Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

04-Dec-2023: Share-Purchase-Plan-Result.PDF

It was more than 2 x oversubscribed and applications above $1K will be scaled back.

Excerpt from today's announcement (link to full announcement above):

The SPP received strong support from eligible shareholders, with valid applications totalling ~$43 million from 3,140 eligible shareholders.

As the total value of applications received under the SPP exceeded the SPP target size of $15-20 million, Aussie Broadband has undertaken a scale back, having regard to the pro rata shareholdings of eligible shareholders as at the record date (Wednesday, 1 November 2023).

The outcome is as follows:

- Eligible shareholders who applied for $1,000 of shares will not be subject to any scale back and will receive the amount they applied for, rounded down to reflect a whole number of shares. Accordingly, those shareholders will receive 281 new shares (for a total issue price $997.55), with their remaining application monies to be refunded

- Eligible shareholders who applied for more than $1,000 of shares have been subject to the scale back methodology having regard to their shareholding as at the record date for the SPP. The scale back methodology ensures that, subject to the $30,000 maximum application amount under the SPP, participating shareholders will receive an amount of new shares that:

- at least maintains their percentage shareholding in Aussie Broadband held prior to the announcement of the Placement and SPP (Pro Rata Amount), subject to a minimum allocation of 281 new shares; or

- is equivalent to their application if that is lower than their Pro Rata Amount.

Approximately 98% of valid SPP applicants will receive at least their Pro Rata Amount, with most SPP applicants receiving an allocation well in excess of their Pro Rata Amount.

Following the close of the SPP, ABB Co-founder & Managing Director Phillip Britt said ”We are extremely appreciative of the support of our shareholders and encouraged by the level of demand shown. We are particularly pleased to have been able to ensure that in the main our retail shareholders who participated in the SPP have been able to maintain or enhance their interest in the company. We now look forward to utilising the proceeds of the Placement and the SPP to generate good returns for all shareholders”.

In line with the SPP timetable, the shares issued under the SPP will be allotted on Wednesday, 6 December 2023 and are expected to commence trading on ASX on Thursday, 7 December 2023. Holding statements are expected to be dispatched on Friday, 8 December 2023.

A number of Aussie Broadband directors applied for and received their full entitlement under the SPP.

--- end of excerpt ---

I applied for the max $30K in the largest real money portfolio that I manage, so will be scaled back, but I won't know by how much until Wednesday.

18-Sep-2023: The following straw is one year old, but it's aged well I think. I've added an update at the bottom.

06-Sep-2022:

Aussie Broadband Ltd (ASX: ABB)

Website: https://www.aussiebroadband.com.au/

Sector: Telecommunications and Data, ICT (Information and Communication Technology), specifically ABB are an Internet Service Provider (ISP) and a provider of other Telecommunications services.

Value Drivers:

- Sentiment around the Telco sector in Australia, particularly the smaller end.

- Profitability and growth, increasing profitability, continuing growth, meeting and exceeding expectations.

- Maintaining a high NPS and increasing market share.

- Positive M&A.

Business Description and Competitive Advantages:

Company Overview (from: https://www.aussiebroadband.com.au/investor-centre/)

Aussie Broadband is a challenger internet service provider, with a reputation for providing high-quality internet and transparent customer service.

We have grown to become Australia’s fifth largest provider of nbn™ (NBN) services, connecting more than 300,000 residential and business customers across the country.

We offer a range of services across the residential, small business and enterprise segments, including broadband, VOIP (Voice over Internet Protocol), mobile plans and entertainment bundles through a partnership with Fetch TV.

https://www.aussiebroadband.com.au/blog/aussie-broadband-beats-the-big-four-at-customer-service/

Aussie Broadband | ProductReview.com.au

Aussie Broadband Review: Value-packed NBN Plans | Reviews.org AU

Aussie Broadband named “The most trusted telco brand in Australia” by Roy Morgan in their annual “Most trusted and distrusted brands” research (2022). Source: ABB FY22 Results Announcement (29-Aug-2022)

https://netpromoterscore.guru/aussiebroadband-com-au.amp

NPS Explained: https://customer.guru/net-promoter-score

ABB have very high customer satisfaction and promote themselves as being customer-focused with their call centre here in Australia. They go out of their way to ensure their customers are happy with the service they receive, and they take complaints seriously and investigate them thoroughly. Feedback from their technicians is also really good. From a quality of service point of view and also from a customer service POV, they are leaders in their industry.

