Top member reports

Price History

Premium Content

Last edited 4 months ago

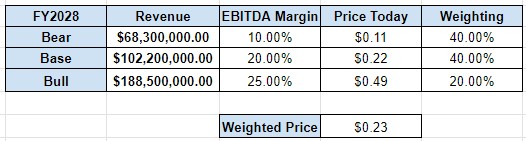

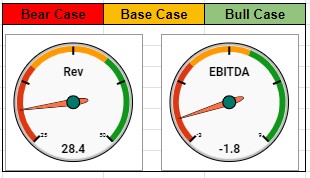

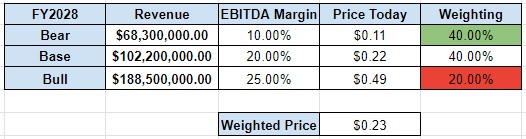

Valuation

Premium Content

Notes

Premium Content

Straws

Sort by:

Recent

Content is delayed by one month. Upgrade your membership to unlock all content. Click for membership options.