio networking and boasts a more-than 10 times lead over its nearest competitor, Ravenna, in terms of the number of products enabled with the protocol. Given Dante’s dominant market share, we see little remaining upside for Audinate from gaining incremental market share from direct competitors in digital audio networking. However, we do expect Audinate to use its network effect, its existing customer relationships, and its scale on research and development to accelerate the AV industry’s transition toward digital audio networking. Specifically, we expect Audinate to continue creating new hardware solutions and reference designs that unlock new device use cases and to continue developing new software solutions for AV professionals. We estimate Audinate has around 10% market share in audio devices, which leaves Audinate with a large and highly winnable market opportunity, as the industry digitizes. Additionally, we expect Audinate to gain significant pricing power, especially in its software segment, as its network effects continue to strengthen

We also expect Audinate to continue developing its nascent digital video networking business, although we view this as a more uncertain and likely less profitable opportunity. Video networking has unique challenges compared with audio, primarily due to the larger data intensity inherent in video data delivery. Because of this, digitally networked video uses various compression technologies that are usually not compatible with each other and therefore hinders the establishment of network effects. However, we believe network effects from Dante’s audio solutions will help pull in AV professionals, who are already familiar with the Dante protocol, which in turn pulls in original equipment manufacturers, or OEMs

Economic Moat

We assign Audinate a narrow economic moat based on network effects in its digital audio networking protocol, Dante. We expect Dante to become the standard for digital audio networking, and for digital to continue to take share from analog networking

Dante is the world’s most widely used protocol for digital audio networking. Over 400 OEMs, such as Bosch, Bose, and Yamaha, license the Dante protocol to enable digital delivery and management of audio for over 4,000 products, such as microphones, mixers, and speakers. Dante’s closest competitor, Ravenna, has fewer than 400 products enabled with its own protocol, and works with fewer than 100 OEMs

Network effects arise from strong interoperability within networking protocols, and limited interoperability between them. When audio products are enabled with Dante, these products can be easily discovered by- and connected to the Dante- network and other Dante-enabled products on the network, which is required for their audio delivery to be synchronized. Such automated discovery and connection provides a compelling benefit for AV professionals because it allows them to easily add, move or remove audio equipment to their installations. This benefit may even exceed any perceived brand value toward specific OEMs. Products not enabled with Dante can still be added to the network through AES67, which is an industry standard for audio over IP, but the networking process is more cumbersome. Similarly, competing networks can add Dante-enabled products through a more cumbersome networking process. Given the limited interoperability between the various networking protocols, Dante’s leadership position of more-than 10 times in terms of the number of enabled products results in clear demand pull from AV professionals

OEMs, in turn, need to cater to the preferences of AV professionals and are therefore increasingly choosing to enable their products with Dante, which leads to Dante’s leadership position expanding over time and a positive flywheel between supply and demand. Dante today enjoys a more than 10 times lead over Ravenna, in terms of enabled products, which is a significant improvement from a 6 times lead in 2017. We also expect Dante’s leadership in terms of deployed products to be even larger than its leadership position in available products, due to Dante’s larger network of interoperable products making its products more appealing to AV professionals

We view analog networking as Audinate’s primary competition. In analog networking, AV professionals connect products by drawing physical cables between them. This cabling is usually many times pricier than digital networking because the cables need to be drawn the full distance between devices. By contrast, the Ethernet cables used to connect Dante-enabled devices can typically be drawn to the nearest Ethernet port in a building. Many devices also don’t require separate power cabling after they are connected with an Ethernet cable. This provides material savings in terms of hardware and labor costs. Additionally, over longer distances, analog audio cabling can suffer from reduced audio quality, which digital audio delivery does not suffer from. Unsurprisingly, the industry has been rapidly digitizing. We estimate that digitally enabled audio devices doubled their market share as a share of new sales to around 10% in 2023, from 5% in 2016. Analog networking continues to be the dominant networking technology, primarily due to switching costs from existing installations and digital networking being cost prohibitive for lower-value devices and use cases