Aussie Broadband are not the cheapest provider, but they are the best ISP in all other respects.

Which Australian ISP has the most satisfied customers? | CHOICE [27-May-2021]

Excerpts:

We gathered feedback from more than 1800 people for our ISP satisfaction survey so you don't have to settle for the devil you know. Or you might find out you're already with one of the best providers out there, meaning you can stay put with confidence.

Most common problems

Just under half (45%) of respondents had problems with their current ISP in the six months prior to the survey.

Aussie Broadband stood out with 76% of its customers reporting no problems with their internet, compared to Telstra (55%), Optus (50%), TPG (56%), iiNet (51%), and Vodafone (52%).

Aussie Broadband also scored significantly higher than the other providers for Connection Speed, Value for money, and Reliable Connection, i.e. ALL of the categories that Choice covered.

In the graphic above Choice was providing the results for all connection types and in the graphic below they are only covering NBN connections, however, once again, Aussie Broadband also scored significantly higher than the other providers for Connection Speed, Value for Money, and Reliable Connection, in addition to Overall Satisfaction, i.e. ABB were the clear winners in ALL of the categories that Choice covered.

There’s their main competitive advantage!

Market Cap and Share Price:

M/cap = $608m (at $2.56/share on 05-Sep-2022).

Share Price = $2.56 (05-Sep-2022). 12 month low/high = $2.45/$6.03.

Valuations:

From fnarena.com:

Of the 7 brokers that FNArena covers (being UBS, Credit Suisse, Morgan Stanley, Ord Minnett, Macquarie, Citi and Morgans), only two of them (Ord Minnett and Credit Suisse) cover ABB:

Credit Suisse - on 30/08/2022, Outperform, Target: $3.70, Gain to target $1.03

FY22 operating earnings were slightly ahead of expectations while guidance was below. Aussie Broadband has guided to revenue in the range of $800-840m with an EBITDA margin of 10-10.5%.

Additional investment in people and product development is planned, while the broker suspects inflationary pressures in a tight labour market are impacting the cost base.

Guidance also assumes a heightened competitive environment will be maintained over FY23 so any withdrawal of discounts from competitors could provide upside risk.

Outperform maintained. Target is reduced to $3.70 from $4.80.

Target price : $3.70, Price : $2.67 (30/08/2022), Gain to target $1.03 (+38.58%)

(excluding dividends, fees and charges).

Ord Minnett - on 30/08/2022, Buy, Target: $4.03 Gain to target $1.36

FY22 operating earnings were ahead of expectations with growth across all three of Aussie Broadband's segments. The main surprise for Ord Minnett was FY23 guidance of $800-840m in revenue and implying EBITDA of $80-88m, below the prior forecasts.

The broker accepts the business is investing in operating costs and overheads to support its customer service yet notes it is facing a more competitive market to win subscribers.

The broker forecasts more than 50% of the FY23 group EBITDA will be generated in the business segment. Buy rating retained. Target is lowered to $4.03 from $4.69.

Target price : $4.03, Price : $2.67 (30/08/2022), Gain to target $1.36 (+50.94%)

(excluding dividends, fees and charges).

In summary, the current recommendations (most recent, both as at 30-Aug-2022) from CS & OM are:

The entire 30-Aug-2022 update from OM is available here: https://www2.asx.com.au/content/dam/asx/broker-reports/2022/abb-update-ordminnett-2922.pdf

Note that Ord Minnett acted as a Co-Manager of the ABB share placement announced 7th September 2021 and received fees for providing that service, so they have likely placed clients into ABB and their views should not be assumed to be entirely independent and without any bias. This is usually the case with most broker reports however, and they can still contain some useful information and facts even if they are likely to paint the company in a favourable light.

See also the Commsec summary of broker recommendations towards the end of the next (Ratios/Metrics) section.

Ratios/Metrics:

From FNArena (https://www.fnarena.com/index.php/analysis-data/consensus-forecasts/stock-analysis/?code=ABB)

From Commsec:

They are a fairly young company, having only IPO’d in October 2020, so they’ve been listed less than 2 years at this point, hence not much data being available.

ABB was not profitable in FY21, but were profitable in FY22, however their share price has come down a lot lately meaning that they have become a lot cheaper. Their PE is fairly meaningless because their earnings are still low because they have just become profitable, however they are growing at a good clip and their metrics are moving in the right direction.

