“An ounce of practice is generally worth more than a tonne of theory.”

E F Schumacher

Here at Strawman we believe that experience is the best teacher.

Our free platform lets you ‘paper trade’ ASX-listed shares and track performance using real-world prices. It’s a great way to get hands on practice with share market investing — without any of the risk.

It’s also a great way to show off your investing skills, and identify the best investors in the Strawman community.

So, how does it all work?

The rules

Strawman members each start with $100,000 in play money, which can be used to ‘buy’ any ASX-listed share that is trading above 2c.

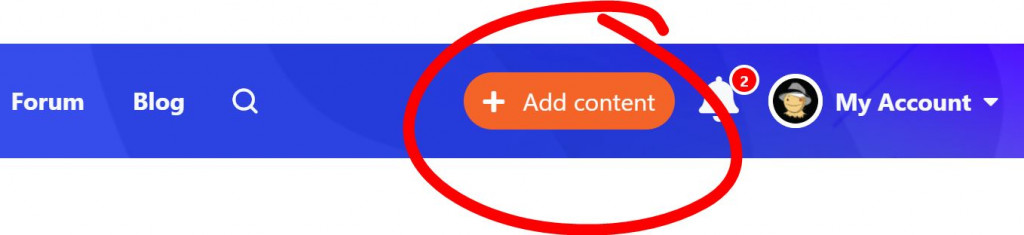

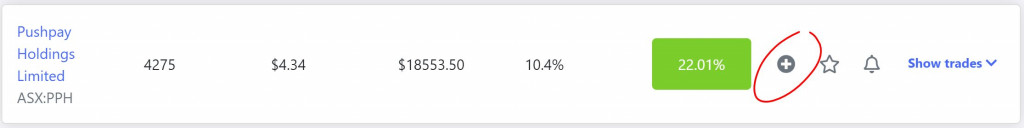

To place a trade, click on the orange ‘Add Content‘ button at the top right of any page, or by clicking the trade icon next to a company name.

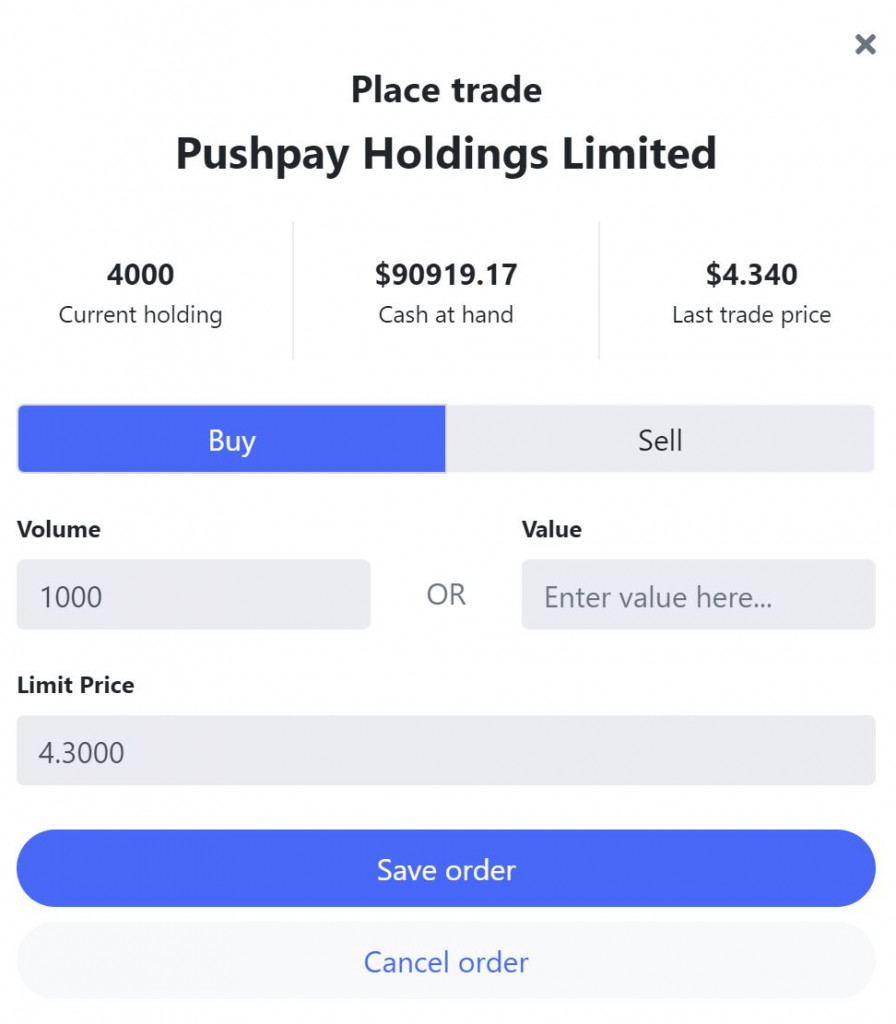

When you place a trade you can set the size of your order by specifying the exact number of shares or a dollar value. If you set a dollar value, the system will purchase as close to this amount as possible given your nominated order price.

You must also set a ‘limit price‘. In the case of a buy trade, this is the maximum price you are prepared to pay per share. If you are selling, this is the minimum share price you are prepared to accept. Of course, if the market offers a better price, that’s what the system will use to complete the trade.

Note that you cannot initiate a position that represents more than 20% of your total portfolio value (including cash). However, a share can represent a higher weighting if its market value subsequently increases. This helps ensure that total portfolio performance is not overly dependent on just a few stocks.