We don’t yet see similar network effects in Audinate’s video networking business. Video networking has unique challenges compared with audio, primarily due to the larger data intensity inherent in video delivery. Because of this, digitally networked video uses various compression technologies that balance speed, cost, data, and quality for specific use cases. As a result, products using different technologies are often not compatible, not just in their discovery and connection, but also in their data delivery. The industry is therefore still much earlier in its digital transition

We do believe Audinate enjoys several distinct advantages in pursuing video networking. Audinate has existing relationships with hundreds of OEMs, many of which also make video products. We believe offering bundling deals through these established customer relationships has traces of an intangible moat. A subset of AV products also has networking needs for both audio and video, which makes them an attractive market entry point for Audinate. Also, over the years, Audinate has been training hundreds of thousands of AV professionals on its technology. These professionals already know how to work with Dante-enabled products and are familiar with the brand, which, we believe, makes for an appealing proposition for OEMs. So far, Audinate is demonstrating strong momentum on all relevant metrics for its video networking business. These include growth in the number of OEMs licensing the protocol, the number of products enabled with the protocol, and in the number of products shipped with the protocol. However, this is from a small base, and we consider the market still up for grabs

Fair Value and Profit Drivers

Our fair value estimate for Audinate is AUD 23 per share, implying an enterprise value/sales multiple of 21 on our fiscal 2024 estimates. We use a weighted average cost of capital, or WACC, of 9%, reflecting high revenue cyclicality, medium operating leverage and low credit risk

We assume revenue to grow at an organic CAGR of 22% over the next decade, driven primarily by Audinate expanding the market for digital audio networking. We expect EBIT margins to expand to 36% by fiscal 2033, compared with 1% in 2023. We expect Audinate’s operating margins to expand because of sales and marketing spending, as well as research and development declining as a share of revenue, once its network effects strengthen. We also expect gross margin expansion as strengthening network effects result in increased pricing power

Risk and Uncertainty

We assign Audinate a Morningstar Uncertainty Rating of High

The AV industry is still in the early stages of digitizing, which means there is still high uncertainty regarding the ultimate market opportunity for Audinate’s products. Given that we view competitive risk as low in digital networking for audio, due to Audinate’s economic moat based on network effects, our uncertainty revolves around the market’s ultimate size, rather than Audinate’s share within this market. Within video, we see additional uncertainty around Audinate’s ability to take market share.

We see high risk from economic cyclicality. Audinate’s devices or license designs are used in products which are highly discretionary. Although these products are often part of systems which eventually need to be replaced, customers can choose to defer these purchases in challenging economic times

We see high risk from technological disruption. Audinate’s Dante protocol primarily uses Ethernet cables for data delivery. We cannot rule out other methods of data delivery eventually substituting Ethernet cables, such as wireless internet or other technologies

Capital Allocation

Audinate has an Exemplary Capital Allocation rating, reflecting our assessment of a sound balance sheet, exceptional investment efficacy, and appropriate shareholder distributions

Audinate’s balance sheet is sound. As of the end of December 2023, it held significant cash with no debt

We rate investment efficacy as exceptional. Although Audinate is supported by network effects, when it started, it faced the traditional cold-start problem, whereby no AV professionals wanted to use Dante’s protocol because there were no products supporting it and no OEMs wanted to develop products because no AV professionals wanted to use them

Audinate demonstrated exceptional execution to solve this problem. Audinate found the right entry points into the market, strategically attracted early customers by making them part owners of the business, developed a product portfolio with the right breadth and depth and delivered the right levels of customer service. All of these competing objectives were achieved with limited resources, which demonstrates to us exceptional capital allocation skills

Audinate does not currently return capital to shareholders, which we view as appropriate given the opportunities for investment into the business

DISC: Held in RL & SM

AD8 down around 30% since high of 23.50. How low will it go?

Rob Goss has resigned as CFO, having been with the company for 7 years. The market didn't take this news too well with shares off 4.5% on a day when you might have expected them to be up 1 or 2 percent with the market. But $AD8 is highly valued, so any news likely generates an outsized reaction.

However, I dont read this as an area of concern given that he is staying through the next reporting season and will prepare the Annual Report. That's not the kind of departure to get the jitters over. (You do, when they leave the building with a cardboard box)

I've recently re-initiated a position in $AD8 in RL and SM and, when I get around to it, I must write a straw about "Audinate - why I changed my mind". But that's for another day.