Debt / Balance Sheet Strength:

Net debt (including finance leases, excluding operating leases) was $138.3m at 30-June-2022.

Net Gearing on 30-June-2022 was 62.9% according to Commsec.

They were in a net cash position at 30-June-2021. The debt has come principally from their acquisition of OTW (Over The Wire) in the December-January period of FY22, which ABB believe has been a major acquisition that has propelled them to what they are calling Aussie Broadband 2.0 in the following slide from their FY22 Results Presentation (on 29-Aug-2022):

While their current debt is significant, it is understandable and, while worth keeping a close eye on, it should be eminently manageable and should be paid down relatively rapidly I expect over the next few years.

Another reason for the debt is that they have been building out their own fibre networks in some of Australia’s major cities. That infrastructure that they own is also providing them with a significant competitive advantage and assets that will provide benefits for decades to come.

Dividends:

No dividends yet. Only IPO’d in 2020. Have just become profitable in FY22.

Guidance:

29-Aug-2022: Trading update

Aussie Broadband has continued to grow over the first eight weeks of FY23. Total net adds (gross sales, less churn) were 15,332 across the enterprise & business, residential and wholesale customer segments. Of this, 1,572 were higher margin business, enterprise net adds. While there are several competitor low/no-margin offers in the residential broadband market at present, Aussie Broadband will not chase growth at any cost and is focused on striking the right balance between growth and margin.

The Company continues to successfully market to higher value residential customers who prioritise solution value and customer experience over price, while also focusing on converting higher margin enterprise & business and government customers within the Company’s growing pipeline of new customer opportunities. This strategy underpinned the growth in margin over FY22, and will continue to drive margin growth expected in FY23.

FY23 guidance

Based on current market conditions, operating plan and year to date trading, Aussie Broadband expects to generate revenue in the range of $800 million to $840 million in FY23.

Planned growth in higher margin business, enterprise and government customers, and with the full year benefit of Over the Wire, is expected to deliver an EBITDA margin (excluding integration costs) of circa 10.0% to 10.5%, up from 7.2% in FY22. This margin is after additional investment in people and product development to support longer term growth in Aussie 2.0.

With the Company currently in the early stages of FY23, there remains uncertainty around market conditions, in addition to a number of potential upside opportunities and downside risks as outlined in the investor presentation released today.

Commenting on the Company's positive outlook and continued growth in FY23, Mr Britt [ABB’s MD, Phillip Britt] said: “Having delivered continued growth across all key operational metrics and record financial results in FY22, Aussie Broadband is well positioned to deliver another record year in FY23. We have now well and truly started implementing our Aussie 2.0 strategy, with multiple attractive growth opportunities in the business, enterprise and government sectors that will underpin our ability to become Australia’s fourth largest communications and technology services company.

“The ingredients for our continued growth are evident. We are rapidly growing in the business, enterprise & government, and wholesale segments. Our unwavering focus on product and technology innovation, as well as customer service, has reinforced our “value” proposition for 5 customers and differentiated us from other providers. Our balance sheet also supports ongoing attractive organic growth initiatives.

“As the benefits from the execution of our growth strategy come to fruition in FY23, we expect to deliver a step change in EBITDA over the next 12 months. A full year of earnings from Over the Wire, revenue and cost synergies from that acquisition, cost benefits from our fibre network, offset by some cost inflation and further investment into growth initiatives, is expected to substantially lift earnings and cashflows for the business.”

Source: ABB FY22 Results Announcement. [29-Aug-2022]

See also: ABB FY22 Results Presentation. [29-Aug-2022]

It is a major positive in my view that Aussie Broadband are rolling out their own fibre, as telcos that own infrastructure are always more valuable, especially as takeover targets for somebody down the track. Owning some of their own infrastructure also gives them some advantages over other providers and some pricing power at least with regard to their own stuff. The NBN has to some extent levelled the playing field, but those Telcos/ISPs that own some infrastructure themselves have the ability to package that and differentiate themselves. Fibre is also still the fastest internet available, and ABB do use superior speed as a major selling point in their advertising.