Once placed, orders are marked as pending and will settle at the next available closing price (we do not presently have access to intraday market prices). Pending orders will automatically expire after one week if they cannot be completed, and can be edited or cancelled at anytime by visiting your profile page.

The order pad will display the “cash” you have available to buy shares. This will also include the value of any outstanding sell orders. If there is insufficient cash available after all eligible sell orders have been completed, any outstanding buy orders will remain as pending. The system will execute pending buy trades in the order they were placed.

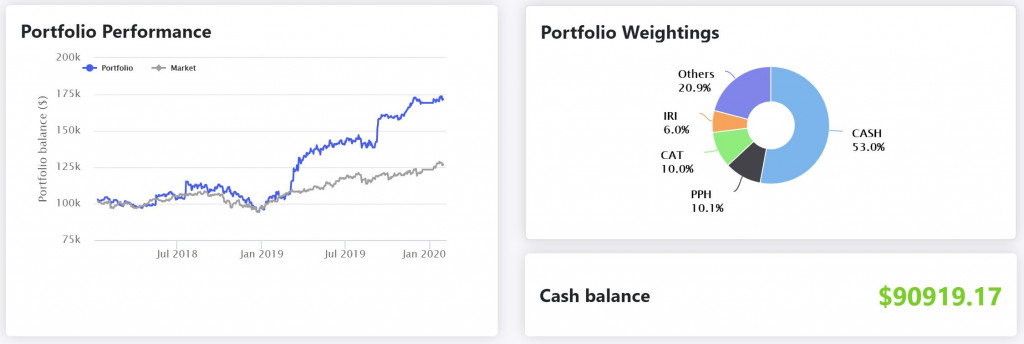

On your Profile page, your virtual portfolio will be compared against the Vanguard Australian Shares Index ETF (ASX:VAS). This provides a practical benchmark to measure your performance against, and is a close approximation of the S&P/ASX 300 index. $100,000 is invested into this ETF the day your first trade is completed.

In all cases, dividends are automatically reinvested and used as part of return calculations.

If you chose, you can start over at anytime by resetting your portfolio. Simply go to “Account actions” under the My Account drop-down menu.

Go to your Profile page to view and manage your portfolio.

F.A.Q’s

Can you short sell?

No. Strawman is presently a “long only” trading game.

Do you account for liquidity?

YES! In order for a trade to be completed on Strawman, a sufficient number of shares must be traded on the ASX that day.

For example, if you place an order to buy $10,000 worth of shares, and only $2,000 worth is traded on the ASX that day, your order will only be partially fulfilled and the rest will remain as pending until sufficient volume is available in subsequent days. So it could take some time to completely fill orders in illiquid shares.

Also not that you can’t buy or sell stocks that are suspended or in a trading halt.

Is there a set number of trades you can make?

You can buy and sell to your heart’s desire — so long as you have sufficient cash, and a buy order doesn’t breach the 20% cap on position sizes.

However, because we don’t have intra-day prices, you cannot ‘day trade’. That is, you can’t buy and sell the same stock on the same day.

How is performance measured?

The performance of individual shares is listed in your portfolio (on your profile page). This is a money weighted total return figure that factors in the value of all trades since the position was initiated. Dividends are reinvested and returns are annualised if the position is held for more than 12 months.

The performance of your entire portfolio is based on its dollar value, and includes the value of any cash. Cash earns a 0% return, so be mindful of how you weight this in your portfolio. (A high cash balance will give you a relative out-performance in a falling market, but will likely drag your total average return lower over time.)

The performance of your portfolio is tracked over various time frames: 3 months, 6 months, 12 months and Since Inception (if your portfolio is more than one year old, the system will display an annualised return figure here).

You can see how members rank across various time frames by visiting the Members page.

How are my old Strawman recommendations treated?

In an earlier version of Strawman, user performance was based on the performance of ‘recommendations’. All recommendations carried an equal weight, and a user’s performance was simply quoted as the average of all individual recommendations.

In order to preserve these track-records (many of which were hard fought for!), we have applied an algorithm to port past recommendations into the new trade system.

The process was as follows: (a) treat all past recommendations as discreet buy orders (b) When recommendations were closed, treat as a sell order. (c) Set trade values at a level that ensures cash balance never drops below $0, and so that no buy orders exceed the 20% cap on starting positions.

With performance now displayed according to the new system rules, many users will no doubt notice a change from what was previously quoted. That being said, these differences are small and the general nature of past performance is maintained. Importantly, this retrofit had little impact on member rankings.

If you were performing well under the old system, that will be fairly captured by your new portfolio.

You can view the exact breakdown of how past recommendations were converted into trades by visiting your portfolio. If you prefer to start fresh, you can always reset your portfolio in the Account Actions menu.

Do I need to post Straws or Valuations before I trade?

No. Under the old system, users were required to post (or like) at least one valuation for a company before they could recommend it. This is no longer the case (although we strongly suggest you do — journaling your thoughts is one of the best ways to improve your investing process).

What about the Strawman Index?

The Strawman index tracks the performance of the most popular stocks on the platform. Under the new trading system the index operates in the same way as user portfolio’s — however trades are automatically determined according to it’s trading rules.

You can learn more about how the Strawman Index works by clicking here.

Need more help?

If ever you get stuck, or just have a comment or suggestion, you can email support at [email protected].

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2020 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211