Mulling over whether to top up a little more, as I am only at 3.8% in RL, and starting to like the value from here.

Disc: Held in RL and SM

nice little jump today, however I hate to say it still, Im not convinced. Im still seeing potential for the down side. Ill see how this next pull back plays out.

Fri 31.05.24

Still a bit more in the tank to give back. I am suspicious of there still being a little more to drop yet. What I'm really be looking for is the first waves 1&2 up to see how they form. This red bar this morning confirms the sentiment still hasnt turned positive enough yet for it to start its upward swing yet. There is definitely movement around this price point though as you can see by the Volume at this level. Note we are at the 38.2% level at $15.05. 50% retrace level of the stock since inception would be $12.45 ish

Im watching that tiny ABC down marked in Orange for now.

You will note the Pink horizontal support line @ $14.06 though. If it gets there I will probably start a position there.

Possible next price target down is $13.52 - $14.04

Also note this came in this morning on Trading View,

Well AD8 made my target, however I do feel there still could be another leg down. Thats purely because yesterday, Jefferies put a PT of $18 (that would take to a resistance level) and also the retrace from the top of major W1 hasn’t even reached 38.2% of W1. Ideally Id like to see it get down to 50% at least however its too early to look that far ahead. For reference, most W2 retraces drop to 61.8% of the prior major wave 1 up.

As you can see from my updated chart, I will be watching closely to see how the next wave up to that resistance takes shape. If it takes 3 waves up to it then I will be looking for a C wave down from that $18 level. I didnt take a position yesterday as I'd like to wait this out and see how it takes shape. Wave A-B will tell me more once it plays out. If your in then you may get 10% ish out of this leg up but watch for the resistance @ $18

Just had a chance to do my technical analyse of AD8. The chart below shows thoughts. without any extreme positive news. I will re evaluate the chart when it arrives there. The yelow line is the path I believe it will take roughly (may happen quicker or longer)

1d Chart

AD8 will be in the ASX200 from start of trade on 18 March. Growth begets growth! Beginning to feel very much like surprises will be to the downside - but this is a long term hold for me.

Held IRL and SM.

Audinate CEO on Livewire:

https://www.youtube.com/watch?v=DuSbMF5oO0E

Audinate delivers record revenue and EBITDA in 1H24

Key 1H24 financial highlights:

• Revenue increased 47.7% on 1H23 to US$30.4 million (A$46.6 million)

• Gross profit (GP) of US$21.8 million, up 50.1% – gross margin of 71.8%

• EBITDA of A$10.1 million, up 137% on 1H23

• Net profit after tax of A$4.7 million, improved from A$0.4 million loss in 1H23

• Operating cash flow A$11.8 million, improved from A$1.8 million in 1H23

• Strong cash and term deposits balance of A$111.7 million

Audinate announced that Dante AV hit a major milestone with 50 manufacturers

Audinate Group Limited (ASX:AD8), developer of the industry-leading Dante® AV-over-IP solution, announced it now has reached 50 manufacturers licensing Dante AV technology to build networked video devices. Kramer, Blustream, Magewell, Kiloview, Zenwin, Aavara, and Infobit AV are a few of the most recent partners that have joined the Dante AV ecosystem. There are now over 60 products available or soon to launch, including cameras, encoders, and decoders.

( as compared to the end of FY23 figure as following screenshot of 34 OEM brands)

A helpful update for November 2023. Only 7:22 long. Basically confirms what @Slomo covered in a previous post.

https://www.youtube.com/watch?v=oGzdDTc3u7w&ab_channel=Dante

Audinate Focuses on Dante in Rebrand with Hopes of Being Known as an AV-over-IP Company

November 28, 2023 - Featured, ProAV News, rAVe [PUBS], rAVe Europe, rAVe Europe Featured, rAVe Europe News, RTA

Audinate made it clear the company wants to be known as an AV-over-IP brand — not just an audio-over-IP brand — with a new logo, tagline, etc. Audinate will emphasize the Dante brand more in the market, given the strong connection and recognition with customers. The Dante AV-over-IP platform tagline, “One Connection. Endless Possibilities” will be used to help strengthen the Dante brand over the Audinate branding. The new Dante logo also captures this concept, taking one connection in multiple directions.