Management

The ABB Board:

See: https://www.aussiebroadband.com.au/investor-centre/

Video Link: https://www.youtube.com/watch?v=ygzNWuZfojE

People and Culture:

Having had some feedback from some of the contractors who have worked for ABB, the general feeling is that they are good, they do care about their customers and their customer service, they do take complaints seriously and try to rectify issues very quickly when they do occur. It also appears that ABB management actually value their employees and want to be viewed as an employer of choice as well as scoring well with ESG credentials, as the following slide explains:

The overall gist of the feedback that I've read is that most employees regard the company as a good one to work for, that cares and is trying to do the right thing by their workers, and it looks like by the community and the environment as well, so the feedback seems to match the investor relations material (such as these slides), which is positive.

Upside (reasons to buy):

- Fast Growing Telco/ISP who are leading the industry in customer service and customer satisfaction.

- Despite listing less than 2 years ago, they are already profitable.

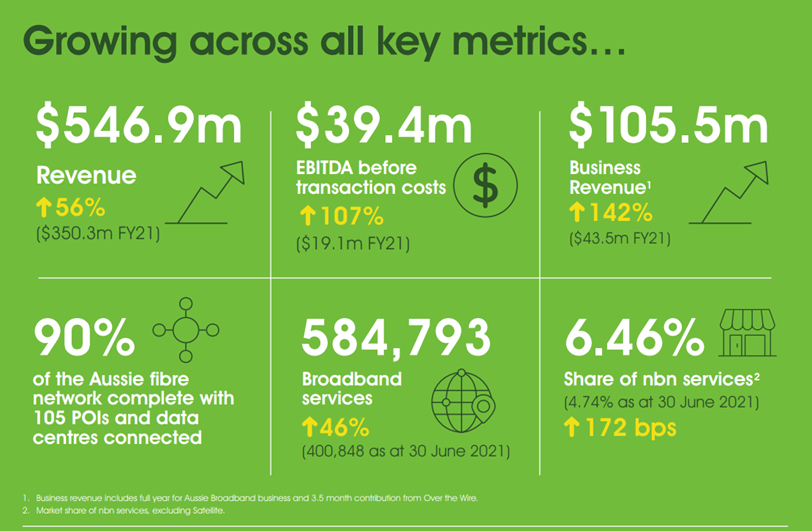

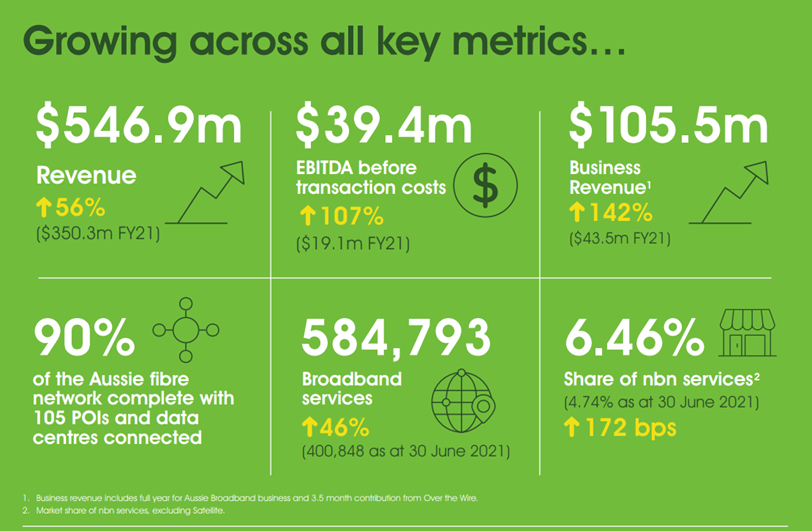

- They are putting runs on the board:

- However those runs on the board are not reflected in the share price which has come down significantly from $6/share to around $2.50/share, levels we haven’t seen since January 2021, shortly after they listed on the ASX.

- ABB is rolling out their own fibre networks in major cities which is valued infrastructure that will provide benefits for decades.

- Well incentivised Board and Management: All of the 6 Board members are ABB shareholders with one NED, Patrick Greene holding over 10 million shares (4.36% of the company, via Greene’s private company, Panama Trial Pty Ltd) and ABB’s MD, Phillip Britt, holding over 16m shares (6.84% of ABB, through a company he controls called Digital Interworks Pty Ltd). A recently retired executive director, John Reisinger, through a company he controls (Intertubes Pty Ltd) also controls 6.84% of ABB (holds over 16 million shares) and John bought half a million dollars worth of ABB shares in early March and another half million worth at the end of August (one week ago), as did Managing Director, Phillip Britt. Those were all on-market trades using their own money. Michael Omeros (a NED, i.e. a non-executive director)) also bought 104,558 ABB shares on-market for $2.69/share (so for a total of $281,261.02) in early May this year. All of the directors appear to be also taking rights or options as part-payment for their directors’ fees, creating even further alignment of interests with ordinary shareholders.

- The Telco/ISP sector is rife with M&A activity, and ABB are going to factor into that at some point. Speaking of which, Origin Energy have a white label contract with ABB where Origin bundle energy supply with telco/ISP services which are provided by ABB and there has been talk in the AFR recently (in the “Street Talk” section) about Origin running their eye over Vocus Group’s retail telco business – see here: https://www.afr.com/street-talk/origin-energy-dials-into-vocus-retail-arm-secret-auction-underway-20220831-p5be9x That part of Vocus when combined with ABB (which Origin is already involved with) would likely create a broad full-service Telco if that is what Origin is after, but it does seem to be a bit of a departure from their core energy business. Point is that ABB will factor into M&A in respect of being a target – at some point in the future. It remains to be seen when, and if they are indeed taken over, and by whom. This does not form a basis or pillar on which my investment thesis is based, it's just some potential extra icing on top.

Downside (reasons not to buy, or to be wary)/risks:

- Execution risk – including acquisition risks. So far, the acquisitions that ABB have made – have made sense and have added to the capabilities of the company and expanded their service offering, however you have to keep an eye on acquisitions. You don’t want them to overpay, or make poor acquisitions, particularly ones that don’t make strategic sense or that are biting off more than they can chew.

- Competition Risk – there are other players in this space who could certainly take market share away from ABB or make their continued growth difficult to achieve, including some massive players, however some of this risk is mitigated by ABB having some clear competitive advantages, the main one being their superior customer service and customer satisfaction ratings. And their superior speed to many other competitors. There is still always a risk that competitors chip away at those competitive advantages and manage to overcome them.

- This is a young company who have only just become profitable, so there is no long track record to look back at yet.

- There is either some shorting going on or possibly a larger shareholder offloading their shares, which is putting significant pressure on the ABB share price, so that’s something to keep an eye on, although the flip side is that it does present a good entry point if it is just a temporary phenomenon.

Potential Positive Catalysts:

- Continued growth and beating market expectations.

- Decrease in churn, which has been a concern lately.

- Positive market updates (upgraded earnings forecasts), and announcements.

- Positive M&A, both as a potential target or an acquirer of strategic assets.

- More broker and analyst coverage.

- Increasing profits and improved margins.

- Eventually, declaring and paying dividends.

Summary:

Aussie Broadband is a market leader in terms of customer service and customer satisfaction and the sharp pullback in their share price presents a great opportunity in my view to enter this company at this still relatively early point in their journey. This is a company that I’ve wanted to own shares in for the last 18 months however they just looked too expensive. They don’t look expensive now. It’s a sector I've had success in previously (UWL and MAQ more recently, previously Amcom, M2 Telecommunications, Vocus and others), and ABB is a well-positioned company within the sector.

Today (Tuesday 6th September 2022) I bought an initial tranche of ABB shares (IRL) at $2.51/share for one of my main portfolios, and I also added them to my Strawman.com portfolio (at the closing price of $2.49/share).

Further Reading:

Aussie Broadband Stung With $213,000 Fine for Breaching Public Safety Rules (msn.com) [2022]

Aussie Broadband net profit rebounds to $5.3M - ARN (arnnet.com.au) [2022]

Aussie Broadband beats the big four at customer service | Aussie Broadband [2019]

Reviews Aussie Broadband employee ratings and reviews | SEEK [current]

Aussie Broadband Reviews | Glassdoor [current]

ABB FY22 Results Announcement and Presentation

The following is from: https://www.intelligentinvestor.com.au/recommendations/aussie-broadband-result-2022/151665?qa=

Growth in the short term may stumble in the face of intense competition. Yet the business has seen off cycles of irrational competition in the past and we expect this time to be no different.

Aussie boasts twice as many customers on top-tier plans as the market. It doesn’t compete on price and churn rates have normalised after spiking for a period. We won't join the panic over short-term discounting.

Expand the core

In the past, we’ve alluded to the similarities between Aussie and another II favourite, Macquarie Telecom. Management has added more credence to that comparison by confirming a pivot from operating as an NBN reseller to focussing on business, enterprise and wholesale products.