“Long the de facto standard in networked audio with more than 550 manufacturers producing over 3,800 products, adding video, control and management has transformed Dante into a complete AV-over-IP platform,” said Joshua Rush, chief Mmarketing officer at Audinate. “This new positioning crystalizes what Dante offers the ProAV industry.”

As the parent company of Dante, Audinate has always been focused on pioneering the future of AV. The new brand platform for Audinate preserves the company’s respected engineering legacy while creating a more human and approachable brand.

Alongside the new branding that will roll out in the coming months, Audinate will launch new separate websites for Audinate and Dante in early 2024, including an initial microsite launching today at https://getdante.com

Key take always from the AD8 AGM for me (apart from TAM expansion per separate straw) were:

There are 2 main strategies

1) “Winning in video”, this will include M&A ($1.2bn Rev Video Mkt), this is their #1 priority.

2) “Building out the operating system of AV” ($1.4bn Rev Software & Services Mkt), this is the big Long Term prize.

So they have a long runway of reinvestment opportunities at (a high expected ROI).

Technically there's a 3rd strategy which is to dominate Audio, but I'd say this is just a matter of time and the focus of CEO Aidan's discussion is all around video. Software & Service (operating system for AV flows from that).

Execution on the Video strategy is everything, and I would say if they don't manage this, the thesis that supports the current share price is badly damaged.

If they can do in Video what they have done in Audio to dominate the Video market, S&S should be easier as they will be the de facto AV operating system and be able to build a product suite earning high margin SaaS Revenue on top of this.

The recent $70m Cap raise was to expedite their Video investment via M&A and in-house Dev (Capex), so aligned to this Video focus.

Expecting minimal growth in Opex so should start to see Operating Leverage in evidence in the next few years.

This Video strategy is de-risked in a few ways.

1) They are following the same playbook as they did in audio where they have now effectively won. Their Dante protocol has 9% of the available market (but 12x the penetration of their nearest competitor). Trajectory is also positive, as this was 6x a few years ago and will soon be > 12x as more design wins translate into OEM (product) deployments.

2) They have a very good name and relationships in the AV industry from their work in Audio. There are a lot of synergies for AV Engineers and OEM’s to have a single integrated protocol across Audio and Video combined – as they have won in Audio they can be the only integrated protocol across both.

3) The Video market is more fragmented than Audio with no clear competitor and the incumbent is inertia (See separate straw on NDI).

4) They have integrated 2 small acquisitions that have allowed them a rapid entry into the market increasing their products from 7 to 48 in FY23. It took more like 6 or 7 years to grow this part of the Audio build out.

Note: The above is not what they spelled out specifically in their presentation (not sure why - building a monopoly concerns, don't want to spook the competitors?), it's just me pulling a few things together from the AGM preso, FY23 results and ASX material and what Aidan's been saying for a while. So I could be off the mark here and reading into what I want to believe...

Disc: Held (largest position)

Inspired by @mushroompanda's DD on NDI, I asked Aidan (CEO) about them as a competitor a the AD8 AGM last week.

He gave a pretty full answer that left me feeling like he had their number and is quite confident of out-competing NDI over the long term – you would hope he thinks this…

Here's some of his comments (paraphrased from my shorthand).

NDI is probably the tech most like AD8 from a technical POV.

NDI is stronger in stronger in broadcast / live production environments. So they are more market specific, but looking to branch out.

AD8 is stronger in commercial installed AV which is a much larger market.

AD8 have advantages over NDI on price, technology, market and people (NDI have lost a lot of staff).

Dr Andrew Cross (https://www.linkedin.com/in/adjc/) no longer works at NDI (he was their founder / CEO / spirit animal).

In summary, NDI is one to watch and will probably remain the biggest competitor for AD8 in Video.

This needs to be seen in a larger context though which I will discuss in a separate straw on Strategy.