This is a similar trajectory to the one taken by Macquarie about a decade ago and should drive higher retention and higher margins. So far, those new segments are working.

The enterprise business, which offers services to business customers, increased revenue by more than 50% and contributed $10m to EBITDA. The wholesale business, which provides white label services to third parties, now boasts 60,000 connections in its first year and is already profitable.

Over the Wire’s voice platform and data service will be crucial in building new products and services. Importantly, a lot of Aussie’s new products will focus on its own infrastructure. There is clearly concern about NBN pricing, from Aussie and more broadly, especially in the short term.

Lower the volume charge

When the NBN was established, it was required to achieve specific return-on-asset targets. To reach those, it introduced a notoriously unpopular volume charge that lifts prices for everyone as data consumption rises.

That makes high-tier plans more expensive and lower margin than they would otherwise be. With consumption volumes soaring since the pandemic, NBN wholesale prices keep penalising high volume providers. That will continue for another year but, beyond that, it looks like NBN pricing will change.

As we’ve previously explained, the new federal government is looking to change the NBN mandate and lower or abolish the volume charge.

That will be most beneficial to higher-tier providers like Aussie and will help lower prices or lift margins. Negotiations are still underway, but early signs are positive that something might change in 2024.

We also note that Aussie’s long fibre rollout is 90% complete and will conclude this year. That will provide savings on backhaul leases and a base for further fibre expansion.

Aussie has already confirmed it will extend its fibre network to some data centres and to dozens of large buildings. It can then offer higher-margin products that bypass the NBN.

We suspect next year might be a tough one for Aussie. The consumer broadband sector is looking harder, labour costs are rising – Aussie had to spend $7m in additional labour costs – and discounts are rife.

Yet we think those difficulties will be offset by growth in new segments of the business and, over time, improved wholesale pricing will help lift broadband margins.

Fallen expectations

Management expects revenue for next year to be between $800m and $840m, while EBITDA margins are expected to rise to over 10%. We should expect over $80m in EBITDA for the year.

Aussie currently carries $138m in net debt, a figure we would prefer to see lowered quickly. After adding that debt to a market capitalisation of $640m, we come to an enterprise value of $780m and a forward EV/EBITDA multiple of less than ten.

We acknowledge that risks from competition and discounting have risen, that growing new business segments is harder than growing existing ones and that the balance sheet now carries debt. It appears the market has now discounted the valuation it is willing to ascribe to Aussie in light of those risks.

Yet Aussie isn’t some fad or fashion. The business started from scratch in 2008 and, with no obvious advantage, fought off almost 100 competitors to become a force in broadband.

The skill, hustle and determination that build an impossible business is again being mobilised and we are happy to back management to do it again. To account for the risks, we’re lowering our Buy price from $3.50 to $3 and our Sell price from $7 to $6, but Aussie remains a BUY.

Note: The Intelligent Investor Australian Ethical Shares Fund owns shares in Aussie Broadband.

Disclosure: The author owns shares in Aussie Broadband.

By Gaurav Sodhi

[30-August-2022]

IMPORTANT: Intelligent Investor is published by InvestSMART Financial Services Pty Limited AFSL 226435 (Licensee). Information is general financial product advice. You should consider your own personal objectives, financial situation and needs before making any investment decision and review the Product Disclosure Statement. InvestSMART Funds Management Limited (RE) is the responsible entity of various managed investment schemes and is a related party of the Licensee. The RE may own, buy or sell the shares suggested in this article simultaneous with, or following the release of this article. Any such transaction could affect the price of the share. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance.

--- ends ---

For a free 15-day trial to Intelligent Investor (to gain access to more of Gaurav's fine work) - go here: https://www.intelligentinvestor.com.au

Information, images, charts, diagrams, etc. used in this straw were from the sources listed above as well as the following websites: https://www.aussiebroadband.com.au/investor-centre/, https://www.intelligentinvestor.com.au, https://www.afr.com/, https://www2.commsec.com.au/, https://www.choice.com.au/electronics-and-technology/internet/connecting-to-the-internet/articles/internet-service-provider-satisfaction-survey and https://www.fnarena.com/.

18-Sep-2023: Update:

OK, I was confident that ABB had upside one year ago when I wrote the stuff above, and their report in August for the FY23 full financial year was really good.