Disc: Held (largest position)

Held IRL. Quite happy continuing riding the growth story:

Looks like Audinate is taking advantage of the rocketing share price to raise capital. Wonder if there will be an SPP for us mere retail investors.

My notes on digesting AD8's sterling results. Focused more on the operational aspects of the results rather than the financials.

Only thing that surprised me was the headcount changes. Not saying its a bad thing at all (constraining headcount is often an organisational "own goal" if it ends up constraining growth), but rather the fact that it went against what the CFO Rob Goss told us in Feb 2023 where they saw the current headcount as sufficient to support 30% growth and it caused a $5.1m cost increase. Something I noted to myself to keep an eye on in FY24.

Discl: Held IRL

GOOD

Financials

- Sharp increase in revenue despite significant challenges with supply chain issues - 40% YoY to US$46.7 million (A$69.7 million) - AUD revenue grew 50.6% to A$69.7 million aided by favourable A$/US$ currency impacts

- FY23 closes the chapter on a challenging 3-year period in which we delivered US$ revenue growth CAGR over 31% despite COVID induced downturns and chip shortages.

- EBITDA was $11.0 million in the year ended 30 June 2023 compared to $4.3 million in the prior year ended 30 June 2022.

- Milestone net profit before tax of A$1.4 million (vs $4.4m loss in FY22)

Cash Flow, Cash Position

- Positive free cashflow of $2.5m in 2H23

- >100% cash conversion in FY23

- Well capitalised with cash and term deposits of $40.0 million at 30 June 2023, no debt

Operations

- Covid-Related Supply Chain Impacts are now in the past - Revenue no longer gated by chip supply

- Successful transition of Chips, per plan (1) Last Brooklyn 2 orders - transition to Brooklyn 3 (2) Broadway chip - now end-of-life

- Achieved a record 142 design wins with OEMs, up 12.7% from FY22, 26 were from video

- Total number of OEM brands shipping and developing Dante-enabled products grew to 538 after accounting for some rationalisation in OEM numbers associated with chip shortages & supply chain challenges - 34 OEM brands now have licensed Dante video products

- OEM customers released another 261 Dante-enabled products taking the total to 3,853 - including 48 products for Dante Video

- Strong Progress on Video Products and Integration of Video into the Dante ecosystem

- Launched Dante AV-H and Dante AV-A - new revenue streams for FY24

- Video support to Dante Domain Manager

- >10,000 video endpoints shipped

- >$3m revenue from video

- 26 of 142 Design Wins were video - 18.3% of Design Wins

- 48 Dante Video products launched in FY23 vs 7 products in FY22

- Video is growing 3x faster than Audio

- Launched Dante Connect - Cloud based solution to deliver audio directly from location to cloud services that enable seamless online production

- Launched Dante Professional Services June 2023

- With the worst of COVID and supply chain pressures receding, the Company anticipates audio OEMs will recommence transitioning products using Dante chips, cards and modules to software Dante implementations. This migration is expected to be relatively neutral for gross profit dollars and result in gradual margin improvement and a slight moderation in headline revenue growth. Irrespective of the pace of this migration, the Company expects % growth in US$ gross profit dollars in FY24 to be consistent with historical performance.

- Backlog at near-record levels - to be fulfilled in 1HFY24

FY24 Outlook

- In our FY21 Annual Report Chairman, David Krall, said “We expect that Audinate will double revenue in the medium term”, and Audinate anticipates achieving this ambitious goal in FY24.

- Growth in USD gross profit consistent with historical performance

- Targeting >30,000 video endpoints from the current ~10,000 end points

- Further growth in uptake of video

NOT SO GOOD

GP Margin Reduction

- GP margin has reduced from 74.7% in FY22 to 72.1% in FY23 as CCM growth outperformed software product and higher priced spot raw material purchases - movement due to product mix (Viper) and temporary Brooklyn III costs

- Gross margin was 71.2% in the first half affected by supply chain impacts, improvement occurred in 1HFY23

Headcount Increases

- Headcount increased 10% (178 to 197), further addition of 15% headcount in 2024 vs "current headcount can support 30% growth" when we spoke to the CFO,Rob Goss in Feb 2023 - a $5.6 million increase in employment costs as headcount grew from 178 to 197 at 30 June 2023.