You can view their announcement here: ABB-FY23-Annual-Results-Announcement.PDF

And their FY23 Results Presentation can be viewed here: ABB-FY23-Results---Investor-Presentation.PDF

The key highlights from their results announcement were:

They provided the following tables to demonstrate their revenue and subscriber (connections) growth:

They also provided the following FY24 upate and guidance:

All very positive - and then, from their results presentation:

And here's something that I don't see too often - not often enough anyway - an explanation of the key risks to the business and it's growth and profitability trajectory (i.e. downside risks) alongside the upside:

However, the overall FY24 outlook remains positive, as detailed below:

Guidance for continued growth, so good numbers which should continue to be good.

The following was sourced from FNArena.com this afternoon:

The following is the FNArena.com summary of the latest update on ABB from OM (on Aug 28th). They believe that MS and Shaw & Partners have both discontinued coverage of ABB, however I've included the most recent calls on ABB by both of those brokers including the dates they made those calls. According to FNArena, ABB is now only covered by just one broker (Ord Minnett) of the 8 major broking houses that FNArena monitor. I view that as a positive actually. The less major broker coverage a company has, the more likely there is some market misspricing (in my experience).

This last slide (from ABB's FY23 Results Presentation) is a major reason why I hold ABB shares. I believe that outstanding customer service and high customer satisfaction (along with positive customer recommendations) are going to continue to result in ABB gaining further market share from Telstra - and to a lesser extent also from TPG and Optus who I believe may have dropped the ball somewhat recently (in the past 18 months or so) in relation to customer service and customer satisfaction.

And it appears that this is one of those rare cases where the market is finally coming around to MY way of thinking. It doesn't always happen, but it's certainly nice to see when it does.

Disclosure: I hold ABB shares.

21-Oct-2022: ABB held their 2022 AGM today - here is a link to their AGM Presentations.

Worth a read. They've been oversold in my opinion.

Disclosure: I hold ABB shares both here and in real life.

Aussie Broadband (ABB) is holding an Investor Day on Wednesday 9 November 2022 at 10am for a 10.30am start, to 2:30pm AEDT; including lunch with Aussie Broadband’s executive leadership team.

Location: Museum of Sydney, cnr Bridge and Phillip Streets, Sydney

RSVP: By Monday 31 October 2022 to [email protected]. Please indicate any dietary requirements for catering purposes.

For those unable to attend in person, the formal presentations and Q&A session of the Investor Day will be livestreamed from 10:30am to 1:00pm AEDT, and participants can register for the livestream via: https://us02web.zoom.us/webinar/register/WN_0RBj17P6SRSIRaeDiffnFw.

Here's their announcement about it today (Wednesday 12th October 2022):

Investors will have the opportunity of meeting with the Company’s executive leadership team, and better understand Aussie Broadband’s ambition to be Australia’s 4th largest provider of communications & technology services.

Presenting from the Company will be:

- Phillip Britt, Managing Director and Co-founder

- John Reisinger, Chief Technology Officer and Co-founder

- Matthew Kusi-Appauh, Chief Operating Officer

- Jonathan Prosser, Chief Strategy Officer

- Aaron O’Keeffe, Chief Growth Officer

In addition to the executives presenting, the following executives will join the Q&A panel:

- Brian Maher, Chief Financial Officer

- Kevin Salerno, Chief Customer Officer

- Jane Betts, Chief People & Reputation Officer.

The Investor Day will focus on Aussie Broadband’s strategy and operations, and will cover the following topics:

- Refresh on Aussie Broadband’s value proposition, business model and industry position

- Aussie Broadband 2.0 strategy underpinning a diversified communications and technology business

- Key market segments and growth opportunities – business, enterprise & government; wholesale; residential

- Delivering the operational benefits of scale via proprietary software technology and infrastructure.

---

Disc: I hold ABB shares. This can't hurt!

The following is a broker report from Ord Minnett on Aussie Broadband (ABB) dated 02-Aug-2022 and distributed by the ASX for free on Friday (05-Aug-2022): abb-ord-minnett-update-050822.pdf

Note that Ord Minnett acted as a Co-Manager of the ABB share placement announced 7th September 2021 and received fees for providing this service.

Ord's Target Price for ABB is A$4.69 (Previously A$5.10), their recommendation is "Buy", with Risk being "Higher".

Disclosure: I do not currently hold ABB shares, but they're on a watchlist, and I like the company a lot.

Post a valuation or endorse another member's valuation.