- 15% headcount allocated to growth to ensure scalability, mostly to Manilla

- Not an issue if additional headcount is allocated to growth (it is) and if revenue growth can absorb it (it appears so), but this is a clear change in plan

WATCH

- Higher revenue expected in 1HFY24 as backlogs are cleared, still expect 2HFY24 revenue to be higher

- Cash flow positive

- Margin to move back to ~75% given Covid issues have subsided

- Headcount movement and costs vs revised plan

- Traction of Dante Connect Cloud Solution

- Traction of Dante Professional Services and contribution to revenue

- Design win growth - this is a leading indicator of future Dante products

RISKS

- M&A opportunities, how they bolt-on to the Dante suite and acquisition cost

- Macro factors, slow global growth, higher interest rates etc - AD8 considers these to be BAU scenarios that needs to be managed

SUMMARY

- Very bullish results

- Continued traction on Audio, good evidence of significant positioning and step uptake of Video from FY22

- Covid Supply Chain issues are over and successfully transitioned to new chips - revenue no longer gated by chip supply, paves way for “unconstrained” growth

- Guiding for same level of revenue growth in FY24

AD8 released FY23 result this morning and it is as expected amazing result.

Revenue

Cash Reciept

Expense

Operating Cash

Audinate (AD8) is another company to release results on Monday.

During the FY22 results presentation it was forecast that revenue would double over the next 3 years. This forecast was confirmed more recently.

To achieve that result requires revenue CAGR of 30% which implies an FY23 target of A$60M. 1H23 revenue was A$30.8M so this is a solid expectation.

Management also reported that costs had increased by 30% mainly to increase salaries and retain talent.

1H23 was borderline EBITDA positive with a A$0.38M loss after tax. This should only deteriorate if costs have continued to blow out.

Things to look for in the FY23 results:

1. Rev > A$60M

2. Staff numbers of 196 to 200.

3. Video revenue of > US$3M

4. Indication of pricing power and price increases on products.

5. Improved staff retention

6. An after-tax profit!!

The current share price of $10.30 is in the fair valuation range only if the revenue continues to grow at the forecast rate and there are no other nasty surprises. I notice the share price has increased 18% over the last 4 weeks so the market is expecting a good result.

Little snippet from Capital IQ Pro on sentiment for Audinate as I don't know my restrictions on reposting content from my trial subscription. Probably doesn't mean much in the grand scheme of things although I do wonder the interpretation of being 1% on sentiment.

But transcript and the recording helps understand the product a bit more at a high level.

Thought I'd post as I see the stock price has trended up since the last on market selling by the CEO.

Audinate released a presentation today and I found this slide very encouraging ( I don't remember seeing this before)

The number of ODMs is a sign of new products coming into the market soon. workflow as per Audinate is:

and they also mention

RH Consulting creates reports every year for AV networked products. There release their report for 2023: https://rhconsulting.uk/blog/networked-audio-products-2023/

Some of the highlights:

Audio over IP

Video over IP

Sharing my notes and takeaways from the very insightful conversation with the AD8 CFO earlier this week. Likely to contain translation accuracy errors, please cross-check before relying on any information.

I walked away with much more operational and opportunity context behind the 1HFY23 preso and a much greater understanding and appreciation of the Video opportunity.

Disclosure: Currently hold AD8 IRL

General

- Digital Audio Network TAM ~A$400m annually - AD8 share is about 7-8%

- 550 OEM manufacturers use Dante in their products, repeat revenue model, similar to Intel - chips, cards, software

- Very sticky customers but the downside is that AD8 is beholden to the manufacturers product rollout plans - impacted by the manufacturers supply chain constraints etc

- Moat is not so much the quality of the technology, but rather the continuous adoption of the Dante technology -

- Inter-operability across products which are on the Dante platform - “It Always Just Works”

- Transport and synching of audio signals and signal speed is the secret sauce

- IP protection from 50 patents globally, have security measures to detect Dante-clones

- Defacto standard for Audio equipment

- Huge base of passionate Dante-trained professionals ~200k

- A manufacturer will typically make and sell products for a 7-8 year product cycle

Margins